XAUUSDG trade ideas

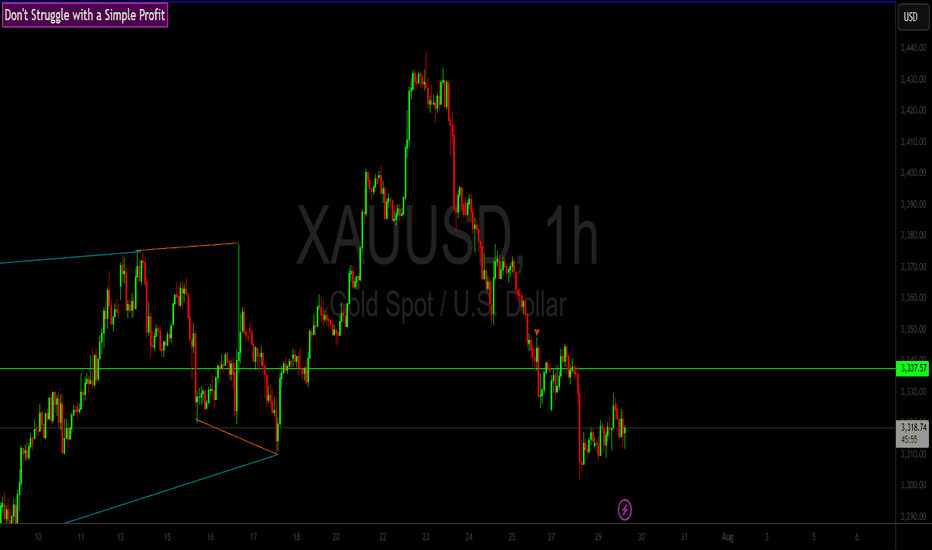

XAU/USD Intraday Plan | Support & Resistance to WatchGold staged a minor recovery overnight after bouncing from the 3,267 Support Zone, and is now trading around 3,305. Price remains below both the 50MA and 200MA, which continue to slope downward—confirming short-term bearish structure.

This current move is still corrective unless bulls manage to reclaim the 3,309–3,334 resistance zone. A clean break and hold above 3,334 would be the first sign of strength, opening up potential retests of 3,348 and 3,362.

Until then, any rallies into the 3,309–3,334 zone should be viewed with caution. If the bounce loses steam, watch for a retest of 3,289 - 3,267. A break below that would expose the 3,241 and 3,208 levels, with the HTF Support Zone (3,241–3,208) acting as a broader downside cushion.

📌 Key Levels to Watch

Resistance:

‣ 3,309

‣ 3,334

‣ 3,348

‣ 3,362

Support:

‣ 3,289

‣ 3,267

‣ 3,241

‣ 3,208

🔍 Fundamental Focus – Thursday, July 31

Big day for data.

🟥 Core PCE, Employment Cost Index, and Unemployment Claims — all critical for Fed outlook and could move gold sharply.

⚠️ Volatility expected around 2:30pm. Stay nimble and manage risk carefully.

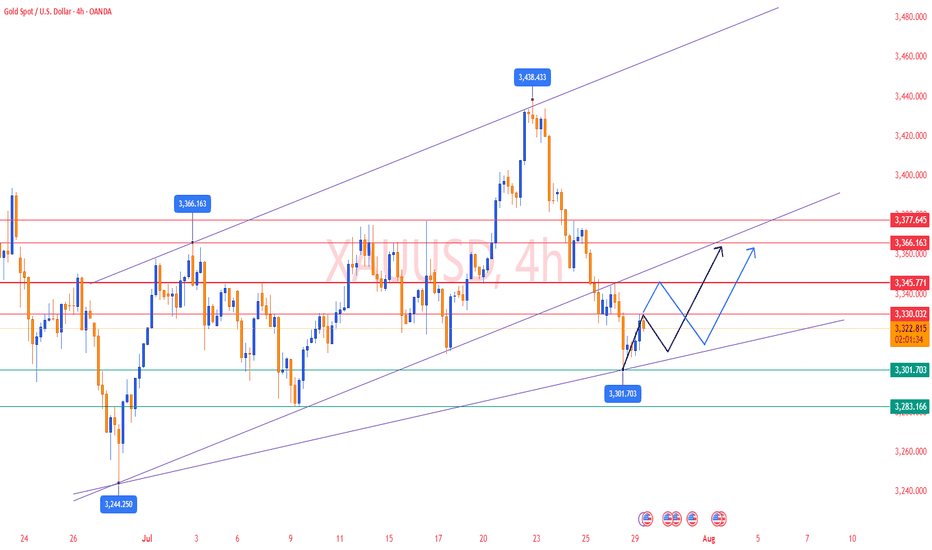

Gold (XAUUSD) Breaks Trendline – Potential Downside Ahead?Gold (XAU/USD) has officially broken below a long-term ascending trendline on the 4H chart, indicating a potential shift in market structure. The recent breakout from a bear flag pattern confirms bearish momentum, and price is now approaching a key horizontal support zone around $3,249 and $3,242.

🔹 Trendline support (now resistance) broken

🔹 Bear flag breakdown – strong bearish candle

🔹 Eyes on support levels: $3,249, $3,165, and possibly lower

🔹 Watch for a potential retest of the broken trendline for short opportunities

A clean break and close below $3,249 could open the door for further downside in the coming sessions. Trade cautiously and manage your risk!

XAUUSD BUY AND SELL LEVELSGold (XAUUSD) is currently showing key movement potential as it reacts to major levels. We are watching closely for price action near important support and resistance zones to identify the next trade setup.

📌 Stay alert for possible retracements or breakouts. Both buying and selling opportunities may arise depending on market reaction.

Trade with confirmation and always manage risk wisely.

GOLD: Bearish Continuation & Short Trade

GOLD

- Classic bearish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Sell GOLD

Entry - 3331.7

Stop - 3334.0

Take - 3327.0

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Gold Market Builds Momentum Toward 3358 Supply ZoneGold market continues to build momentum gradually, with price action targeting supply mitigation at 3358.

The duration of this stance depends on whether price can clear this zone decisively; failure may lead to short-term consolidation before the next stance.comment ,boost idea and follow for more informed decisions on gold market

Gold recently experienced a typical "suppression and release"Capital dynamics and sentiment modeling, found that the gold market has recently experienced a typical "suppression and release" type of reaction. After a period of sustained pressure on the emotional background, the dominant force of the short side began to weaken, and both long and short sentiment tends to be balanced, and the logic of gold as a safe-haven asset has been re-explored and recognized.

This type of trend is often non-explosive, but through the emotional layers of repair and structural slow reversal of the gradual unfolding. The current signal strength has reached the bearish threshold set by the system, with a certain operational feasibility.

It is recommended that traders try to follow up with a low percentage of positions, but still need to retain enough position space to cope with the possible continuation of fluctuations. The whole layout is mainly defensive and offensive, and it is appropriate to seek progress in a stable manner.

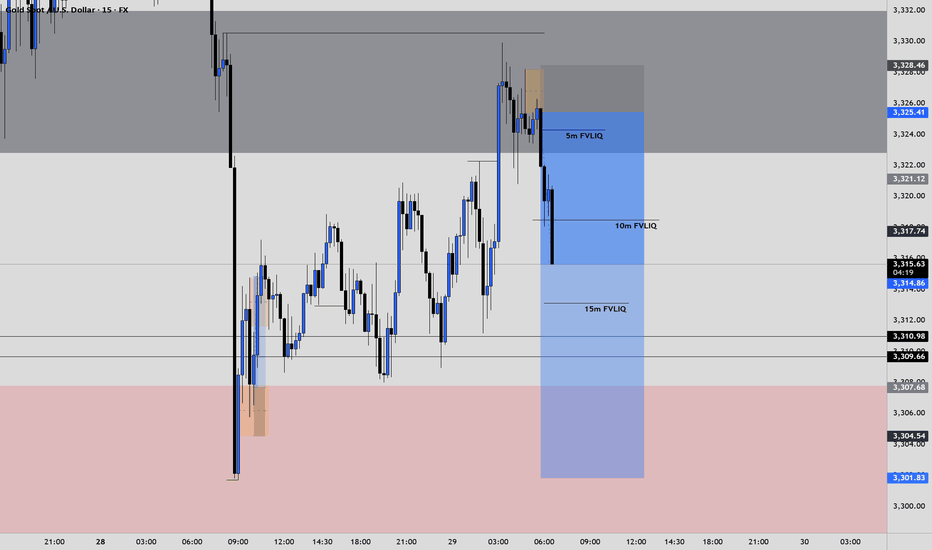

Gold (XAU/USD) – Technical UpdateDate: July 30, 2025

✅ Market Reaction Confirms the Forecast

In our previous analysis, we highlighted the $3,308–$3,315 region as a high-probability demand zone, reinforced by a deep retracement into the 89% Fibonacci level. We also pointed to a liquidity grab beneath $3,308 and projected a potential bullish reversal toward $3,345 and $3,398.

Today, price action has validated this view with precision.

✅ Price swept liquidity below $3,308 as expected, triggering a sharp rejection from our zone.

✅ A clear bounce followed, pushing price upward and confirming that large buyers stepped in—exactly where we anticipated.

✅ The structure is now shifting bullish, with price currently trading above $3,331, heading confidently toward our first target at $3,345.

📊 Why This Matters

This reaction was not random—it followed the logic laid out in the prior analysis:

-The demand zone was respected.

-The discounted pricing at 89% retracement offered maximum risk-reward.

-The internal imbalance between $3,345–$3,398 continues to act as a magnet, just as we outlined.

This is a textbook move where price hunted stops, tapped into demand, and began its upward drive—exactly as described in advance.

🎯 Targets Remain Valid

Target 1: $3,345 → Currently in progress. Price is gravitating toward this level, which also aligns with the 50% Fib retracement and minor supply.

Target 2: $3,398 → The final destination of this bullish move, completing the fill of the inefficiency left behind by the last drop.

🧠 Final Word

This is a strong confirmation of the original idea. The technical story has unfolded step by step as predicted, proving the reliability of the analysis. For traders following along, this not only reinforces confidence in the setup—but also showcases the power of disciplined, structure-based trading.

🔥 The move is unfolding exactly as projected. Patience, precision, and planning are now paying off.

consider like and follow so you don't miss any next analysis or update of the chart

you can ask me in the comment section

Please check how to trade later.Since the release of the trading strategy, I have been able to accurately predict market trends. I am also grateful to so many brothers for following me. My premium privileges are about to expire. I will put the subsequent trading content in the group. If any brothers are interested, they can find me through 🌐. As for how to deal with the future market, I have stated the extraordinary situation and will patiently wait for the rebound of gold. At the same time, I will pay attention to the impact of the Sino-US trade talks.

Gold Analysis and Trading Strategy | July 29✅ Fundamental Analysis

🔹 U.S. Dollar Index Surges Strongly: On Monday, the U.S. Dollar Index jumped over 1%, closing at 98.6, marking a new short-term high. This rally was primarily driven by the U.S.-EU trade agreement, which reduced tariffs to 15%, easing concerns of a trade war escalation. As a result, risk assets gained appeal, while gold's safe-haven demand was suppressed.

🔹 U.S.-China Talks Resume with Limited Expectations: The U.S. and China resumed trade negotiations in Stockholm, aiming to extend the 90-day tariff truce. However, the U.S. side made it clear that "no major breakthroughs are expected," leaving room for uncertainty, which provides some support for gold.

🔹 Geopolitical Risks Remain Elevated: President Trump has set a 10–12 day deadline regarding the Russia-Ukraine issue, warning of stronger measures if no progress is made. Meanwhile, tensions in the Middle East continue. Any escalation in conflicts could trigger renewed safe-haven buying in gold.

✅ Technical Analysis

🔸 Gold closed lower again on Monday, marking the fourth consecutive daily loss. The price rebounded to the 3345 level during the day but encountered strong resistance. During the European session, gold broke down swiftly, reaching a low of around 3301, showing a typical one-sided sell-off with strong bearish momentum.

🔸 On the 4-hour chart, gold broke below the key support level at 3320 and continued trading below the MA system. If the price fails to reclaim the 3330–3340 zone, the outlook remains bearish. However, if the European or U.S. session can push the price firmly above 3330, a potential bottom formation could be underway.

🔴 Resistance Levels: 3330 / 3345–3350

🟢 Support Levels: 3300 / 3285–3280

✅ Trading Strategy Reference:

🔻 Short Position Strategy:

🔰Consider entering short positions in batches if gold rebounds to the 3340-3345 area. Target: 3320-3310;If support breaks, the move may extend to 3300.

🔺 Long Position Strategy:

🔰Consider entering long positions in batches if gold pulls back to the 3300-3305 area. Target: 3325-3335;If resistance breaks, the move may extend to 3345.

🔥Trading Reminder: Trading strategies are time-sensitive, and market conditions can change rapidly. Please adjust your trading plan based on real-time market conditions. If you have any questions or need one-on-one guidance, feel free to contact me🤝

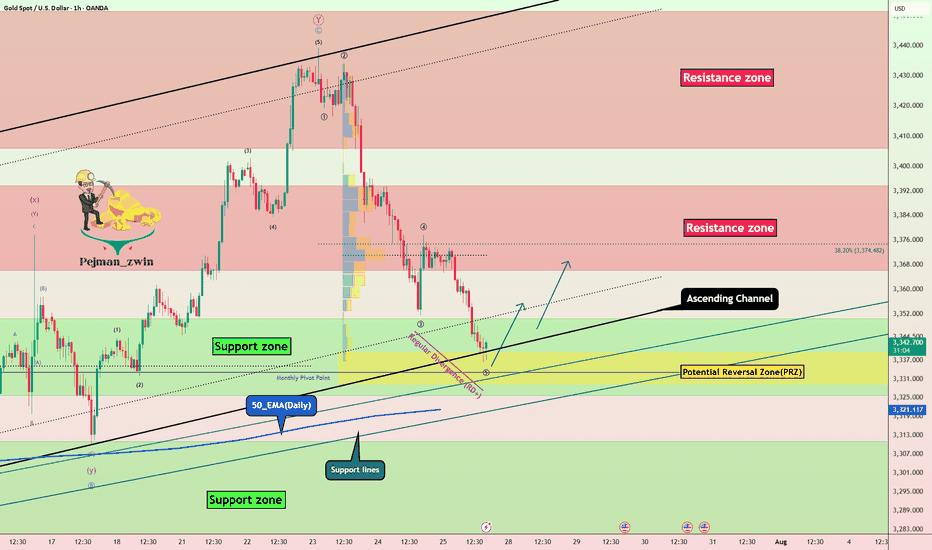

Gold Recovery Setup = Divergence + Support ClusterGold ( OANDA:XAUUSD ) fell to the lower line of the ascending channel and the Support zone($3,350-$3,326) , as I expected in my previous idea .

Gold is currently near a set of Supports .

Supports:

Support zone: $3,350-$3,326

Monthly Pivot Point: $3,333

Potential Reversal Zone(PRZ): $3,339-$3,329

Lower line of the ascending Channel

50_EMA(Daily)

Support lines

In terms of Elliott Wave theory , Gold appears to be completing a bearish wave 5 .

Also, we can see the Regular Divergence(RD+) between Consecutive Valleys .

I expect Gold to rise to at least $3,359 .

Second target: $3,367

Note: Stop Loss (SL) = $3,319

Do you think Gold can break the Support cluster by the end of trading hours?

Gold Analyze (XAUUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Gold repeatedly tested lows. Will it break through?On Monday, the Asian market opened low and rose in the early trading. In the European trading, it rose to around 3345. The European trading was under pressure and fluctuated. The US trading began to accelerate its decline, and the lowest point reached around 3302. Then it continued to fluctuate in the range of 3300-3320.

On July 27, the United States and the European Union reached a framework trade agreement; the agreement reduced market concerns about the global economic recession, promoted the attractiveness of risky assets, and boosted the stock market and the US dollar. Although Trump has repeatedly pressured for a substantial interest rate cut, the market has strong expectations for a September interest rate cut. The current expectation of maintaining a stable interest rate dominates the market, coupled with the strength of the US dollar, which puts gold prices under downward pressure in the short term.

Gold opened low in the early trading on Monday and then rebounded to recover the losses, but then fell below the low again, and the daily line closed in the negative, and now it has formed a four-day negative decline. MA5 and 10-day moving averages form a dead cross, and there is a downward turn.

The focus on the upper side is around Monday's high of 3345, which is also near the current position of MA5, 20, and 30-day moving averages. Below this position, gold is weak; if it breaks upward, it is necessary to prevent the possibility of a rebound correction.

The lower support first focuses on the 3300 integer mark; secondly, focus on the area around 3285-3275.

Operation strategy:

Short near 3340, stop loss 3350, profit range 3320-3300;

Long near 3300, stop loss 3290, profit range 3320-3340.

Before the release of US data on Tuesday, you can maintain this operation strategy; after the data is released, adjust the strategy based on the impact of the data.

uptrend for GOLD ?According to the chart, we have an ascending channel and the RSI indicator is also in the ascending channel.

Considering the data on the tension between China and Taiwan and the tariff and oil wars between the United States and China, Russia, India, etc., the possibility of gold growth is not far from imagination.

Gold Consolidates at the Top, Bearish Reversal Ahead?On the 15-minute chart, XAUUSD is showing signs of exhaustion after a strong bullish impulse. Price is currently consolidating around the 3,370–3,375 resistance area, failing to make a clean breakout. Volume is fading, suggesting buyer momentum is weakening.

Technical Breakdown:

1. Market Structure:

Since late July, the market has formed a clear uptrend with higher highs and higher lows.

However, recent price action is showing indecision at the top, with multiple rejection wicks – indicating a potential short-term distribution phase.

2. Price Action & Supply-Demand Zones:

Demand Zone 1: Around 3,310–3,320 acted as the launchpad for the strong bullish breakout on August 2.

Demand Zone 2: Around 3,345–3,350 provided support for the next leg up.

Current Supply Zone: Between 3,375–3,380 – multiple rejections have been observed here.

3. Indicators Overview:

EMA20 & EMA50 (not shown but inferred): Upward sloping, but starting to flatten – signaling potential consolidation or bearish divergence.

RSI (likely above 70 earlier): Now showing signs of bearish divergence, supporting a possible short-term correction.

4. Fibonacci Retracement Analysis:

From the recent bullish swing (3,310 → 3,375), key retracement levels are:

0.382 → ~3,350

0.5 → ~3,342

0.618 → ~3,334

This confluence around the 3,334–3,342 range makes it a critical zone for a potential bullish bounce.

Suggested Trading Strategies

Scenario 1 – Scalping the Rejection (Counter-trend short):

Entry: SELL limit at 3,375–3,380

Stop Loss: 3,386

Take Profits:

TP1: 3,350 (Fibonacci 0.382)

TP2: 3,335 (Fibonacci 0.618 + previous support)

Scenario 2 – Trend Confirmation (Breakdown Play):

Setup: Sell if price breaks below 3,350 with volume confirmation.

Target Zones:

Initial target: 3,310 (prior demand zone)

Extended target: 3,280–3,265 (possible Wyckoff distribution breakdown)

Key Levels to Watch:

Significance: 3,380 - Resistance - Short-term supply zone

3,350: Support - Key Fibonacci 0.382 level

3,334: Support - Strong confluence zone (Fibo + demand)

3,310: Support - Bullish breakout base

Conclusion:

Gold is currently in a vulnerable position with signs of bullish exhaustion. Traders should stay patient and wait for confirmation before entering. Watch the 3,350–3,334 zone for reaction – it will likely decide the next directional move.

If you found this analysis helpful, make sure to follow for more updated strategies and save this post for future reference.

XAUUSD Intraday Signal Analysis – Gold Price Momentum & RSI SetuIn today’s 1-hour chart of XAUUSD (Gold vs USD), we observe a strong upward momentum supported by technical indicators, suggesting a well-defined bullish trend in the short term. Traders looking to capture short-term profits may find this chart setup especially favorable. Here's a breakdown of the price action and what it could mean for intraday traders.

Price Action Overview

The price of gold has surged past the $3,320 mark, showing a clear bullish breakout with a series of higher highs and higher lows. Currently, the market is trading near the $3,378 level, consolidating slightly after a strong upward movement.

The SMA 9 (Simple Moving Average) is providing dynamic support, curving upward and closely hugging the candlesticks. This is typically a sign that buyers are actively pushing the price higher and dips are being bought up quickly.

Additionally, the spread between the Buy ($3,378.78) and Sell ($3,378.51) prices is extremely narrow, suggesting tight liquidity and fast execution potential — ideal conditions for scalpers and short-term traders.

RSI Analysis

The RSI (Relative Strength Index) 14 is hovering around the 68–70 level, which traditionally indicates the asset is approaching overbought territory. However, it hasn’t crossed into the 70+ danger zone yet, which implies there could still be room for further upside.

One key observation is the RSI divergence forming on the right-hand side. While price has been climbing steadily, RSI has started to curve down slightly — this could hint at a minor pullback or consolidation phase before the next big move. Smart traders may consider watching for bullish RSI bounces or hidden divergences before re-entering long trades.

Trade Idea

Trend: Bullish

Support: $3,360 / $3,340

Resistance: $3,400 / $3,420

Signal: Wait for a minor pullback toward the SMA, and look for bullish candlestick confirmation near $3,360 before entering long.

Conclusion

This XAUUSD 1H chart presents a strong case for continued bullish momentum with cautious optimism due to RSI nearing overbought levels. A pullback could offer fresh entry opportunities before a push toward the next resistance zone. Intraday traders and swing traders alike can benefit from closely monitoring price action around the SMA 9 line.

Will gold break through on August 5th?

1. Key News Drivers

✅ Expectations of a Fed Rate Cut Strengthen (Core Logic)

Weak non-farm payroll data (the probability of a September rate cut soars to 90%) leads the market to anticipate two rate cuts this year, with the first likely in September.

The US dollar weakens: expectations of interest rate cuts suppress the US dollar, and the attractiveness of gold as an interest-free asset increases.

✅ Rising risk aversion

Trump's tariff policy has sparked trade concerns, compounded by global economic uncertainty (such as a slowdown in Europe and geopolitical risks).

Fragile market sentiment: If subsequent economic data (such as CPI and retail sales) falls short of expectations, gold could rally further.

⚠️ Risk Warning: If Fed officials signal hawkishness (such as downplaying rate cuts) or if economic data rebounds, gold could experience a short-term correction.

2. Key Technical Signals

📈 Bullish Trend Confirmation Conditions:

A break above $3,375 (previous resistance level) opens up upside potential, with targets between $3,390 and $3,400, or even $3,450. Hold the support of 3335 (bull defense line). If the pullback does not break this level, the trend will remain strong.

📉 Pullback Risk Warning:

If 3335 is broken, a pullback to 3300 (a key psychological barrier) is possible, turning into a volatile market.

4-hour chart is overbought: Be wary of short-term profit-taking after consecutive days of gains.

🔍 Key Levels:

Resistance: 3375 → 3390-3400 → 3450

Support: 3360-3350 → 3335 → 3300

3. Today's Trading Strategy

🎯 Main Strategy: Buy on pullbacks (low-cost buying), supplemented by shorting at key resistance levels.

👉 Long Opportunities:

Conservatives: Enter after a pullback to 3360-3350 and stabilization. Stop loss at 3340, target at 3380-3390.

Aggressive: If it breaks through 3375, go long with a light position, set a stop-loss at 3360, and target 3400.

👉 Short Opportunities:

Short if it first hits the 3390-3400 range and finds resistance, set a stop-loss at 3410, and target 3375-3360.

⚠️ Notes:

Avoid chasing the ups and downs, and wait for key levels to be confirmed.

If it falls below 3335, pause long positions and wait for support at 3300 before repositioning.

4. Medium- to Long-Term Outlook

Bull Market Start Signal: A weekly break above 3400 could confirm the start of the Fed's rate cut cycle.

Potential target: 3500-3600 (historical high area).

Risks: If US economic data improves or the Fed turns hawkish, gold could experience a deep correction to 3200-3150.

Summary

Short-term outlook: 3375 is the dividing line between bulls and bears. If it breaks through, go long; if it hits resistance, trade in a range.

Medium- to long-term: Focus on Fed policy and economic data. Trend-setting long positions should wait for clearer signals.

📌 Action suggestion: Give priority to callback of long orders during the day, strictly set stop-loss, and be wary of high-level shocks and washouts!

In-depth Analysis of the Gold Bull-Bear Game on August 4th:

I. Gold's Current Core Contradiction

Bull Support Factors

Weak non-farm payroll data reinforces expectations of a Fed rate cut, with the market betting on an over 80% probability of a September rate cut.

Risk Aversion: Although the tariff extension has not yet been finalized, the market remains concerned about escalating trade frictions, and gold is in high demand as a safe-haven asset.

Technical Breakout: Friday saw a strong breakout above the 3340-3350 resistance zone, with the daily chart showing a positive enveloping negative trend. Short-term bullish momentum prevails.

Potential Short-Term Opportunities

Monthly Top Signal: Consecutive high-level doji candlesticks with long upper shadows suggest medium-term selling pressure.

Fundamental Bearish Hidden Dangers:

The Fed's independence remains, and Powell may not cut interest rates prematurely due to pressure from Trump.

II. Key Technical Signals

1. Weekly Level: Range Unbroken

The 3268-3438 range persists, currently nearing its upper limit, so be wary of a pullback.

Bollinger Bands are converging, with the MA5/MA10 convergence signaling an approaching market reversal window.

2. Daily and short-term cycles: Overbought correction needs

After Friday's surge: 4-hour/1-hour RSI is overbought, the Bollinger Band opening is unsustainable, and a technical retracement is needed.

Key positions:

Resistance: 3376 (previous high) + 3385 (Fibonacci expansion level);

Support: 3340 (top and bottom conversion) + 3315 (bull defense line).

3. Triangle convergence pattern:

If it opens high and breaks through 3376 on Monday, August 4, it may test 3400; if it opens low and falls below 3340, it will look down to 3315-3280.

III. Operation strategy for next week on August 4

(1) Response to three opening scenarios

Scenario 1: Opening high (above 3370)

Strategy: Short in batches in the 3376-3385 area, stop loss at 3400, target 3340→3315.

Logic: Positive overdraft + technical overbought, betting on a pullback.

Scenario 2: Flat opening (around 3360)

Strategy: If the price rises from 3366 but does not break through, go short with a light position, stop loss at 3376, target 3340; if it falls below 3340, go short and look at 3315.

Alternative: If the support at 3340 is effective, go long, stop loss at 3330, target 3360.

Scenario 3: Low opening (below 3340)

Strategy: Go long in the 3338-3340 area, stop loss at 3325, target 3360; if it breaks through 3315, go short.

(2) Mid-term layout

Short opportunity: Go short in the 3385-3400 area, stop loss at 3420, target 3245 (monthly support).

Buy opportunity: If the price falls back to 3315-3280 at the beginning of the week and stabilizes, go long in the mid-term, stop loss at 3260, target 3400.

IV. Risks and Warnings

Beware of institutional manipulation: Friday's late-day surge may be a trap for buying; beware of a flash crash at Monday's opening.

Data disturbance: Pay close attention to the speeches of Fed officials. If inflation rebounds or hawkish remarks are made, it will be bearish for gold.

Undetermined trend: The market is still volatile and unilateral trends need to wait for confirmation of a breakthrough in the range.

Conclusion

Short-term: Prioritize shorting in the 3370-3385 area, and enter long positions in the 3340-3315 area when appropriate, maintaining strict stop-loss orders.

Mid-term: The monthly bearish pattern has not changed, and above 3385 is the ideal entry point for short positions.

Key Strategies: "Don't chase long positions during strong resistance; don't sell short during deep declines; follow the trend after a breakout; exercise caution in controlling the market."