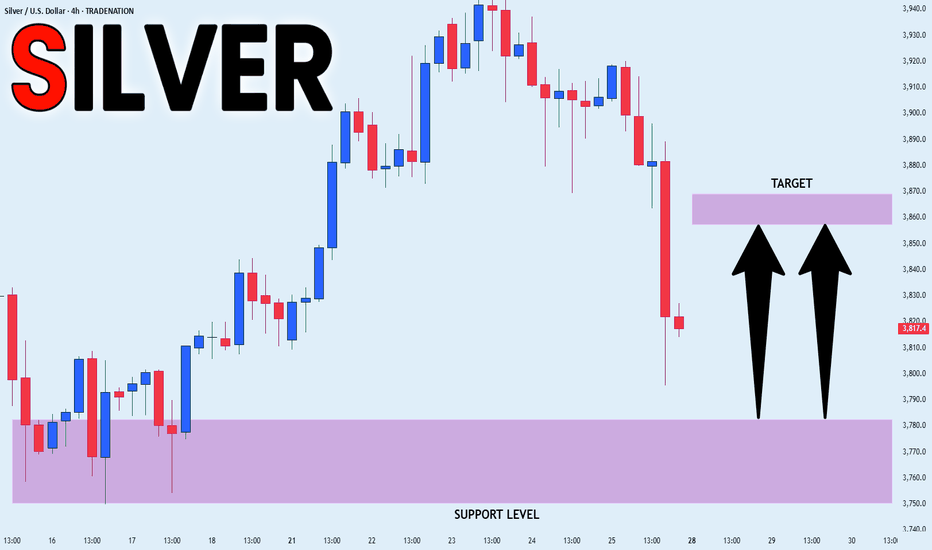

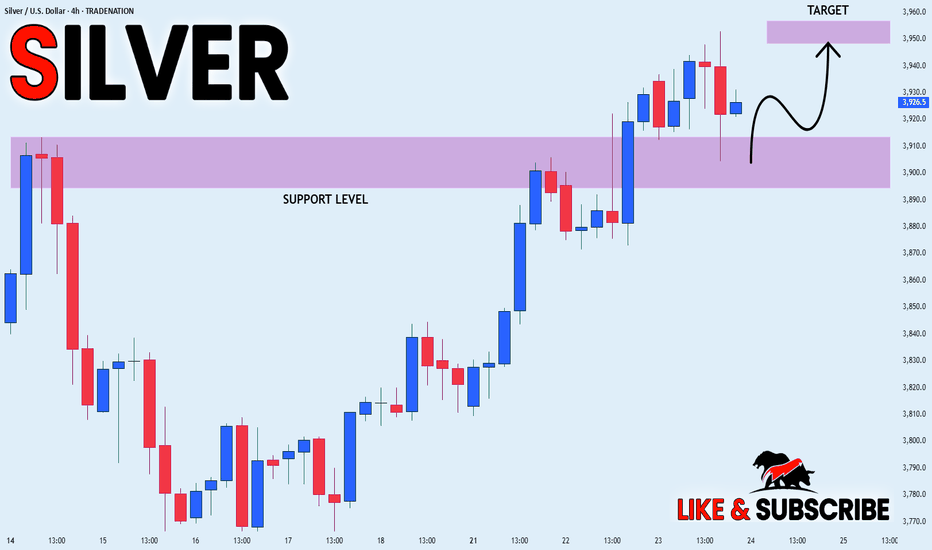

SILVER SUPPORT AHEAD|LONG|

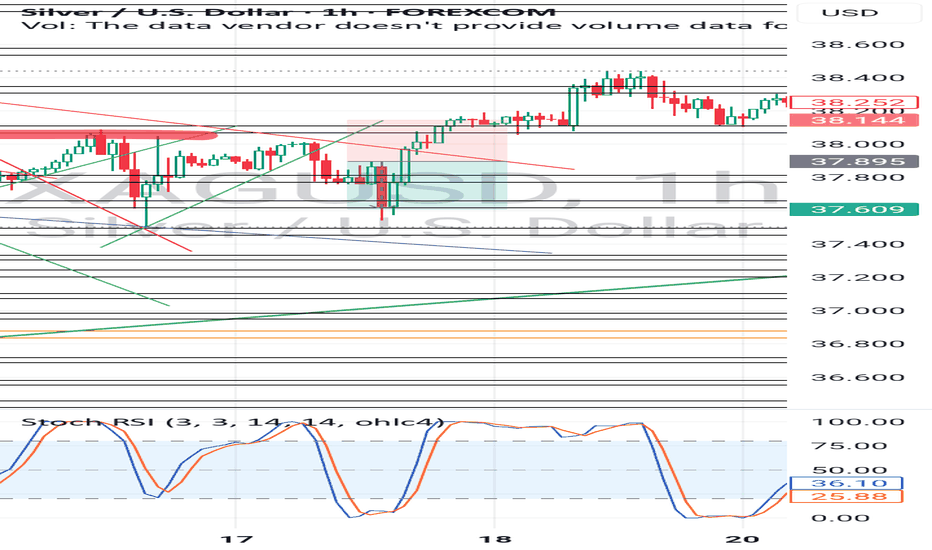

✅SILVER has been falling recently

And Silver seems locally oversold

So as the pair is approaching

A horizontal support of 37.80$

Price growth is to be expected

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XAGUSD01 trade ideas

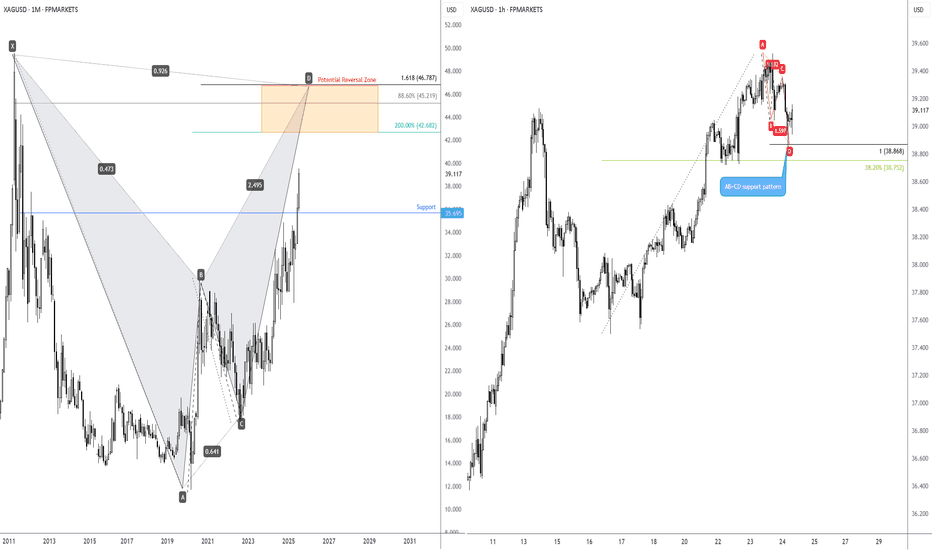

The biggest cup&handle of all times: silver targets $50The data suggests a cup&handle:

Cup was between 1980-2011

Handle is still in progress and probably may finish by 2025 or earlier.

For the short run: a re-test of low re-accumulation range of $23 can be seen.

The next mid-term target will be $25.

Final target will be $50.

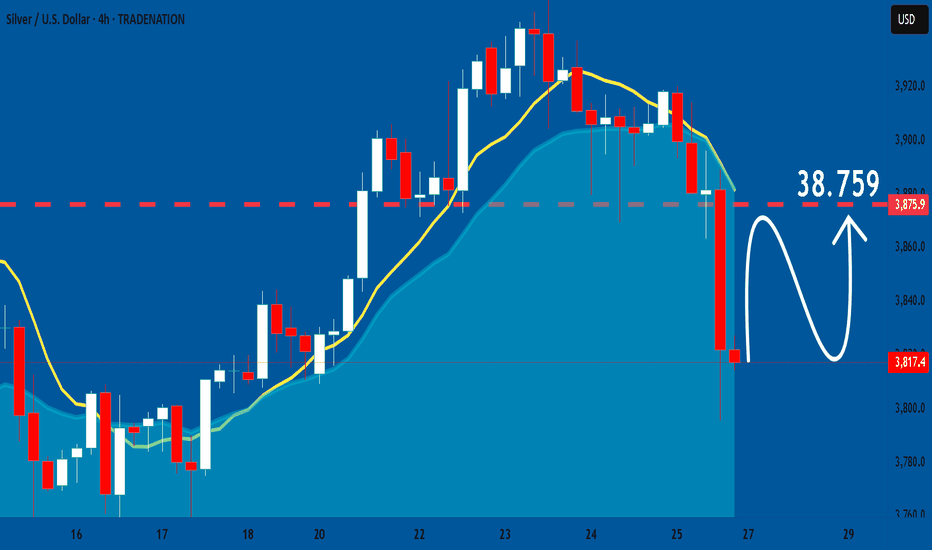

SILVER: Expecting Bullish Continuation! Here is Why:

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the SILVER pair price action which suggests a high likelihood of a coming move up.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

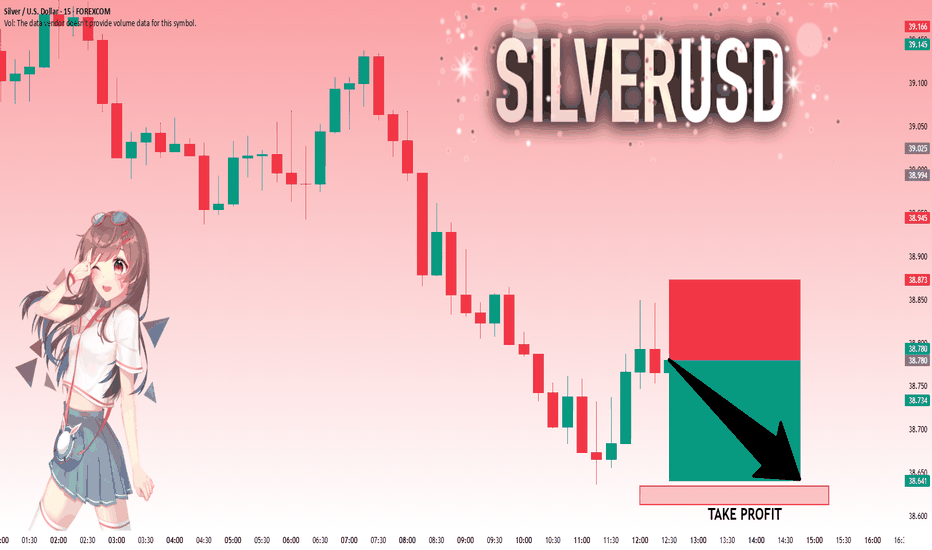

SILVER: The Market Is Looking Down! Short!

My dear friends,

Today we will analyse SILVER together☺️

The recent price action suggests a shift in mid-term momentum. A break below the current local range around 38.780 will confirm the new direction downwards with the target being the next key level of 38.635.and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

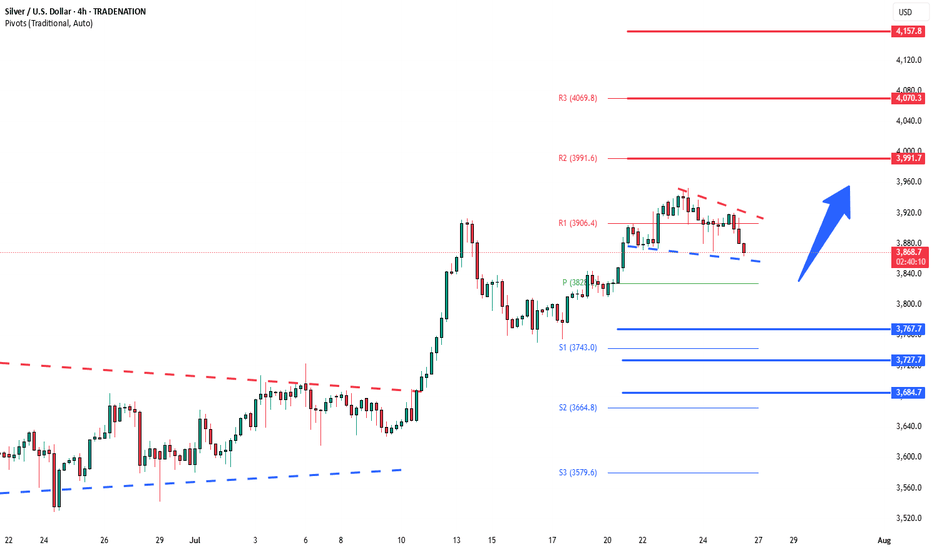

Silver bullish sideways consolidation The Silver remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend.

Support Zone: 3686 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 3686 would confirm ongoing upside momentum, with potential targets at:

3814 – initial resistance

3865 – psychological and structural level

3920 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 3686 would weaken the bullish outlook and suggest deeper downside risk toward:

3645 – minor support

3590 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the Silver holds above 3686. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

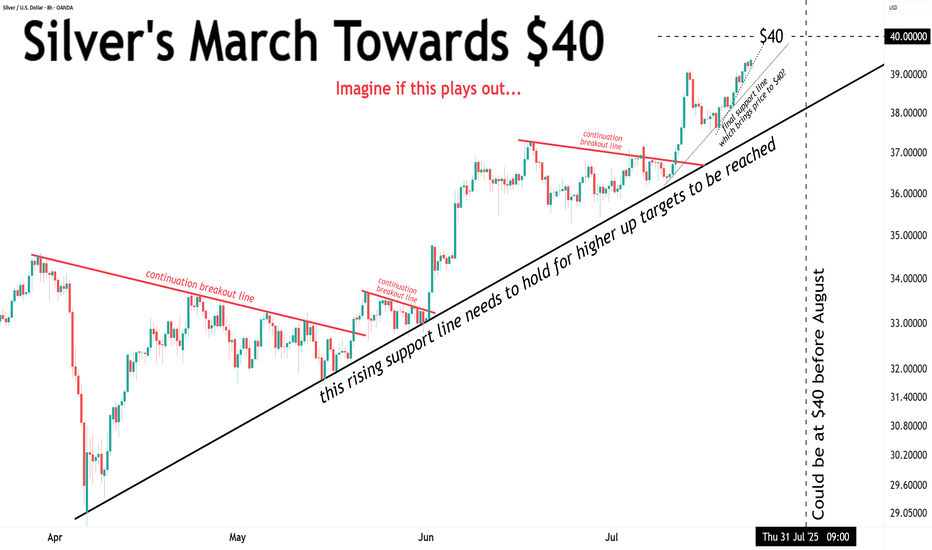

SILVER Retest of Cup and Handle Neckline📈 XAGUSD Trade Idea – July 25, 2025

Timeframe: 4H

Instrument: Silver / USD (XAGUSD)

Direction: Bullish continuation

Entry Zone: $39.00 - $39.10

Current Price: $39.103

🔍 Technical Analysis:

Cup & Handle Pattern: A clean cup formation is visible from July 15–21, followed by a bullish breakout and minor handle-like retracement.

Retest in Progress: Price is retesting the breakout zone around $39.00, showing consolidation above a strong support structure.

Dynamic Support Confluence: Multiple EMAs (green/orange/red cloud) are acting as support, with recent bullish candles bouncing off the mid-band area.

TD Sequential: A new "7" count signals potential continuation of the trend if support holds.

Volume Gap Below: Clean inefficiency (thin volume) below $38.40–$38.00 which may act as a magnet in case of invalidation, but is also untested demand.

📌 Trade Setup:

Entry: Around $39.00–$39.10 on confirmed support hold

Stop Loss: Below $38.50 (beneath EMA and recent higher low)

Take Profit Zones:

TP1: $39.80 (recent swing high)

TP2: $40.60 (measured move from cup breakout)

TP3: $41.00 psychological round number

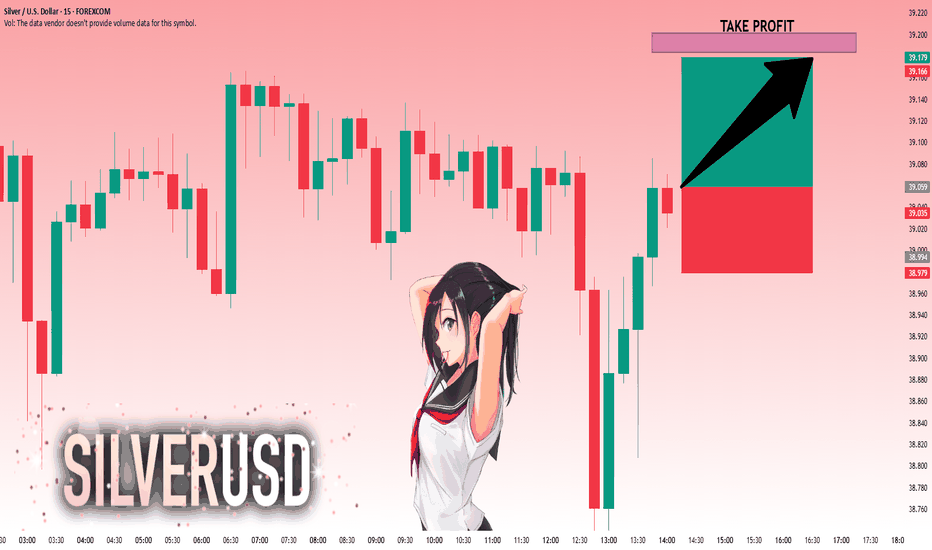

SILVER: Bulls Are Winning! Long!

My dear friends,

Today we will analyse SILVER together☺️

The market is at an inflection zone and price has now reached an area around 39.025 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move up so we can enter on confirmation, and target the next key level of 39.148.Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

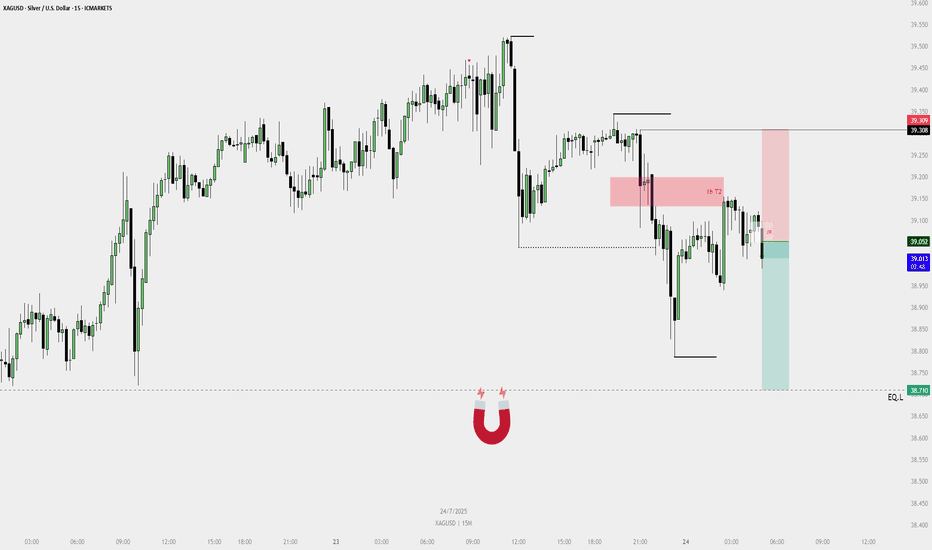

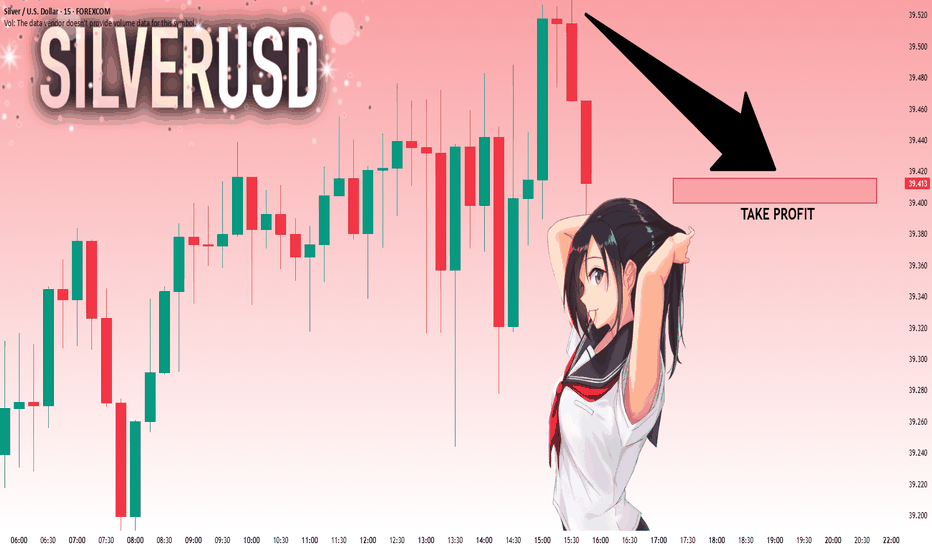

Sell Plan – XAGUSD (15M)🟥 Sell Plan – XAGUSD (15M)

Context:

Price swept liquidity from the previous swing high near the red FVG zone.

Reacted from H1 T2 bearish FVG.

Dealing Range (DR) confirmed in the 15M timeframe.

Bearish FVG formed, followed by a break of internal structure to the downside.

🔻 Trade Narrative:

After sweeping the short-term high, price tapped into the 1H T2 bearish FVG. A bearish fair value gap formed on the 15M chart, leading to the creation of a valid dealing range. Price respected this DR and showed rejection, signaling bearish intent.

⚙️ Confluences:

HTF Bearish FVG tapped (H1 T2).

Internal structure broken after the FVG.

DR formed within HTF POI.

Entry taken below DR after rejection candle.

Liquidity magnet (🧲 icon) marked below, aligning with bearish direction.

🎯 Target:

EQL (Equal Lows) marked at 38.710 – acting as liquidity target.

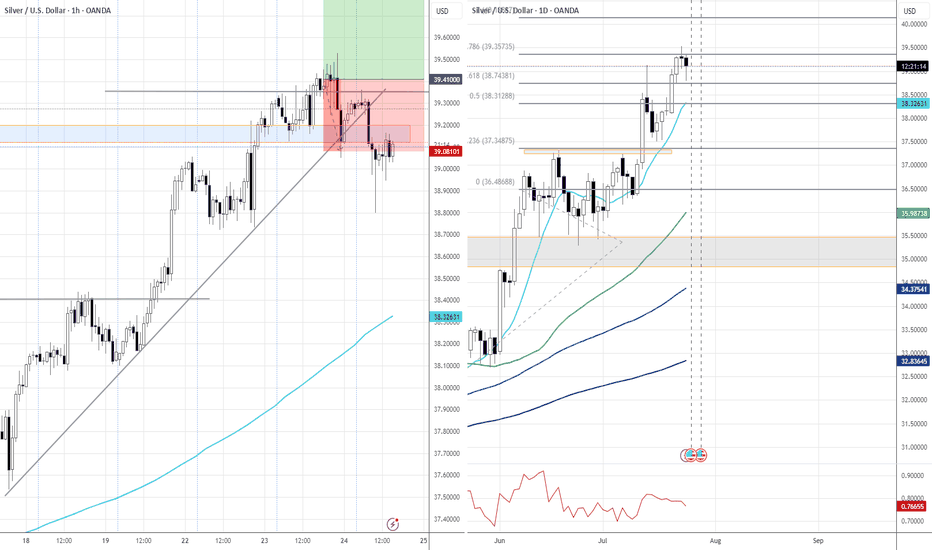

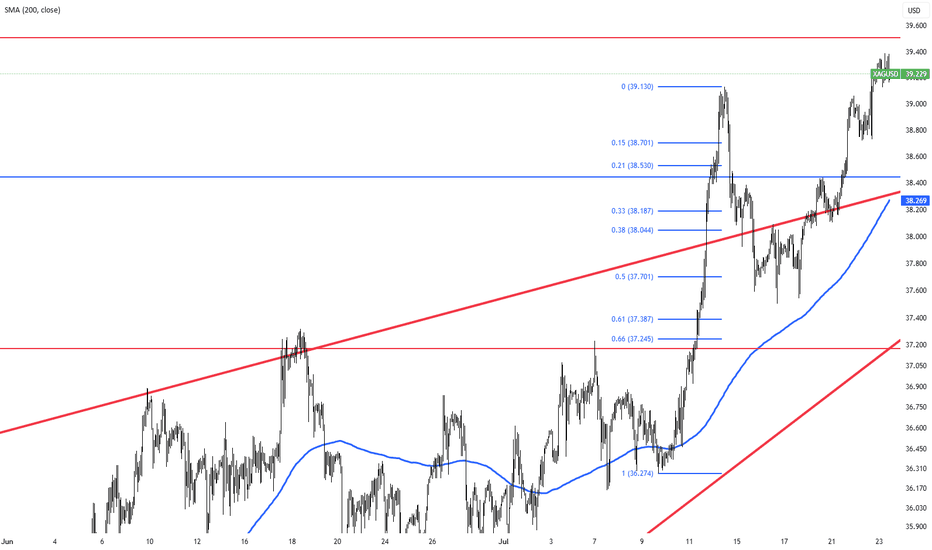

Long-term bullish action on Silver?I touched on the longer-term price action of Spot Silver (XAG/USD) last week, showing that the unit is on track to shake hands with a Potential Reversal Zone (PRZ) of a monthly harmonic bat pattern between US$46.79 and US$42.68.

Keeping things aligned with the harmonic landscape, you will note that H1 price action recently printed an AB=CD bullish pattern at US$38.87 (100% projection ratio), set just north of a 38.2% Fibonacci retracement ratio of US$38.75. While the H1 chart is generally considered short-term in nature, you may find that given we have longer-term flow suggesting scope for additional outperformance, short-term dip-buyers may consider holding a portion of their long positions open in an attempt to catch some of the possible longer-term upside.

SILVER WILL KEEP GROWING|LONG|

✅SILVER is trading in an

Uptrend and the price made

A retest of the horizontal support

Level of 39.10$ and we are already

Seeing a bullish reaction so we

Are bullish biased and we will be

Expecting a further bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bullish Continuation on Silver. 4 Areas To TargetWhen we last visited Silver we were looking at a Bullish Daily Chore opportunity. That opportunity played out nicely and now that we've officially violated the most recent structure high, it should be relatively smooth sailing to our next level of structure from back in 2011.

I say relatively, because the most conservative target area is right above current price, but don't worry, because in this video we'll discuss how there will still be plenty of trading opportunities, even if you choose to wait for a sign after that initial level.

If you have any questions or comments, please leave them below. Also, if you want to share your analysis that's always helpful for the community.

Akil

SILVER: Will Go Down! Short!

My dear friends,

Today we will analyse SILVER together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 39.520 Therefore, a strong bearish reaction here could determine the next move down.We will watch for a confirmation candle, and then target the next key level of 39.416..Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

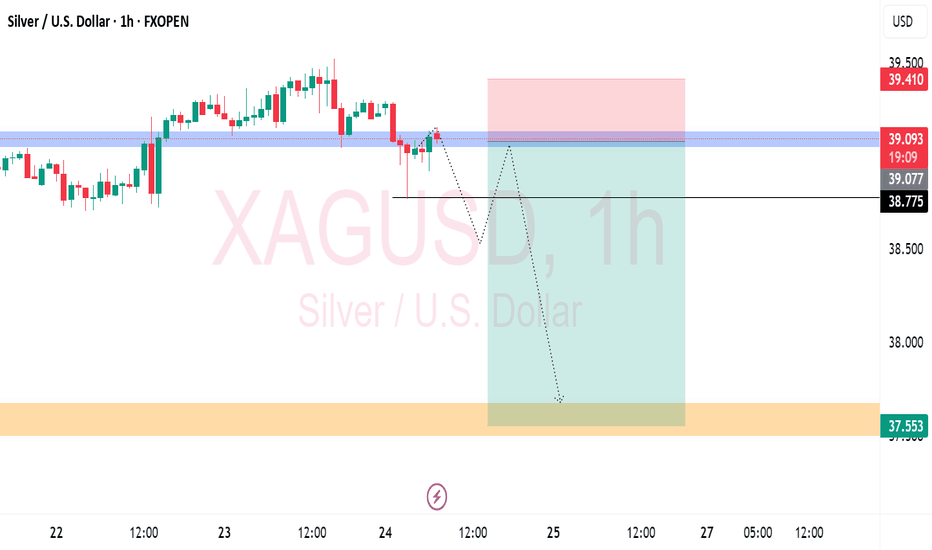

XAGUSD Sell Plan – 15M📉 XAGUSD Sell Plan – 15M

Bias: Bearish

Timeframe: 15-Minute

Date: July 23, 2025

🧠 Reasoning

Liquidity Grab: Price is sweeping short-term highs during New York open.

No More FVGs Above: Price seems to be exhausting upward momentum.

Magnet Below:

Equal lows (EQ_L) acting as a liquidity pool.

Tokyo low also lies below current price — another liquidity target.

High Probability Setup: Clean structure with a likely rejection from current premium zone.

🔴 Sell Strategy (Conceptual)

Wait for a minor liquidity grab or rejection wick to trap buyers.

Confirm a market structure shift or bearish order block.

Sell from that zone aiming for:

🎯 Target 1: Tokyo Low

🎯 Target 2: Equal Lows (Magnet zone)

⚠️ No SL/TP levels shown — trade based on structure and confirmation using your entry system (e.g., 5M DR, bearish FVG, etc.).

So how many times has silver touched or broken $40?So how many times has silver touched or broken $40?

ONLY TWICE !!!

• 1980 – short spike

• 2011 – brief sustained rally

Didn’t end well either time, both marked the end of bull markets.

But this time?

No mania. Just stealth. Silver’s quietly moving up.

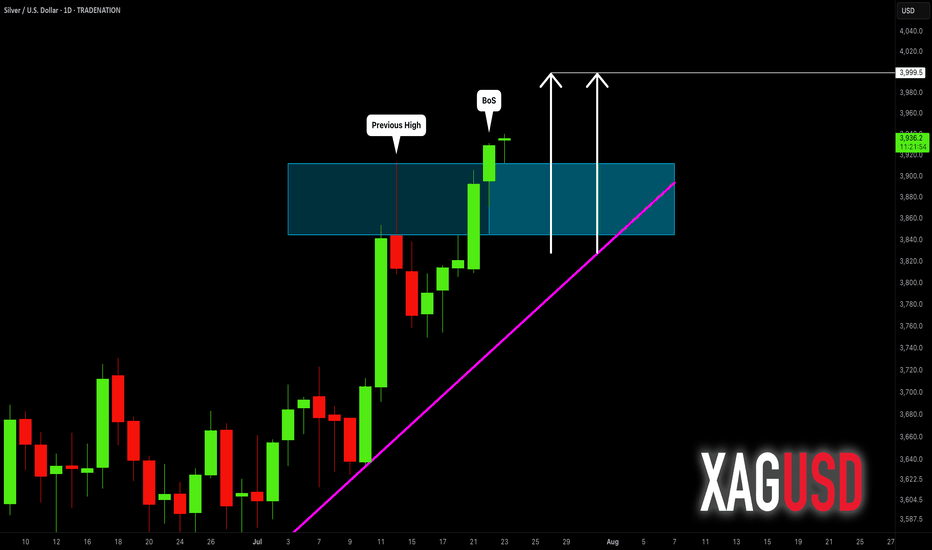

SILVER (XAGUSD): Confirmed Break of Structure

Silver updated a year's high yesterday, breaking a strong daily resistance.

With a confirmed Break of Structure BoS, we can expect that

the market will rise even more.

The next strong resistance is 40.

It is a round number based psychological level.

It can be the next goal for the buyers.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis

Silver Stays Strong on China Growth HopesSilver remained firm around $38.90 per ounce, holding near its highest levels since 2010. A weaker dollar and lower U.S. yields underpinned the metal, while traders await Fed Chair Powell’s comments and trade updates ahead of the August 1 deadline. China’s pledge to boost industrial growth also added to silver’s positive outlook.

Resistance is at $39.50, with support at $37.40.

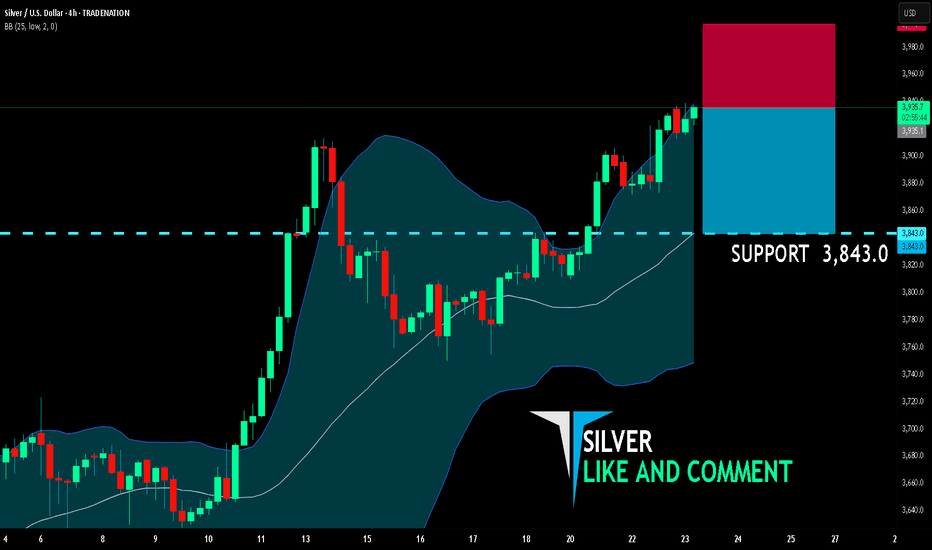

SILVER BEARS ARE GAINING STRENGTH|SHORT

SILVER SIGNAL

Trade Direction: short

Entry Level: 3,935.1

Target Level: 3,843.0

Stop Loss: 3,996.7

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 4h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅