Gold looks like bearish move as the price hitting it resistance Gold is showing signs of a bearish move as the price tests its resistance zone. Sellers may take control if it fails to break above. Watch for confirmations before entering! 💹

#GoldAnalysis #XAUUSD #ForexTrading #BearishMove #ResistanceLevel"

XAUUSDG trade ideas

XAUUSD breaks out – bullish bias returnsGold has bounced from the bottom of the descending channel, initiating a clear upward move with a series of strong bullish candles. On the H2 chart, price has broken above the upper boundary of the medium-term downtrend channel and filled the nearest fair value gap, signaling a resurgence in buying pressure.

Current price action is approaching a previous resistance zone, aligned with recent swing highs. The chart suggests a potential consolidation before further upside, provided that the current bullish structure remains intact.

From a macro perspective, while the stronger-than-expected U.S. PMI data supports the USD in the short term, weak labor market figures and ongoing global geopolitical tensions continue to fuel demand for gold as a safe-haven asset. This environment is helping sustain XAUUSD’s current recovery structure.

GOLD may be subject to manipulation ahead of the NFPGOLD has reversed its upward trend and a local downward channel is forming. There is pressure from sellers on the market while the dollar is rising...

NFP data will be released today. The market may form a short squeeze before declining within the local downward trend.

There is a possibility that NFP data will be strong (needed by the presidential administration) to confirm the readiness to lower interest rates.

Scenario: ahead lies a strong resistance zone at 3311.5 - 3324.85. The formation of a false breakout could intensify bearish pressure, leading to a decline in prices to 3255

7.29 Gold 1-hour bottom signal appearsIn the short term, we see the daily line as the range of 3301-3345, and the current price is showing a volatile rebound, so we have to buy on dips. Then 3306-08 is the long point, but the price has risen in the morning, so the long position should be around 3310-12 in advance. If it falls below 3301 during the day, it will continue to test the 3292-3282 line downward. Similarly, if it breaks above 3345 during the day, it will continue to test 3372 upward and show a rebound trend in the next few days.

XAUUSD analysis - 1H FVG and OB setupsOn the 1H chart, price has made a sharp bullish move from the lower 1H OB zone (3,275 – 3,285) and is now hovering just below the 1H supply zone.

🔴 1H Supply Zone (OB):

3,354 – 3,368 → Price is consolidating here with no strong rejection yet.

🟢 1H Demand Zone (OB):

3,337 – 3,344 → First area to watch for potential bullish reaction.

👁 Mid-level support zone (waiting for confirmation):

3,310 – 3,320 → If price pulls back here and gives confirmation on lower timeframe, we’ll look for long setups.

📌 Trade scenarios:

1️⃣ Bullish: Wait for a retracement into 3,310 – 3,320, and if confirmed on LTF (3M–5M), go long.

2️⃣ If price drops deeper into the lower OB zone 3,275 – 3,285 and gives strong bullish reaction → potential long setup again.

3️⃣ Bearish: If price rejects the current OB zone (3,354 – 3,368) with confirmation → short entry targeting the green zones below (~3,320 or 3,310).

✅ Entry only after confirmation on lower timeframe

❌ No confirmation = no trade

XAUUSD Daily Sniper Plan – August 4, 2025🧠 Macro & Context

Gold is surging back toward premium structure after sweeping 3287. With no major news today, flow is dictated by structure, liquidity, and the residual strength from July’s closing push. Bulls have reclaimed internal control, but are now pressing into major resistance zones. This is the perfect battleground for sniper entries.

🔥 Bias: Bullish short-term, but hitting premium exhaustion

The current candle is testing prior supply and imbalance. Unless we break 3375–3380 cleanly, price remains vulnerable to rejection from premium. Above that, clean air until external zones. Any pullbacks into discount (under 3310) remain buyable — if the structure holds.

🎯 Daily Sniper Zones

🔷 3360–3375 – Decision Supply

📍 Where we are now

This is the current premium pressure zone. Built from a bearish OB + unmitigated imbalance from late July. First contact is live. If price rejects this level, sellers may regain control short-term. But if buyers break and hold above 3375 → bullish expansion is open. This is our Decision Zone.

🔷 3387–3405 – External Supply Block

📍 Premium target for breakout move

Clean HTF OB + imbalance resting above liquidity. If 3375 gives way, this is the next sniper target. Expect strong reaction — either reversal or inducement wick. Ideal for shorts if price shows exhaustion and BOS on LTF.

🔷 3430–3439 – Final Supply Cap (Weekly)

📍 Extreme supply wick

This is the highest defined zone on the Daily/Weekly chart before unknown territory. Full wick zone, untouched since early May. Reactions from here tend to be sharp. A strong rejection could initiate a new sell cycle.

🔷 3310–3325 – Mid-Demand Support

📍 Pullback buy zone

If price rejects 3375 and pulls back, this is the first area to monitor for higher low formation. Built from bullish OB, Fibonacci 50%, and alignment with internal structure. RSI supports buyers here if retested cleanly.

🔷 3285–3300 – Key Reversal Demand

📍 The origin of the current rally

Strong institutional footprint. Last BOS + OB confluence area. Any retest here is valid for sniper buys as long as no bearish HTF shift appears.

🔷 3240–3260 – Final Daily Demand Base

📍 Only valid if structure breaks down

If we lose 3285, this is the last demand zone holding Daily structure. Deep discount + HTF mitigation block. A visit here would require bearish breakdown first.

🧠 Game Plan Summary

⚠️ Right now, we are in a decision zone (3360–3375). Do not rush. Wait for confirmation.

✅ If we break 3375, next bullish target = 3405, then 3439.

🔻 If we reject 3375, watch for controlled retracement into 3325 or 3300 for buys.

⛔️ Do not sell blindly into current price — we are at equilibrium.

💬 If this sniper breakdown sharpened your vision, show some love ❤️

Comment, follow, and hit that like to stay locked in with GoldFxMinds.

More sniper updates dropping 💥

Powered by Trade Nation – for clear structure and no chart noise.

Gold Struggles at Resistance – Indicates Lower Lows AheadGold has been in a clear downtrend after facing a strong rejection around the 3,438 level (main resistance zone). Price is currently moving within a descending channel, confirming the formation of lower highs and lower lows – a classic bearish market structure.

Currently, Gold is trading near 3,306, facing resistance at 3,339 (marked as a possible lower high). If price fails to break above this level and sustain, there is a strong probability of continuation towards 3,249 and even 3,216.

Key Technical Highlights

- Immediate Resistance: 3,339 – 3,353

- Support Levels: 3,301 (short-term), 3,249, and 3,216

A rejection near 3,339 can lead to another leg down targeting 3,249 and 3,216. However, a strong breakout above 3,339–3,353 could temporarily shift momentum towards 3,394.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

The idea of shorting on rallies below 3315 remains unchanged.Gold remains generally weak, with multiple rebounds showing signs of fatigue. The upward moving average continues to suppress prices, indicating that the bearish trend remains intact, and the short-term market outlook remains bearish. Trading strategies remain bearish today, with a key focus on the 3300-3315 area, a key short-term resistance zone. If the market rebounds before the US market opens and approaches this area, or if a clear topping signal appears near this range, consider entering a short position. Today will see the release of the non-farm payroll data, which may influence the market's trajectory. We recommend prioritizing short-term trading before the release, and reconsidering the market's direction based on market feedback after the release. Structurally, gold continues to exhibit a volatile downward trend, with lower highs and lower lows. Today's low is expected to be lower than yesterday's. Short-term short positions are focused on 3285-3280, with a break below this level potentially allowing for further declines. Please carefully time your entry, strictly implement risk management, and avoid emotional trading.

Impact of the Non-Farm Payrolls? Latest Analysis.Information Summary:

Most traders are turning their attention to the crucial US labor market report, which is being closely watched as the market actively searches for new clues regarding the timing of the next interest rate cut this year.

The July non-farm payrolls report will be released at 8:30 AM US time. US non-farm payrolls increased by 110,000 in July, seasonally adjusted, lower than the 147,000 increase in June. The US unemployment rate is expected to rise from 4.1% to 4.2% in July.

If the non-farm payrolls figure falls below 100,000 and the unemployment rate rises, it could signal a weakening job market, undermining the Fed's rekindled hawkish outlook and dampening the dollar's upward momentum. In this scenario, gold prices could re-cross the 3,400 mark. However, if the non-farm payrolls unexpectedly exceed 150,000, it could support the dollar's continued rise and hurt gold. Strong US employment data could rule out two rate cuts from the Fed this year.

Market Analysis:

Quaid believes that the current moving average crossover is trending downward, and downward momentum is still in play. The RSI remains at 42.7, hovering below the midline, indicating that gold's downward trend remains intact. The 20-day moving average fell below the 50-day moving average on Wednesday, confirming the bearish momentum.

Therefore, if gold closes below the key support level of the 100-day moving average at $3,270 on a weekly basis, a new downtrend could begin, potentially leading to a drop towards the June 30 low of $3,248.

Quaid believes that the current bull-bear watershed needs to focus on around 3315, which is the previous intensive trading area and is also the first resistance position for short-term upward movement.

On the last trading day of Super Data Week, Quaid hopes that everyone has gained something and has a happy weekend; I wish you all good luck.

XAUUSD Breakout and Retest – Targeting 3428 Supply ZoneGold (XAUUSD) has broken above key resistance at 3346 and successfully retested it as support, forming a bullish structure with higher lows. This aligns with a classic breakout–retest continuation setup.

The entry is taken after confirmation of support holding, with the following levels in focus:

Entry: Around 3355

Stop Loss: Below retest zone at 3339

Targets:

TP1: 3377 (minor resistance)

TP2: 3396

Final TP: 3428–3430 supply zone

Market structure is bullish on the 1H timeframe, and momentum supports upside continuation. Trade aligned with trend and key demand zone reaction.

📌 Always manage risk. Not financial advice.

Gold 4H timeframe Based on the chart my shared (Gold 4H timeframe with Ichimoku cloud), here are the identified target points:

📈 Upside Targets:

1. First Target: 3380

This is marked just above the Ichimoku cloud breakout.

It is a short-term resistance zone.

2. Second Target: 3420

This is the higher target zone indicated in the chart.

It aligns with a previous high and potential resistance area.

---

🟡 Key Support:

Support Zone: Around 3322 – 3353

Price needs to hold above this zone to maintain the bullish momentum.

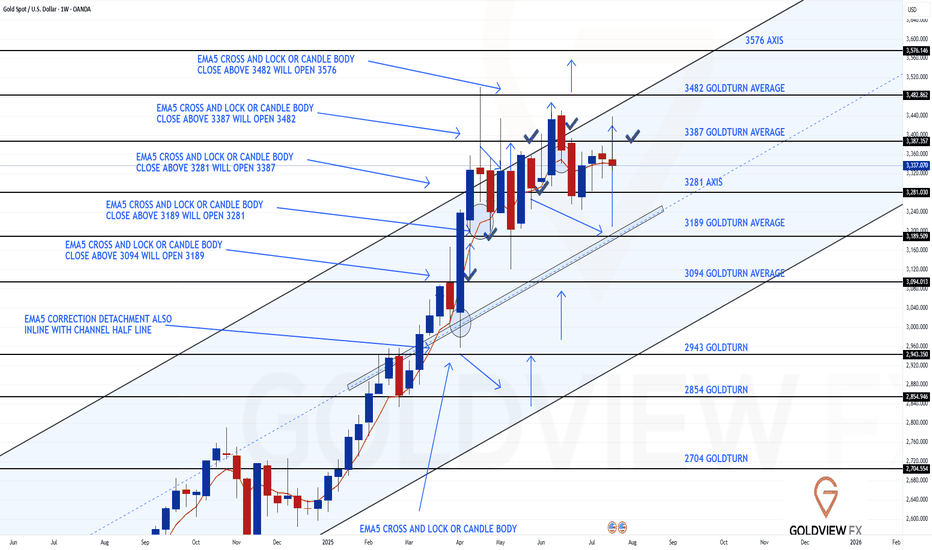

GOLD WEEKLY CHART MID/LONG TERM ROUTE MAPHey Everyone,

Weekly Chart Update – 3387 Tested, Channel Top Rejected

Quick follow up on our Weekly Chart roadmap – price continues to respect the structure with precision.

As anticipated, we got the test of 3387, completing the short term magnet move we've been tracking. That level aligned perfectly with the channel top, and true to form, we saw a clean rejection right on cue just short of the full channel top leaving that open.

Importantly, there was no close or lock above that zone, reaffirming it as valid resistance for now. As a result, the range remains active, with price still oscillating between 3281 support and 3387 resistance.

Key structural notes:

🔹 Structure remains intact

No weekly close above 3387, no breakdown below 3281. The rising channel is still fully respected, and EMA5 has yet to turn bearish.

🔹 3281 Holding Strong

This level continues to act as a key weekly pivot. As long as it holds, we maintain a constructive outlook within the current range.

🔹 3387 Tested + Rejected

First test gave us the expected reaction. Until we see a confirmed close above, it remains the top of the current range.

Updated Levels to Watch:

📉 Support – 3281

Weekly pivot and current range low. Still our key area for dip buys within this structure.

📈 Resistance – 3387

Now tested and confirmed. No break or lock above = valid rejection level.

📈 Resistance 2 – 3482

Unfilled weekly gap. Still the broader target, but we need a proper breakout above 3387 first.

Plan: We continue to treat 3281–3387 as the active weekly range. If 3281 fails, we reassess at the midline of the channel. If 3387 breaks and holds, we shift focus toward 3482.

Thanks again for all the incredible engagement and support, it means a lot to us here at GoldViewFX. Stay focused, stay disciplined.

Mr Gold

GoldViewFX

Risk Capacity: The Real Reason Traders Blow Accounts | Ep. 4In this pre-recorded video, I unpack one of the most overlooked reasons why traders blow their accounts over and over again, and it’s not about your system, strategy, or signal.

It’s about risk capacity, the internal threshold your nervous system can handle before fear, greed, or shutdown kicks in.

This is part of my ongoing series on YouTube “Rebuilding the Trader Within”, where I reflect on the emotional and psychological dimensions of trading that no indicator can fix.

If you've ever found yourself repeating the same mistakes, feeling stuck at the same equity level, or losing composure in high-stakes trades... this might be the pattern underneath it all.

I'm still learning too, and I’d love to hear your thoughts. Drop a comment — let’s grow together.

#RiskCapacity #TradingPsychology #TraderMindset #RebuildingTheTraderWithin #ForexMentorship #TraderGrowth #InnerWork #ForexPsychology

XAUUSD – Weak Rebound, Bearish Bias RemainsYesterday was a quiet and choppy day for Gold.

Although price managed to recover a small portion of last week’s 1400 pip drop, the rebound remains anemic — price barely reached the 23% Fibonacci retracement.

To make things worse for the bulls, the recovery from around $3300 is starting to take the shape of a bearish flag, a continuation pattern that typically signals further downside ahead.

📌 Resistance Zones to Watch:

- Initial resistance: $3345–3350

- Stronger resistance: $3370, a level already proven and well-defined

As long as the price is under those levels, I remain firmly bearish.

📈 Trading Plan:

I already have a short position open, and I'm still waiting to add more, preferably on a push into higher resistance, ideally above $3345.

No need to force entries — I’d rather scale in on strength, not weakness.

Once the correction is complete, I’m targeting:

- $3280 as the first support

- $3250 as a realistic downside objective

Conclusion:

The rebound lacks power. The structure favors the bears.

Still watching for better entries to add short, with eyes on 3280 and 3250 as likely targets.

Let’s stay patient and let the setup come to us. 🎯

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

$GOLD: Projections of Compression & Release 🏛️ Research Notes

Price is at fib boundary derived from its structure that covers growth patterns. Several attempts were taken place to push higher and ended up as lower highs.

Contraction of fractal cycles and amplitude.

Topologically, the compression to a point of proportional release in fibonacci proportions and scaling law 1:1 to original triangle would look like a cube. And let's limit for now with that horizon.

Probabilistic Filter - Another layer of fibonacci channels to inherit roughness of observed temporal pattern which then rhymes with extended series.

The longer the price fluctuates in these geometric boundaries, the more accurate the colors tend to reflect the outcome.

For measuring percentages of swings I used this modification of Zig Zag.

XAUUSD 4H AnalysisGold is currently in a clear downtrend after failing to hold above the mid-channel. Price is retracing into a potential short zone with confluence from the moving average bands.

Fibonacci Retracement: Price is reacting near the 38.2% level (3,318).

Downside Fibonacci Targets:

1️⃣ 3,249.36 (38.2%)

2️⃣ 3,228.11 (61.8%)

3️⃣ 3,193.73 (100%)

As long as the price stays below the red resistance zone, the bearish momentum is likely to continue toward the lower Fibonacci targets. A break above 3,339 would invalidate the short setup.

The golden direction in the volatile trend

💡Message Strategy

The market is currently in a wait-and-see phase ahead of major fundamental events. With the Federal Reserve's interest rate decision and key data such as second-quarter GDP and the core PCE price index set to be released, traders are generally cautious. Gold has stabilized slightly after a series of declines, but a meaningful reversal has yet to materialize. The divergence between bulls and bears is intensifying, and the market is on the verge of a breakout. This week's gold market is driven by uncertainty surrounding macroeconomic expectations and the Fed's monetary policy.

After four consecutive trading days of gains, the US dollar index has slowed its gains, temporarily retreating to around 99. Traders are still betting on a September Fed rate cut, with the market placing a 64% probability on a September rate cut. However, this week's release of Q2 GDP and the core PCE price index data will significantly impact this outlook.

If GDP and inflation data are weak, this will reinforce market expectations of easing and potentially attract renewed buying for gold. Conversely, strong data could dampen expectations of a rate cut, supporting a stronger dollar and putting pressure on gold.

Furthermore, the Federal Reserve is about to hold its interest rate meeting. While it's almost certain that interest rates will remain unchanged, Powell's speech will be a key focus for the market. Any signals regarding internal disagreements, adjustments to the inflation path, or adjustments to the policy framework could trigger significant market volatility. From a global perspective, geopolitical risks have been relatively stable recently, providing no sudden support for gold.

📊Technical aspects

Gold is showing signs of a short-term rebound, but the technical structure still indicates a weak rebound, with no confirmed trend reversal. A break above 3350 would be considered a temporary stabilization, while a break below 3300 would reopen the downside. Current market sentiment is in a "wait for a signal" phase.

Gold currently has limited downward space, and data factors are accelerating this week. Gold is likely to undergo a long-short conversion, so our trading strategy uses a small stop loss to counter the larger space for gold's shape conversion.

💰Strategy Package

Long Position:3290-3305,SL:3280,Target: 3340-3360

GOLD Buyers In Panic! SELL!

My dear friends,

Please, find my technical outlook for GOLD below:

The instrument tests an important psychological level 3309.2

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 3296.9

Recommended Stop Loss - 3316.4

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GOLD PRICE: 2 BIG OPTIONS.1. Option 1: Wave 4 of gold price ends, with this scenario, the DXY trend will not be like the chart below, but this week DXY will return to the old bottom and head towards 95-91, gold will increase to complete wave (5).

Price range for the next 3-4 months: 3350-3750.

2. Option 2:

In terms of time, wave (4) has not yet ensured balance. DXY increases and recovers as the chart.

That means we have a gold price range for the next 3-4 months of 3400-3100.

XAUUSD Intraday Technical Analysis – Bullish Breakout SetupGold (XAUUSD) is showing signs of bullish recovery after a sharp sell-off, with current price action around 3305.86 USD hinting at a potential breakout on the 1-hour timeframe.

- Technical Overview

Price structure: After a steep decline, gold formed a base near the 3284–3299 zone and is now climbing back, with a potential inverse head-and-shoulders formation taking shape.

EMA cluster: Price is approaching the confluence of the EMA 50, EMA 100, and EMA 200, currently acting as dynamic resistance around 3309–3323. A break above these levels may confirm bullish strength.

Fibonacci retracement: The bounce appears from the 0.874 extension, indicating the end of the previous bearish leg.

Volume analysis: Increasing bullish volume supports the idea of a potential breakout.

- Key Levels to Watch

Zone Type

Price Level (USD)

Remarks

Immediate Resistance: 3,309 – 3,323 - Major test zone; overlaps with EMA 50/100

Major Resistance : 3,337 – 3,340 - Previous high; if broken confirms bullish continuation

Support Zone: 3,299 – 3,302 - Intraday support turned demand zone

Critical Support: 3,284 – 3,285 - Recent swing low; invalidates bullish view if broken

- Intraday Strategy Suggestion

Scenario 1 – Bullish Breakout

Entry: Buy on breakout and retest of 3,309–3,323

SL: Below 3,299

TP1: 3,337

TP2: 3,355

- Confirmation by strong bullish candle closing above EMA cluster and above resistance zone.

Scenario 2 – Buy on Pullback

Entry: Buy limit at 3,300–3,302

SL: Below 3,284

TP1: 3,323

TP2: 3,337

- Look for RSI divergence or bullish engulfing candle at support for higher conviction.

- Final Note

The bulls are attempting to reclaim momentum after a major correction. If gold can sustain above the 3,309 resistance and hold the 3,300 base, a short-term bullish reversal could materialize.