Continued recovery, positive after NFP news✍️ NOVA hello everyone, Let's comment on gold price next week from 08/04/2025 - 08/8/2025

⭐️GOLDEN INFORMATION:

Gold prices surged over 1.5% on Friday, climbing toward $3,350, as a weaker-than-expected U.S. Nonfarm Payrolls (NFP) report signaled a faster-than-anticipated slowdown in the labor market. Heightened geopolitical tensions between the U.S. and Russia further boosted safe-haven demand for the precious metal.

Following the disappointing July jobs data, markets began pricing in a potential interest rate cut by the Federal Reserve. While the Unemployment Rate held relatively steady, signs of labor market softness supported recent comments from Fed officials Michelle Bowman and Christopher Waller, who advocated for a 25-basis-point rate cut at the July 29–30 meeting.

Additional data added to the cautious sentiment: the ISM’s July report confirmed that U.S. manufacturing activity remains in contraction territory, while consumer confidence took a hit, according to the University of Michigan’s latest survey.

⭐️Personal comments NOVA:

Gold prices continue to be positively affected after last week's NFP news, market expectations of an early rate cut are rising

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3384, $3434

Support: $3331, $3307, $3268

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

XAUUSDG trade ideas

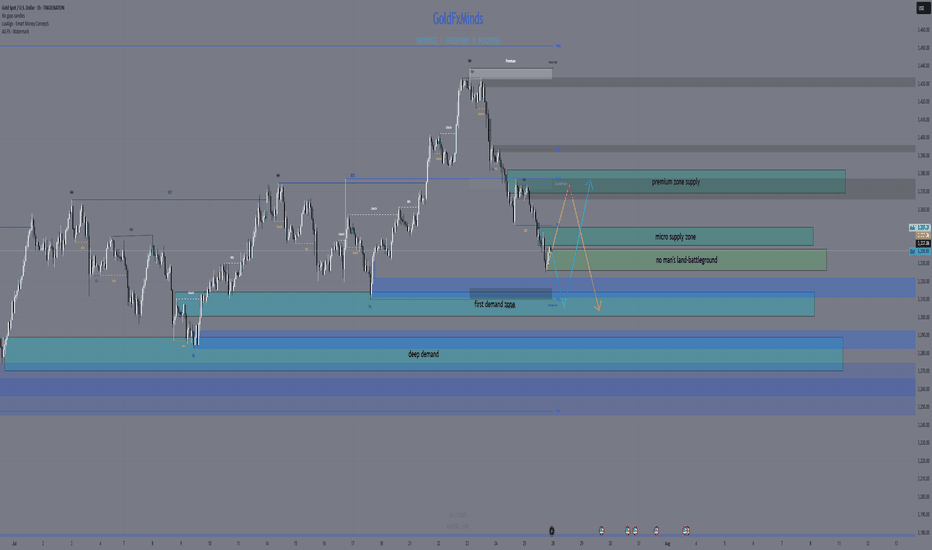

XAUUSD SNIPER OUTLOOK – JULY 28, 2025🔥 Macro & Sentiment

The dollar remains dominant — DXY holding above 105 keeps gold under pressure. No fundamental support for bullish continuation unless major macro shifts. Risk flows are defensive, not aggressive. FOMC and US GDP data remain key drivers for direction this week.

BIAS:

• Short-term bearish under 3350

• Market still in distribution mode — every bounce gets sold

• Real buy interest only deep below 3315

🔻 INTRADAY SUPPLY ZONES (Short Only With Rejection)

1. 3382–3370 (H1/M30 Premium Supply)

🔹 H1 order block, FVG alignment, EMA21/50/100 convergence

🔹 Liquidity inducement above → then rejection

📍 Short only if rejection shows via engulf / upper wick.

2. 3355–3340 (Decision Zone / Micro Supply)

🔹 EMA100/200 alignment, former support flipped resistance

🔹 M30 FVG fully filled, structure flip from mid-July

📍 Short bias below. Long only if reclaimed with H1 close above 3355.

🔵 NEUTRAL / PIVOT ZONE

3. 3338–3326 (Decision Band – M30/M15)

🔹 Consolidation area post-BOS, internal liquidity sweeps

🔹 EMA21 base on M15, no clear dominance

📍 Wait for clean reaction. Bullish engulf = scalp long to 3355. Failure = slide to demand.

🟢 DEMAND ZONES (Buy Only On Strong Reversal Confirmation)

4. 3314–3302 (M30/M15 Deep Demand)

🔹 H1 OB + hidden FVG + fib 38.2%

🔹 First real demand zone where buyers may engage

📍 Long only if strong M15 confirmation: engulf + RSI cross + EMA5/21 angle change.

5. 3289–3272 (True Reversal Demand – H1/M30)

🔹 Full NY reversal origin (July 18), major FVG left unfilled

🔹 Institutional volume + liquidity grab zone

📍 Buy only on full flush + fast snapback with BOS on M15/H1.

🧭 BIAS & EXECUTION BY TIMEFRAME

H4 Bias:

Bearish while below 3350. No valid supply above until 3370+. Avoid longs unless price sweeps 3314 or 3272 and confirms.

H1 Bias:

Sell clean rejection at 3355 or 3370–3382. Only flip long above 3355 with full-bodied close.

M30 Bias:

Watch decision zone 3338–3326 for direction. No-man’s land in between — don’t force trades.

M15 Bias:

Scalp long from 3314 or 3272 only on full confluence (OB + RSI + EMA realignment). Short only confirmed rejections above.

📊 FULL INTRADAY KEY LEVELS (Top → Bottom)

Level Context

3405 Fib ext. 127% (HTF sweep target only)

3385 OB

3375–3350 Valid Premium Supply (H1 shelf)

3350–3340 Micro Supply / Flip Zone

3338–3326 Decision Zone – watch reaction

3314–3302 Deep Demand (H1/M30 confluence)

3289–3272 Extreme Demand Base

3260 Fib 61.8% + HTF support

3250 Minor volume node

3240 Final structural floor

✅ EXECUTION NOTES

⛔ Avoid entering inside 3340–3326 → fakeout zone

✅ Play only clean sniper triggers with structure

⚠️ Wait for macro — FOMC / GDP releases may fake both sides

💡 Patience wins. Pick your zone, wait for setup, strike.

Which zone are you watching to strike? Drop your bias below.

📍 Like, comment & follow GoldFxMinds for the most precise sniper maps on TradingView.

Disclosure: This plan is based on the Trade Nation chart feed. I am part of their Influencer Program.

XAUUSD: Market Analysis and Strategy for July 31stGold Technical Analysis:

Daily chart resistance: 3351, support: 3250

4-hour chart resistance: 3335, support: 3270

1-hour chart resistance: 3315, support: 3290.

Gold was trading sideways between 3320 and 3333 yesterday before the New York market. During the US trading session, the release of US ADP employment figures and PCE price data was bearish for gold, causing it to plummet below Monday's low of 3301. The Federal Reserve held interest rates steady, and Powell's hawkish speech sent gold plummeting to around $3268.

Affected by the news, gold prices fell rapidly yesterday, reaching a low near the lower Bollinger band on the daily chart. It rebounded in the Asian session today, reaching a high near 3315. Selling is recommended in the sideways range between 3310 and 3320. The US PCE data will be released in the New York market, so avoid the news release period.

BUY: near 3290

SELL: near 3270

XAUUSD Short1. Market Structure Overview

The overall market structure on this 15-minute chart is bearish. A clear Break of Structure (BOS) occurred at $3,307.765, confirming that previous support failed and sellers are in control. After the BOS, price formed a lower high near $3,328, maintaining bearish momentum and setting the stage for potential continuation downward.

2. Supply & Demand Zones

The chart reveals two notable supply zones where sellers have been active. The first is a minor zone just above the current price, which has already triggered a rejection and shows signs of short-term bearish control. The second, positioned higher, marks the origin of a strong sell-off and represents a significant resistance level. On the demand side, the closest support zone lies just beneath the current price, but it appears weak due to prior tests. A stronger demand zone is located further down, where price previously saw an aggressive bullish reaction, indicating solid buyer interest. If bearish momentum continues, price may drop even lower into a deeper liquidity pocket—an area likely to attract strong institutional buying.

3. Price Action within the Current Region

Price is currently hovering around $3,325, inside a narrow range between the minor supply and weak local demand. After rejecting the upper supply zone, price is showing bearish intent. If the market maintains this rejection pattern, a drop toward the $3,293–$3,301 demand area is likely. This zone is expected to offer a bounce or at least temporary reaction due to the strong response seen there previously.

4. Trade Bias & Plan

The active bias is bearish. Short opportunities are favored while price remains below $3,328. Ideal short entries are from the rejection of the minor supply zone, targeting $3,301 and possibly $3,293. A clear break and hold above $3,329 would invalidate the short bias and shift focus toward higher liquidity levels. Until then, structure supports downside continuation.

5. Momentum & Confirmation

Momentum is currently favoring sellers. The lower highs and strong rejections near supply reinforce the bearish bias. Confirmation for continuation comes from bearish engulfing candles and sharp rejections from supply zones. A clean break below the nearest demand zone would further validate the move toward deeper targets.

I maintain my #3,277.80 and #3,252.80 TargetsI didn't engaged any re-Sell orders throughout yesterday's session and re-Sold Gold on #3,295.80 ahead of Asian session, with plan to keep orders over-night. However due NFP, Gold might be stationary / ranging until the news as I closed both of my orders on #3,291.80 / each #9.000 Eur Profit and my #3,300.80 pending Sell limit has been triggered over-night which is now running in Profits with Stop on breakeven. I do expect #3,277.80 and #3,252.80 Targets to be met within #1 - #3 sessions and if there aren't NFP numbers, I would keep all three orders / set of Selling orders maintaining my first #3,277.80 Target. Due the news, Gold might fluctuate within Neutral Rectangle until the news.

Technical analysis: My earlier Selling configuration / Technical expectations was confirmed on Hourly 4 chart under prolonged weakness and Price-action respecting the trend-line guarding the downtrend (very Bearish formation) as Hourly 1 chart is already an aggressive Descending Channel (width opened on Williams) that should reach it’s next local Low’s (currently Trading slightly below Double Bottom) and Oversold state near my take Profit of #3,252.80 benchmark. If the bands are widened Traders may witness #3,277.80 test, also if gets invalidated and #3,270.80 gives away, #3,252.80 mark extension test is inevitable. In any case I will update my Targets or levels of Profit taking if I decide to exit earlier than #3,252.80 benchmark to be in accordance with the Daily chart’s period / I already ride Selling wave since #,3,300's and my Profit will be already good to ignore.

My position: DX is soaring, Gold is under Bearish Technical developments and #3,252.80 benchmark is my final Target of current Selling leg. Only factor which can reverse this Intra-day but not postpone is NFP. I expect downside Jobs surprise which may reverse DX from local High's however hot upside surprise will make Gold test #3,252.80 Intra-day. NFP or not I do believe Gold is Bearish. Trade accordingly.

Gold soaring with NFP debacle as an catalystQuick update: Gold is Trading on NFP fuelled relief rally and Bearish Technicals are invalidated once again (I announced lately that this might happen if NFP delivers downside surprise / debacle). The Hourly 4 chart's Ascending Channel increases it's gains towards Overbought levels as #3,352.80 benchmark is showcasing strong durability. Both Weekly chart (#1W) and Monthly (#1M) are on mild gains (# +0.65% and # +0.71% respectively) and with ranging candles (Gold consolidating above the Support for the fractal) I do not see any rebound (to the downside) possibility yet.

My position: As discussed above, I will keep Buying every dip on Gold and will not Sell Gold throughout today's session (if I do, will be aggressive in & out Scalp only). Gold remains very sensitive to every Bullish development while Bearish ones are still on second place.

Bullish Momentum Ahead? XAAUSD Price to Watch!The market just closed above 3,353 , which is our BOS and RBS level. It was previously a resistance, then became support, and now it's being tested as resistance again. Looking at how gold moved last week, it came really close to the major resistance area I had marked. Unfortunately, it didn’t quite reach my pending order, which was set just a bit lower.

After reviewing the price action, I noticed that gold reacted to an order block before making its move upward. Luckily, we managed to catch a nice HnS sell setup & the golden zone fibo I had marked earlier, using my trusted golden Fibonacci levels. They’ve consistently delivered reliable entries.

Looking ahead to the upcoming week, I’ll be using the same golden fibo setup. The market is showing a clean pattern, and I’ve already mapped out a solid entry zone. The zone is fairly wide, but with proper risk management and entry layering, there’s definitely good potential for profit .

Let’s see how things play out next week. That’s all from me for now. If you found this helpful, feel free to like and follow for more analysis.

Gold establishes bullish wave. Wait for recovery point to BUY✏️ OANDA:XAUUSD Nonfarm announcement has shaped a new trend for gold price. completely broke the previous bearish wave structures and formed a new bullish trend with the break of wave 1 peak around 3315. Trading strategy next week only focuses on BUY signals. Maybe this bullish wave can make gold reach the all-time high.

📉 Key Levels

Support 3333-3315

Resistance 3373-3416

BUY zone: 3333 ; 3315 ( Strong support zone)

BUY DCA trigger Break resistance 3373

Target 3416

Leave your comments on the idea. I am happy to read your views.

Excellent re-Sell opportunities from #3,332.80 ResistanceAs discussed throughout my yesterday's session commentary: "My position: I will continue re-Sells starting with #3,332.80 Resistance and my continuation will be re-Sell every High's on Gold unless Gold closes the market above #3,352.80 benchmark."

Firstly I have Sold Gold on #3,321.80 with my set of Selling orders and in addition I have added Sells at #3,318.80 / closing all on #3,312.80 / first line of wall of Supports ahead of #3,300.80 benchmark. Then I have planned to re-Sell strong on #3,332.80 with Double Lot and closed my order on #3,322.80 (#3,332.80 - #3,322.80) which delivered excellent results. I am making spectacular Profits from my key reversal zones.

Technical analysis: Gold is Trading within my predicted values however both sides are equally probable at the moment. Needless to mention, Price-action is on important Short-term crossroads. Since #3,300.80 psychological benchmark isn't invalidated even with DX on extended relief rally, now Bullish reversal is possible towards #3,342.80 first Resistance, then #3,352.80 mark Trading above the fractal. Also #3,320.80 - #3,332.80 Neutral Rectangle Trading is possible until I have a break-out.

My position: My break-out points on both sides are calculated and ready to be used for more Profits.

Excellent re-Sell opportunities from #3,332.80 ResistanceAs discussed throughout my yesterday's session commentary: "My position: I will continue re-Sells starting with #3,332.80 Resistance and my continuation will be re-Sell every High's on Gold unless Gold closes the market above #3,352.80 benchmark."

Firstly I have Sold Gold on #3,321.80 with my set of Selling orders and in addition I have added Sells at #3,318.80 / closing all on #3,312.80 / first line of wall of Supports ahead of #3,300.80 benchmark. Then I have planned to re-Sell strong on #3,332.80 with Double Lot and closed my order on #3,322.80 (#3,332.80 - #3,322.80) which delivered excellent results. I am making spectacular Profits from my key reversal zones.

Technical analysis: Gold is Trading within my predicted values however both sides are equally probable at the moment. Needless to mention, Price-action is on important Short-term crossroads. Since #3,300.80 psychological benchmark isn't invalidated even with DX on extended relief rally, now Bullish reversal is possible towards #3,342.80 first Resistance, then #3,352.80 mark Trading above the fractal. Also #3,320.80 - #3,332.80 Neutral Rectangle Trading is possible until I have a break-out.

My position: My break-out points on both sides are calculated and ready to be used for more Profits.

GOLD BUY M15 Gold (XAUUSD) 15-Min Chart Analysis – July 31, 2025

The chart shows a clear bullish structure after a confirmed Change of Character (ChoCH) and Break of Structure (BOS) on the lower time frame. Price has broken above previous resistance zones, indicating strong buying momentum.

Entry Zone:

Price is currently retesting a demand zone (highlighted in pink).

Ideal buy entry was taken after the bullish ChoCH.

Stop Loss:

SL: 3397, placed just below the demand zone for risk protection.

Targets / Resistance Levels:

1. First Resistance: 3308

2. Second Resistance: 3311

3. Third Resistance: 3316

4. Final Target: 3325

Bias:

Bullish, expecting higher highs as long as price holds above the demand zone.

Break and retest strategy is forming, suggesting continuation toward the final target.

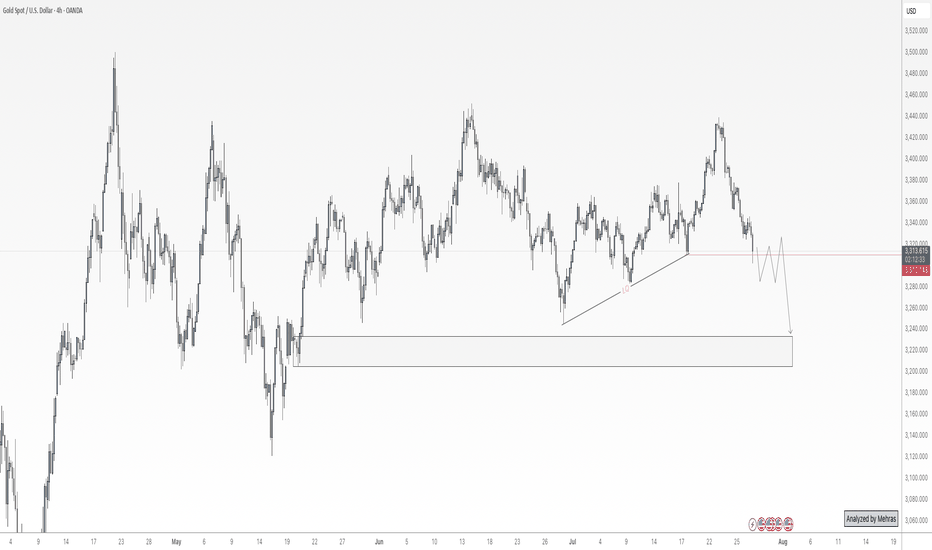

XAUUSD 4H – Massive Sell Setup: Gold Crash Incoming? Gold (XAUUSD) just tapped into a key liquidity zone near the 38.2% Fibonacci retracement at $3,364, followed by a sharp rejection. This aligns with the upper channel resistance and a bearish confluence from previous supply zones.

Price has failed to break above the dynamic EMA cluster and is showing signs of exhaustion after a relief rally. If momentum follows through, this could mark the beginning of a deeper selloff targeting major downside levels.

Short Setup

Entry: Around $3,349–$3,364 (rejection zone)

SL: Above $3,379

🚨Strong bearish engulfing candle confirms seller pressure

🎯 Take Profit Targets (Fibonacci):

TP1: $3,305 (38.2%)

TP2: $3,275 (61.8%)

TP3: $3,241 (Full move – 100% Fibonacci extension)

This setup offers high risk-reward if the rejection holds and price breaks below the mid-zone structure at $3,330. A drop below $3,305 could accelerate the move as liquidity gets swept.

Gold at a Crossroads: $100 Drop Ahead or New All-Time High?Gold is now sitting at a critical decision zone near the $3300 level — a key bank-level area. If we see a daily candle close below this level, I anticipate a minimum drop of 1,000 pips, with the first major support around the $3220–$3200 range. The $3200 level is extremely significant, and I’ll discuss its importance more in future updates if necessary.

On the flip side, if buyers step in and we get a daily close above $3300, I still believe it’s too early to jump into longs. The selling pressure remains quite obvious, and we’ve already seen multiple failed attempts to push beyond this level toward the $3500 all-time high. That tells me the orders at this level might be exhausted.

Personally, I’ll only consider a long position if we get at least a clean 4-hour candle close above $3350.

It’s going to be an exciting week ahead with high-impact data releases including ADP, Core PCE, the Federal Funds Rate — and most importantly, Friday’s NFP.

📌 Stay tuned for updates throughout the week!

Disclaimer: This is not financial advice. Just my personal opinion!!!

Gold Awaits Fed Rate Decision – Key Levels & Volatility AheadGold is currently trading near $3,332, showing a minor recovery after recent downward momentum. The price action on the 1-hour chart highlights a short-term ascending structure, which often acts as a corrective move rather than a strong bullish trend. The market previously saw significant selling pressure from above $3,355–$3,360, creating a short-term supply zone. Unless the price breaks and holds above this zone, the overall momentum remains bearish.

The chart also shows a projected price path where gold could push slightly higher toward $3,355, meet resistance, and potentially reverse downward again. Key support lies at $3,320, and if this breaks, we could see gold testing $3,290–$3,280 levels, aligning with the black trend line support. However, if bulls manage to break above $3,360, it would signal potential upside continuation toward $3,380–$3,400.

Key Points

- Key Resistance Levels: $3,355 and $3,360 (critical supply zone).

- Key Support Levels: $3,320 (short-term), followed by $3,290–$3,280 (major trendline support).

- Expected Short-Term Move: Possible push toward $3,355 → rejection → decline back toward $3,320 and possibly $3,290.

Bullish Breakout Scenario: A strong close above $3,360 could push price toward $3,380–$3,400.

Overall Bias: Bearish while trading below $3,360.

4hr Chart

Price remains under pressure below the descending trendline. A small pullback toward $3,345–$3,350 is possible, but as long as price stays under this resistance, the bias remains bearish with potential downside targets around $3,300–$3,280.

Key Levels:

- Resistance: $3,350 → $3,381 → $3,394

- Support: $3,324 → $3,281 → $3,254

Today’s FOMC interest rate decision is a key driver for Gold. Here’s the quick analysis:

- If Fed Hikes Rates or Maintains Hawkish Tone:

- Strong USD likely → Gold could face more selling pressure.

- Key support zones: $3,324 – $3,300, then $3,281 and $3,254.

- If Fed Pauses or Turns Dovish:

- Dollar weakens → Gold may bounce toward resistance zones.

- Upside levels: $3,355 – $3,360 and higher toward $3,381 – $3,394 (Fib levels).

Expect high volatility; $3,300 is a critical support to watch. A dovish Fed may give Gold short-term relief, but a hawkish stance could accelerate the downtrend.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

GOLD Weekly Recap & Outlook (Week 31 | July 28 – Aug 01)Note: Some elements may shift depending on your screen size. View the full snapshot in perfect layout:

📈 CAPITALCOM:GOLD

Timeframe: 30m | MJTrading View

⸻

🔹 Weekly Performance

• Open: 3,320.06

• High: 3,363.63

• Low: 3,268.05

• Close: 3,363.05

Gold delivered a classic Smart Money move this week: liquidity sweep, structural shift, and bullish expansion.

⸻

🔹 Price Action Breakdown

1️⃣ Early Week: Bearish Continuation

• Price opened around 3,320 with a gap and extended last week’s bearish leg.

• Formed lower lows (LL) and a bearish flag, signaling continuation.

2️⃣Midweek: Liquidity Grab, Reversal Point and

• Last Bearish leg marks the exhaustion gap and stop run.

• Market printed a liquidity sweep below 3,310 then 3,280 (weekly low), trapping late sellers.

• Smart Money likely absorbed sell-side liquidity before initiating the reversal leg.

• This aligns perfectly with SMC principles: sweep → accumulation → expansion.

3️⃣ Late Week Rally

• Following NFP & Unemployment Rate news, price broke 3,333 and rallied strongly to 3,363.63 confirming a Bullish Market Structure Shift (MSS).

• Resistance turned into support, validating the accumulation phase.

• Price rallied strongly to 3,363.63,.

• The weekly candle flipped bullish, closing near the high, with Smart Money leaving a clear footprint of accumulation and expansion.

⸻

🎯 Key Levels & Outlook

• Support: 3,355 → 3,333 - 3,340

• Resistance: 3,377 → 3,380+

• Bias: Bullish above 3,333.

• Watch for liquidity sweeps of intraday lows to catch new long entries, targeting 3420-3440.

⸻

💡 MJTrading View:

A structural shift and weekly strong close confirms bullish intent into next week.

As long as 3,333 holds, dips are buying opportunities.

⸻

Please share your opinions...

#MJTrading #GoldAnalysis #SmartMoney #LiquiditySweep #PriceAction #MarketStructure #Forex #TradingView #ChartDesigner #BullishMarket

Fortnight Overview:

Psychology Always Matters:

XAU/USD – Endphase der Circle Wave 1 & Vorbereitung auf die KorrOANDA:XAUUSD

We are currently in the final stages of the yellow (Circle) Wave 1 on Gold.

We have just completed wave 4.

How do I identify wave 4? Simple:

📏 I drew a trendline, and once that trendline was broken, the trend of wave 3 was considered complete.

However, we’ve now made a new low, which broke the low of wave 3 — this could very well be our wave A of wave 4 ⚠️.

I’m expecting one more final low, potentially around 3252, or even as low as 3200.

But personally, I lean towards ~3252 as the likely target 🎯.

After that, we should see a move upward into the yellow Fibonacci zone of wave 2 🟡.

The path from Circle 1 to Circle 2 will likely unfold as a corrective A-B-C structure to the upside 🔁.

Following that, we hopefully get a clean five-wave impulse into our (Circle) Wave 3 🚀.