XAUUSDG trade ideas

XAUUSD: Market Analysis and Strategy for August 4th.Gold Technical Analysis:

Daily Chart Resistance: 3400, Support: 3300

4-Hour Chart Resistance: 3370, Support: 3330

1-Hour Chart Resistance: 3363, Support: 3352.

Last week's NFP data was positive for gold prices, sending gold prices sharply higher. The market trend was much stronger than expected, breaking through the resistance level of 3333 and then rising to around 3360.

The daily chart shows Friday's sharp rise, erasing the losses from the first four days of last week. This signals continued bullishness for this week and the market outlook.

However, for those of us who are day traders, please be cautious about buying at high levels. After all, excessive short-term gains in gold could lead to profit-taking.

Technically, the daily MACD fast and slow lines are about to form a golden cross near the zero axis, indicating that the downward correction is nearing its end. However, the 1-hour RSI indicator shows a strong overbought signal, suggesting continued movement towards the lower support level.

For today's trading, it's best to wait for a pullback before buying. This is both safer and offers greater profit potential. Focus on the lower support level around 3333-3320. Upside targets could be in the 3375-3390 range.

Buy: near 3330

Sell: near 3370

Analysis of gold market operation strategies and ideas next week

Gold rallied unilaterally on Friday following positive non-farm payroll data, reaching a new high for the week. This week's candlestick formed a hammer pattern, suggesting further upside potential next week. Bulls continued their push late Friday, closing at 3363. Next week, we will continue to monitor short-term resistance around 3370-3375. We will continue to buy on pullbacks. If your current trading is not satisfactory, I hope I can help you avoid investment setbacks. Welcome to discuss your options!

Based on a 4-hour analysis, short-term resistance will be seen around 3370-3375 next week, with a key resistance around 3395-3400. We will continue to buy on pullbacks. In the intermediate range, we recommend maintaining a cautious wait-and-see approach. I will provide detailed trading strategies during the trading session, so please stay tuned.

Gold Trading Strategy:

Go long on gold pullbacks to 3330-335, with a stop-loss at 3318 and a target at 3370-3375. Hold on if it breaks above this level.

Gold Intraday Trading Plan 8/1/2025Although yesterday's retracement is a bit too deep, I am still bearish in gold in medium term as long as 3333 resistance is not broken. Therefore, I will still look for selling opportunities today.

Currently daily is in green bar while smaller timeframe shows bearish signs. If there is a double top formed near 3300, I will sell toward my weekly target at 3255.

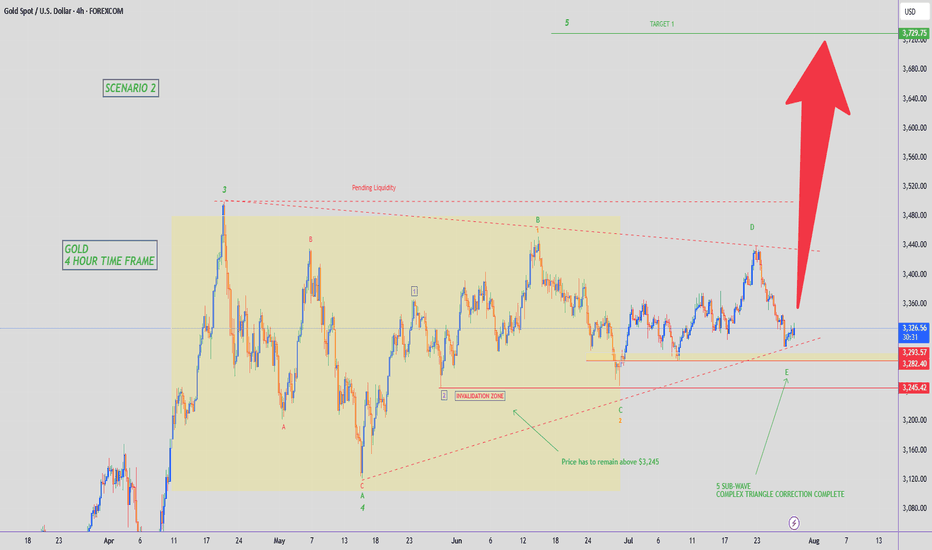

Analysis For The Next WeekHello Traders,

I hope you had joyful weekend, the market is going to open tonight so we are back with new idea for next week.

As you know gold was dropping for last two weeks and suddenly pumped almost 650 pips after the impact of NFP News. We saw the high pressure in the market on Friday due to news impact.

Gold has broken the buy trend line D1,H4. According to D1,H4 gold still wants to drop till 3251.

If price respects area 3372-3393, then gold will drop. If price breaks the area 3400 then it will pump and it can make another All Time High. As you know 3501 is the All Time High (ATH). Price can break if there will be a breakout for bullish moment.

Keep in touch and drop positive comments here, Thanks.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Gold Trend Reversal: MSS Completed Eyes on OB and Breaker Block!The gold market has executed a Market Structure Shift (MSS) in the New York session, indicating a trend reversal. Initially, the market made a Break of Structure (BoS) to the upside, but later dropped sharply and closed below the MSS level, confirming a bearish shift. Currently, the market is likely entering a retracement phase and may look to fill its Pending Demand (PD) arrays.

There are two critical levels from which the market could potentially drop again:

1. The first is an Order Block (OB).

2. The second is a Breaker Block (BB).

Keep a close watch on these two levels. If the market returns to either and presents bearish confirmation signals, it could resume the downward move towards swing lows.

Do Your Own Research (DYOR).

Gold: final pullback or bull trap?On the 1H chart, gold (GOLD) is forming a bullish flag after a sharp decline, which may just be a corrective move within a broader downtrend. The price is now approaching the key resistance zone around $3313–$3317 - this area holds the POC, broken trendline, and the 0.705–0.79 Fibonacci retracement from the last drop. This is the decision-making zone.

If bulls fail to push above it, we expect a move down toward $3268 - the next strong support and potential buy zone, also confirmed by Fibonacci and local demand. Stochastic divergence and slowing volume suggest a possible rebound from that level. However, if the price breaks and holds above $3317, this would indicate a local trend reversal, with targets at $3333 and $3374.

Watch the $3317 zone closely - bulls have yet to prove this is more than just a bounce.

XAUUSD Long Setup – 1HGold (XAUUSD) has shown strong bullish rejection from the lower volatility band after a sharp selloff. The appearance of a Heikin Ashi reversal candle, suggests a short-term reversal is forming. Price has reclaimed key structure and is now targeting a reversion back to the mean, supported by Fibonacci retracement levels.

Entry: 3293.55

Target Zone: 3308.91 → 3333.76 (Fib 38.2% – 100%)

Stop Loss: 3253.35

Confluences:

✅ Bullish engulfing + Heikin Ashi trend shift

✅ Oversold bounce from lower channel extremity

✅ Fib retracement aligns with key structural resistance zones

✅ Custom signal confirmation (green dot)

✅ Clean R:R toward upper band and previous POI

Short-term counter-trend long targeting liquidity grab and mean reversion toward the 3308–3333 zone. Risk tightly managed with SL below local swing low.

XAU/USD – Bullish Breakout Toward 3,440 Target🔹 Trend & Structure:

Market formed a Higher High (HH) followed by a Lower Low (LL), indicating bearish correction within a falling channel.

Price then created a Higher Low (HL) suggesting a potential trend reversal.

🔹 Channel Breakout:

Price broke above the descending channel, confirming bullish momentum.

A strong bullish candle closed above the 70 EMA, showing further strength.

🔹 Support Zone:

A support level between 3,314.485 – 3,335.703 is now established, which was previous resistance turned support.

🔹 Target Projection:

Using measured move strategy, the projected bullish target is around 3,439.802, a 3.09% move from the breakout zone.

🔹 Volume & Momentum:

Sharp bullish impulse indicates increased buying interest, supported by possible retest before continuation.

📈 Conclusion:

Bullish breakout confirmed. Ideal strategy:

🔹 Entry: On retest of the support zone (3,335 area)

🔹 Stop-loss: Below 3,314

🔹 Take-profit: Near 3,439

✅ Strategies used:

Trendline & Channel Analysis

Support/Resistance.

EMA (70) confirmation.

Price Action (HH, LL, HL)

Measured Move Target.

Gold Breakout Failed – Bearish Reversal in Play?Last week was both interesting and revealing for Gold.

After breaking above the key $3375 resistance—which also marked the upper boundary of a large triangle—price quickly accelerated higher, reaching the $3440 resistance zone.

However, instead of a bullish continuation, we witnessed a false breakout and sharp reversal. What initially looked like a healthy pullback turned into a full bearish rejection by week’s end.

________________________________________

📉 Current Technical Picture:

• On the daily chart, we now see a clear Three Black Crows formation

• On the weekly chart, a strong bearish Pin Bar confirms rejection

• And if we add the failed breakout above 3375, the bias tilts decisively bearish

________________________________________

📌 Key Zones and Trading Plan:

• Gold is currently bouncing from the ascending trendline zone, which is natural after dropping more than 1,000 pips in just 3 days

• The $3375–3380 area has regained importance as a key resistance zone, and that’s where I’ll be looking to sell rallies

• A bullish invalidation would only come if price manages to stabilize above $3400

Until then, this remains a bear-dominated market, and a drop below $3300 is on the table.

________________________________________

🧭 Support levels to watch:

• First support: $3280

• Major support: $3250 zone

________________________________________

📉 Conclusion:

The failed breakout, bearish candle formations, and current price structure all point to a market that's shifting in favor of sellers.

I’m looking to sell spikes into resistance, with a clear invalidation above $3400.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Market Analysis: Gold Prices Ease – Market Awaits Fresh CatalystMarket Analysis: Gold Prices Ease – Market Awaits Fresh Catalyst

Gold price started a fresh decline below $3,380.

Important Takeaways for Gold Price Analysis Today

- Gold price climbed higher toward the $3,430 zone before there was a sharp decline against the US Dollar.

- A key bearish trend line is forming with resistance near $3,350 on the hourly chart of gold at FXOpen.

Gold Price Technical Analysis

On the hourly chart of gold at FXOpen, the price climbed above the $3,380 resistance. The price even spiked above $3,400 before the bears appeared.

A high was formed near $3,432 before there was a fresh decline. There was a move below the $3,380 support level. The bears even pushed the price below the $3,350 support and the 50-hour simple moving average.

It tested the $3,325 zone. A low was formed near $3,325 and the price is now showing bearish signs. There was a minor recovery wave towards the 23.6% Fib retracement level of the downward move from the $3,433 swing high to the $3,325 low.

However, the bears are active below $3,342. Immediate resistance is near $3,350. There is also a key bearish trend line forming with resistance near $3,350.

The next major resistance is near the $3,380 zone. It is close to the 50% Fib retracement level of the downward move from the $3,433 swing high to the $3,325 low. The main resistance could be $3,410, above which the price could test $3,432. The next major resistance is $3,450.

An upside break above $3,450 could send the gold price towards $3,465. Any more gains may perhaps set the pace for an increase toward the $3,480 level.

Initial support on the downside is near the $3,325 level. The first major support is near the $3,310 level. If there is a downside break below it, the price might decline further. In the stated case, the price might drop towards the $3,265 support.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

GOLD possible ScenarioCurrently gold has broken a major trendline and currently trading in bearish momentum, currently consolidating or pullback from support and may get rejected from 0.5 or 0.618 if bearish ahs to continue 3240-3250, if breaks the fib level along with trendline resistance can easily price can reach 3340 major resistance level. let us see.

XAUUSD - Short XAUUSD Short Trade Idea – 4H Chart

Price has made a strong move up, but it's now entering an area where sellers were in control before.

Why I'm looking to short:

Price is retesting a supply zone where the last big drop started

It’s also near a resistance level and rejected from there

The downtrend is still valid with lower highs

There's a good chance price could drop to grab liquidity below

*** Target areas:

First target: around 3288

Final target: around 3250, where we have a demand zone

*** Invalidation:

If price breaks and closes above 3385, this short idea is no longer valid.

**"Gold Price Rebounding from Support:Potential Move Toward 3436This chart shows the **price movement of Gold (XAU/USD)** on a **daily timeframe**.

### Key Points:

* **Support Zone** : Around **\$3,266**, this is the area where price has bounced up multiple times, meaning buyers step in here.

* **Resistance Line**: Around **\$3,436**, this is the level where price has been rejected before, meaning sellers are strong here.

* **Current Price**: Around **\$3,293**.

### What the Chart Suggests:

* Price is near the **support** zone again.

* If the support holds, the green arrow shows a possible move **upward**.

* Price may first move up slightly, pull back, and then try to **break above resistance** at \$3,436.

Gold is in a sideways range. It's near a strong support level and might go up from here toward the resistance level, as shown by the green line.

Gold (XAUUSD) – Buy the Dip Toward Key SupportTrade Idea

Type: Buy Limit

Entry: 3360.00

Target: 3400.00

Stop Loss: 3350.00

Duration: Intraday

Expires: 25/07/2025 06:00

Technical Overview

The primary trend remains bullish, supported by recent price structure and sentiment.

Price is correcting lower, and is approaching Fibonacci retracement support at 3360.00.

A Buy Limit at 3360.00 aligns with bespoke support and offers a low-risk entry opportunity.

The target at 3400.00 is modest but achievable within the current intraday cycle

Upcoming Events to Watch

24/07/2025 at 14:45 – S&P Global Manufacturing & Services PMIs (US) could add volatility and act as a catalyst for a reversal from support.

Key Technical Levels

Resistance: 3400.00 / 3420.00 / 3435.00

Support: 3360.00 / 3340.00 / 3320.00

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

How to accurately capture golden trading opportunities?Bullish trend is still the main trend of gold at present. After rising to 3368 at the opening today, it fell under pressure and fluctuated. Technically, it has tested the pressure level and needs to be adjusted. The overall high-level carrying capacity has also declined, so it is not advisable to chase the rise too much. In terms of operation, it is recommended to wait for the price to stabilize before buying more. Judging from the current gold trend, the upper short-term resistance is in the 3380-3385 area, and the key pressure is at the 3395-3400 line; the lower short-term support is in the 3365-3355 area, and the key support is in the 3350-3345 range. The overall suggestion is to arrange long orders on dips around the support area, and try to maintain a stable wait-and-see attitude in the middle position. I will prompt the specific operation strategy at the bottom, please pay attention in time.

Gold Trading Strategy: Buy in batches as gold retreats to the 3365-3350 area, targeting the 3380-3385 area. If this resistance zone is broken, hold and look for upward movement.

How to accurately grasp the gold trading opportunitiesGold was greatly affected by the positive non-farm payroll data, and it rose strongly, with the increase completely covering all the losses this week. The current gold trend has completely reversed the previous bull-short balance. After breaking through the 3300 level and rising to around 3355, it maintains strong upward momentum, and the possibility of further testing the 3360-3375 area cannot be ruled out. Due to the strong positive data, if everyone fails to chase the long position or set a breakout long position in time in the first wave of the market, the subsequent pullback opportunities may be relatively limited, so it is necessary to maintain an active strategy in operation. It is recommended to continue to be bullish when it retreats to the 3335-3320 area, and the upper target is the 3360-3375 pressure range.