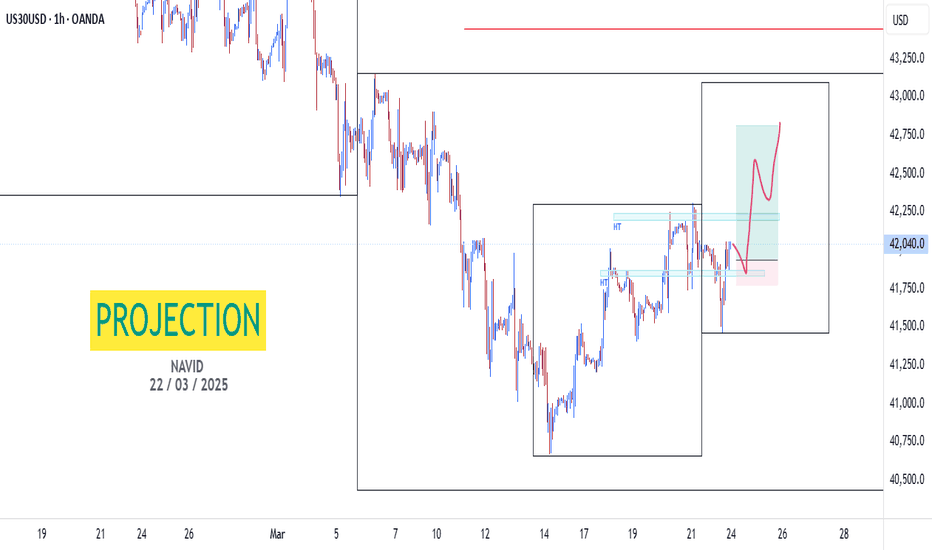

US30 Trade Outlook – 24/03/2025📊 Market Structure & Key Levels

US30 continues its bullish momentum, breaking through resistance levels and pushing toward key supply zones. Price is now approaching a major area where sellers may step in.

🔍 Key Observations:

✅ Strong Bullish Push – Clear higher highs and higher lows forming.

✅ Next Resistance Zones:

‣ 42,787 – 42,872

‣ 43,021 – 43,200

✅ Support to Hold: 42,000 – 41,700 zone

🎯 Trade Plan:

🔹 Long continuation if price breaks 42,872 with volume → Target 43,200

🔻 Short setup if price rejects 42,872 – 43,021 → Target 42,000 – 41,700

⚡ Stay sharp. Don’t chase. Wait for structure & confirmation. 🔥

WALLSTREETCFD trade ideas

Dow Jones: Double-Top Signals Heightened VulnerabilityThe Dow Jones Industrial Average (DJI) closed at 41985 on Friday, up 0.08%, maintaining its position above critical support at 41330. The index has dropped more than 6% since the start of the pullback from highs of 45073 in January 2025. The long-term bullish price structure that has lasted over two years remains intact; however, a double-top formation at recent highs and the observed weakness in the current quarter suggest a vulnerability in the long-term price structure, particularly around 42732 and 42248. Should it fail to maintain support at 41330, the index could collapse below the bullish structure. If it holds above this critical support, a temporary rebound targeting 42248, 42732, and 43388 is possible before the price declines again.

Reflecting on past market corrections, the index fell 38% in February 2020 and 22% in January 2022. This time, the situation may differ due to the current political and economic climate shaped by the US administration. If we experience a four-stage pullback, the index could decline to 39062, 36794, and 34526, resulting in a correction of over 23%. Should it fall below 34526, there is potential for a deeper dive into bear territory, reaching 32257 with a correction exceeding 28%.

The Dow Jones Industrial Average (US30) 23 MARCH 2025The Dow Jones Industrial Average (US30) is currently trading within a well-defined ascending channel, maintaining its long-term bullish structure. Price recently tested the lower boundary of the channel, aligning with a strong demand zone around 40,892 - 40,053, and is now showing signs of a potential reversal. The smart money concept (SMC) perspective suggests that institutions may have accumulated positions at this level, preparing for a bullish move toward the 44,500 - 44,800 supply zone. If price sustains above 42,000, buyers could take control, targeting liquidity above previous highs.

From a supply and demand standpoint, the 40,892 - 40,053 level acted as a key demand zone, where buyers aggressively stepped in to defend the trend. The next area of interest is the 44,502 - 44,809 supply zone, which aligns with historical resistance. If price reaches this level, we may see profit-taking or a potential rejection. However, a break above 44,809 would indicate bullish continuation toward new all-time highs.

On the fundamental side, several factors support a potential bullish move. Federal Reserve policy remains a key driver; if the Fed signals rate cuts later in 2025 due to slowing inflation, equities could rally further, benefiting the Dow. Additionally, US economic resilience, strong labor markets, and robust earnings from industrial and financial sectors could provide further upside momentum. On the downside, risks remain from geopolitical tensions, trade wars, and inflation concerns, which could create volatility and potential corrections.

Given these factors, a long trade setup appears favorable. The ideal entry point would be near 42,000, aligning with trendline support and demand. A stop-loss below 40,800 would protect against an unexpected bearish break. Take-profit targets include 44,500 (supply zone) and 44,800 (liquidity sweep level), where price may face resistance. However, if price fails to hold 42,000, a deeper retracement toward 38,473 could be possible before the next bullish impulse.

Would you like me to refine this setup further with risk management and position sizing details? 🚀

Bearish reversal off pullback resistance?Dow Jones (US30) is rising towards the pivot which is a pullback resistance and could drop to the 1st support.

Pivot: 42,476.16

1st Support: 41,442.18

1st Resistance: 43,185.84

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

US30 - Potential Targets How I see it in the shorter term:

KEY LEVEL OF CONFLUENCE, NOW SUPPORT @ 41640.00

Potential "LONG" -

TP 1 = 42355.00

TP 2 = 42890.00

Potential "SHORT" -

(Requires a break and hold below KEY SUPPORT)

TP 1 = 40652.00

Keynote:

Stocks are still not showing the "reversal" type quality and energy.

Upwards might only be a higher TF correction.

On the 4HR TF there is also signs of a potential bearish flag.

Thank you for taking the time to study my analysis

US30 - Catch The Next Wave!US30 is currently in an uptrend, with price action respecting a well-defined ascending channel. We anticipate another bounce from channel support.

In Wave 2, price was rejected at the 38.2% Fibonacci retracement level, and we expect a similar reaction for Wave 4.

Our strategy is to wait for price to enter the buy zone, between the 38.2% and 50% Fibonacci retracement levels, and look for bullish reversal signals before entering a position.

Potential Bullish Reversal Signals:

Trendline break

Break of structure (BOS)

Other confirmation patterns

Trade Plan:

- Monitor price movement into the buy zone, aligning with channel support.

- Enter long positions upon confirmation of bullish price action, placing stop-loss below the established low formed after bullish confirmation.

Target levels: 45,000 and 48,500, with the remainder held for a potential extended swing trade.

Goodluck and as always, trade safe!

US30 Analysis SCENARIO 1 (sells)

Gold is in a bullish momentum, so the current bearish move in conjunction with the trump tariffs should

have us see a good retest zone back to the upside with continious bad news occuring in the US

Recent high impact events have been in the red (when you see a red number that means that the release of certain data was lower than what was expected)

In the upcoming weeks, we have the Standard & poors global manufacturing PMI and the S&P Global services PMI with the consensus for

each to be 51.9 and 51.2 which is accounting for a drop in the S&P Manufacturing PMI but a 0.2 % increase in the S&P global services PMI

for beginners, understand that these are economic indicators to show people how a courntries economy is doing with Manufacturing PMI

leading towards the production of goods in the US.

Now I believe that both actual results when released will be negative due to the fact that the current tariff hits have been hurting the US.

This will lead to a bearish market open on the Nasdaq and US30 indices and a buy on gold.

Why this is so is a lower number than the consensus (the consensus refers to a healthy number for the economy to "be at" for that month) meaning

a lower result than what they have put will lead to a brief economic panic with investors taking sells on their postitions on the top 30 and 100 businesses

(nasdaq and US30) and the further sells on the US market from retail investors will cause a greater bearish move on Monday.

Now the reason why Gold goes up is because it is a security, safe haven for investors. When Investors take their cash out of their stocks

and when their is more economic stress then there will be more reason to invest into a safe commodity like gold.

More news to note is the tesla stock crash which is a driving factor of the current losses in the Nasdaq and the S&P and the Dow jones. The upcoming tariffs will

see a downturn in the market.

Now that is my bet, we need to add these fundamentals in with perfect technical anlysis entry points

SCENARIO 2 (buys)

For buys everything oposite to the sells will occur meaning that if a positive number above consensus happens then there may be a brief period of buys

US30 analysis SCENARIO 1 (sells)

Gold is in a bullish momentum, so the current bearish move in conjunction with the trump tariffs should

have us see a good retest zone back to the upside with continious bad news occuring in the US

Recent high impact events have been in the red (when you see a red number that means that the release of certain data was lower than what was expected)

In the upcoming weeks, we have the Standard & poors global manufacturing PMI and the S&P Global services PMI with the consensus for

each to be 51.9 and 51.2 which is accounting for a drop in the S&P Manufacturing PMI but a 0.2 % increase in the S&P global services PMI

for beginners, understand that these are economic indicators to show people how a courntries economy is doing with Manufacturing PMI

leading towards the production of goods in the US.

Now I believe that both actual results when released will be negative due to the fact that the current tariff hits have been hurting the US.

This will lead to a bearish market open on the Nasdaq and US30 indices and a buy on gold.

Why this is so is a lower number than the consensus (the consensus refers to a healthy number for the economy to "be at" for that month) meaning

a lower result than what they have put will lead to a brief economic panic with investors taking sells on their postitions on the top 30 and 100 businesses

(nasdaq and US30) and the further sells on the US market from retail investors will cause a greater bearish move on Monday.

Now the reason why Gold goes up is because it is a security, safe haven for investors. When Investors take their cash out of their stocks

and when their is more economic stress then there will be more reason to invest into a safe commodity like gold.

More news to note is the tesla stock crash which is a driving factor of the current losses in the Nasdaq and the S&P and the Dow jones. The upcoming tariffs will

see a downturn in the market.

Now that is my bet, we need to add these fundamentals in with perfect technical anlysis entry points

Dow Jones The Week Ahead 24th March '25 Dow Jones bearish & oversold, the key trading level is at 42488

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

US30BUY Opportunity

- Base channel on Daily time frame retested indicating end of Wave 4.

- Buy opportunity towards wave 5, potentially at price - 47 838.64

Buy Confirmation

- On 2 Hour timeframe, Bos and with a leading diagonal.

- We then place a buy limit at 41 087.27 as the demand zone

This is not investment advise. Enter at your own risk.