Gold Technical Outlook

Gold is currently consolidating inside a triangle pattern. After a recent bullish rally, price retraced between the 61.8% – 76.4% Fibonacci levels, finding support and bouncing upward. At present, gold is facing resistance at both the falling trendline and the 3298–3300 zone.

Bullish Scenario:

A breakout above the resistance trendline and the 3298–3300 zone could trigger a strong bullish move toward 3311, 3322, and 3333. A sustained break above 3333 would confirm a short-term bullish trend, opening the way for higher targets at 3360 and 3400.

Bearish Scenario:

If price faces rejection from the 3300 resistance and the falling trendline, gold is expected to move lower, retesting 3270. A decisive break below 3270 may extend the decline toward 3250. If 3250 is broken, gold could enter strong bearish momentum, potentially shifting the long-term trend to the downside with targets at 3000 and 2850.

OANDA:XAUUSD Gold Technical Outlook

XAUUSDG trade ideas

Gold prices are fluctuating. Is a correction coming?Gold surged last Friday, directly breaking through multiple moving average resistance levels. This trend is quite strong. Currently, the 5-day moving average has turned upward, indicating short-term upward momentum; however, the 10-day moving average remains slightly downward, indicating some divergence in the short- and medium-term trends. The 20- and 30-day moving averages have flattened. Overall, the short-term moving averages are less reliable, making it difficult to clearly predict the precise short-term trend based on them.

Since mid-May, gold has been fluctuating widely at high levels. Within this trend pattern, continued monitoring of fluctuations within this broad range is warranted. Until a major trend breakout occurs, the overall approach should be to maintain a volatile outlook and avoid prematurely declaring a unilateral trend.

The upper resistance level is around 3375, which has been repeatedly suppressed during previous price fluctuations. Focus on support in the 3340-3335 area below. This marks the low point after last Friday's sharp rise. The market has stabilized in this area and continued its upward trend. If the decline is significant, the 3300 round-number resistance level will need to be monitored.

Trading strategy:

For aggressive trading, short around 3375 with a stop-loss at 3385 and a profit range of 3345-3335.

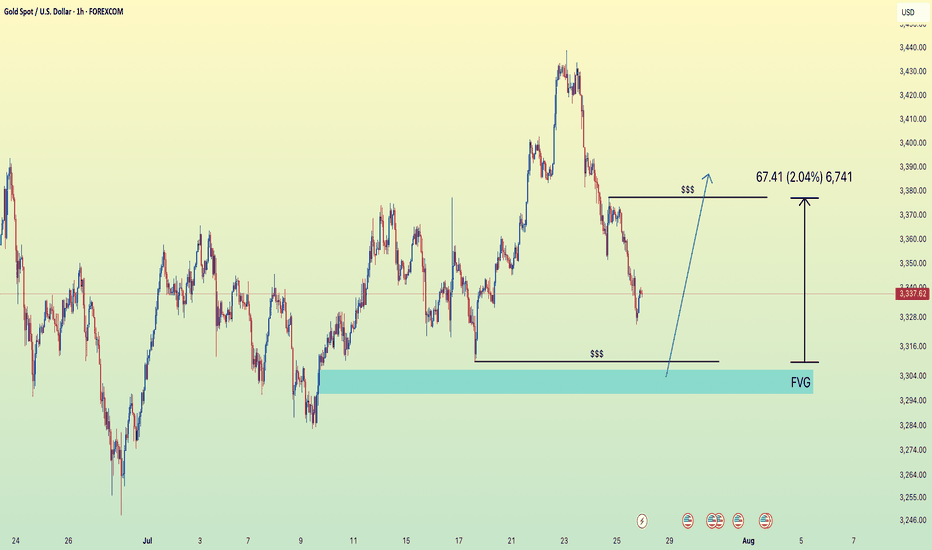

GOLD | Bullish Mitigation + Inducement Lining Up For Execution(Refined & Structured):

• Pair: XAUUSD (Gold)

• Bias: Bullish

• 4H Overview: Gold broke last week’s previous high, then pulled back and mitigated this week’s order block within the same range. A significant internal high (turnover HH) has now been broken, and price retraced to sweep liquidity and tap into the OB zone.

• 30M Structure: Now watching for a clean pullback into a refined OB after taking out sell-side liquidity/inducement. Structure is aligning perfectly for the next leg up.

• Entry Zone: Once price enters the OB zone, I’ll be watching the 5M for church-level confirmation. Execution follows once LTF speaks clearly.

• Targets: 5M to 30M structural highs depending on delivery.

• Mindset Note: I’m not rushing. Just following structure and reading price. Analysis mode right now—execution comes once price gives the sermon.

Roadmap to 3982: Key Long Entries and Profit ZonesThe initial long entry zone is between 3290 and 3275 .

From this range, an uptrend is expected to begin, targeting 3416 , which is our first exit point to close the initial long position.

After that, we wait for the next long entry , ideally around 3333 to 3319 . A new upward movement from this range is expected to reach 3455 . At this level, we continue to hold the position while placing the stop loss at the entry level to protect profits.

The next take profit target is 3650 , which may be reached by the end of 2025 or in 2026.

The final target is 3982 , which is likely to be hit in 2026, as the market may not have enough strength to reach it in 2025.

Gold is in the Bearish Direction after Breaking SupportHello Traders

In This Chart GOLD HOURLY Forex Forecast By FOREX PLANET

today Gold analysis 👆

🟢This Chart includes_ (GOLD market update)

🟢What is The Next Opportunity on GOLD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

XAUUSD Eyeing Liquidity Grab – M30 OB Zone in PlayPrice is respecting the ascending trendline and consolidating near a key resistance level. A bullish breakout is expected, with a potential retest of the trendline and the M30 Order Block (OB) zone acting as a key demand area.

📈 Trade Plan:

Wait for a minor pullback into the OB and trendline confluence

Look for bullish confirmation to go long

Target the liquidity zone above (around 3347)

📌 A clean structure and bullish order flow hint at a continuation to the upside.

Daily gold analysisDaily gold analysis

A long position with the target and stop loss as shown in the chart

The trend is up, we may see more upside

All the best, I hope for your participation in the analysis, and for any inquiries, please send in the comments.

He gave a signal from the strongest areas of entry, special recommendations, with a success rate of 95%, for any inquiry or request for analysis, contact me

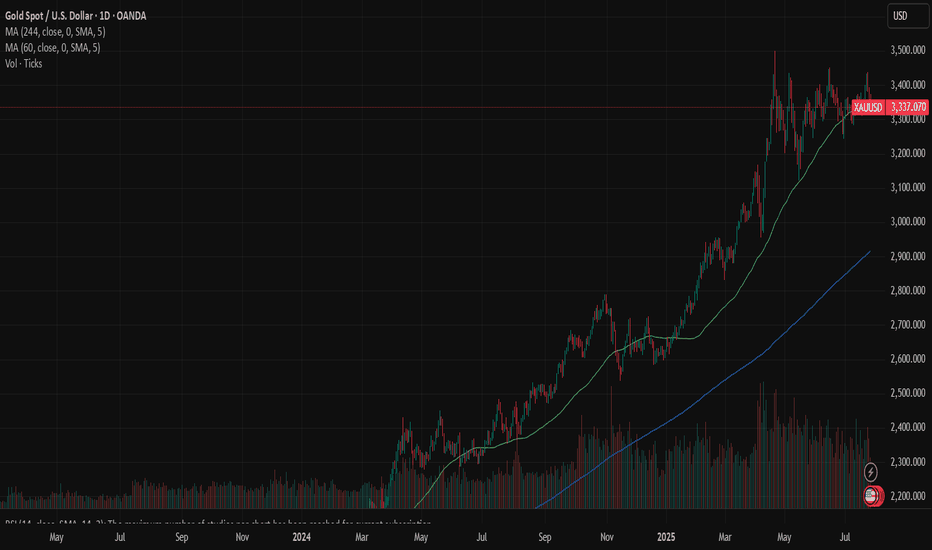

Gold: dropped on trade deals The safe-haven asset had its ups and downs during the previous week. The week started with an uptrend, where the price of gold reached its highest weekly level at $3.430, on trade tariff tensions. However, the deal made between the US and Japan, pushed the price toward lower grounds, ending the week at $3.340. In addition, Friday's drop was supported by announced tariffs negotiations between the US and EU in Scotland during the weekend.

The RSI dropped below the level of 50 on Friday, ending the week at the level of 48. The MA50 slowed down its divergence from MA200, however, the potential cross is still far away. Still, weekly lows of the price of gold found support at MA50 levels.

The week ahead brings several currently very important US macro data, including JOLTs, PCE, NFP and Unemployment data. In addition, the FOMC meeting will be held where the market will receive the latest Fed's view on economic developments in the country and future expectations. Also, further news on trade tariff agreements, especially regarding ongoing negotiations between the EU and the US in Scotland, might make an impact on investors sentiment for safe-haven assets. As per current charts, the price of gold might revert a bit to the upside, after a drop during the last three days of the previous week. In this sense, the resistance level at $3,4K might be tested. On the opposite side, the situation on charts is a little bit tricky. Namely, there is a line which perfectly connects all lows from February this year. Friday's closing was exactly at this line, which again adds to the probability of a short reversal. However, if, in any case, the price of gold breaks this longer term trend, then it will indicate that the longer path to the downside is in store for gold.

XAUUSD Live Trade with 11,641 USD ProfitsI managed to ride the momentum last night on XAUUSD and made over 11,641 usd profit on a live trading account. Gold usually create a range. It will create a top and a bottom then it will spend most of its time inside that range. That is pretty much how XAUUSD moves. If you can identify the top and the bottom then you can short it from the top and do a long trade on the bottom. The price will just travel from bottom to top and top to bottom. You can scalp your way to profits on this move if you can time it properly. Once in a while, a break from the top or the bottom happens. This is where you switch from trading the range to trading breakouts.

When you trade breakouts, you must trade it with the knowledge that less than 15 percent of breakouts are successful. Failed breakouts are very common. You need to have some form of stoploss below your breakout levels. You will know that the breakout fails once your stoploss is hit. If the breakout is successful then ride it. Do not put some TP (target price or take profit price) rather just trail your profits. Move your stops a few pips behind the price. Just enough distance to let the price breathe. If the price reverses then it will hit your stops. If the breakout is strong then you will ride it for a while until it reverses.

It will form another top and bottom again and move inside that range. Switch your approach again in trading long trades near the bottom and short trades near the top.

Just remember to always have some stoploss on every trade and never try to predict what the market will do or how the price will move. Let the market do its thing and just react to its movements.

Goodluck on your trades.

XAU / USD 1 Hour ChartHello traders. Taking a look at the hourly chart, it's kind of ugly. Smart trades would wait until we get out of all this cluster. Saying that, I have marked some potential scalp trade set ups for either buy or sells trades. This is just an idea, not trading advice. I am not trading as of now, I would rather wait for a better set up. For people who are more risk takers, there are plenty of trades out there, but for me, I am just monitoring for the best trade set up to ensure a good win. Big G gets my thanks. Let's see how the next 30 min. candle and hourly close. Be well an trade the trend. Happy Tuesday.

Gold prices soar to new highs!Market News:

Spot gold prices fluctuated at high levels in early Asian trading on Monday (August 4), currently trading around $3,349 per ounce. Gold prices surged by over 2% last Friday (August 1), reaching a weekly high. This is due to the fact that US July non-farm payroll data fell far short of expectations, increasing the likelihood of a Federal Reserve rate cut. Furthermore, Trump's new round of tariff announcements has fueled safe-haven demand. Global economic uncertainty, a weakening US dollar, and rising expectations of a Fed rate cut have all provided strong momentum for the rise in international gold prices.

Against the backdrop of continued global economic uncertainty, gold's appeal as a safe-haven asset is expected to further increase. Investors should closely monitor market trends to seize potential opportunities. This trading day, attention should be paid to the US June factory orders monthly rate and continued monitoring of news related to the international trade and geopolitical situation.

Technical Analysis:

From a macro perspective, the monthly chart shows four consecutive long upper shadows and three dojis. This high-level doji formation in an uptrend is overwhelming, prompting caution in buying and caution in the market. Be wary of potential sell-offs in the future. We have repeatedly emphasized the importance of the monthly gold chart in recent months!

On a weekly basis, gold bottomed out and rebounded last week, hitting the middle support band and rebounding. Prices remain within the range, currently shrinking to 3268-3438. The Bollinger Bands continue to close, while the MA5 and MA10 levels remain in a volatile pattern. A unilateral trend still needs time to develop. On a daily basis, there was an extreme rally on Friday night, with the daily chart closing with a large real bullish candlestick. The price directly broke through the short-term moving average and the middle support band, forming a strong Yang-enclosing-Yin pattern. This is a positive bullish signal. So, is it a good time to buy on Monday?

I personally don't recommend buying directly from high levels. Gold rebounded from 3268, surging nearly $100 over two trading days without a significant pullback. Even if there was a pullback on Thursday, it was a single-digit pattern, which doesn't provide solid support for a bullish rally. Therefore, I don't recommend chasing long positions. Instead, watch for a potential sell-off after a rally. Focus on resistance at 618 and resistance near 3376, a previous top-bottom reversal.

Looking at gold on both the 4-hour and hourly charts, the Bollinger Bands are showing signs of opening after last Friday's surge. However, it's important to note that such surge-like openings are generally not sustainable, and will close again upon retracing technical indicators. The 4-hour candlestick chart is currently trading above the upper band, no longer favoring a buy-now-up move. The 1-hour moving average is blunting, and the upper band of the Bollinger Band is about to close. Overall, while gold is strong, it's best not to chase the bulls. Focus on selling opportunities on rallies today, and then consider a bullish move after a pullback.

Trading strategy:

Short-term gold: Buy at 3330-3333, stop loss at 3322, target at 3360-3380;

Short-term gold: Sell at 3375-3378, stop loss at 3387, target at 3340-3320;

Key points:

First support level: 3342, second support level: 3330, third support level: 3316

First resistance level: 3376, second resistance level: 3388, third resistance level: 3400

XAUUSD 4Hour TF - August 3rd,2025🟦 XAUUSD 4H Analysis Long Idea

📅 August 3rd, 2025

🔹 Top-Down Trend Bias:

• Monthly – Bullish

• Weekly – Bullish

• Daily – Bullish

• 4H – Bullish

Price has broken out of a consolidation, confirming short term bullish momentum in alignment with the higher timeframes. We’re now watching how price reacts on a potential retest of the key $3,320 structure.

🔍 Key Level: $3,320

This former resistance now acts as a critical support zone. How price reacts here will determine short-term direction.

✅ Scenario A: Bullish Continuation

Clean retest of $3,320–$3,335

1.Look for bullish confirmation: wick rejections, bullish engulfing, or lower timeframe structure shift

Target 1: $3,395

Target 2: $3,450

This setup aligns with the overall bullish bias. We have ideal R:R with a clear invalidation to exit on if $3,320 fails as support.

⚠️ Scenario B: Bearish Rejection

1.Failure to hold $3,320 = potential trap breakout

2.Look for structure below $3,320 + bearish conviction

Target: $3,225 support zone

Only valid if $3,320 flips to resistance and confirms structure shift.

🧠 Final Notes

• Let price confirm the setup

• Structure > emotion

• Both scenarios are valid, but only with confirmation

Gold weekly chart with buy and sell entries plus swing trade ide1. Overall Chart Analysis

Timeframe and Trend: This 4-hour chart highlights a short-term downtrend with signs of exhaustion and consolidation. Gold peaked sharply on the left (possibly a local high around 2,400+), followed by a steep decline with lower highs and lower lows, forming what looks like a descending channel (diagonal trendlines connecting peaks and troughs). Recent candles show sideways ranging with smaller bodies and wicks, indicating indecision or a potential reversal setup. This could be a bear flag pattern or a base for accumulation.

Key Patterns:

Bearish Decline: Strong red candles early on suggest impulsive selling, possibly driven by external factors like USD strength or rising yields. However, the downtrend is losing steam, with recent bounces off lower levels.

Range-Bound Action: Price is trapped in a horizontal range (bounded by your marked lines), with dojis and spinning tops signaling buyer-seller balance. A breakout could lead to a volatile move.

Support and Resistance: Your green lines (lower) align with support zones where price has reversed upward multiple times. Red lines (upper) act as resistance caps, rejecting rallies.

Indicators (Inferred):

Moving Averages: Price is likely below key MAs (e.g., 50-period or 200-period EMA), confirming bearish bias. A golden cross (shorter MA crossing above longer) near green lines could validate buys.

RSI (Relative Strength Index): Potentially oversold (below 30) at green line tests, supporting buy entries. Neutral or overbought (above 70) near red lines would favor sells.

Volume and Momentum: Volume bars on the right show spikes on down moves but fading recently, hinting at bearish exhaustion. MACD might show narrowing histograms, indicating weakening momentum.

Volatility: If Bollinger Bands are applied, they're likely contracting, suggesting an imminent expansion (breakout).

Market Bias: Bearish in the short term due to the downtrend, but with bullish potential if support holds (gold's macro uptrend from inflation/geopolitical hedging). Watch for catalysts like US economic data or Fed announcements. The setup favors range trading (buy low, sell high) until a clear breakout.

Risk Considerations: Gold can move 50-100 pips per 4H candle; use tight stop-losses (SL) 1-2% away from entries. Risk no more than 1% of your account per trade. Multi-timeframe confirmation (e.g., daily chart) is recommended.

2. Analysis of Marked Levels and Entry Rationale

Your lines are horizontal, with green lines clustered at lower price levels (buy zones, e.g., around 2,300–2,320) and red lines at higher levels (sell zones, e.g., around 2,340–2,360). These appear to be based on prior price action (swing points). I'll group them by color and explain the technicals, drawing from support/resistance, patterns, Fibonacci, and momentum.

Green Lines: Potential Buy Entries (Bullish Setups)

These lower lines seem to mark strong support areas where price has bounced repeatedly, often with bullish candle formations. They could represent the floor of the descending channel or a demand zone.

Technicals Supporting Buys:

Support Zones: Green lines align with historical swing lows (e.g., visible double or triple bottoms in the chart's dips), where buyers have defended price. This creates a "value area" for accumulation, especially in gold's broader bullish context.

Candlestick Patterns: Bullish signals like hammers, bullish engulfing, or long lower wicks appear at these levels—indicating rejection of lower prices and potential reversal. For example, a green candle closing above the line after a touch would confirm entry.

Fibonacci Retracement: Drawing from the chart's high (left peak) to low, green lines likely hit key levels like 61.8% or 78.6% retracements—common for buying deep pullbacks in trending markets.

Momentum and Divergence: RSI bullish divergence (price lower lows, RSI higher lows) or an oversold reading supports upside. The downtrend's slowing pace (smaller red candles) suggests fading sellers.

Trend Context: These are counter-trend buys in a downtrend—ideal for scalps or reversals. Wait for confirmation, like a 4H close above the green line or increased volume.

Entry Strategy: Enter long on a retest of the green line with bullish confirmation (e.g., RSI >30 crossover). Place SL 20-30 pips below the line to account for wicks.

Suggested Take-Profit Levels:

TP1 (Conservative): Nearest minor resistance or 38.2% Fibonacci level—e.g., if entry at ~2,310, TP at 2,330 (1:1 risk-reward, ~20 pips profit for quick partial exit).

TP2 (Aggressive): Mid-range or next red line—e.g., 2,340–2,350 (1:2 ratio, scale out 50% of position).

Stretch TP3: If bullish breakout above the channel, target prior highs (e.g., 2,370–2,400). Trail stops using a 20-period MA or ATR-based levels for dynamic exits.

Red Lines: Potential Sell Entries (Bearish Setups)

These upper lines appear to cap price action, with rejections forming bearish patterns. They could be the ceiling of the channel or supply zones.

Technicals Supporting Sells:

Resistance Zones: Red lines correspond to prior swing highs (e.g., failed rallies in the mid-chart), round psychological numbers, or the upper channel boundary. Multiple touches with downside reversals confirm seller control.

Candlestick Patterns: Bearish indicators like shooting stars, bearish engulfing, or long upper wicks at red lines signal rally failures—sellers stepping in aggressively.

Fibonacci Extension/Retracement: From the downtrend's wave, red lines might align with 38.2% or 50% retracements—prime spots for selling into strength within a bearish structure.

Momentum Indicators: RSI overbought (above 70) or bearish divergence (price higher highs, RSI lower highs) at these levels reinforces downside. MACD line cross below signal line could trigger entries.

Trend Context: Aligns perfectly with the downtrend's "sell the rallies" mantra. The overall lower highs pattern suggests continuation unless broken.

Entry Strategy: Enter short on a rejection from the red line (e.g., red candle close below it with volume). Place SL 20-30 pips above the line.

Suggested Take-Profit Levels:

TP1 (Conservative): Nearest minor support or green line below—e.g., if entry at ~2,350, TP at 2,330 (1:1 ratio, ~20 pips for scalping).

TP2 (Aggressive): Lower range or channel support—e.g., 2,310–2,300 (1:2 ratio, partial close).

Stretch TP3: If bearish breakdown below green lines, target extended supports (e.g., 2,280–2,250 via 161.8% Fibonacci extension). Trail stops with a parabolic SAR or based on recent swing lows.

3. Additional Suggestions and Scenarios

Breakout Scenarios:

Bullish Breakout: A strong close above the highest red line (e.g., on high volume or positive news) invalidates sells—switch to longs targeting 2,400+ (macro resistance).

Bearish Breakdown: Close below the lowest green line accelerates downside to 2,250–2,280 (next major support, possibly a monthly low).

Risk-Reward and Position Management:

Prioritize 1:2+ RR (e.g., risk 20 pips to gain 40+). Use partial profits: Exit 50% at TP1, trail the rest.

Combine with oscillators: Avoid buys if RSI <20 (extreme oversold) or sells if >80 (overbought).

Time of Day: Gold volatility peaks in NY/London sessions; avoid thin markets.

Potential Biases or Warnings:

Gold's inverse correlation to USD (check DXY) or bonds could override technicals—e.g., a weak USD might break red lines upward.

The range is tightening; a false breakout is possible. If consolidation persists, consider straddle strategies.

This is a technical view only; fundamental shifts (e.g., Middle East tensions boosting gold) could alter dynamics.

GOLD – SMC ProTrading Breakdown Plan Next WEEK GOLD – SMC ProTrading Breakdown | Clinton Scalper | 4H Timeframe

XAUUSD is currently displaying clear institutional order flow behavior after a deep liquidity sweep at the end of July. Here’s a full breakdown using advanced SMC (Smart Money Concepts) methodology:

🔍 1. Liquidity Sweep at the Low

Price maintained a series of lower highs and bearish structure until it executed a classic liquidity grab between 3,270 – 3,290. This is a textbook move by Smart Money: sweep retail stop orders before initiating a reversal.

This zone aligned with:

✅ Untapped Fair Value Gap (FVG)

✅ Reversal Order Block (OB)

✅ Fibo 0.236 of the mid-term bullish leg

After the sweep, the market printed a micro CHoCH, indicating early signs of smart money accumulation.

🧠 2. CHoCH → BOS → Reaccumulation Structure

CHoCH (Change of Character) marks the first break in the bearish microstructure – suggesting a possible shift.

Then, price delivered a BOS (Break of Structure) around the 3,334 zone, confirming bullish intent.

Buy-side is now:

Positioned from a deep discount zone

Mitigating key inefficiencies

Targeting higher liquidity zones above current price

Price is currently reacting to a previous supply OB around 3,362.

📐 3. Institutional Order Flow & Target Zones

Now that price is in a key reaction zone, we prepare for two high-probability scenarios:

🅰️ Continuation Scenario (Reaccumulation)

A retracement to the 3,317–3,311 zone (Fibo 0.5–0.618) could offer a premium re-entry

This area is stacked with:

FVG

Order Block

Equal lows liquidity

🔼 From there, potential targets include:

🎯 TP1: 3,371 – previous imbalance zone

🎯 TP2: 3,392 – minor liquidity cluster

🎯 TP3: 3,429 – premium OB and high-liquidity zone

🅱️ Distribution Scenario (Bearish Rejection)

If price fails to hold bullish structure and forms a bearish CHoCH around 3,392–3,429

This would signal a distribution zone, and potential reversal back toward 3,290 support

🔂 4. Smart Money Flow Logic

“Smart Money doesn’t follow price. They lead price to liquidity.”

This chart reflects the complete Sweep → CHoCH → BOS → Mitigation → Expansion sequence. A classic SMC Pro model where:

Liquidity is engineered and swept

Structure is shifted

Price returns to mitigate institutional entries

Price expands into external liquidity

📌 Clinton Scalper Outlook:

We don’t chase reversals – we track the footprints of capital. The real edge is understanding where smart money is positioned, and aligning with their narrative.

🔔 Stay tuned for continued updates using this precise and probability-driven Pro SMC framework.

GOLD Short From Resistance! Sell!

Hello, Traders!

GOLD surged up sharply

On Friday and is already

Retesting the horizontal

Resistance of 3377$

From where we will be

Expecting a local pullback

On Monday as Gold

Is locally overbought

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Gold Approaches Key Reversal Zone After Liquidity Sweep.Gold has recently broken out of a parallel channel during the New York session, followed by a strong upward move triggered by the NFP (Non-Farm Payroll) news event. Currently, the market is trading near a key trendline resistance zone. In this area, the price has also swept the liquidity residing above recent highs, indicating that potential buy-side liquidity has been taken out.

This level now becomes critical for observation. If the market forms a Market Structure Shift (MSS) or provides any valid bearish confirmation — such as a strong rejection candle, bearish engulfing, or a break of lower timeframe support — then there is a high probability that a downward move may follow from this zone.

As always, conduct your own research (DYOR) and wait for price action to confirm the bias before executing any trades. Acting on confirmation rather than assumptions protects both capital and strategy.