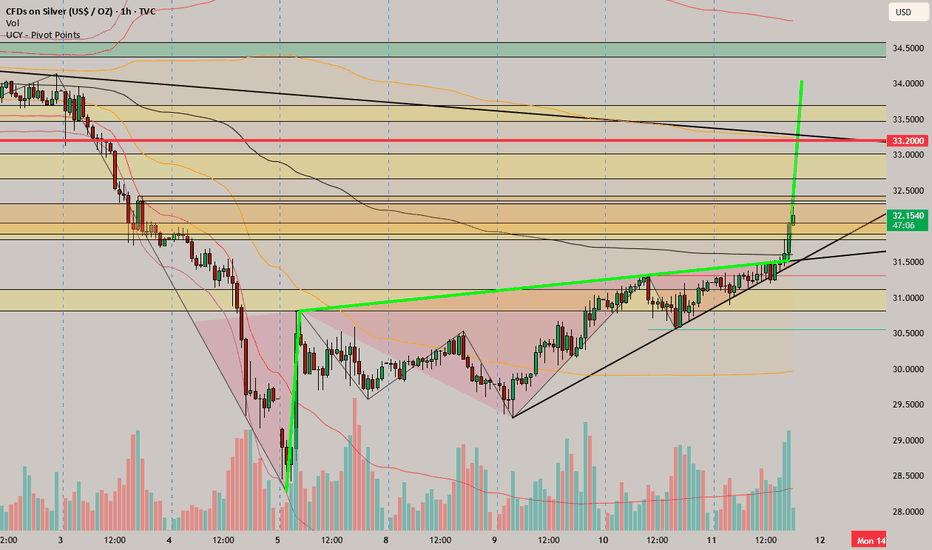

SELVER BUY SETUP 45minute chart analysisChart Observations:

Instrument: Silver (XAGUSD or CFDs on Silver in USD).

Timeframe: 45-minute.

Current price: Around 31.27.

Structure: There's a clear Change of Character (ChoCH) marked, suggesting a potential shift from bearish to bullish market structure.

Entry Zone: Price has returned to a demand zone (marked in blue) and is currently moving upward, which aligns with a bullish setup.

Projection: A bullish move is drawn with targets around 32.1389 and ultimately 33.5000.

Your Key Levels:

Entry Point: Around 31.27 (current market price aligning with structure and breakout).

Stop Loss (SL): Below the demand zone — looks like around 30.50 would be your SL (a bit under the low of the blue demand box).

Final Target (TP): Around 33.50 (as per your arrow projection and marked resistance zone).

Intermediate Target: 32.1389 (where horizontal line is drawn, previous supply zone).

Trade Summary:

Entry: 31.27

Stop Loss: 30.50

Target 1: 32.1389

Final Target: 33.50

Please hit the like button and

Leave a comment to support for My Post!

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, JAMES_GOLD_MASTER_MQL5

Thank you.

RRR (Risk-Reward Ratio):

Risk: 31.27 - 30.50 = 0.77

Reward: 33.50 - 31.27 = 2.23

RRR: ≈ 1:2.9 — very solid setup.

XAGUSDG trade ideas

Bearish reversal off overlap resistance?The Silver (XAG/USD) is rising towards the pivot and could reverse to the 1st support which has been identified as a pullback support.

Pivot: 32.73

1st Support:31.25

1st Resistance: 33.51

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

XAGUSD H4 | Be arish Reversal Based on the H4 chart, the price is approaching our sell entry level at 32.71, a pullback resistance

Our take profit is set at 31.25, a pullback support.

The stop loss is set at 34.52, a swing high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

SILVER Will Grow! Buy!

Hello,Traders!

SILVER is trading in an

Uptrend and the price is

Now consolidating above

The horizontal support

Of 31.80$ and as we are

Bullish biased we will be

Expecting a further bullish

Move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SILVER My Opinion! SELL!`

My dear subscribers,

This is my opinion on the SILVER next move:

The instrument tests an important psychological level 32.295

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 30.783

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

SILVER: Local Bearish Bias! Short!

My dear friends,

Today we will analyse SILVER together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding below a key level of 32.134 So a bearish continuation seems plausible, targeting the next low. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

SILVER Will Move Lower! Sell!

Please, check our technical outlook for SILVER.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 3,219.5.

Considering the today's price action, probabilities will be high to see a movement to 3,090.7.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

SILVER Is Bullish! Buy!

Please, check our technical outlook for SILVER.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 3,027.0.

Considering the today's price action, probabilities will be high to see a movement to 3,231.0.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

Silver Market Analysis 14-Apr-2025 (15m & 1Hr timeframe)Possible scenarios that could takes place on Silver

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Continuing the Uptrend: Buy or Add More SilverThe metal has returned to its upward trend after a dip. The current chart setup suggests a continuation of the rally, with possible consolidation around this level. Overall, the trend remains bullish, so I'm taking long positions.

OANDA:XPTUSD

OANDA:XPDUSD

MARKETSCOM:OIL

A similar setup can be seen in platinum, palladium, and oil—I'm also trading long there.

OANDA:XAUUSD

As for gold, everything looks great, but the exponential rise makes me cautious. I'd consider entering on a pullback, but for now, I'm staying on the sidelines and watching.

SILVER (XAGUSD): Strong Bullish Sentiment

With 2 breakouts of 2 key daily resistances,

Silver demonstrates a very strong bullish sentiment.

I believe that it will keep rising this week

and reach at least 3265 resistance.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Monday bounce points to extension of bullish move

Silver bounced off minor support at $31.84 in early Asian trade on Monday, indicating the level may be useful for traders eyeing a potential bullish setup.

Longs could be established above the level with a tight stop beneath to protect against reversal. Overhead, former uptrend support currently intersects with the key 50-day moving average around $32.50, making that a potential initial target. A break above would bring $32.73 into play, a level that acted as both support and resistance during March.

The momentum picture has become more palatable for bulls, with RSI (14) trending higher and back near neutral. MACD remains in negative territory and is yet to cross the signal, though it’s starting to curl higher, suggesting bearish momentum is ebbing.

If silver reverses and breaks $31.84, the setup would be invalidated, opening the door to trades targeting a partial retracement of the recent bounce.

Good luck!

DS

Bearish reversal off overlap resistance?XAG/USD is rising towards the resistance level which is an overlap resistance that lines up with the 71% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 32.71

Why we like it:

There is an overlap resistance level that lines up with the 71% Fibonacci retracement.

Stop loss: 33.59

Why we like it:

There is a pullback resistance level.

Take profit: 31.47

Why we like it:

There is a pullback support level that lines up with the 23.6% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bearish reversal?The Silver (XAG/USD) is rising towards the pivot and could reverse to the 1st support which acts as an overlap support.

Pivot: 32.82

1st Support: 30.90

1st Resistance: 34.56

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

SILVER SHORT FROM STRONG RESISTANCE|

✅SILVER is going up now

Following the market-wide

Bullish rebound on most assets

But a strong wide resistance

Level is ahead around 33.00$

Thus I am expecting a pullback

And a move down towards

The local target of 31.75$

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SILVER: Bearish Forecast & Bearish Scenario

It is essential that we apply multitimeframe technical analysis and there is no better example of why that is the case than the current SILVER chart which, if analyzed properly, clearly points in the downward direction.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

XAGUSD - Awaiting Correction Before Next Leg HigherSilver (XAG/USD) appears to be in a recovery phase after experiencing a sharp selloff in early April that found a bottom near $2,840. The 4-hour chart shows the price has rebounded significantly from those lows and we are expecting for it to form a correction pattern. Based on the projected price path, we can expect a period of consolidation with some downside movement to establish a higher low, potentially targeting the $3,060-3,080 support zone, before resuming the larger uptrend toward $3,350 and beyond. This anticipated correction provides an excellent opportunity for traders to prepare long setups at discounted prices, with the highlighted support area around $2,880 serving as a major floor that should contain any deeper pullbacks. The overall technical structure suggests this retracement will be temporary before bulls regain control of the market.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Silver Massive C&H Bull Market 400%+ gains Lifetime opportunity🏆 Silver Market Update (April 13th, 2025)

📊 Technical Outlook Update

▪️Long-term outlook 2weeks/candle

▪️Massive C&H formation in progress

▪️40 USD breakout pending now

▪️PT BULLS 400%+ gains BUY/HOLD

▪️Price Target BULLS 125/150 USD

▪️Bull market still pending

▪️BUY/HOLD now or miss out on gains

📢 Silver Market Update – April 2025

📈Silver is widely used in electronics due to its exceptional electrical and thermal conductivity, making it ideal for various applications, including printed circuit boards, connectors, and contact surfaces.

🚀 It is also employed in devices like touch screens, batteries, and solar panels. Silver's high conductivity, solderability, and resistance to corrosion and oxidation contribute to its popularity in the electronics industry.

XAG/USD Daily AnalysisStrong buying came into play at the $29 supply/support zone which we last saw tested and rejected twice back in December 2024.

After a brief pause at $31 on Thursday, buyers took price to a high of the week at $32.27

It's possible that we might see a pullback and correction, testing $31 which was support in February this year.

This is just an idea of what may happen. You should always trade with a well tested and profitable trading strategy using good risk management.

SILVER Massive Long! BUY!

My dear friends,

Please, find my technical outlook for SILVER below:

The price is coiling around a solid key level - 29.588

Bias -Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 31.319

Safe Stop Loss - 28.754

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK