WHEAT: Short signal amidst Russia/Ukraine truce deadlineThe market seems to be pricing in a possible truce between Ukraine and Russia, since Trump gave Russia a 2 week deadline to achieve it or risk further sanctions. The technical chart has a picture perfect short signal in the daily timeframe with good reward to risk here.

Best of luck!

Cheers,

Ivan Labrie.

WHTUSD trade ideas

Rob the Wheat Market Before the Trend Escapes!🏴☠️Wheat Vault Breach: Sweet Profit Heist in Progress!🍫💰

(Thief Trader’s Swing/Day Plan – Only Bulls Allowed)

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

We’ve cracked the code to the 🏉"WHEAT"🏉 Commodities CFD market, and now it’s time to launch a high-stakes heist based on 🔥Thief Trading style technical + fundamental analysis🔥.

🎯 Mission Objective: Infiltrate the overbought zone, where traps are set, robbers are lurking, and the market’s about to turn. The plan? Ride the bullish wave, loot the Red Zone, and vanish with sweet profits. 🏆💸

🔓 Entry Point:

"The vault is wide open!"

Buy at will — loot that bullish treasure!

⏱️ Best tactic: Set buy limits on the 15M or 30M swing low/high zones. Set alerts and stay sharp.

🛑 Stop Loss:

SL = Nearest 6H Swing Low below the MA line (520.00)

🔐 Protect your stash. Use risk-adjusted SL based on trade size and number of entries.

🎯 Target:

575.00 or escape early if the pressure builds!

⚔️ Scalper’s Note:

Only steal on the long side.

💰 Big money = Go direct

💼 Small bags = Team up with swing traders

📉 Use trailing SLs to guard your gains.

🔥Wheat Market is Bullish – Why?

☑️ Fundamentals

☑️ Macroeconomics

☑️ COT Report

☑️ Sentiment Signals

☑️ Intermarket Vibes

☑️ Seasonal Patterns

☑️ Trend Forecasts & Target Levels

👉 Dive into the data: 🔗🔗🔗

⚠️ Trading Alerts:

News releases = Danger zones!

❌ No new entries during news

✅ Trailing SL to protect ongoing raids

💥 Smash the Boost Button 💥

Support this Thief Plan and keep our crew winning daily.

💪 Rob with confidence. Win with consistency.

🎉 Thief Trading Style = Your daily cash machine.

💣Stay tuned for the next robbery blueprint!

— Your Friendly Market Criminal, 🐱👤

WHEAT IS IN ITS LAST TURN.I think that the bottom levels in wheat prices are very close and there may be an increase in the coming months and years. The 5th and final downward wave is about to end. And there is a very clear rsi positive divergence.

* The purpose of my graphic drawings is purely educational.

* What i write here is not an investment advice. Please do your own research before investing in any asset.

* Never take my personal opinions as investment advice, you may lose your money.

Wajani Investments: Wheat analysisWheat has formed a very strong Head and Shoulder with a bearish wedge or descending triangle . This can be seen from both monthly, weekly and daily timeframes. All these points to lower prices in the weeks ahead. In this market you can risk a 1:3

Remember to always adapt or make changes as the market changes.

Let me know your thoughts.

Wheat should go to 540 then target 610Daily chart,

The commodity WHEAT - cash contract - PEPPERSTONE:WHEAT is trading in a soft rising channel (yellow), and the price should test the line R1 at around 540 - After crossing, the target will be towards the channel upper line R2, around 610 , passing through the resistance levels 550 and 563

Stop loss below 505 to be considered.

Technical indicators:

RSI is in the 50%, with a bullish trend

MACD is about to cross up

WHEATIn April/May, wheat harvests occur in the eastern part of the globe. India has banned wheat exports since 2022 in order to replenish domestic reserves. Subsidies for farmers have meant that the sowing area is larger than usual, which translates into quite high expectations when it comes to harvests. But as is often the case in life, things are not always as we plan. Adding to this the weather in the final period before harvest, I think that the harvest will be lower than expected, which will translate into an increase in price.

WHEAT is a difficult instrument to play, but I think that the area around 680 is achievable - long shot

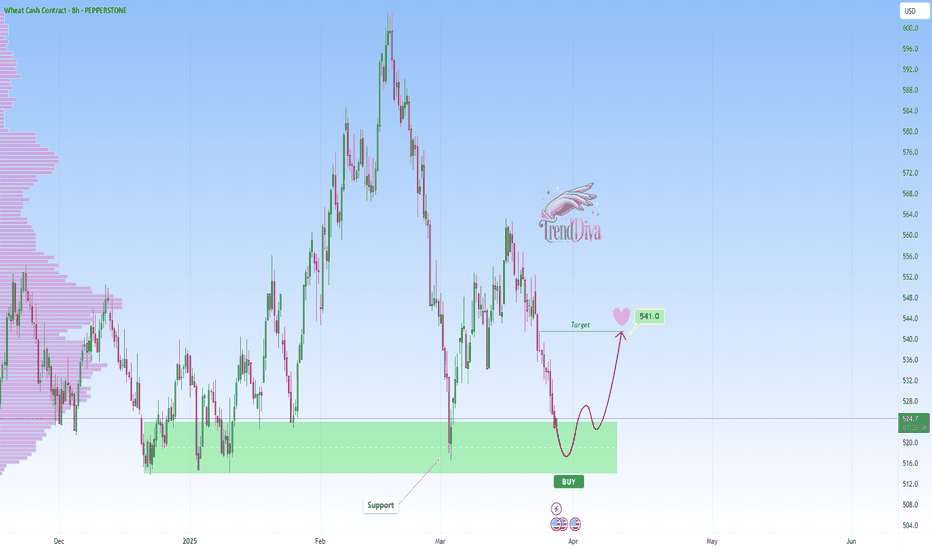

WHEAT at Key Support Level - Will Price Rebound to 541$?PEPPERSTONE:WHEAT has reached a major support level, an area where buyers have previously shown strong interest. This area has previously acted as a key demand zone, increasing the likelihood of a bounce if buyers step in.

A bullish confirmation, such as a strong rejection pattern, bullish engulfing candles, or long lower wicks, would strengthen the case for a move higher. If buyers step in, the price could rally toward the 541$ target. However, a decisive breakdown below this support would invalidate the bullish scenario and could lead to further downside.

This is not financial advice but rather how I approach support/resistance zones. Remember, always wait for confirmation, like a rejection candle or volume spike before jumping in.

Best of luck , TrendDiva

Global Wheat Market: Lower Production and Trade AdjustmentsAs outlined in the March WASDE report , the global wheat market is undergoing significant shifts due to production declines, lower trade volumes, and changing stock levels. These factors are expected to shape pricing and investment strategies in 2025.

Global Production and Stock Adjustments

The latest estimates indicate that global wheat production for the 2024/25 season has been revised downward to 787.3 million metric tons (MMT), reflecting lower yields in key regions such as Argentina, the EU, and Australia. The reduction in output comes amid adverse weather conditions and higher production costs, particularly in the EU, where dry conditions have impacted crop development.

Meanwhile, global ending stocks are projected to decline to 258.8 MMT, marking one of the lowest levels in recent years. The tightening of reserves may put upward pressure on prices, reinforcing wheat’s role as a key agricultural commodity in volatile market conditions.

Trade and Export Revisions

The report also projects a shift in global wheat trade. The United States is expected to see exports remain subdued at 19.2 MMT, facing strong competition from Russia and Canada. Russian wheat exports, while slightly reduced from previous estimates, still dominate the market at 49 MMT, benefiting from a weak ruble and competitive pricing.

Australia, traditionally a major wheat exporter, has also experienced downward revisions due to lower production, cutting its export forecast to 21.5 MMT. These changes underscore shifting global trade dynamics, where price-sensitive buyers increasingly turn to alternative sources for wheat supply.

Market Outlook and Price Trends

With global wheat stocks declining and exports adjusting, prices are expected to remain volatile. The tightening supply, coupled with geopolitical factors such as trade restrictions and weather risks, suggests that wheat prices could experience further fluctuations. Additionally, demand from key importing countries, including China and Egypt, will play a crucial role in shaping the price trajectory.

Investment Considerations

Wheat is still remains a critical agricultural commodity with strong fundamental drivers. The ongoing supply constraints and shifting trade flows present opportunities in futures markets, while agribusiness stocks related to wheat production and distribution could also gain traction. Those monitoring wheat ETFs or futures contracts may find potential in the market’s response to supply shocks and trade developments.

The wheat market will continue to react to production shifts, export competition, and macroeconomic trends, making it a sector worth watching closely.

WHEAT Approaching Key Support - Will Price Rebound to 550$?PEPPERSTONE:WHEAT is approaching a key support level, an area where buyers have previously shown strong interest. The recent bearish movement suggests that price may soon be testing this level, potentially setting up for a rebound.

A bullish confirmation, such as a strong rejection pattern, bullish engulfing candles, or long lower wicks, would strengthen the case for a move higher. If buyers step in, the price could rally toward the 550$ target. However, a decisive breakdown below this support would invalidate the bullish scenario and could lead to further downside.

This is not financial advice but rather how I approach support/resistance zones. Remember, always wait for confirmation, like a rejection candle or volume spike before jumping in.

Best of luck , TrendDiva

WHEAT at Key Support Zone – Bullish Bounce ExpectedPEPPERSTONE:WHEAT has approached a key support zone, marked by previous price reactions and strong buying interest. This area has previously acted as a demand zone, increasing the likelihood of a bullish bounce if buyers step in.

The current market structure suggests that if the price confirms support within this zone, we could see a reversal toward 573.0, a logical target based on prior price behavior and current structure. A clear bullish signal, such as a rejection wick or bullish engulfing candle, would strengthen this outlook.

However, if the price breaks below this support zone, the bullish scenario may be invalidated, signaling potential further downside.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!

"WHEAT" Cash CFD Commodities Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "WHEAT" Cash CFD Commodities Market market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise placing Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 2H timeframe (568.0) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

1st Target - 594.0 (or) Escape Before the Target

Final Target - 616.0 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

🌾"WHEAT" Cash CFD Commodities Market is currently experiencing a bullish trend,., driven by several key factors.

🌿Fundamental Analysis

Supply and Demand: Global wheat production is expected to increase by 2% in 2025, driven by favorable weather conditions in major producing countries

Weather Conditions: Weather forecasts indicate a high probability of drought in key wheat-producing regions, which could impact yields and support prices

Global Economic Trends: The ongoing global economic recovery is expected to drive up demand for wheat, particularly from emerging markets

Trade Policies: The recent trade agreements between major wheat-producing countries are expected to increase global wheat trade and support prices

🌿Macro Economics

Global GDP Growth: The World Bank forecasts global GDP growth to accelerate to 3.4% in 2025, up from 3.2% in 2024

Inflation Rate: Global inflation is expected to rise to 3.8% in 2025, driven by increasing demand and supply chain disruptions

Interest Rates: Central banks are expected to maintain low interest rates in 2025, supporting commodity prices

Unemployment Rate: The global unemployment rate is expected to decline to 5.4% in 2025, driven by job growth in emerging markets.

🌿COT Data

Net Long Positions: Institutional traders have increased their net long positions in wheat to 55%

COT Ratio: The COT ratio has risen to 2.2, indicating a bullish trend

Open Interest: Open interest in wheat futures has increased by 10% over the past month, indicating growing investor interest

🌿Sentimental Outlook

Institutional Sentiment: 60% bullish, 40% bearish

Retail Sentiment: 55% bullish, 45% bearish

Market Mood: The overall market mood is bullish, with a sentiment score of +30

🌿Technical Analysis

Moving Averages: 50-period SMA: 565.0, 200-period SMA: 540.0.

Relative Strength Index (RSI): 4-hour chart: 62.21, daily chart: 58.14.

Bollinger Bands: 4-hour chart: 580.0 (upper band), 560.0 (lower band).

🌿Next Move Prediction

Bullish Move: Potential upside to 600.0-620.0.

Key Support Levels: 565.0, 540.0.

Key Resistance Levels: 600.0, 620.0.

🌿Overall Outlook

The overall outlook for wheat is bullish, driven by a combination of fundamental, technical, and sentimental factors. The expected increase in global wheat demand, favorable weather conditions, and low interest rates are all supporting the bullish trend. However, investors should remain cautious of potential downside risks, including changes in global trade policies and unexpected weather events.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

WHEAT - Broadening Bottom / Falling WedgeBeautiful weekly chart here on Wheat, attempting to break the supply line coming down from the highs here, and challenging local resistance.

Real clean double bottom nearing the apex of consolidation here. Holding above 578 keeps you above the range low, and the expectation would be a resolution to the top of the broadening formation.

Typically this is where youd expect a partial decline, and retest of the range high, statistically favoring a breakout when confirmed.

Targets would be into extension levels, and eventually a full return for the measured move challenging the highs once again.

This is a long term position trade until invalidated and will be following lower time frames to add.

WHEAT - Testing a major resistance zoneCAPITALCOM:WHEAT is testing a major resistance zone that has previously led to significant bearish reversals. The recent bullish momentum into this area increases the likelihood of seller interest.

If the market shows bearish confirmation through rejection wicks, bearish engulfing candles, or increased selling volume, a move toward 579.9 seems likely. But, a breakout above this resistance may suggest continued bullish strength.

Just my take on key support and resistance levels—remember, this isn’t financial advice. Always confirm your setups and manage risk wisely.

WHEAT at Key Resistance Zone - Sellers Ready to Step In?PEPPERSTONE:WHEAT is approaching a key resistance zone, an area that has previously triggered strong selling pressure, making it a key level to watch.

If rejection occurs—such as wicks, bearish engulfing patterns, or a shift in momentum—sellers could regain control, driving the price lower toward the 559.0 target. This aligns with a short-term pullback scenario within the broader market structure. However, a sustained breakout above this resistance would invalidate the bearish outlook, potentially opening the door for further upside.

This is not financial advice but rather how I approach support/resistance zones. Remember, always wait for confirmation, like a rejection candle or volume spike before jumping in.

Please boost this post, every like and comment drives me to bring you more ideas! I’d love to hear your perspective in the comments.

Best of luck , TrendDiva

WHEAT – Signs of Weakness, Could a Short Be Next?PEPPERSTONE:WHEAT is within a clear resistance zone that has times before led to bearish reversals. In any case, this zone marked by previous price rejections, could once again attract selling pressure.

If bearish confirmation occurs—through rejection wicks, bearish engulfing candles, or a decrease in buying volume—we could see a decline toward the 544,00 level.

However, I’ll be watching for strong support reactions or signs of exhaustion before confirming the next move.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management!

What’s your take on the potential trend of this chart? I’d love to hear your perspective in the comments.

Best of luck , TrendDiva

Wheat- In a Clean Resistance Zone, can it reach 542.00?Wheat is already within a critical resistance zone that has times before led to bearish reversals. In any case this area, marked by previous price rejections, could once again attract selling pressure.

If bearish confirmation occurs—through rejection wicks, bearish engulfing candles, or a decrease in buying volume—we could see a decline toward the 542,00 level. However, a breakout above this resistance would invalidate the bearish outlook and suggest potential for further upward movement. So keep an eye on that.

Wait for clear signs of rejection before considering short positions.