XAUUSD trade ideas

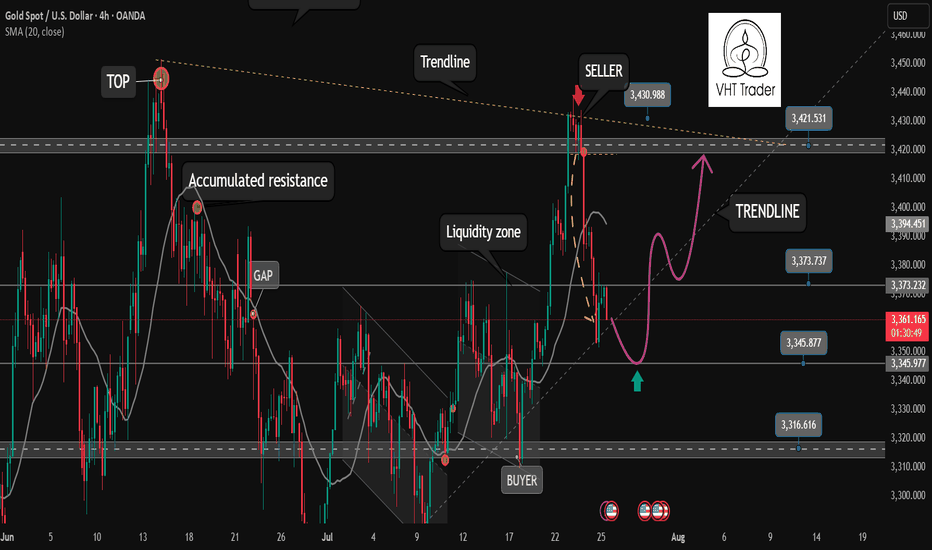

XAU/USD (Gold Spot vs US Dollar) Technical Analysis – 4H Char🔍 XAU/USD (Gold Spot vs US Dollar) Technical Analysis – 4H Chart

Based on my shared image from TradingView, here's a detailed analysis of the current XAU/USD market scenario:

---

🧩 Chart Type & Indicators Used

Timeframe: 4-Hour (H4)

Platform: TradingView

Indicators:

Ichimoku Cloud

Bollinger Bands (BB)

Support/Resistance zones

Trendlines

Price Action with Target Points Marked

---

📉 Current Market Structure

Price: ~$3,324 (Sell/Buy zone shown)

Overall Trend: Turning bearish in the short term.

Price Action:

Price has broken below an ascending trendline, suggesting a shift from bullish to bearish momentum.

The price is trading below the Ichimoku cloud, reinforcing a bearish bias.

Failed retest of the cloud resistance zone (around 3,335–3,340), which now acts as a resistance.

---

🔻 Bearish Signals

1. Trendline Break:

The rising trendline support (mid-July to now) is broken.

This indicates a potential reversal from the previous bullish momentum.

2. Retest & Rejection:

Price attempted to retest the breakdown zone and was rejected from the 3,335–3,340 level.

3. Ichimoku Cloud Bearish Setup:

Price is clearly below the cloud.

Future cloud is bearish (red shaded).

Chikou Span (lagging line) is below price candles and cloud.

---

🎯 Targets

First Target Point: ~3,300

This is the next horizontal support level (near recent lows).

Final Target Point: ~3,270

Stronger support zone and measured move from breakdown.

---

🛡 Resistance Zone

Immediate Resistance: 3,335–3,340

Stronger Resistance: 3,370

---

📌 Conclusion

The XAU/USD 4H chart shows a bearish breakout below the rising channel, with confirmation from Ichimoku and price rejection at cloud resistance. The market is targeting 3,300 as the first support, and if that breaks, 3,270 will likely follow.

---

✅ Strategy Suggestion (if trading):

Bias: Short/Sell

Entry: After a weak pullback or retest near 3,330–3,335

Targets:

TP1: 3,300

TP2: 3,270

Stop Loss: Above 3,345 or near 3,350 zone

Let me know if you'd like this in simpler terms or want me to track the next setup.

Gold Intraday Trading Plan 8/1/2025Although yesterday's retracement is a bit too deep, I am still bearish in gold in medium term as long as 3333 resistance is not broken. Therefore, I will still look for selling opportunities today.

Currently daily is in green bar while smaller timeframe shows bearish signs. If there is a double top formed near 3300, I will sell toward my weekly target at 3255.

GOLD BUYGold maintains its daily gains around $3,300

After retreating markedly on Wednesday, Gold rebounds moderately and remains positive at about $3,300 per troy ounce on Thursday. The precious metal’s rebound comes in response to the daily retracement in US yields across the curve and the so far irresolute price action in the Greenback

The US Federal Reserve kept its benchmark interest rate unchanged for the fifth consecutive meeting, in a range of 4.25% to 4.5%, despite intense pressure from US President Donald Trump and his allies to lower borrowing costs. The decision, however, met opposition from Fed Governors Michelle Bowman and Christopher Waller. This was the first time since 1993 that two governors had dissented on a rate decision.

In the accompanying monetary policy statement, the committee had a more optimistic view and noted that the economy continued to expand at a solid pace. Adding to this, Fed Chair Jerome Powell said during the post-meeting press conference that the central bank had made no decisions about whether to cut rates in September. This comes on top of the upbeat US macro data, and lifted the US Dollar to a two-month high.

Automatic Data Processing reported that private payrolls in the US rose by 104,000 jobs in July, following a revised 23,000 fall recorded in the previous month. Adding to this, the Advance US Gross Domestic Product (GDP) report published by the US Commerce Department showed that the economy expanded at a 3.0% annualized pace during the second quarter after contracting by 0.5% in the previous quarter

SUPPORT 3,346

SUPPORT 3,328

SUPPORT 3,309

RESISTANCE 3,283

RESISTANCE 3,273

Keep an eye on the correction pattern —Quick Take:

- Strong bearish move, but wave structure still unclear — not a confirmed impulse.

- Bear trendline has broken; market now leaning toward sideways-up.

- Divergence is visible.

Plan:

Wait for correction pattern → confirm with your system → execute only with full data and strict risk management.

GOLD: Strong Bullish Sentiment! Long!

My dear friends,

Today we will analyse GOLD together☺️

The recent price action suggests a shift in mid-term momentum. A break above the current local range around 3,296.556 will confirm the new direction upwards with the target being the next key level of 3,310.375 and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

Gold Market Eyes Daily Demand Zones at 3270–3315Gold market aligns with daily candle formation, seeking to mitigate substantial demand zones between 3270 and 3315. This area may provide the necessary liquidity for a potential bullish reaction, pending confirmation. follow for more insights , comment and boost idea

Will gold continues the uptrend from now?I have notice that price retraces in 5 waves before continued go up, from Jun 2025 onwards until now (refer to chart above), and now price has went for 5 waves, and had break the last lower low level. I am going to anticipate the long with my strategy, projecting to higher high of this up trend.

XAUUSD 4H AnalysisGold is currently in a clear downtrend after failing to hold above the mid-channel. Price is retracing into a potential short zone with confluence from the moving average bands.

Fibonacci Retracement: Price is reacting near the 38.2% level (3,318).

Downside Fibonacci Targets:

1️⃣ 3,249.36 (38.2%)

2️⃣ 3,228.11 (61.8%)

3️⃣ 3,193.73 (100%)

As long as the price stays below the red resistance zone, the bearish momentum is likely to continue toward the lower Fibonacci targets. A break above 3,339 would invalidate the short setup.

Gold (XAU/USD) Analysis:Following yesterday's Fed statements regarding the economic impact of tariffs and the decision to keep interest rates unchanged, gold prices dropped to $3,268, before rebounding today to retest the $3,310 zone. The short-term trend remains bearish.

1️⃣ A break and hold below $3,300 may push the price toward $3,280, and potentially $3,260.

🔻 A confirmed break below $3,260 could lead to a deeper decline toward a strong support zone near $3,245.

2️⃣ On the other hand, if bullish momentum appears and the price breaks above $3,310, it may open the path to $3,330 — a key level that could trigger a bearish rejection.

📈 However, if the price holds above $3,330, the next target would be $3,350.

⚠️ Disclaimer:

This analysis is not financial advice. It is recommended to monitor the markets and carefully analyze the data before making any investment decisions.

GOLD Will Move Lower! Sell!

Here is our detailed technical review for GOLD.

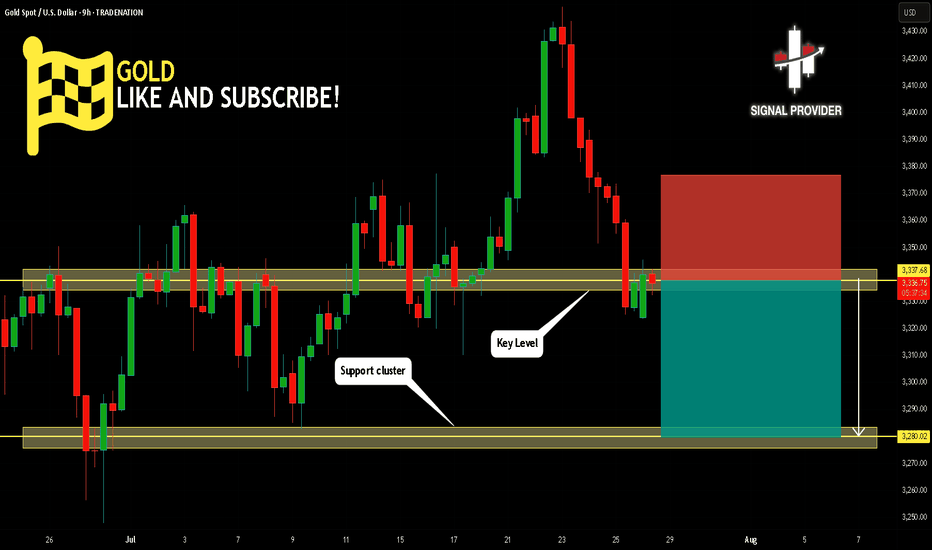

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 3,337.68.

Taking into consideration the structure & trend analysis, I believe that the market will reach 3,280.02 level soon.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

XAU/USD Intraday Plan | Support & Resistance to WatchGold staged a minor recovery overnight after bouncing from the 3,267 Support Zone, and is now trading around 3,305. Price remains below both the 50MA and 200MA, which continue to slope downward—confirming short-term bearish structure.

This current move is still corrective unless bulls manage to reclaim the 3,309–3,334 resistance zone. A clean break and hold above 3,334 would be the first sign of strength, opening up potential retests of 3,348 and 3,362.

Until then, any rallies into the 3,309–3,334 zone should be viewed with caution. If the bounce loses steam, watch for a retest of 3,289 - 3,267. A break below that would expose the 3,241 and 3,208 levels, with the HTF Support Zone (3,241–3,208) acting as a broader downside cushion.

📌 Key Levels to Watch

Resistance:

‣ 3,309

‣ 3,334

‣ 3,348

‣ 3,362

Support:

‣ 3,289

‣ 3,267

‣ 3,241

‣ 3,208

🔍 Fundamental Focus – Thursday, July 31

Big day for data.

🟥 Core PCE, Employment Cost Index, and Unemployment Claims — all critical for Fed outlook and could move gold sharply.

⚠️ Volatility expected around 2:30pm. Stay nimble and manage risk carefully.

XAUUSD Analysis : Channel Break, Demand Zone + SR - Interchange"High-Probability Zone Reaction & SR Flip Confirmation"

Gold (XAUUSD) is currently reacting from a significant support zone after completing a bearish breakout from a well-established ascending channel. The market structure indicates both threat and opportunity depending on how price behaves around key levels ahead.

🔍 Structure Breakdown & Price Behavior:

🔹 1. Rising Channel Violation

Over the past few weeks, price was comfortably moving inside a well-respected ascending channel, making higher highs and higher lows.

Recently, however, price broke below the lower boundary, which is often a bearish signal—indicating a possible trend reversal or a deeper correction phase.

Such breakdowns suggest buyers are losing control, and bearish sentiment is gaining strength.

🔹 2. Supply Zone Reaction & Drop

Before the breakout, we observed a sharp rejection from a high point, triggering a sell-off.

The price completed its move into a previously defined supply zone, resulting in a strong bearish impulsive leg that pushed it outside the channel.

This move shows clear institutional distribution—where large sellers unloaded positions around that zone.

📍 Key Zone Focus:

🟩 Previous Reversal / Demand Zone (Green Box)

Price is now sitting in a historically strong demand zone, which acted as a major reversal point in the past.

This area is marked as the first zone of interest where buyers might step back in to defend.

The green box represents a liquidity pocket where institutions previously accumulated positions—hence it’s a strong bounce candidate.

🟦 SR Interchange Zone (Blue Box)

The next major level above current price is the SR Interchange zone, around 3,320–3,340.

This level was previously broken and now acts as resistance.

It's crucial because it represents the battle zone where the market will decide whether to continue bearish or shift back bullish.

🧠 Market Psychology & Order Flow Insight:

The recent aggressive selling pressure from the highs, followed by a bounce from the demand zone, shows a shift from euphoria to fear.

Sellers are active at supply, while buyers are attempting to defend the previous demand.

The market is currently in decision mode—and the SR flip zone (3,320–3,340) will be the judge.

A break and retest above this level signals strength and potential for a trend resumption.

A failure to reclaim it would confirm bearish dominance and open doors for deeper targets.

🔄 Possible Scenarios Ahead:

📈 Scenario 1 – Bullish Rejection & Breakout:

If buyers successfully hold the 3,280–3,260 demand zone and push price above the SR Interchange zone, we can expect:

📍 Target 1: 3,360 (mid-term resistance)

📍 Target 2: 3,400–3,420 (previous high & upper trendline)

This would confirm a fakeout from the channel and a bullish continuation pattern.

📉 Scenario 2 – Failure at Resistance & Drop Continuation:

If price fails to reclaim the interchange zone, expect a retest of the green demand, followed by a potential drop toward:

📍 3,260 – local support

📍 3,240 – major support (unfilled demand below)

📍 3,220–3,200 – ultimate downside target

This would solidify a bearish market structure, confirming the sellers are in control.

🧭 Key Levels To Watch:

Level Type Price Range Significance

Supply Zone ~3,400–3,420 Major institutional selling area

SR Interchange (Blue) ~3,320–3,340 Critical resistance / flip zone

Current Price ~3,297 Watching reaction for momentum shift

Demand Zone (Green) ~3,280–3,260 Key support / bounce zone

Major Demand Pending ~3,240–3,220 Next support level if drop continues

✅ Conclusion:

Gold is at a critical inflection point.

The recent bearish breakout signals weakness, but the current support zone may provide a short-term bullish setup if buyers defend it effectively. A successful reclaim of the SR flip zone will shift sentiment bullish again. Otherwise, a deeper correction is likely.

This setup is ideal for both swing and intraday traders—look for confirmation signals at the current support and SR zone before executing trades.

Bullish Sentiment Returns to Gold?Hello everyone, what are your thoughts on XAUUSD?

From a technical perspective, XAUUSD has just retested its long-term ascending trendline and formed a bullish reaction candle, suggesting that buying pressure may be returning.

Recently, a survey of 206 investors revealed that market sentiment remains optimistic, with 66% expecting gold prices to continue rising, 19% predicting a decline, and 15% anticipating a sideways market.

What do you think? Share your opinion in the comments!

Gold Market Update: Major Support at and Supply atGold is recovering after a strong drop from the previous range high. Price is approaching a 4H Order Block near the 3300–3310 zone, which may act as a supply area. A minor liquidity zone has just been tapped, suggesting a potential short-term rejection.

The major support lies at 3269, which sparked the recent bullish move. If price rejects from the OB zone, a pullback toward this support is likely. However, a clean break and hold above the OB may signal further upside.

📌 Key Levels:

Supply Zone: 3300–3310

Support: 3269

🧠 Wait for clear confirmation before executing trades.

XAU/USD at Make-or-Break: $3,304 Holds the Key!"XAU/USD is testing a key resistance at $3,304. A breakout could trigger a rally to $3,315, while rejection may lead to a drop to $3,292."

Price Action & Key Levels

Support: 3,298 → 3,292 (critical demand zone).

Resistance: 3,304 → 3,310 (supply zone).

Breakout Level: 3,304 (confirmation needed).

Indicator-Based Evidence

RSI: "RSI at 62 (not overbought), suggesting room for upside."

MACD: "MACD histogram is rising, supporting bullish momentum."

Moving Averages: *"Price above 9 & 21 EMA, short-term trend bullish."

Fundamental Context

"Gold is supported by Fed rate cut expectations, but a strong USD could limit gains."

"Geopolitical risks (e.g., Middle East tensions) may boost safe-haven demand."

Scenario 1: Bullish Breakout

Entry: Buy above $3,304 (confirmed close).

Target: $3,310 → $3,315.

Stop-Loss: Below $3,298 (risk management).

Scenario 2: Bearish Rejection

Entry: Sell below $3,298.

Target: $3,292 → $3,288.

Stop-Loss: Above $3,306.

Is the gold correction over?✏️Yesterday's D1 candle closed above the Breakout 3363 zone. This shows that the buyers in the US session are still strong. There is a possibility of a liquidity sweep in the Tokyo and London sessions, then in the New York session, Gold will recover and increase again. The uptrend is really broken when Gold confirms a close below 3345. In this case, we have to wait for 3320 to confirm the BUY point. The gold uptrend at this time also needs new momentum to be able to move towards ATH 3500.

📉 Key Levels

Support: 3345-3320

Resistance: 3373-3418

Buy zone: 3345 (bullish wave structure maintained); BUY DCA break 3373

Buy zone: 3320 (Strong support zone)

Target: 3417

Leave your comments on the idea. I am happy to read your views.