GOLD NEXT MOVE (expecting a mild bullish(24-07-2025)Go through the analysis carefully and do trade accordingly.

Anup 'BIAS for the day (24-07-2025)

Current price- 3357

"if Price stays above 3345, then next target is 3370, 3320 and 3400 and below that 3330 and 3310 ".

-POSSIBILITY-1

Wait (as geopolitical situation are worsening )

-POSSIBILITY-2

Wait (as geopolitical situation are worsening)

Best of luck

Never risk more than 1% of principal to follow any position.

Support us by liking and sharing the post.

XAUUSDK trade ideas

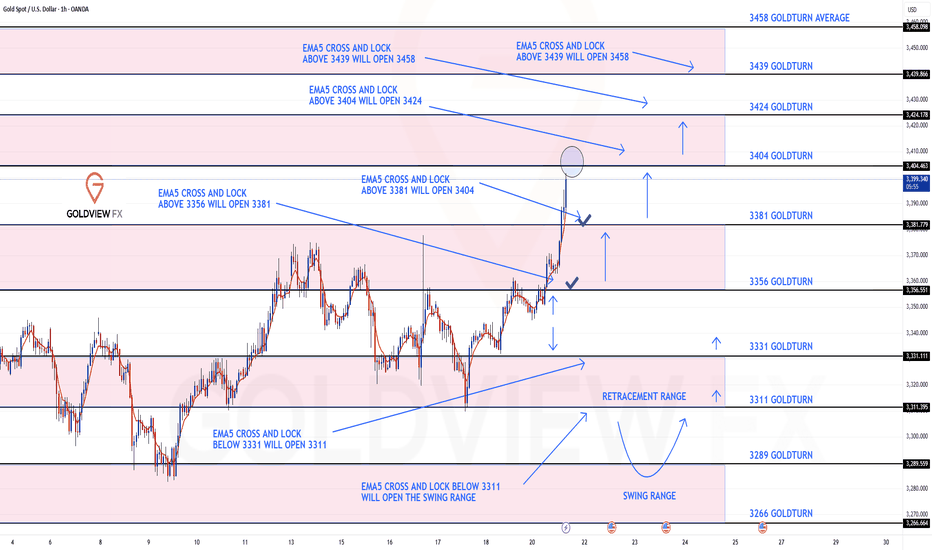

GOLD ROUTE MAP UPDATEHey Everyone,

Great start to the week with our chart idea playing out, as analysed.

We started with our Bullish target 3356 hit, followed with ema5 cross and lock above 3356 opening 3381. This was also hit perfectly completing this target. We now have a further ema5 cross and lock above 3381 leaving 3404 open with already a nice push up, just short of the full gap.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3356 - DONE

EMA5 CROSS AND LOCK ABOVE 3356 WILL OPEN THE FOLLOWING BULLISH TARGETS

3381 - DONE

EMA5 CROSS AND LOCK ABOVE 3381 WILL OPEN THE FOLLOWING BULLISH TARGET

3404

EMA5 CROSS AND LOCK ABOVE 3404 WILL OPEN THE FOLLOWING BULLISH TARGET

3424

EMA5 CROSS AND LOCK ABOVE 3424 WILL OPEN THE FOLLOWING BULLISH TARGET

3458

BEARISH TARGETS

3331

EMA5 CROSS AND LOCK BELOW 3331 WILL OPEN THE FOLLOWING BEARISH TARGET

3311

EMA5 CROSS AND LOCK BELOW 3311 WILL OPEN THE SWING RANGE

3289

3266

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

Feed Your Ego or Feed Your Account- Your Choise🧭 From Rookie to Realization

I’ve been trading since 2002. That’s nearly a quarter of a century in the markets.

I’ve lived through it all:

• The early days, when the internet was slow and information was scarce

• The forums, the books, the overanalyzing

• The obsession with finding “the perfect system”

• And later… the dangerous phase: needing to be right, because I have a few years of experience and I KNOW

At one point, I thought that being a good trader meant calling the market in advance — proving I was smarter than the rest.

But the truth is: the market doesn't pay for being right. It pays for managing risk, always adapting and executing cleanly.

________________________________________

😤 The Psychological Trap Most Traders Fall Into

There’s one thing I’ve seen consistently over the last 25 years:

Most traders don’t trade to make money.

They trade to feel right.

And this need — this psychological craving to validate an opinion — is exactly what keeps them from growing.

You’ve seen it too:

• The guy who’s been screaming “altcoin season” for 2 years

• Who first called it when EGLD was at 80, TIA, and others that kept dropping

• But now that something finally moves, he says:

“See? I was right all along, altcoin season is here”

He’s not trading.

He’s rehearsing an ego story, ignoring every failed call, every drawdown, every frozen position.

He doesn’t remember the trades that didn’t work — only the one that eventually did.

This is not strategy.

It’s delusion dressed up as conviction.

________________________________________

📉 The Market Doesn’t Care What You Think

Here’s the reality:

You can be right in your analysis — and still lose money.

You can be wrong — and still come out profitable.

Because the market doesn’t reward your opinion.

It rewards how well you manage risk, entries, exits, expectations, and flexibility

I’ve seen traders who were “right” on direction but blew their accounts by overleveraging.

And I’ve seen others who were wrong on their first two trades — but adjusted quickly, cut losses, and ended green overall in the end.

This is what separates pros from opinionated amateurs.

________________________________________

📍 A Real Example: Today’s Gold Analysis

Let’s take a real, current example — my own Gold analysis from this morning.

I said:

• Short-term, Gold could go to 3450

• Long-term, the breakout from the weekly triangle could take us to 3800

Sounds “right,” right? But let’s dissect it:

Short-term:

✅ I identified 3370 as support

If I buy there, I also have a clear invalidation level (below 3350)

If it breaks that and hits my stop?

👉 I reassess — because being “right” means nothing if the trade setup is invalidated

And no, it doesn’t help my PnL if Gold eventually reaches 3450 after taking me out.

Long-term:

✅ The weekly chart shows a symmetrical triangle

Yes — if we break above, the measured move targets 3800

But…

If Gold goes below 3300, that long-term scenario is invalidated too.

And even worse — if Gold trades sideways between 3000 and 3500 for the next 5 years and finally hits 3800 in 2030, that “correct call” is worth nothing.

You can't build a career on "eventually I was right."

You need precision, timing, risk management, and the ability to say:

“This setup is no longer valid. I’m out.”

________________________________________

💡 The Shift That Changed Everything

It took me years to realize this.

The day I stopped needing to be right was the day I started making consistent money.

I stopped arguing with the market.

I stopped holding losers out of pride.

I stopped needing to "prove" anything to anyone — especially not myself.

Now, my job is simple:

• Protect capital

• Execute with discipline

• Let the edge do its job

• And never fall in love with my opinion

________________________________________

✅ Final Thought – Let Go of Being Right

If you’re still stuck in the “I knew it” mindset — let it go.

It’s not helping you. It’s costing you.

The best traders lose small, admit mistakes fast, and stay emotionally neutral.

The worst traders hold on to “being right” while their account burns.

The market doesn’t owe you respect.

It doesn’t care if you called the top, bottom, or middle.

It pays the ones who trade objectively, flexibly, and without ego.

After almost 25 years, this is the one thing I wish I had learned sooner:

Don’t try to win an argument with the market.

Just get paid.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

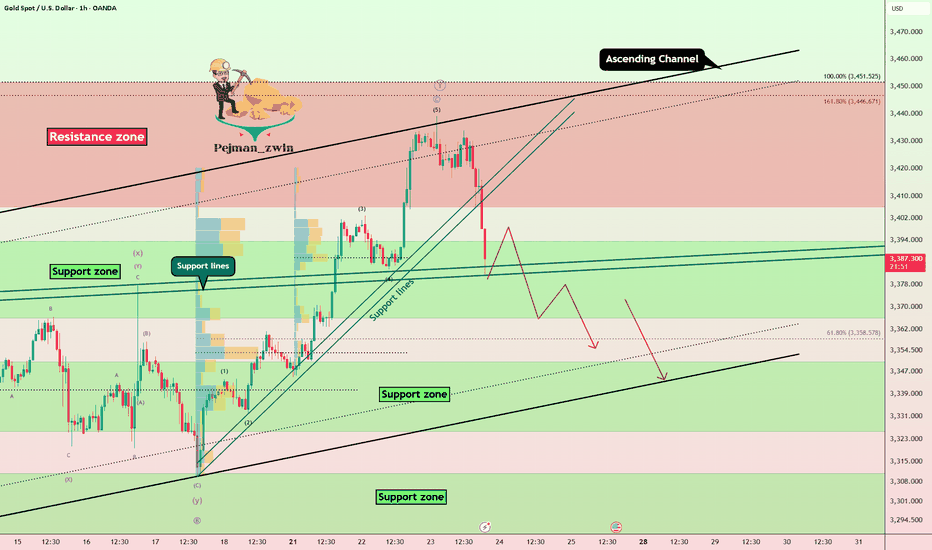

Gold Fails at Resistance, Elliott Wave Signals Deeper CorrectionGold ( OANDA:XAUUSD ) started to rise after the Richmond Manufacturing Index(Actual:-20/Forecast:-2/Previous-7) index was announced, but failed to break the upper line of the ascending channel and the Resistance zone($3,451-$3,406) .

Gold has now broken through the Support lines and is attempting to break through the next Support lines and Support zone($3,394-$3,366) .

In terms of Elliott Wave theory , it appears that the main wave Y has completed above the ascending channel.

I expect that given the momentum of gold's decline , gold will be able to break the Support zone($3,394-$3,366) and Support lines and fall to at least $3,356 . The next target could be the lower line of the ascending channel .

Note: Stop Loss (SL) = $3,423

Gold Analyze (XAUUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

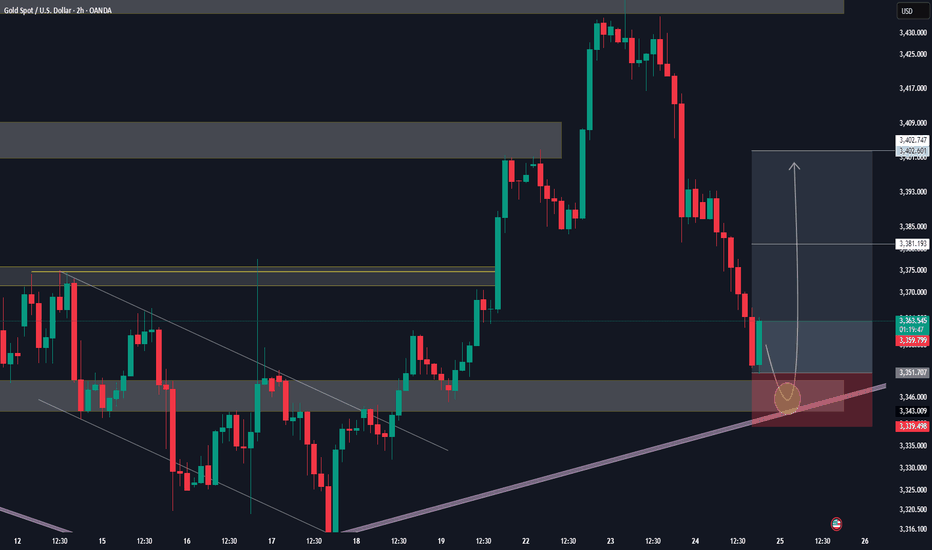

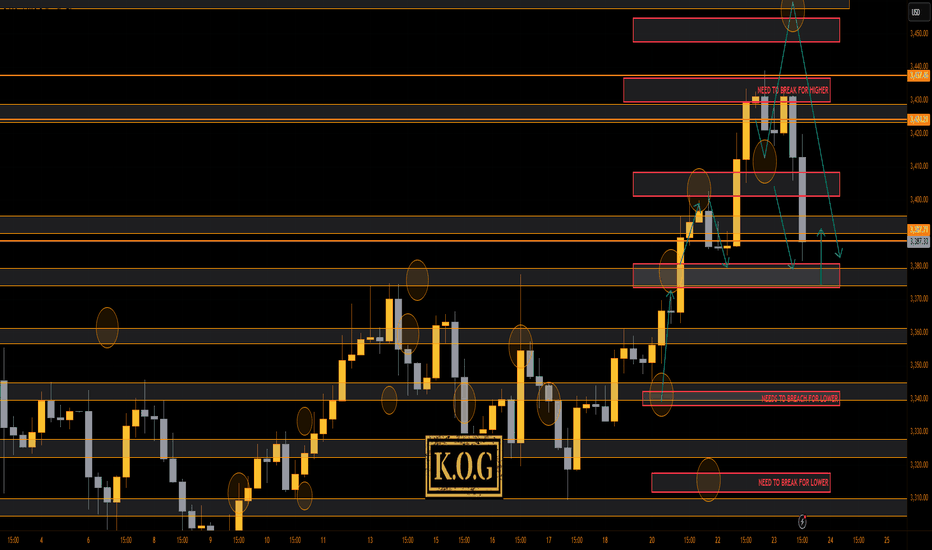

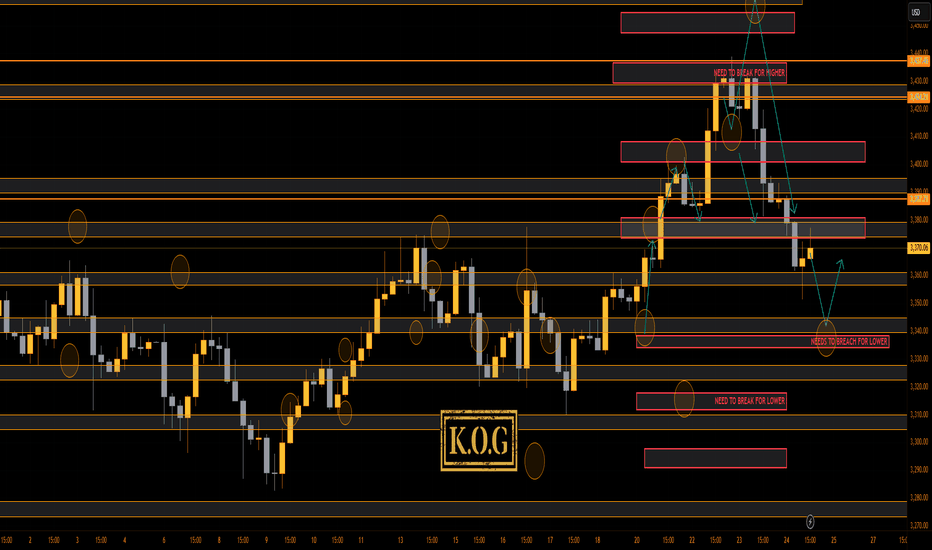

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

That was worth waiting for! We were expecting higher to then short this into the level we wanted, but as you can see, we had no red box break and our bias level was 3335. That resistance gave us an opportunity early session to get in and then the break of the 3320 level confirmed the move completing a majority of our targets.

Now we have support here and resistance at the 3395 level and above that 3406. We have a lower level here of 3375 which we feel if targeted and rejected, could give the opportunity for a RIP into the higher levels.

KOG’s Bias of the day:

Bearish below 3450 with targets below 3420✅, 3410✅, 3406✅, 3397✅ and 3390✅

Bullish on break of 3450 with targets above 3455, 3458, 3464 and 3478

RED BOXES:

Break above 3435 for 3440, 3446, 3449 and 3461 in extension of the move

Break below 3420 for 3410✅, 3406✅, 3397✅ and 3379 in extension of the move

As always, trade safe.

KOG

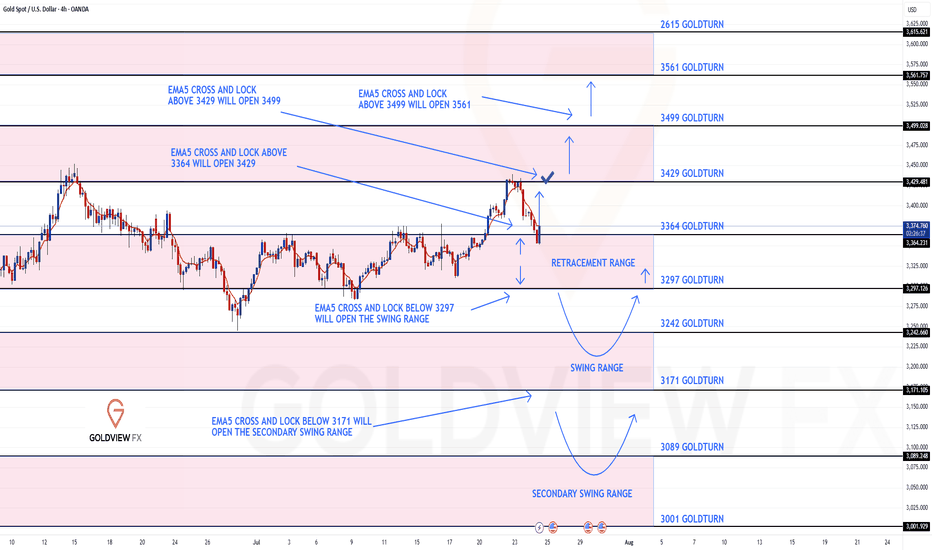

GOLD 4H CHART ROUTE MAP UPDATEHey Everyone,

After completing our 1h chart idea update yesterday, please see our 4chart idea also played out to perfection!!!

We started with our Bullish target hit at 3364 followed with ema5 cross and lock opening 3429. This was also hit perfectly with no further cross and lock above 3429 confirming the perfect rejection.

We are now seeing price play into the retracement zone and will continue to look for reactions on the lower Goldturn, inline with our plans to buy dips.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3364 - DONE

EMA5 CROSS AND LOCK ABOVE 3364 WILL OPEN THE FOLLOWING BULLISH TARGETS

3429 - DONE

EMA5 CROSS AND LOCK ABOVE 3429 WILL OPEN THE FOLLOWING BULLISH TARGET

3499

EMA5 CROSS AND LOCK ABOVE 3499 WILL OPEN THE FOLLOWING BULLISH TARGET

3561

BEARISH TARGETS

3297

EMA5 CROSS AND LOCK BELOW 3297 WILL OPEN THE SWING RANGE

3242

3171

EMA5 CROSS AND LOCK BELOW 3171 WILL OPEN THE SECONDARY SWING RANGE

3089

3001

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

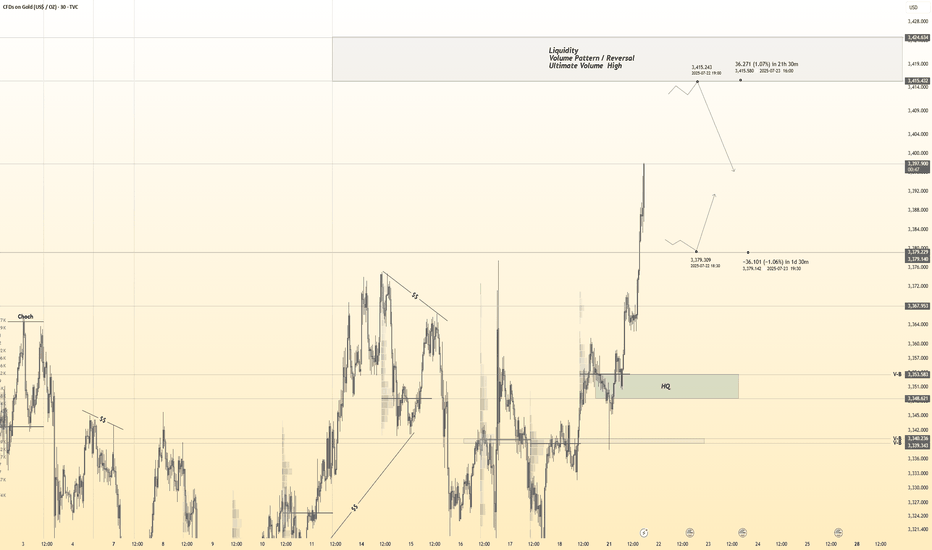

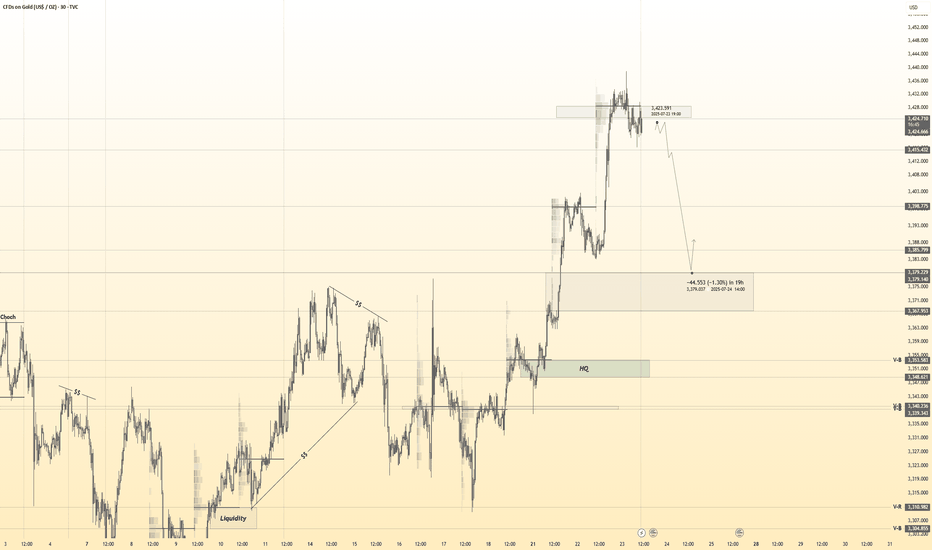

Gold 30Min Engaged ( Bullish & Bearish Reversal Entry Detected )————-

➕ Objective: Precision Volume Execution

Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸 Accurate Bullish Reversal : 3380

🩸 Accurate Bearish Reversal : 3314.5

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

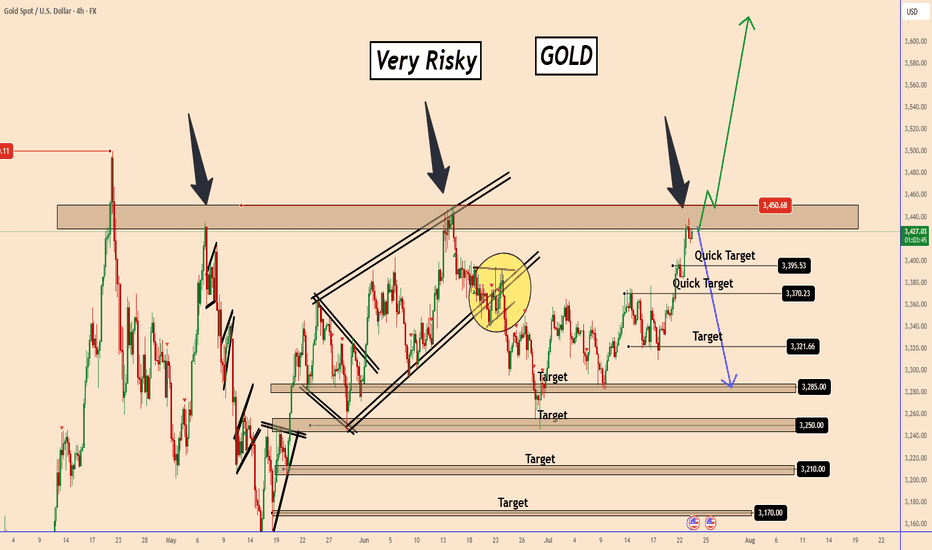

GOLD: In-depth Fundamental and Technical AnalysisGOLD: In-depth Fundamental and Technical Analysis

In this video analysis, I discussed in detail how gold can develop from a fundamental and technical perspective.

It remains a very risky and highly manipulated instrument.

You may watch the analysis for further details

Thank you!

Gold 30Min Engaged ( Bearish Entry Detected )————-

➕ Objective: Precision Volume Execution

Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸 Bearish From now Price : 3423

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

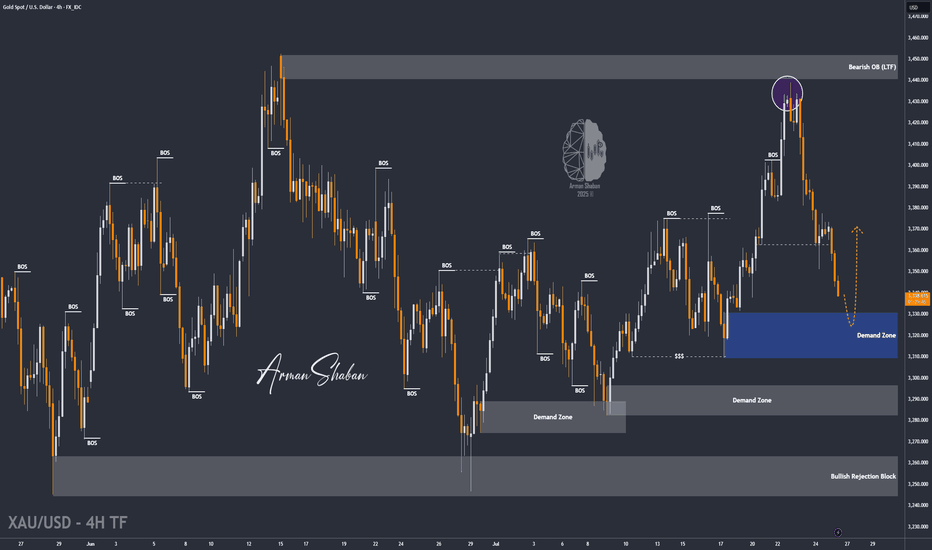

XAU/USD | Gold Holding Strong – Watching for Next Bullish Move!By analyzing the gold chart on the 4-hour timeframe, we can see that yesterday, as expected, when the price dropped to around $3357, it faced strong buying pressure and rallied up to $3377. After that, it corrected again, pulling back to $3338 so far, and is currently trading around $3341. If gold manages to hold above $3337, we can expect another bullish move, with potential targets at $3347, $3354, $3364, and $3374.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

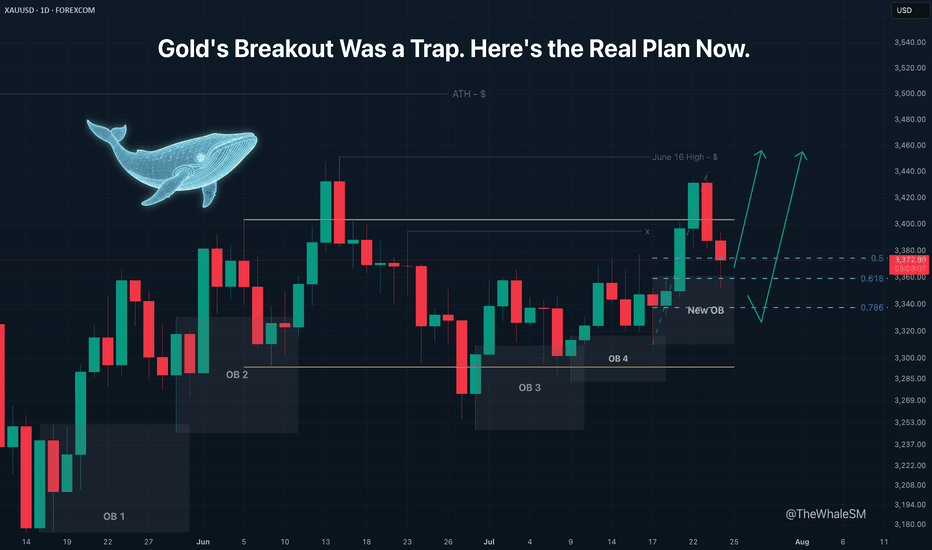

Gold's Breakout Was a Trap. Here's the Real Plan Now.Gold has made its next move, and it was quite sharp. I was expecting a smoother correction with a return to the manipulation zone, but Gold followed a different scenario, which I described at the end of my last gold analysis:

Gold has practically confirmed its breakout from the global range it has been in since the beginning of June. The only thing that could prevent this is a complete engulfing of the bullish daily candle that broke the upper boundary of the range by a bearish candle, but I consider this an unlikely scenario.

The closed red daily candle, which completely engulfed the preceding bullish one, showed that the move was, in fact, an internal liquidity sweep . The price has not yet managed to break out of the range. Therefore, when I wrote "Gold has practically confirmed its breakout from the global range" , the daily candle had not yet closed, and the price had not secured its position above the range's upper boundary.

Essentially, it's not important how the price arrives at a Point of Interest (POI) . What matters is what we have now: the price has mitigated a manipulation in the form of a new daily order block that was formed inside the range.

Although the middle of a range is a highly unpredictable area for price movement, and I almost never consider it for entries, in this case, there is a strong exception that allows us to consider longs from this order block. The reason for this exception is the bullish order flow on the daily structure, which I have mentioned several times, and the ascending daily structure within the range. This structure allows us to identify the start of the last impulse and draw Fibonacci retracement levels, which will serve as an additional condition for our potential long setup. We can now see that the price has reached the 61.8% Fib level and has shown a reversal reaction to it. To see more precisely if there is a potential entry point, let's switch to the 4H timeframe.

On the 4H chart, we see that the 61.8% level has held, and we can look for entry confirmation on a lower timeframe. The 4H timeframe also shows that the liquidity sweep created a supply zone , which will act as resistance on the path of the next attempt to break out of the range. Due to this zone, considering a long from the current position is not optimal because the risk-to-reward ratio is too small. Furthermore, the price could reject from this supply zone and continue its correction to the next level, the 78.6% Fib level . To find an entry with a more acceptable R:R, let's move to the lower timeframes.

Two Potential Long Scenarios

SCENARIO 1: Entry from the 15M Demand Zone or 15M OB

The 15M timeframe shows a break of the 15M structure and the formation of manipulations in the form of a demand zone and a 15M order block within it.

► Setup Condition: I will consider a long position upon the mitigation of one of these manipulation zones and a clear reversal reaction from it. If the price continues to move up from the current levels, I will not enter due to the large stop loss required and the suboptimal R:R to the nearest resistance.

► Invalidation: A break below these support zones on the lower timeframe will invalidate this scenario.

SCENARIO 2: Entry from the 78.6% Fib Level

This scenario becomes active if the first one fails.

► Setup Condition: If the price breaks the 15M supports, I will watch for its interaction with the 78.6% Fib level . For a potential entry, this level must hold, show a reversal reaction, and be followed by confirmation on a lower timeframe.

► Invalidation: A decisive close below the 78.6% Fib level.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The principles and conditions for forming the manipulation zones I show in this trade idea are detailed in my educational publication, which was chosen by TradingView for the "Editor's Picks" category and received a huge amount of positive feedback from this wonderful, advanced TV community. To better understand the logic I've used here and the general principles of price movement in most markets from the perspective of institutional capital, I highly recommend checking out this guide if you haven't already. 👇

P.S. This is not a prediction of the exact price direction. It is a description of high-probability setups that become valid only if specific conditions are met when the price reaches the marked POI. If the conditions are not met, the setups are invalid. No setup has a 100% success rate, so if you decide to use this trade idea, always use a stop-loss and proper risk management. Trade smart.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

If you found this analysis helpful, support it with a Boost! 🚀

Have a question or your own view on this idea? Share it in the comments. 💬

► Follow me on TradingView to get real-time updates on THIS idea (entry, targets & live trade management) and not to miss my next detailed breakdown.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

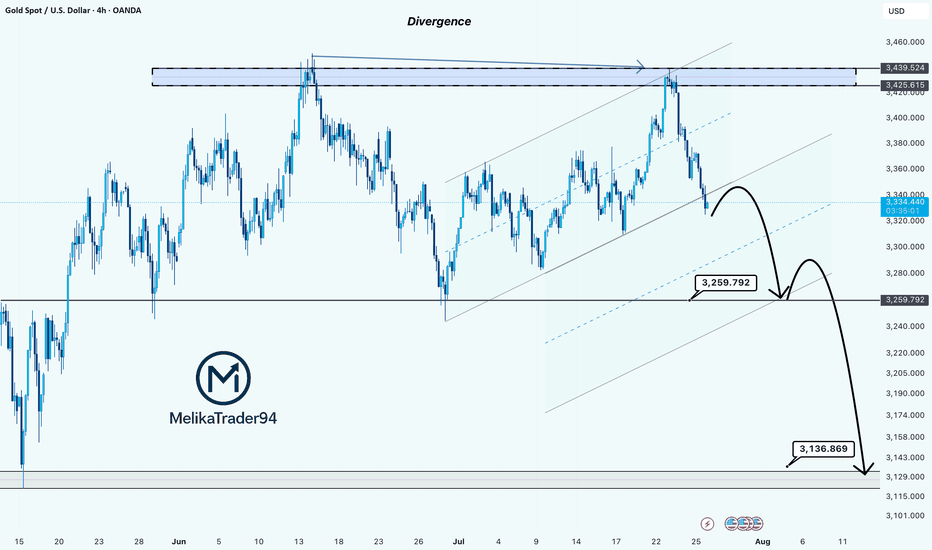

Gold Showing Signs of Reversal After Hitting Key ResistanceHello Guys.

Gold has reached a major resistance zone around 3439–3425, which has already acted as a strong ceiling in the past. The price tapped into this area again, forming a clear divergence, and failed to break higher.

Here’s what stands out:

Divergence signals a weakening bullish momentum at the top.

The price rejected the resistance and is now breaking structure to the downside.

A minor pullback may occur before continuation, as shown in the projected moves.

First target: 3259.792

Second target (if support breaks): 3136.869, a deeper zone for potential bounce or further drop.

This setup hints at a bearish trend building up. Stay cautious on longs unless the price structure changes again.

Japanese Candlestick Cheat Sheet – Part Two- 2 candle patternsTwo-Candle Patterns That Signal Shifts in Sentiment

Single candles whisper…

But two candles talk to each other — and when they do, they often reveal the first signs of a reversal or continuation.

In this second part of the series, we go deeper.

From engulfings to haramis, tweezer tops to piercing lines — these patterns don’t just look good on charts… they capture the psychological tug-of-war between buyers and sellers.

Price doesn’t lie.

And two candles in a row can say: “Something just changed.”

Learn to spot them early. Learn to listen when the chart speaks.

This is Part Two of your practical guide to mastering candlestick formations.

BULLISH KICKER

Bias: Bullish

What is the Bullish Kicker pattern?

The Bullish Kicker forms when a strong bullish candle follows a bearish one with no overlap between the two, indicating a sudden shift in sentiment. This pattern is a powerful indicator of a reversal as buyers take control. The sharp contrast between the bearish and bullish candles reflects a dramatic shift in market psychology, where bears are caught off-guard and forced to cover their positions.

Bullish Kickers are rare but extremely telling, providing a clear signal that sentiment is favoring buyers. Recognizing such decisive patterns can be a game-changer.

Meaning:

Found after downtrends or sell-offs; suggests a sudden shift in sentiment, indicating strong buying interest and potential trend reversal.

BULLISH ENGULFING

Bias: Bullish

What is the Bullish Engulfing pattern?

The Bullish Engulfing pattern occurs when a large bullish candle fully engulfs the previous smaller bearish candle, signaling a potential trend reversal. This pattern highlights a moment when buyers overpower sellers, often marking the beginning of upward momentum. Psychologically, it suggests that buyer confidence is returning, and sellers are losing their grip.

For traders, understanding Bullish Engulfing patterns can provide crucial entry points into emerging trends. Learning to identify and trade such patterns is essential for capturing momentum and new trends.

Meaning:

Typically found in downtrends, this pattern signals a potential bullish reversal as buyers overpower sellers, often indicating a shift toward upward momentum.

BULLISH HARAMI

Bias: Bullish

What is the Bullish Harami pattern?

The Bullish Harami consists of a small bullish candle within a preceding larger bearish one, indicating a pause in downward momentum and hinting at a potential reversal. This pattern shows that sellers are beginning to weaken as buyers cautiously test the waters. The Harami reflects a shift in sentiment from bearish to neutral, often marking a transitional phase in the market.

Interpreting the Bullish Harami helps traders spot moments when sentiment is shifting, potentially signaling the start of a trend change.

Meaning:

Seen in downtrends, it suggests indecision, with possible bullish reversal if the following candles confirm buying strength, indicating a weakening bearish trend.

PIERCING LINE

Bias: Bullish

What is the Piercing Line pattern?

The Piercing Line forms when a bullish candle opens below the previous bearish candle’s low but closes over halfway into it. Found in downtrends, this pattern reflects strong buying pressure as buyers step in at lower prices, creating a potential bullish reversal. The Piercing Line pattern suggests that sentiment may be shifting as buyers gain confidence.

This pattern’s strength lies in its psychological impact, revealing moments when buyers are willing to take risks. Recognizing these signs early can provide valuable insights for traders looking to time entries.

Meaning :

Found in downtrends, this pattern suggests a possible bullish reversal if buying continues, as sellers lose control to buyers.

TWEEZER BOTTOM

Bias: Bullish

What is the Tweezer Bottom pattern?

The Tweezer Bottom pattern is characterized by two consecutive candles with nearly identical lows, one bearish and one bullish. This pattern often signals the end of a downtrend, as the matching lows suggest a strong support level where buyers are stepping in. The Tweezer Bottom highlights market psychology at work, with sellers unable to push prices lower, reflecting renewed buying interest.

Tweezer Bottoms are ideal for traders looking to identify support zones and potential reversal points. By understanding this pattern’s significance, traders can make informed decisions.

Meaning:

Found in downtrends, it signals potential reversal, showing strong support at the matching low, suggesting buyers are stepping in.

BEARISH KICKER

Bias: Bearish

What is the Bearish Kicker pattern?

The Bearish Kicker is the inverse of the Bullish Kicker, forming when a strong bearish candle follows a bullish one without overlap, indicating a sharp sentiment shift. This pattern often marks a sudden reversal, with sellers taking control after an initial bullish period. Psychologically, Bearish Kickers are powerful, signaling that buyers are caught off-guard and losing momentum.

Recognizing Bearish Kickers provides traders with insights into sudden shifts in market dynamics, helping them avoid buying into weakening trends.

Meaning:

Found after uptrends; indicates a sudden sentiment shift, signaling potential trend reversal and intensified selling pressure.

BEARISH ENGULFING

Bias: Bearish

What is the Bearish Engulfing pattern?

The Bearish Engulfing pattern forms when a large bearish candle engulfs the previous smaller bullish candle, suggesting a potential reversal in an uptrend. This pattern signals that sellers have regained control, often marking the start of downward momentum. The Bearish Engulfing reveals a psychological shift, as selling pressure overtakes buying interest.

This pattern is a powerful tool for traders who aim to catch trend reversals, allowing them to align with emerging downward momentum.

Meaning:

Typically found in uptrends, this pattern signals a potential bearish reversal as sellers overpower buyers, often indicating a downward momentum shift.

BEARISH HARAMI

Bias: Bearish

What is the Bearish Harami pattern?

The Bearish Harami consists of a small bearish candle contained within a larger preceding bullish one, reflecting indecision and a potential trend reversal. Found in uptrends, it hints that buyers are losing strength, while sellers are cautiously testing the market. This pattern highlights moments when buyer momentum begins to wane, suggesting caution.

Interpreting the Bearish Harami allows traders to spot potential shifts in sentiment, helping them manage risk and time their exits.

Meaning:

Seen in uptrends, it suggests indecision with a potential bearish reversal if following candles confirm, indicating a weakening bullish trend.

DARK CLOUD COVER

Bias: Bearish

What is the Dark Cloud Cover pattern?

The Dark Cloud Cover appears when a bearish candle opens above the previous bullish candle but closes over halfway into it, reflecting a shift in control from buyers to sellers. This pattern suggests that bullish momentum may be fading, hinting at a potential reversal. Dark Cloud Cover patterns reveal moments when sentiment shifts from optimism to caution.

For traders, understanding this pattern helps them anticipate reversals at the top of uptrends.

Meaning:

Found in uptrends; signals potential bearish reversal if selling continues, as buyers lose control to sellers.

TWEEZER TOP

Bias: Bearish

W hat is the Tweezer Top pattern?

The Tweezer Top is formed by two candles with matching or nearly matching highs, typically one bullish and one bearish. This pattern signals potential resistance, as sellers are consistently pushing back against the same level. The Tweezer Top reflects a moment of seller strength, often marking the end of an uptrend.

Recognizing Tweezer Tops helps traders spot resistance zones and potential reversal points, allowing them to avoid buying into weakening trends or even shorting the asset.

Meaning:

Found in uptrends, it signals potential reversal, showing strong resistance at the matching high, suggesting selling pressure.

🧭 Final Thought

Two-candle formations often appear at key turning points — right where most traders hesitate or get trapped.

Learn to read them not just as patterns, but as conversations between candles — one pushing, the other reacting.

And if this is your first time reading the series, don’t miss Part One – where we covered single-candle signals like dojis, hammers, and marubozus — the very foundations of candlestick reading.

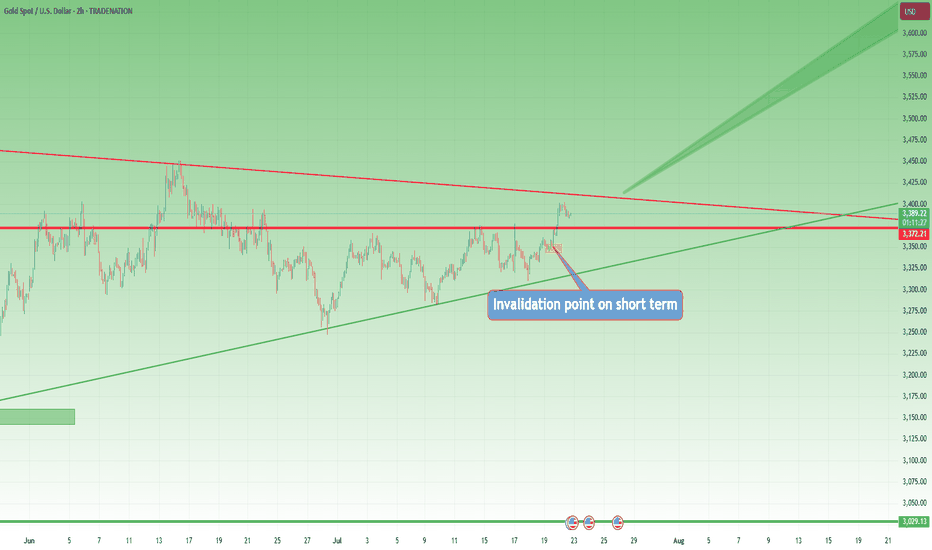

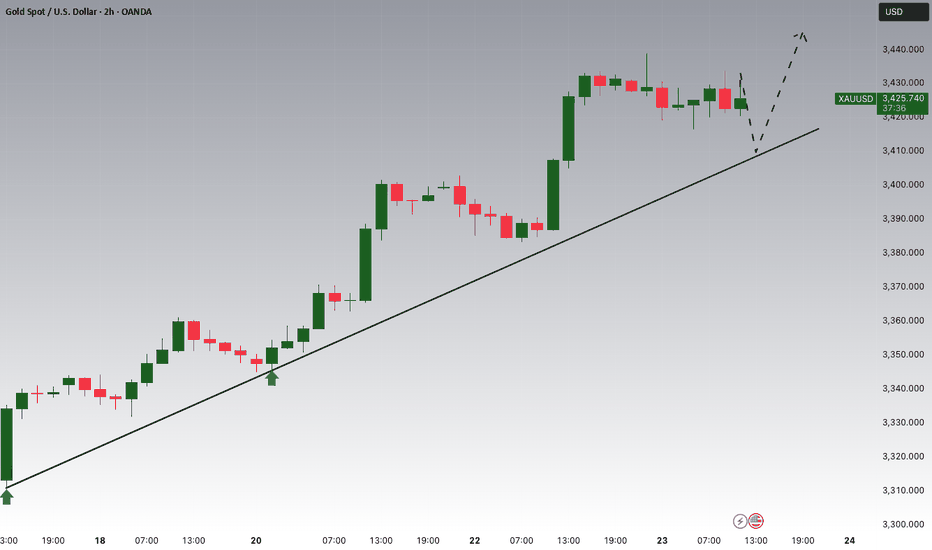

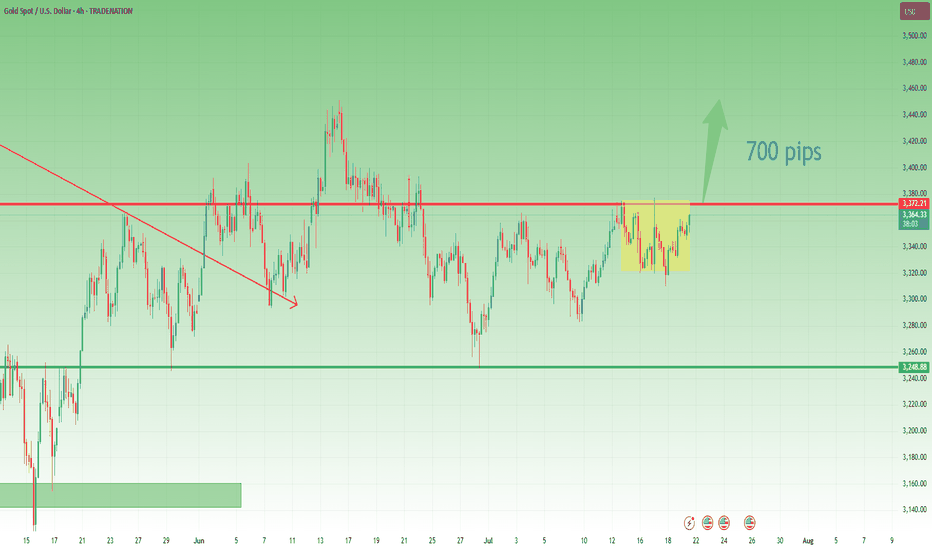

Gold Outlook – The Range Holds, Direction Still Pending📆 What happened recently?

Since the middle of last week, I’ve been repeating the same core idea like a broken record:

👉 “Gold needs to break out of the range to define its next real move.”

And once again, on Friday, TRADENATION:XAUUSD respected the structure, fluctuating quietly and closing the week right in the middle of the range — no breakout, no confirmation.

📈 Current status:

The new week opened with some bullish interest, and at the time of writing, Gold trades around 3363. Still inside the box.

So far, no technical change, and certainly no resolution.

❓ What am I watching for?

A clear break above 3375 → confirms bullish continuation

A decisive break below 3320 → confirms reversal potential

Until then, everything in between is noise and chop.

🧭 Trading plan:

My stance remains unchanged:

⏳ No position. No bias. Just waiting.

Once we get confirmation in either direction, I’ll take action.

📌 Conclusion:

Gold is still locked inside the range. The market is coiling, but no side is winning yet.

Patience here is a weapon — and I’m keeping it loaded. 🚀

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

Not bad play at all with the red boxes working well, KOG's bias of the day and the red box targets working well and of course the indicators and our trusted algo Excalibur guiding the way completing the move that we wanted downside. We then got a fantastic long from the bias level and red box activation up into where we are now.

So, what now?

We have resistance and a red box above which is broken suggesting we may see some more movement downside in the coming sessions. This would also align with the hunt and undercut low that can take place at this key level. We're a bit too low to short, so we'll either look for the break above 3375 to go higher, or, we'll wait lower for a potential long trade from the red box region.

Immediate support here is 3360-5 and resistance 3375.

Price: 3364

KOG’s Bias of the day:

Bullish above 3350 with targets above 3358✅, 3365✅ and above that 3379✅

Bearish on break of 3350 with target below 3337 and below that 3330

RED BOXES:

Break above 3365 for 3372✅, 3375✅, 3388 and 3406 in extension of the move

Break below 3350 for 3335, 3330, 3326 and 3307 in extension of the move

As always, trade safe.

KOG

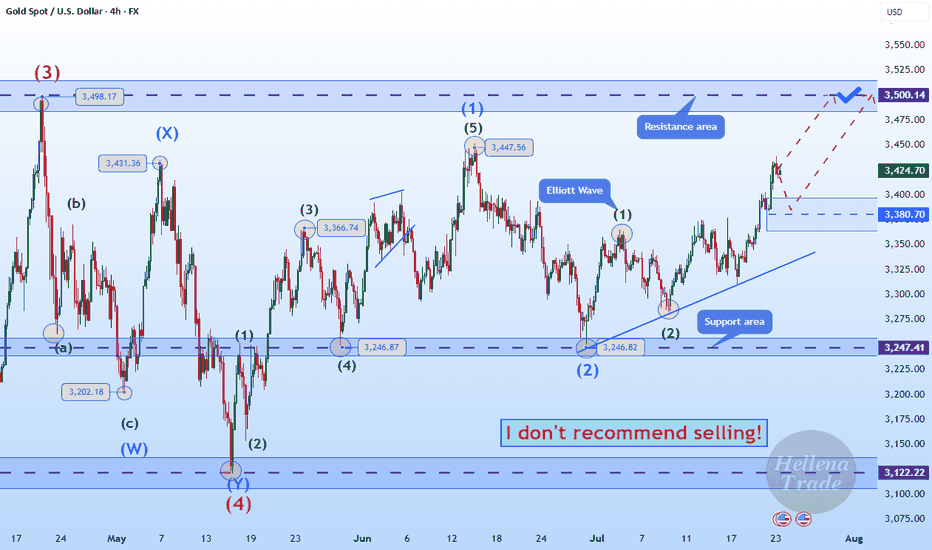

Hellena | GOLD (4H): LONG to resistance area of 3498 (Wave 3).The price continues to move in a bullish direction, and I believe that now is the time to pay attention to the medium-term wave “3.” It is actively developing, and I believe that the target should be set at the maximum area of the higher-order wave “3” — the resistance area of 3498.

This is the nearest target, which carries significant weight.

Overall, the upward five-wave movement is developing according to the old scenario.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Gold will pause its rally today. Be cautious✏️ OANDA:XAUUSD continues to hit new highs this week. As the daily candle closes above the 3430 area, gold is creating a wide trading range of about 50 prices today. The uptrend may face a slight slowdown due to profit-taking psychology of some investors.

📉 Key Levels

Sell trigger: Rejection from 3445

Sell zone: 3463

Target: 3405

BUY trigger: 3402 (Price retests breakout zone and buyers react)

Leave your comments on the idea. I am happy to read your views.

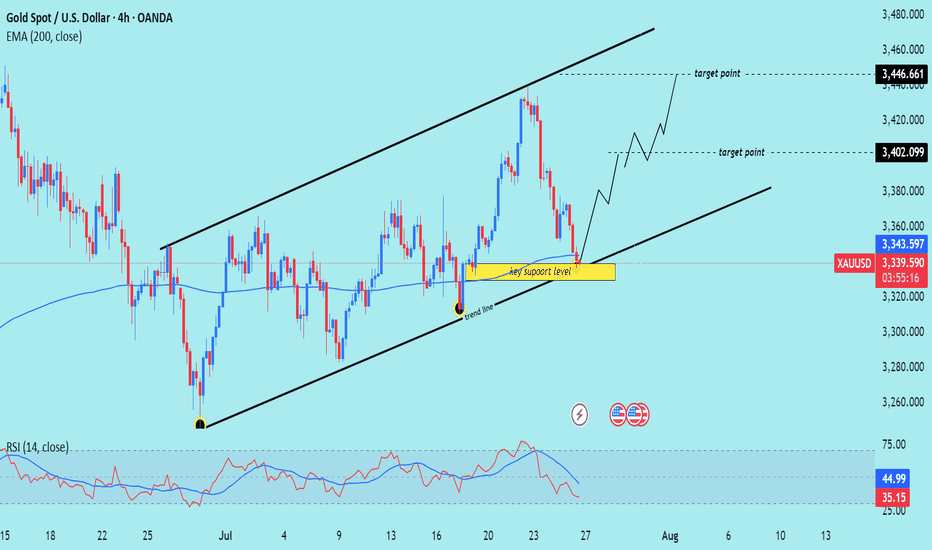

XAU/USD) bullish the support Read The captionSMC Trading point update

Technical analysis of (XAU/USD) on the 4-hour timeframe, indicating a potential bounce from a key trendline support within a rising channel.

---

Analysis Summary

Pair: XAU/USD (Gold Spot vs. USD)

Timeframe: 4H

Current Price: 3,338.715

Bias: Bullish rebound within ascending channel

---

Key Technical Elements

1. Ascending Channel:

Price has been respecting a well-defined rising channel, bouncing between support and resistance levels.

2. Key Support Zone:

The yellow highlighted area marks a critical support level and lower boundary of the channel.

Also intersects with the trendline, strengthening the potential for a bounce.

3. 200 EMA (Dynamic Support):

The 200 EMA at 3,343.616 lies just below current price, acting as a dynamic support level.

4. RSI (14):

RSI is around 34.93, nearing the oversold zone, suggesting a buying opportunity may be near.

---

Target Points

First Target: 3,402.099

Second Target: 3,446.661

---

Trade Idea

Direction Entry Zone Stop-Loss Target Zones

Buy 3,330–3,345 Below 3,320 3,402 / 3,446

Mr SMC Trading point

---

Summary

Gold is currently testing a key support level and ascending trendline. If price holds above this area, we can expect a bullish rebound toward 3,400–3,446 levels, aligning with the upper channel resistance.

Please support boost 🚀 this analysis)

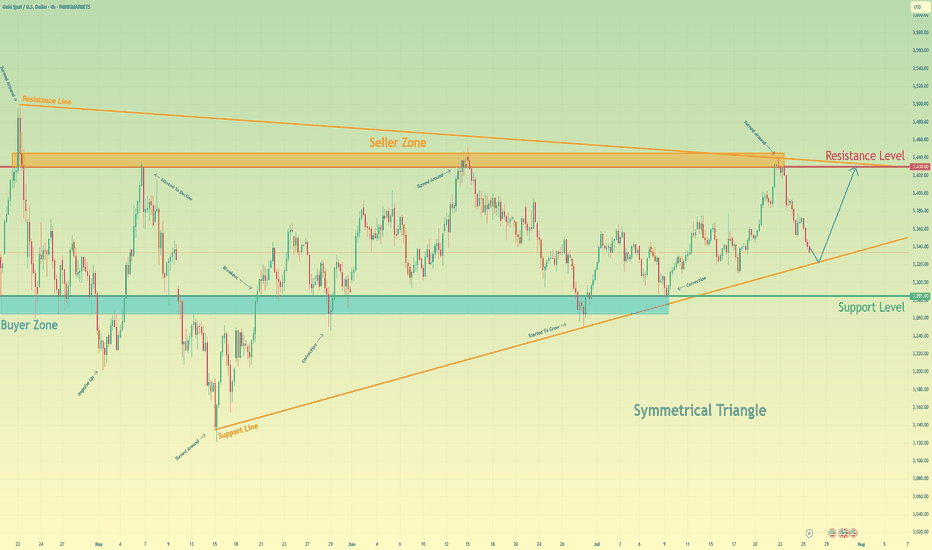

Gold will rebound from support line of triangle and rise to 3430Hello traders, I want share with you my opinion about Gold. Following a sequence of significant upward trends and the subsequent downward corrections that defined its range, gold has entered a broad market zone of consolidation. This battleground is clearly anchored by the historically significant buyer zone around 3285 and a formidable seller zone near 3430. Currently, the asset's price action is coiling and contracting within the confines of a large symmetrical triangle, a classic pattern that signifies a period of equilibrium and energy build-up before a potential high-volatility breakout. After a recent upward rebound was decisively rejected by the upper resistance line, the price is now in a corrective descent, heading towards the crucial ascending support line of the triangle. The primary working hypothesis is a long scenario, which is based on the expectation that this downward move will find strong buying interest on this key trendline, respecting the pattern's integrity. A confirmed and strong bounce from this level would signal another complete upward rotation within the triangle is underway. Therefore, the tp is logically and strategically set at the 3430 resistance level, as it not only aligns with the formation's upper boundary but also represents the major seller zone, a natural magnet for price on such a rebound. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

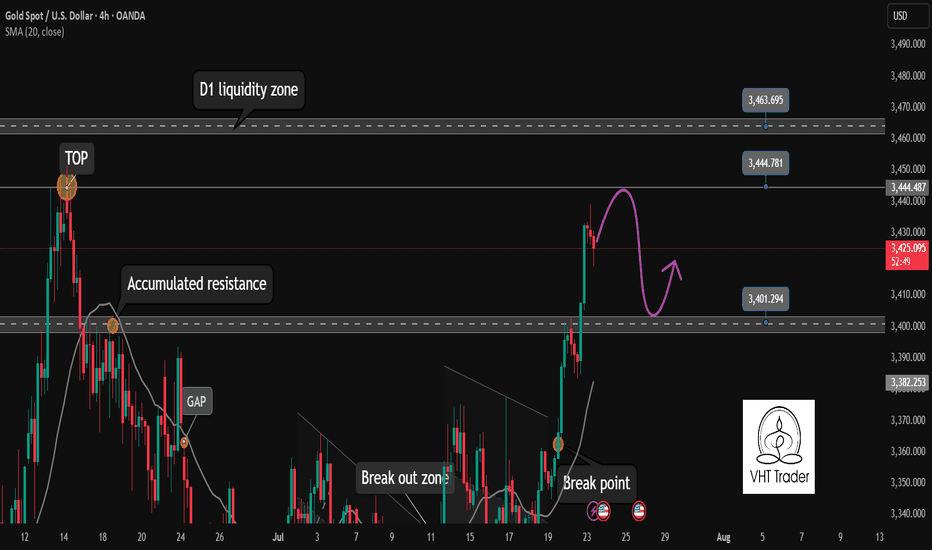

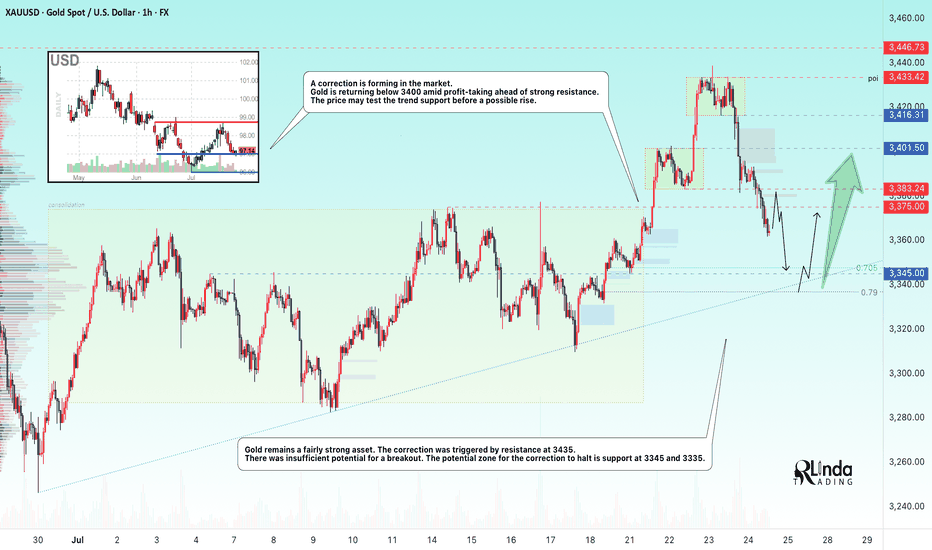

GOLD → Countertrend correction. Where will growth begin?FX:XAUUSD faced pressure in the 3430 zone, traders moved into profit-taking mode, triggering a correction. The price entered the sell-off zone...

On Thursday, gold is trading below $3400 as traders assess progress in US-EU trade talks and await preliminary PMI data from the US and the EU. These indicators could influence expectations for Fed and ECB rates. Optimism is being bolstered by reports of trade agreements between the US and Japan and other countries. The ECB is expected to keep rates unchanged, while the probability of a Fed rate cut in September is estimated at 60%. Investors are also watching Trump's conflict with Powell amid his visit to the Fed. Technically, the daily market structure is not broken, and a correction is forming within acceptable limits.

Based on the current direction, the market may test the intermediate bottom: trend support, the 3345-3320 area.

Resistance levels: 3375, 3383, 3400.

Support levels: 3345, 3320

A retest of resistance at 3375-3383 is possible. If the bears keep the price below this zone, the metal may continue its correction phase towards the zone of interest indicated on the chart. Local sell-offs have not yet broken the bullish daily structure.

However, the absence of a downward impulse and consolidation in 3375 - 3383 with a subsequent breakout of local resistance could increase demand again, which would generally lead to premature growth to 3400 - 3435.

Best regards, R. Linda!

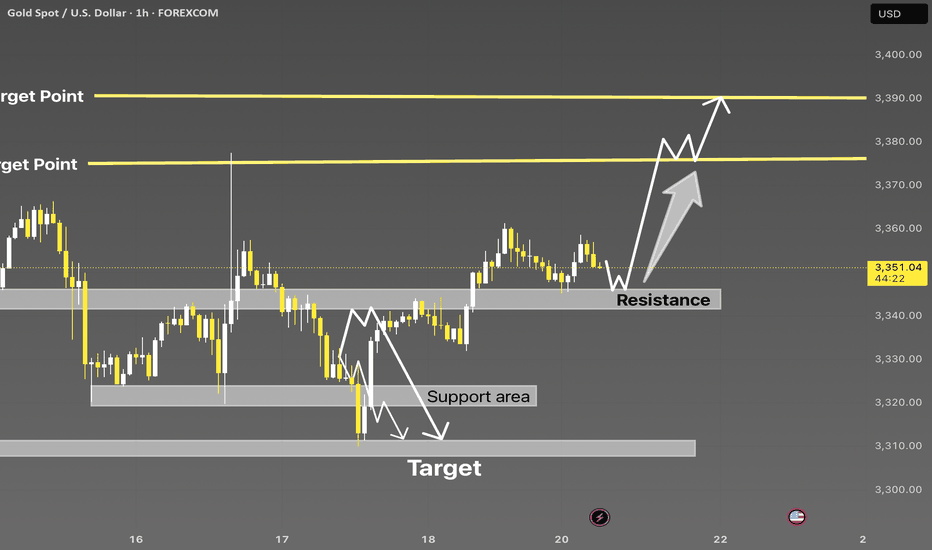

XAUUSD Bullish Setup | Liquidity Grab to Breakout📊 XAUUSD Bullish Breakout Plan | Price Action + Key Levels Analysis 🔥

Gold (XAUUSD) is currently holding above a strong support-turned-resistance zone around $3,340 - $3,345. After a clear rejection from the support area and a bullish structure forming, price is showing potential for a clean breakout toward higher targets.

🔍 Key Technical Highlights:

• Support Area: $3,310 - $3,320 held strongly

• Resistance Flip: $3,345 zone acting as new demand

• Target 1: $3,375

• Target 2: $3,390 major liquidity zone

• Structure: Bullish W pattern forming above demand

This setup favors buy on retracement, aiming for breakout above recent highs. Wait for a confirmation candle above resistance before entering.

📈 Watch for liquidity grab and strong bullish impulse.

#XAUUSD #GoldAnalysis #SmartMoney #BreakoutSetup #LiquidityHunt #ForexTrading #TechnicalAnalysis #BuySetup #PriceAction #TradingView #GoldSetup #ForYou

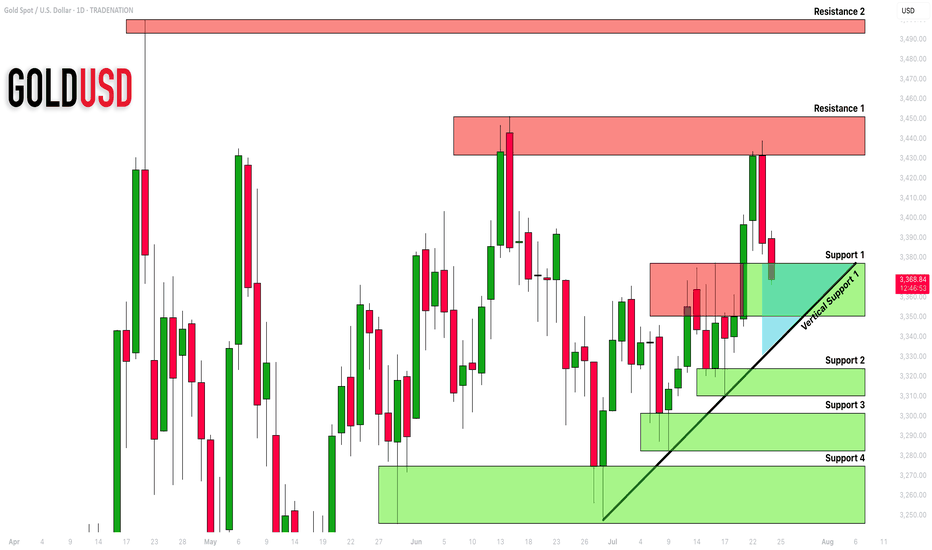

GOLD (XAUUSD): Important Demand Zone Ahead

Gold is currently retracing from a key daily horizontal resistance.

Here are important structures to watch.

Horizontal Structures

Support 1: 3350 - 3377 area

Support 2: 3310 - 3324 area

Support 3: 3282 - 3301 area

Support 4: 3245 - 3374 area

Resistance 1: 3431 - 3451 area

Resistance 2: 3493 - 3500 area

Vertical Structures

Vertical Support 1: rising trend line

Vertical and Horizontal Supports 1 compose a contracting demand zone.

Probabilities are high the price will pull back from that.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.