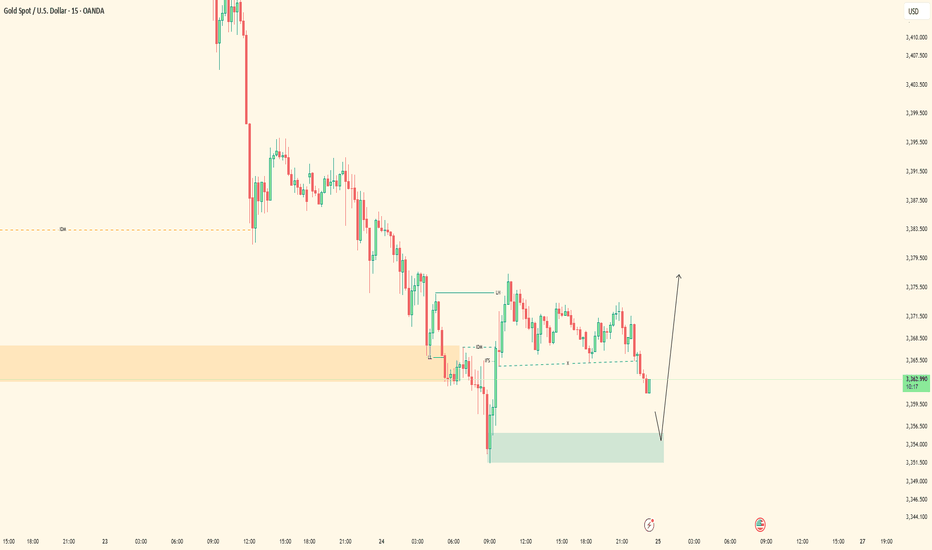

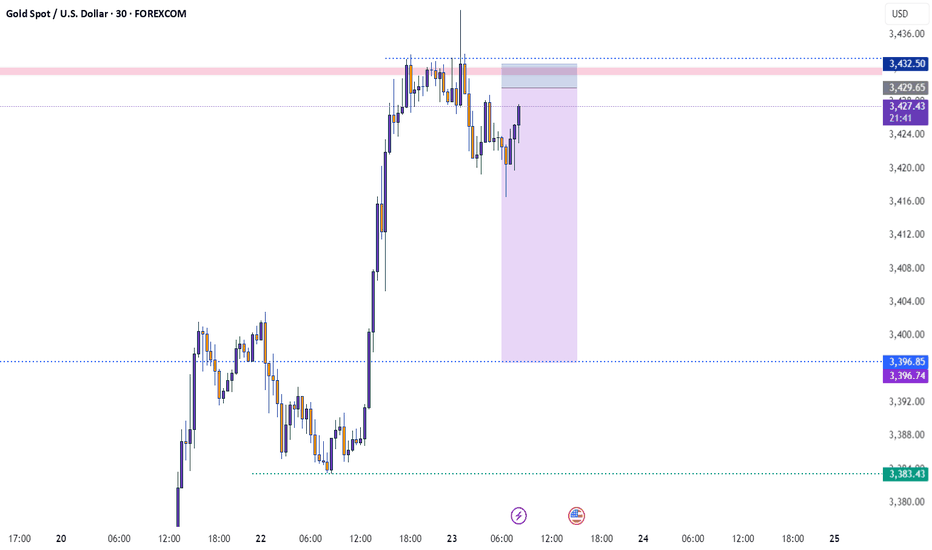

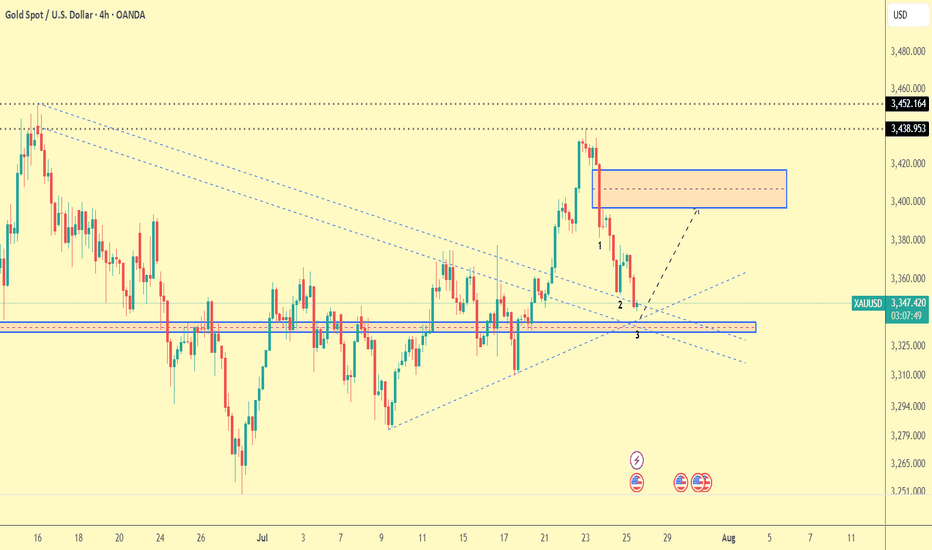

XAUUSD Locked In| Waiting for 5M OB SparkPair: XAUUSD (Gold)

Bias: Bullish

Timeframes: 30M / 5M

Gold has followed structure beautifully — top-down alignment from 30M into 5M is clear. Price respected the 30M OB and showed intent, but now we’re approaching the moment of truth.

I’m watching the 5M OB for entry — this is where execution mode activates. No rush. I’m in analysis mode right now, but the shift is coming.

Entry zone is mapped, structure’s in place, order flow is aligned — all I need now is price to do what it always does: respect the blueprint.

Entry Zone: 5M OB

Target: 5M highs

Mindset Note: Patience before the spark. I don’t force entries — I wait for the market to hand me the move it already hinted at. ⚡️

XAUUSD trade ideas

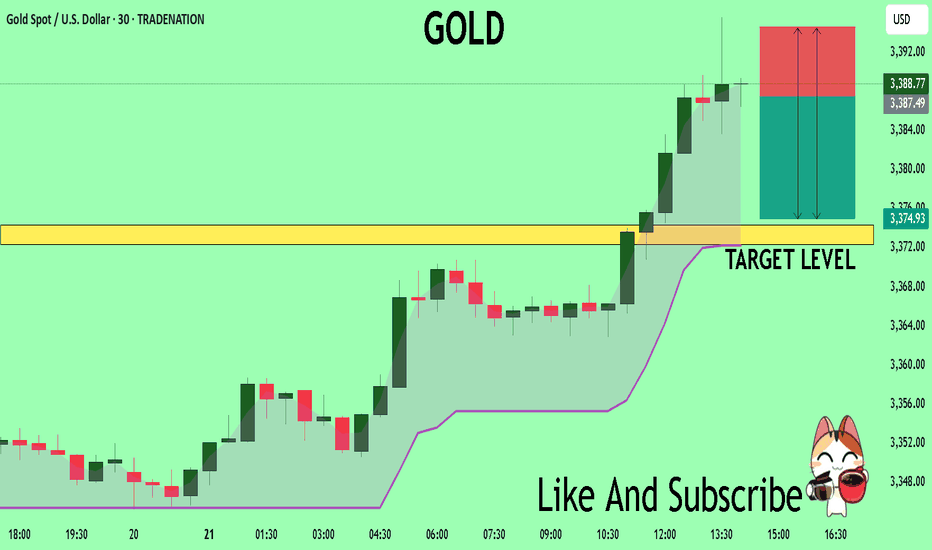

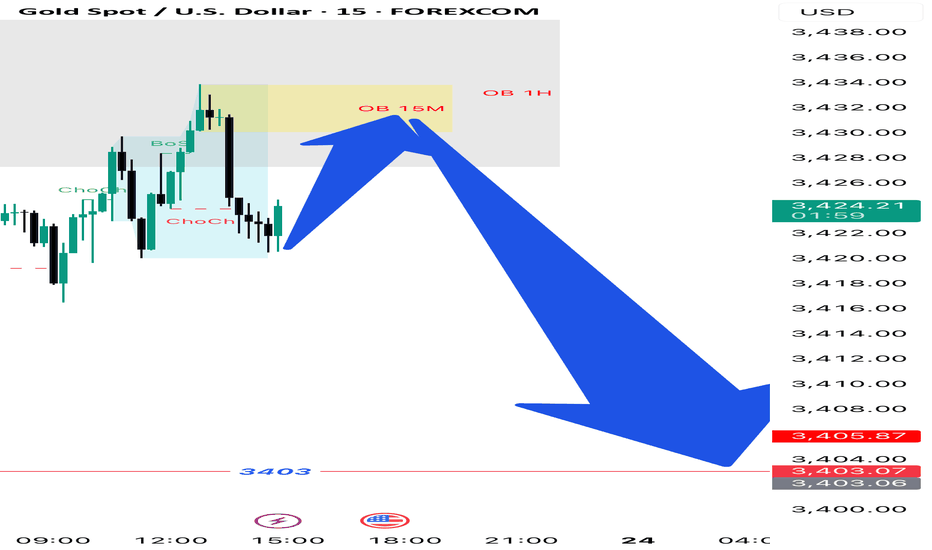

GOLD Technical Analysis! SELL!

My dear subscribers,

This is my opinion on the GOLD next move:

The instrument tests an important psychological level 3387.7

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 3374.3

My Stop Loss - 3394.5

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

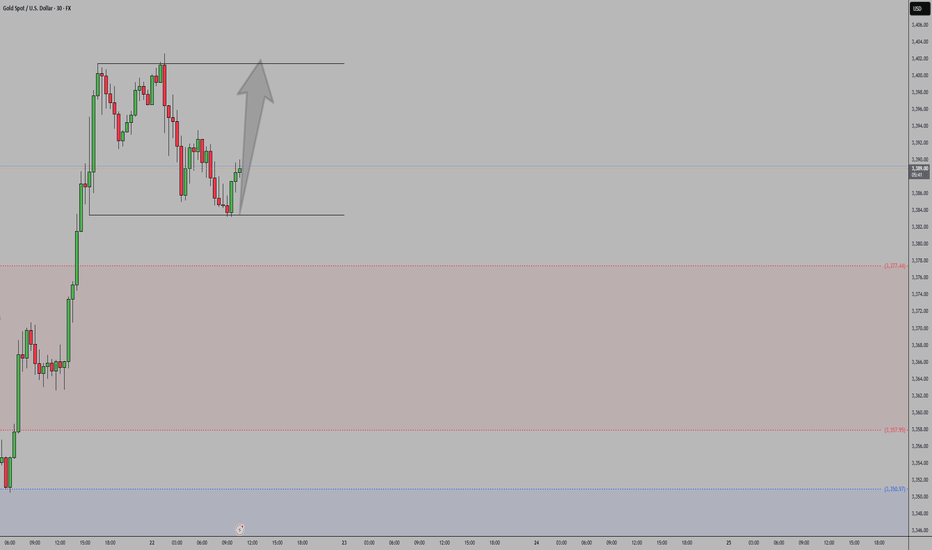

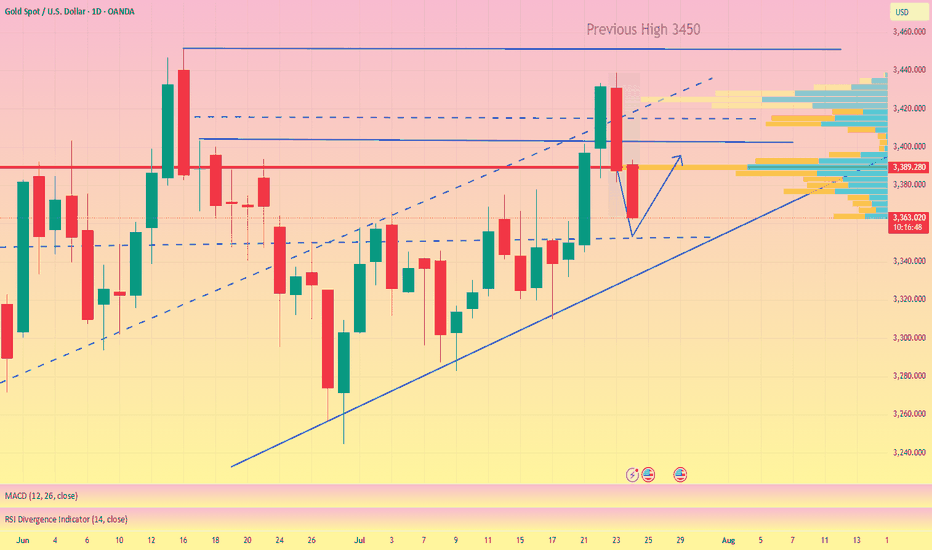

Gold Trade Plan 21/07/2025 ( 3380-3400 ( Important Area))Dear Traders,

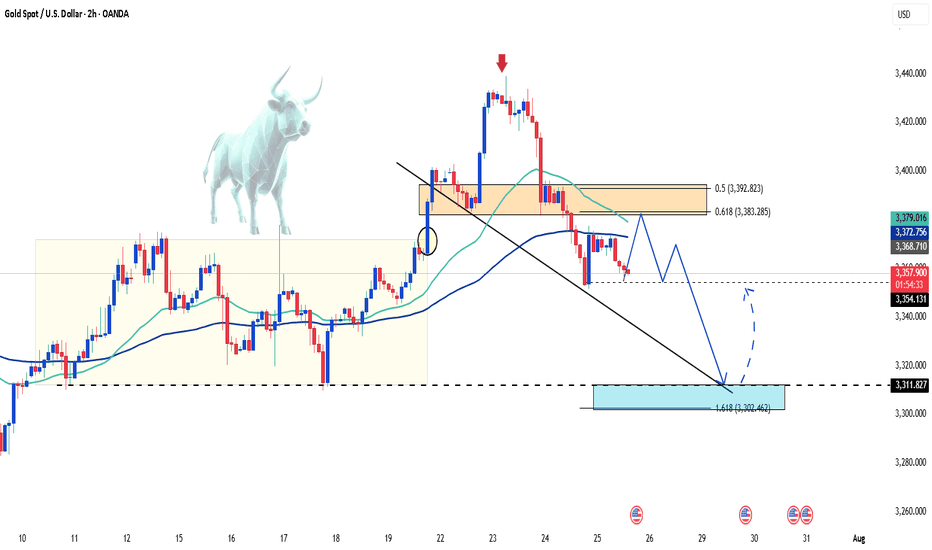

The price is inside an ascending triangle, and it is certain that we will see a definitive breakout above the previous high. However, the important point is whether wave 4 has completed and we are entering wave 5, or if we are still in the correction phase of wave 4. In case of a breakout and stabilization between 3380-3400, the price will continue its bullish trend. However, as long as this zone is not broken, I expect a correction towards around 3220-3240.

Regards,

Alireza!

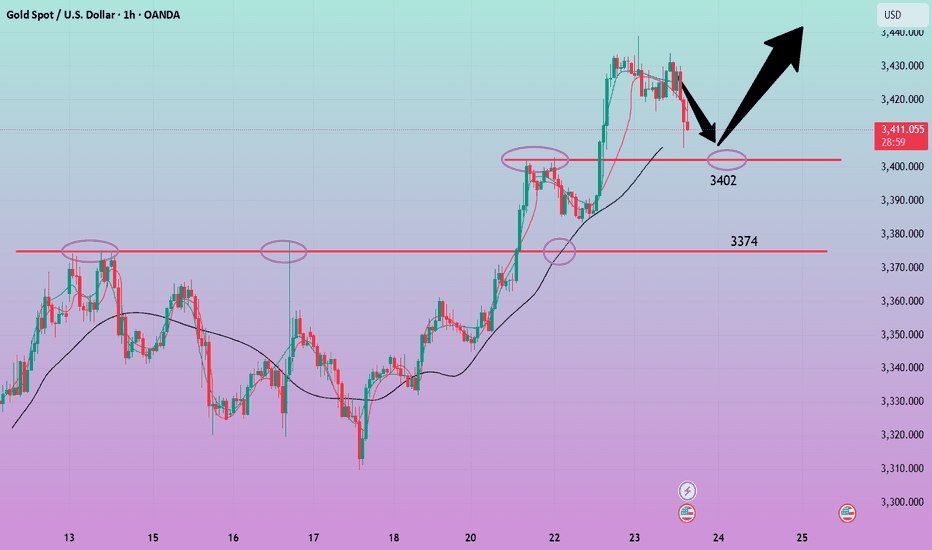

GOLD OUTLOOK – READY FOR THE NEW TRADING WEEK (JULY 21–25)GOLD OUTLOOK – READY FOR THE NEW TRADING WEEK (JULY 21–25)

🟡 Market Recap:

Gold made a strong bullish reversal at the end of last week, following a liquidity sweep at the FVG ZONE 3310. Price surged quickly toward the OBS SELL ZONE around 335x–336x.

However, by Friday’s close, price reacted to multiple confluences (OBS + FIBO zones) and closed below the VPOC level in the recent uptrend – forming a potential short-term top.

📉 Outlook for July 21–25:

No major economic data expected next week.

However, geopolitical tensions and trade policy concerns (e.g. tariffs, military conflicts) will be the key catalysts.

These events could lead to high volatility and liquidity grabs across the board.

🧠 Technical Perspective – H1 Mid-Term View:

Gold continues to form multiple unfilled Fair Value Gaps (FVGs) after strong bullish moves.

Recent price action created new high-zone FVGs, but lower FVGs remain untested.

🔁 Expected scenario: A potential retracement to fill the lower FVG zones (3310/3305), followed by another bullish leg.

📍Trading Strategy:

Wait for price to retrace into FVG Low Zones.

Look for early BUY setups at confluence areas:

CP zones

FIBO retracement levels

Volume/Price reaction zones

🎯 Target Outlook:

Bullish targets around 333x – 336x remain valid.

If price sustains momentum after pullback, we may aim for Buy Side Liquidity near 3371.749.

✅ Key Reminders:

Avoid chasing highs (FOMO).

Stick to proper TP/SL rules, especially with headline-driven markets next week.

🎉 Wishing you a relaxing weekend – recharge and get ready to conquer the markets next week!

🚀 GOD BLESS ALL

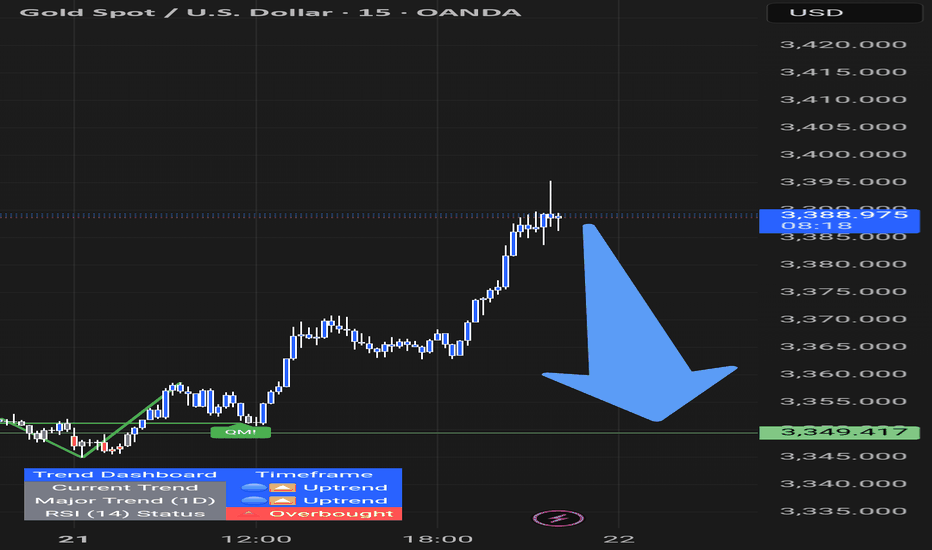

Wait for 3330 to buy the bottom and reduce unnecessary operation#XAUUSD

We have made good profits from short selling yesterday. Currently, gold has fallen to 3350📎. The 4HMACD death cross has increased in volume and is expected to continue to decline. Consider going long near 3330📈. I don’t think it is prudent to bottom out at 3340. Move forward steadily on Friday and reduce unnecessary operations⚖️.

🚀 BUY 3335-3330

🚀 TP 3345-3362

Gold dips on profit-taking, long-term outlook still bullishGold prices continued to decline this morning as investors locked in profits following the precious metal’s recent rally above $3,400.

In the short term, further downside is possible if profit-taking persists and capital flows shift toward equities, especially as U.S. stock markets hover near record highs. However, gold remains a favored safe-haven asset for the long run amid ongoing global economic and geopolitical uncertainties.

Markets are also turning their focus to the upcoming Federal Reserve policy meeting on July 29–30. While the Fed is expected to hold interest rates steady this time, many investors still anticipate a potential rate cut in September. A low interest rate environment typically supports non-yielding assets like gold.

GOLD continues to correct down, good news from trade situationOANDA:XAUUSD has fallen sharply again, currently trading around $3,360/oz, reflecting the easing of global trade tensions, affecting demand for safe-haven assets. The US Dollar and US Treasury yields have also increased, affecting gold prices.

The US Dollar Index ( TVC:DXY ), which tracks the greenback against six other currencies, rose to 97.56.

The yield on the 10-year US Treasury note US10Y rose to 4.386%. The US real yield, calculated by subtracting inflation expectations from nominal interest rates, rose nearly 3.5 basis points to 2.046%.

Markets are increasingly optimistic about such deals after the United States and Japan reached a trade deal, and the European Union could be next. In addition, rising stock markets and low volatility have kept gold's gains in check.

The United States and the European Union are moving toward a potential trade deal that would include a 15% tariff on EU goods and zero tariffs on some items.

The European Commission said Thursday that a negotiated trade solution with the United States is within reach.

“Our focus is on reaching a negotiated outcome with the United States,” a European Commission spokesperson told reporters about the EU-U.S. tariff talks. “We believe that such an outcome is achievable.” The European Commission has repeatedly said that its current priority is to reach a deal with the United States to avoid the 30% tariffs that U.S. President Trump has proposed to impose on EU products starting August 1.

On the economic data front, initial jobless claims in the United States unexpectedly fell last week, suggesting the job market remains solid.

The U.S. Bureau of Labor Statistics reported on Thursday that initial jobless claims fell to 217,000 in the week ended July 19, below expectations of 227,000 and down from 221,000 the previous week.

Technical Outlook Analysis OANDA:XAUUSD

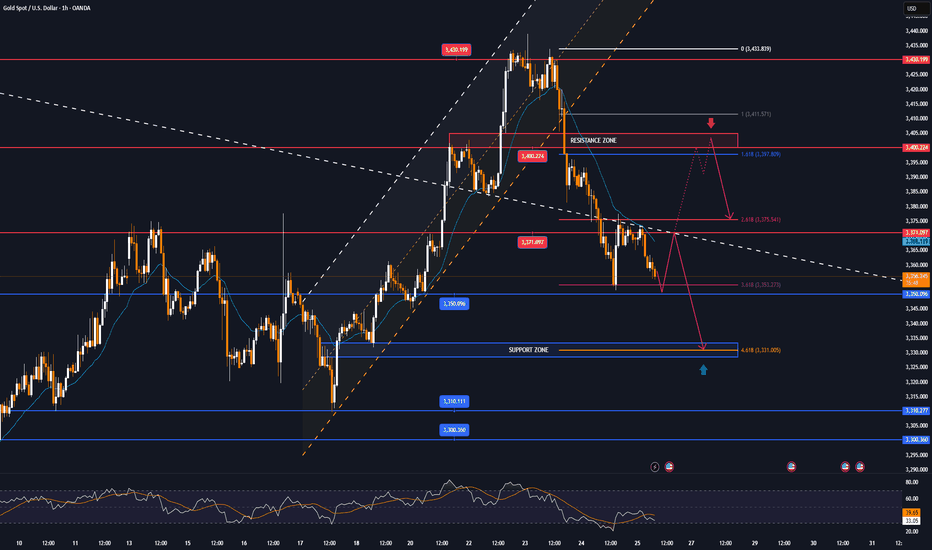

Gold is heading for its third consecutive day of decline since hitting the bullish target level sent to readers in the weekly edition on Sunday at $3,430.

Despite the sharp decline, gold still has enough technical conditions for an uptrend given its current position and structure.

Specifically, gold is still above the EMA21, which is considered the nearest support at the moment. Along with that, the uptrend price channel is the short-term trend. However, for gold to qualify for a short-term bullish cycle, it needs to be confirmed by price action above the 0.236% Fibonacci retracement level, then the target is $3,400 in the short term, more than $3,430.

On the other hand, RSI is still holding above 50, and 50 in this case acts as momentum support. Therefore, gold still has room to rise.

In case gold is sold below EMA21, it may suffer a further decline with the next target around $3,310 in the short term, more than $3,300 and the 0.382% Fibonacci retracement level. And if gold loses the support at the 0.382% Fibonacci level, it will qualify for a bearish cycle.

Intraday, the current position of gold price is still tilted towards the upside, and the notable price points will be listed as follows.

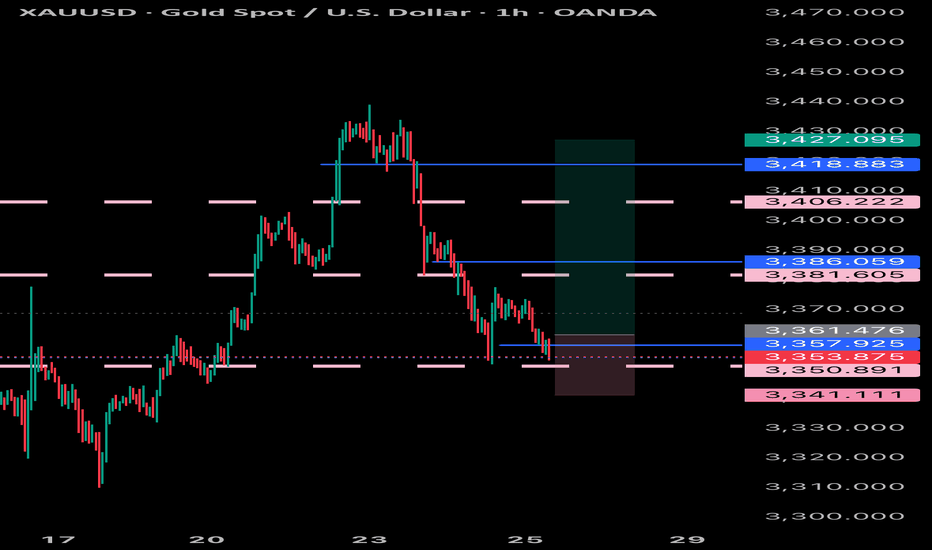

Support: $3,350 – $3,310 – $3,300

Resistance: $3,371 – $3,400 – $3,430

SELL XAUUSD PRICE 3406 - 3404⚡️

↠↠ Stop Loss 3410

→Take Profit 1 3398

↨

→Take Profit 2 3392

BUY XAUUSD PRICE 3329 - 3331⚡️

↠↠ Stop Loss 3326

→Take Profit 1 3337

↨

→Take Profit 2 3343

The callback is coming to an end, don't chase the short easily#XAUUSD

The long positions held last night have already left the market at a loss😔. After the Asian session opened, I continued to watch the trend of gold, but it did not effectively rebound to the ideal target area. After repeatedly testing around 3393, I chose to manually exit the market📀.

Gold is currently somewhat overcorrected, with the hourly line falling into severe oversold territory📉. But the market will eventually return to the bullish trend🐂. Why do I say that? First, there are less than 8 days left before the final deadline for tariffs. Second, the Federal Reserve’s interest rate cut is also approaching. In the medium and long term, there is definitely no problem with being bullish. There will be initial jobless claims data later, which will affect the trend of gold today. We need to pay some attention to it👀.

From the daily line, the current Bollinger Band middle track is near the 3343 line, and the SMA60 moving average is near the 3330 below. In the short term, the downward momentum of gold is released, and it is expected to test the 3343 mid-line support below💪.

📊Therefore, we can consider going long again at 3360-3343 below and look towards 3375-3385. Short-term losses don’t mean anything. With the recent frequent news fluctuations, we still have a good chance to turn losses into profits🚀.

🚀BUY 3360-3350

🚀TP 3375-3385

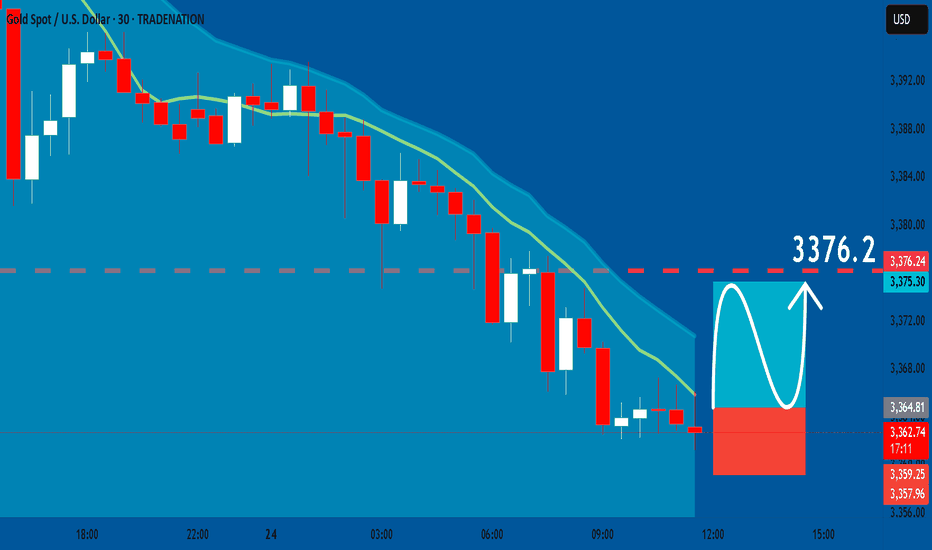

GOLD: Bullish Continuation & Long Signal

GOLD

- Classic bullish formation

- Our team expects growth

SUGGESTED TRADE:

Swing Trade

Buy GOLD

Entry Level - 3364.8

Sl - 3359.2

Tp - 3376.2

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

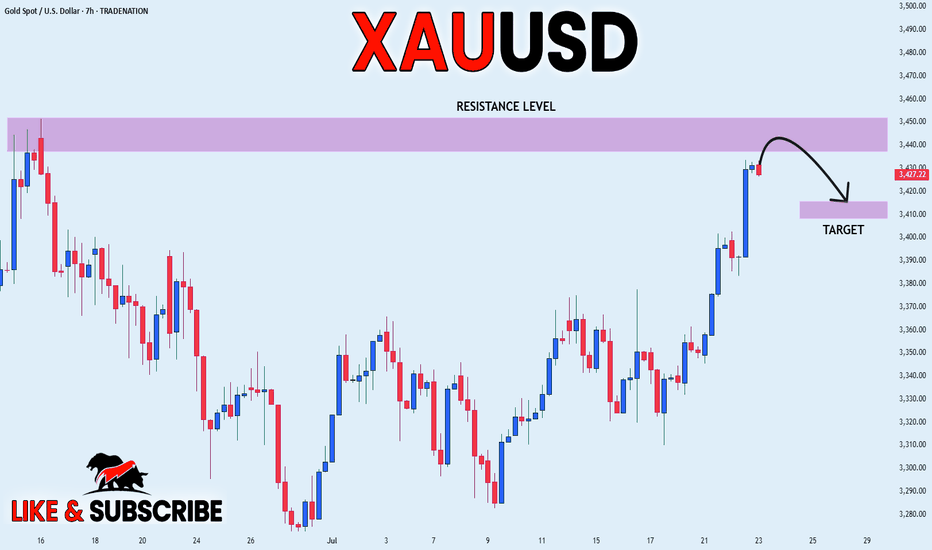

GOLD SHORT FROM RESISTANCE|

✅GOLD is set to retest a

Strong resistance level above at 3450$

After trading in an uptrend for some time

Which makes a bearish pullback a likely scenario

With the target being a local support below at 3414$

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

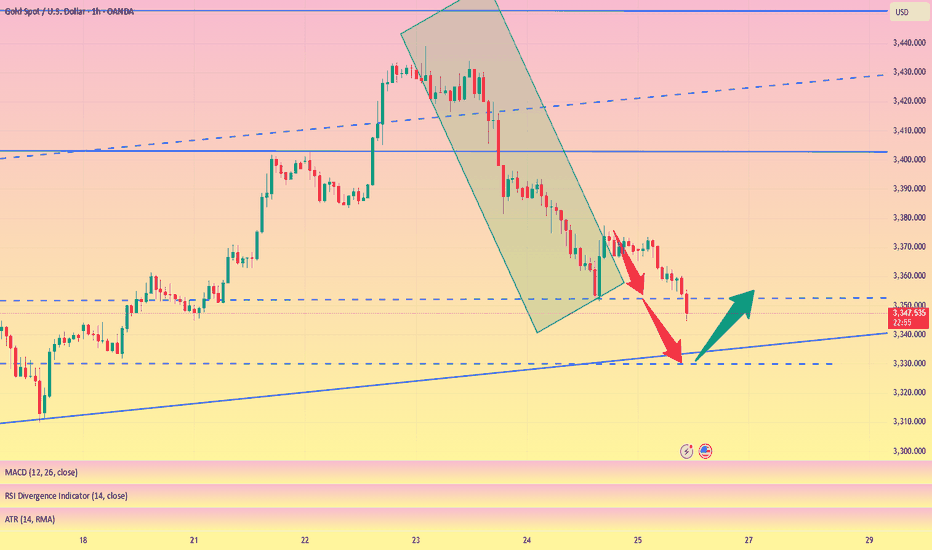

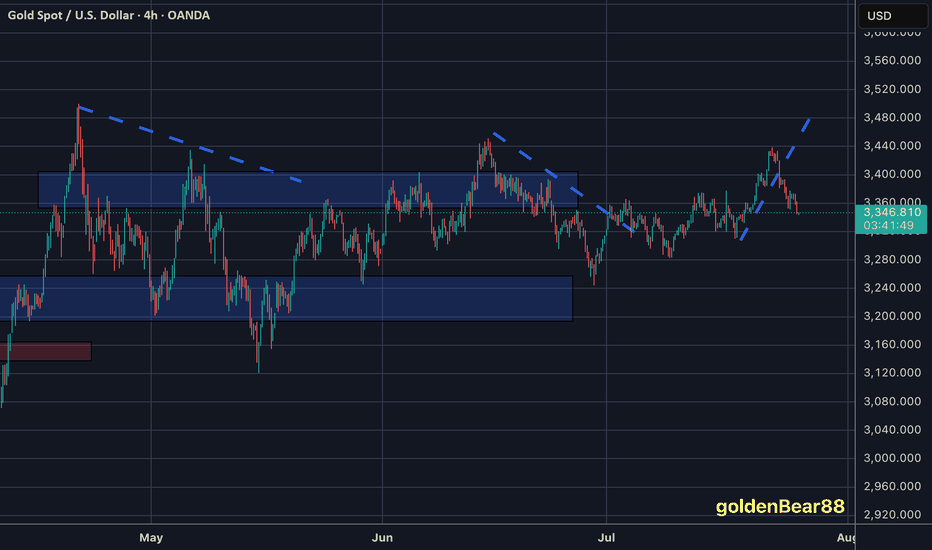

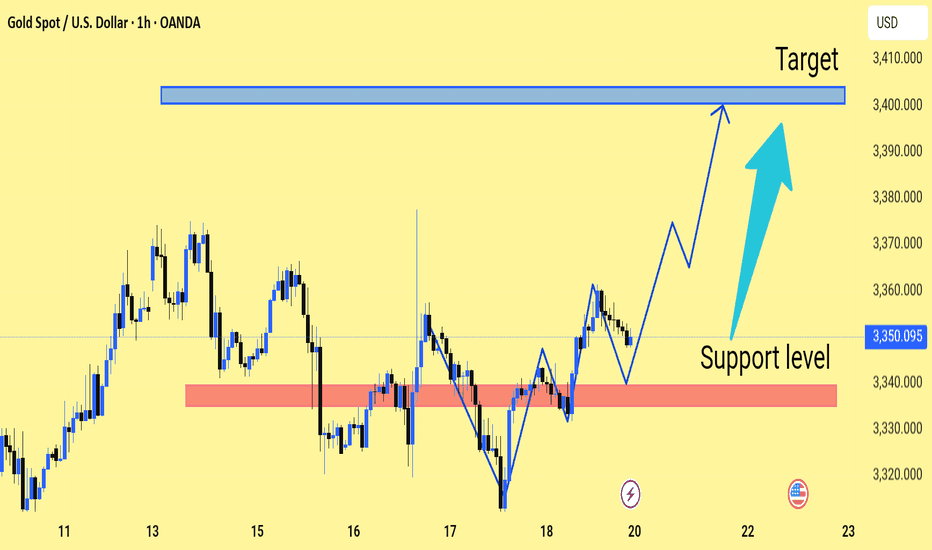

Gold Trade Plan 25/07/2025Dear Trader,

Gold (XAU/USD) is currently in a corrective phase, reaching near the support zone at around 3,340. The price is testing the trendline, and we may see a potential bounce towards the resistance level at 3,400-3,420. If the price breaks below this support, we could expect a further drop towards the next support levels near 3,325-3,310. The market will likely consolidate in this range until we see a breakout in either direction. The key levels to watch are 3,340 (support) and 3,400-3,420 (resistance). Monitor the price action closely as a reversal or continuation can occur here.

Regards,

Alireza!

#3,377.80 Resistance remains strongMy position: I have Bought Gold many times above #3,400.80 benchmark however as it got invalidated, I Bought #3,390.80 again late U.S. session and closed my set of Buying orders on #3,395.80 nearby extension. I left one runner (#3,390.80 entry point) with Stop on breakeven expecting Asian session to recover #3,400.80 benchmark, however it was closed on break-even as Gold extended Selling sequence. I will continue Selling every High's on Gold and if #3,357.80 gives away, expect #3,352.80 and #3,342.80 contact points to be met.

As expected Gold delivered excellent #3,372.80 and especially #3,365.80 - #3,352.80 Selling opportunities throughout yesterday's session which I utilized to it's maximum. I have also Bought Gold on late U.S. session with #3,372.80 as an entry point / however since Gold was ranging, I closed my order on break-even and met Gold below #3,352.80 benchmark this morning personally on my surprise (I did expected #3,377.80 to be invalidated to the upside).

Technical analysis: Gold’s Price-action is performing well below both the Hourly 4 chart’s and Daily chart’s Resistance zones for the cycle. Selling direction of today’s session is directly correlated with Fundamentals leaving the scene which found Sellers near the Intra-day #3,377.80 Resistance and most likely DX will close the Trading week in green, however struggling to make Bullish comeback and if #3,327.80 - #3,342.80 reverses the Selling motion, Gold’s Daily chart’s healthy Technicals which preserved core uptrend values. If the Price-action gets rejected at #3,352.80 - #3,357.80 Resistance zone, then further decline (under conditions where I will have more information with U.S.’s session candle) is possible and cannot be ruled out. Notice that at the same time and manner, Bond Yields are on consecutive Selling spree as well which Fundamentally has a diagonal correlation with Gold. The slightest uptrend continuation there, should add enormous Selling pressure on Gold.

My position: I am Highly satisfied with recent results and will take early weekend break (no need to Trade more). If however you decide to Trade today, Sell every High's on Gold / no Buying until Monday's session (my practical suggestion).

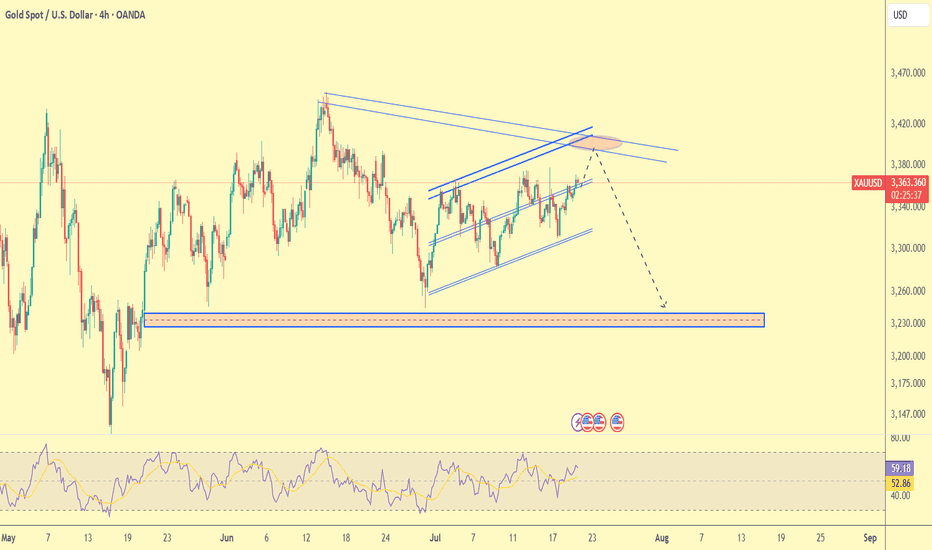

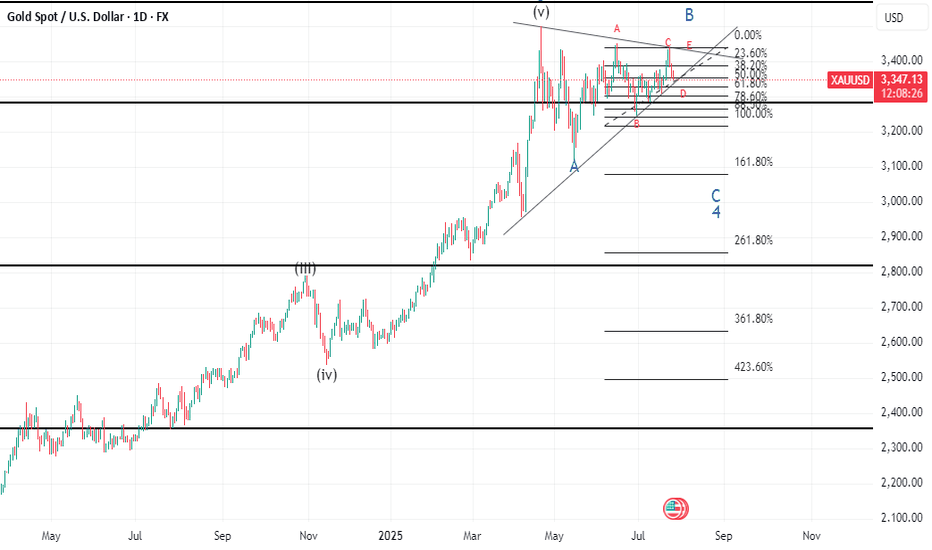

XAUUSD FORMING A CONTRACTING TRIANGLEXAUUSD is forming a contracting triangle which is much visual on the Daily T.F.

This is a continuation pattern.Since Wave 3 is completed,Wave 4 is forming a contracting triangle which is time consuming which can lead to permature trade entries or missed opportunities.

Best trade is to wait for the completion of Wave 4 at the 3055 level,which may push prices higher to the 3850 level a new high.

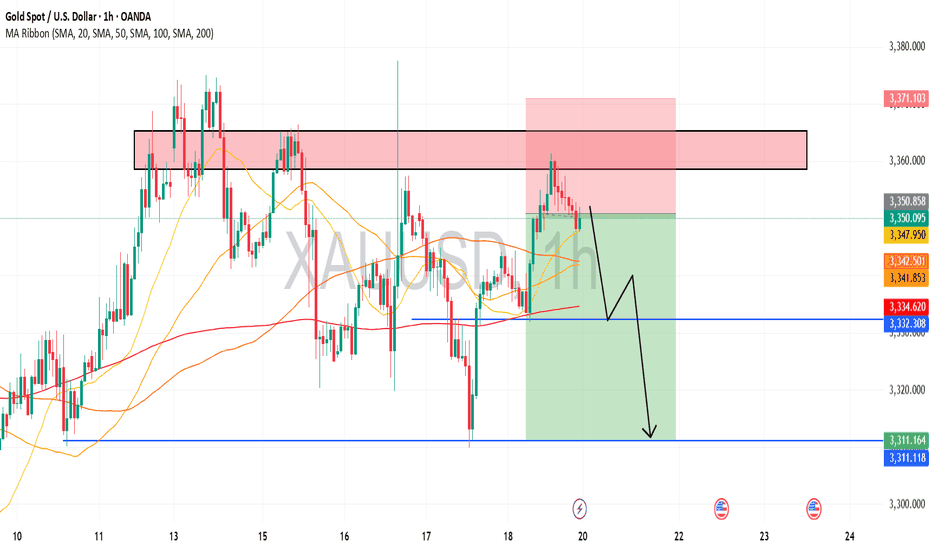

XAU / USD 1 Hour ChartHello traders. We had a good push down with the overnight sessions. Pre NY volume starts in just over an hour from this writing. Let's see if we correct the move down with a push up or keep pushing down. My area of interest is marked on the chart. Lower time frame confirmation is always a must. We have big news here in the US today, unemployment, flash manufacturing PMI and flash services PMI as well. So any scalp trades I am trying to catch will be before the news. I am not trying to have an open trade when news happens. Be well and trade the trend. Big G get a shout out. Thank you so much for checking out my analysis / idea for this morning.

Gold-----Buy around 3400-3410, target 3430-3450Gold market analysis:

The current highest gold buying has reached around 3438, which is the daily pressure level. This position is the high ground position that has touched the top many times before. The time to buy at these positions will not be long. There have been many dives before. However, as far as the current trend is concerned, the general trend is still buying, and short-term operations still have to buy. The daily buying is still not enough and closed positive again. The daily moving average began to diverge. Today's idea is to follow the buying first. I estimate that gold will enter a large game structure repair below 3451. In theory, short-term buying can be done, but the difficulty of intercepting on both sides will be more. You can keep buying at a low price in the short term. If it breaks 3400, it will turn weak.

Our idea is to find buying opportunities above 3400-3410. The previous pattern was near 3405, and the daily moving average position was near 3390. The time and space for repair will be very large. If it breaks 3400, we need to think about whether it will enter a large technical adjustment.

Support 3400-3405, small support 3409, suppression 3438, 3445, 3451, the strength and weakness dividing line 3402.

Fundamental analysis:

Recently, it is all regular data, there is no big fundamentals and new news that can affect the market.

Operation suggestion:

Gold-----Buy around 3400-3410, target 3430-3450

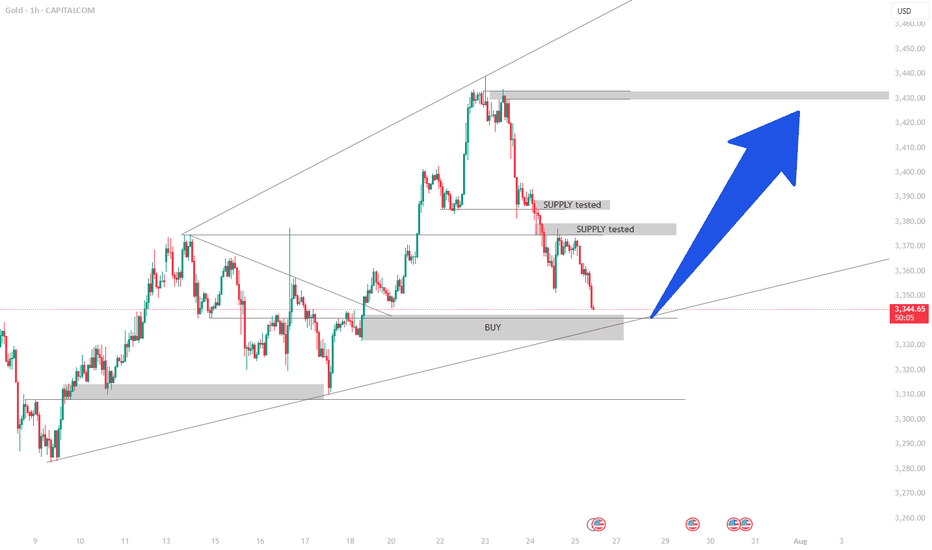

Expecting Gold bullish Movement Gold (XAU/USD) is showing signs of a potential bullish reversal on the 1 hour chart. Price action has respected the highlighted support zone around the 3,340 level forming higher lows and indicating buying pressure

A strong support level has been established in the red zone, suggesting buyer interest and a potential springboard for upward momentum. The projected path shows a bullish breakout with a possible rally toward the target area near 3,400 3,410 as indicated by the blue resistance zone

If the current support holds XAU/USD may continue to form higher highs and higher lows leading to a potential test of the upper resistance zone Traders should monitor price action closely near the support for confirmation of bullish continuation

Gold is in the Bearish DirectionHello Traders

In This Chart GOLD HOURLY Forex Forecast By FOREX PLANET

today Gold analysis 👆

🟢This Chart includes_ (GOLD market update)

🟢What is The Next Opportunity on GOLD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts