Report - 22 jully, 2025Institutional Integrity Crisis at the Federal Reserve:

The Treasury Secretary's demand for a full investigation into the Federal Reserve, alongside President Trump’s repeated attacks on Chair Jerome Powell, has severely shaken institutional confidence. Accusations of mismanagement around a $2.5 billion renovation, public comparisons to failed aviation regulators, and Trump’s flirtation with Powell’s removal for "fraud" have undermined the perception of the Fed as an apolitical, data-dependent central bank. These moves are highly destabilizing at a time when inflation remains elevated (2.7% YoY), tariffs are beginning to bite, and rate-cut odds are growing.

Markets have reacted with mixed tones. The bond market is flashing warning signals, with the yield curve steepening modestly as investors reassess Fed independence and pricing power. Equities, by contrast, have so far displayed resilience thanks to solid earnings and rotation into sectors less sensitive to rates (e.g., financials, healthcare).

The DXY has softened as political risk clouds yield-driven strength. The USDJPY continues to flirt with the 149 level, supported by rate differentials but vulnerable to headline risk. Gold (XAUUSD) has reclaimed a bid after dipping to $3,300, as long-end real rates remain uncertain and central bank buying continues globally.

→ If Powell is removed or constrained, expect a sharp repricing lower in the dollar, upward pressure on gold, and a potential equity volatility spike.

Dividend Shift Map: Signals of Sector Confidence & Fragility

Dividend movements are signaling investor positioning under macro stress:

Boosts from GS (+33%), Citi, UNP, JPM, MS, BK, and PPG point to institutional strength in financials, industrials, and infrastructure.

Cuts from MSB (−78.6%), United-Guardian (−28.6%), VOC (−15.4%) show stress in energy trusts, chemicals, and manufacturing niches, reflecting margin compression and spot price weakness.

The divergence reflects both sectoral dispersion and management outlooks on sustained rate pressures. Dividend payers are drawing capital rotation, particularly in value-heavy indexes like the Dow.

UK–EU SAFE Defense Fund Arrangement: Industrial & Fiscal Implications

The UK’s entry into the €150B EU SAFE fund reopens post-Brexit military-industrial cooperation. However, London must pay a portion of EU subsidies used to buy British arms. France is pressing for higher UK contributions, while Germany seeks compromise. Despite potential fiscal friction, UK defense firms (e.g., BAE Systems, QinetiQ) are likely to benefit from expanded procurement markets, which could support hiring and capex.

For UK assets, this is a mild bullish signal: defense sector outperformance, GBP support, and fiscal clarity despite headline noise.

Japan's Taiwan Evacuation Stance: Strategic Retreat in East Asia

Japan’s unofficial warnings to firms that they would be “on their own” in evacuating staff from Taiwan marks a pivotal moment in East Asian FDI risk. The message, privately circulated since 2022, is now widely acknowledged. Japan’s FDI into Taiwan fell 27% YoY, dropping from $1.7B to $452M. Sectors like semiconductors and materials (JSR, Tokyo Electron) are rethinking exposure.

This stance favors India, Vietnam, and Malaysia as alternate chip/tech hubs. It also suggests increasing strategic divergence within the U.S.–Japan alliance over operational military readiness.

USDJPY could strengthen if investors rotate out of JPY as geopolitical fragility grows. The BOJ’s passive stance adds fuel to this view. Longer term, a global Taiwan contingency premium may build across EM Asia FX and tech equities.

AI Infrastructure Stalls: Stargate’s Failure & OpenAI's Workaround

Stargate, the $500B OpenAI–SoftBank AI infrastructure mega-project, has failed to produce a single data center deal, despite grand White House fanfare in January. Key friction centers on land rights, SoftBank’s SB Energy prioritization, and operational delays. The project is now scaled back to a pilot site in Ohio, down from the original 5GW goal for 2025.

Meanwhile, OpenAI has independently signed a $30B/year, 4.5GW infrastructure deal with Oracle—divorcing from Stargate.

Implications:

SoftBank (9984.T): Damaged reputation; lowered tech credibility short term.

Oracle (ORCL): Strong positioning in AI infrastructure. Bullish long-term.

Infra REITs (DLR, EQIX): Likely beneficiaries as private leasing demand accelerates.

Pentagon’s Rare Earths Intervention: Strategic Subsidization

In a seismic intervention, the U.S. Department of Defense has acquired a stake in MP Materials, guaranteeing NdPr purchases at nearly 2x market prices ($110/kg). The $400M commitment and a 10-year price floor represent unprecedented industrial policy in the critical minerals sector. Apple has already pledged $200M to MP’s magnet output.

The backlash among rivals reflects fears of a “China-style” industrial model—subsidized monopolies. Still, the goal is clear: detach U.S. military supply chains from Chinese materials.

MP Materials (MP): Bullish short and medium term.

Other rare earth startups: Bearish unless similar support is extended.

XAUUSD: No direct impact, but this adds to U.S. industrial policy risk premium supporting metals.

Market Risks & Watchpoints

Powell Removal / Fed Discredit: Dollar tailspin risk. Watch 103.00 DXY.

Taiwan Hotspot Premium: Insurance and chip costs to rise. Monitor EMFX reaction.

Stargate Fallout: SoftBank asset markdowns, but Oracle/Altman momentum persists.

Defense & Arms Politics: UK–EU deal fiscal impact mild; industrial upside for UK arms players.

Dividend Map: Useful real-time sector thermometer. Energy/commodities may face next downgrades.

XAUUSDK trade ideas

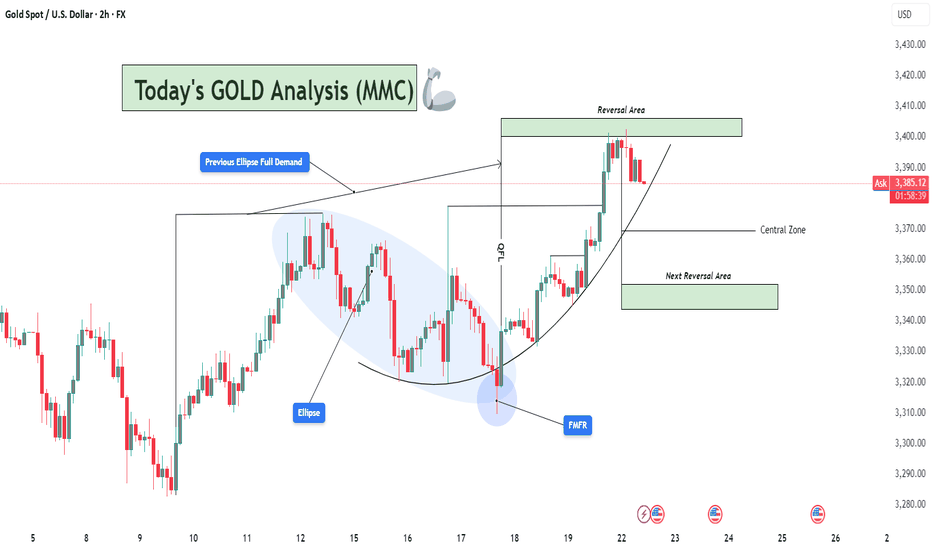

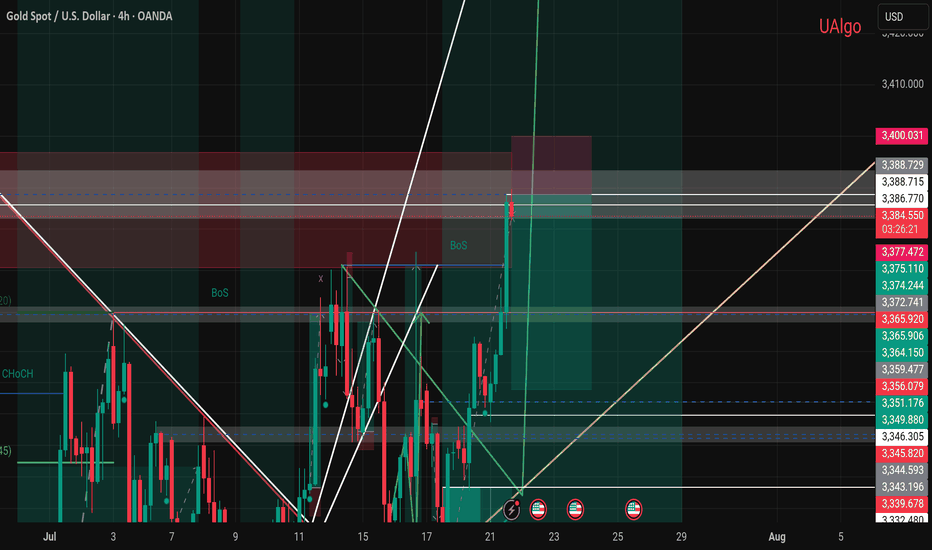

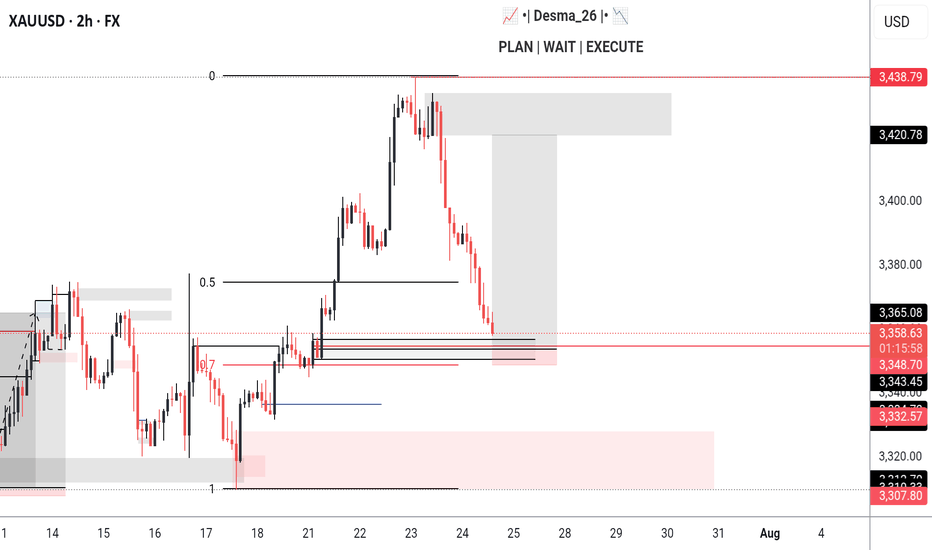

XAUUSD Analysis : From Ellipse Demand to Reversal Zone – Target Hello traders!

Let’s decode today’s GOLD setup using the MMC (Mirror Market Concepts) strategy. This is a clean and textbook example of how institutional price delivery works – from demand creation to reversal zones. Let’s go step by step👇

🔵 Previous Ellipse Full Demand – The Accumulation Phase:

The market initially formed an Ellipse structure, which you’ve rightly marked as the Previous Full Demand Zone. This is where smart money started to accumulate long positions after pushing the market into a discounted area.

Price remained inside this ellipse zone for a while, showing slow and controlled price action with multiple rejections from the bottom. This type of price behavior is usually a trap zone, where retail traders are shaken out, and institutions silently build their positions.

💥 FMFR Zone – Where Momentum Begins:

On July 18, a clear FMFR (Fresh Money Flow Reversal) took place. This is the moment where price broke out of the ellipse demand zone with strength.

This FMFR marks the transition from accumulation to markup phase. It signals that the market makers have done their job in collecting liquidity and are now ready to drive price upward.

From this FMFR, the market respected a curved path — a classic MMC parabolic build-up, showing buyer dominance throughout.

📈 One-Time Delivery (OTD) – Clean Impulse:

Following the FMFR, price followed a One-Time Delivery (OTD) move. You’ve marked this beautifully with the vertical box showing the aggressive bullish impulse.

The candles are strong, consecutive, and with minimal pullbacks — a sign that the market is being delivered efficiently by the institutions toward their target.

🟩 Reversal Area – Target Reached:

Price has now entered the Reversal Area (Supply Zone), which was expected based on previous structure and imbalance. The market is reacting to this area already — giving signs of exhaustion.

From an MMC perspective, this is a potential “sell to buy” or “buy to sell” trap zone, where the market could either reverse completely or engineer liquidity before moving again.

⚖️ Central Zone – Balance Area:

Below the current price lies the Central Zone, which is a neutral area where the market may consolidate if it fails to hold higher or reject immediately. This area usually acts as a pause or buffer zone, often seen before the market decides the next leg (up or down).

🔄 Next Reversal Area – Demand Reload Zone:

If price drops, the Next Reversal Area marked below (around the 3,345–3,355 range) will be crucial. This is the zone where you should watch for:

Bullish rejections

FMFR signals

Trap candles (like liquidity wicks)

Expect this area to act as the next “Buy Program”, where institutions might step back in to reload longs.

🧠 Conclusion & Trader Mindset:

✅ Market respected MMC phases: Accumulation ➝ FMFR ➝ Delivery ➝ Reversal

🛑 Currently in a high-probability reaction zone – wait for confirmation before trading.

👁️ Watch how price behaves in the Reversal Area — rejection or continuation?

🔁 If market retraces, Next Reversal Area is your prime hunting zone for long setups.

🔔 Stay Patient – React, Don’t Predict.

Let the market reveal its next move. Whether it’s a pullback to reload longs or a deeper retracement, MMC logic will guide you to stay on the right side.

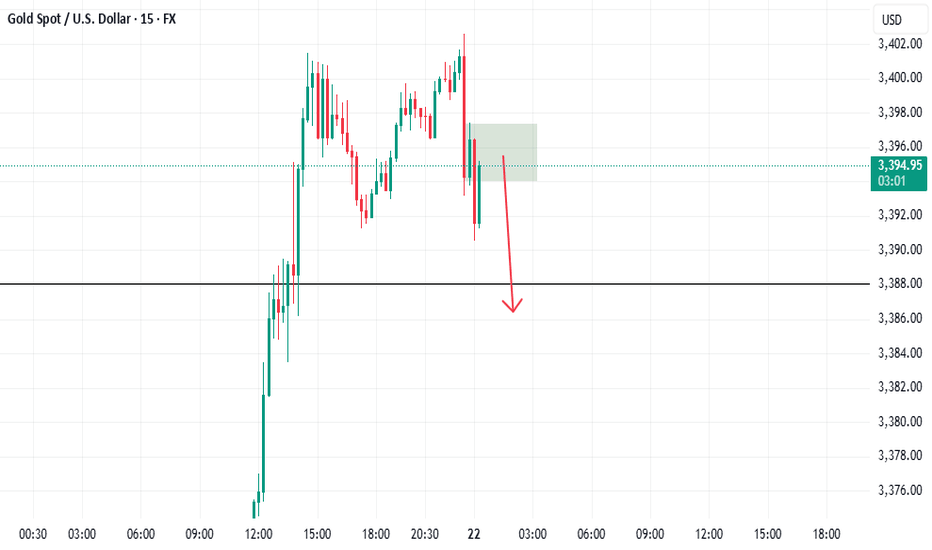

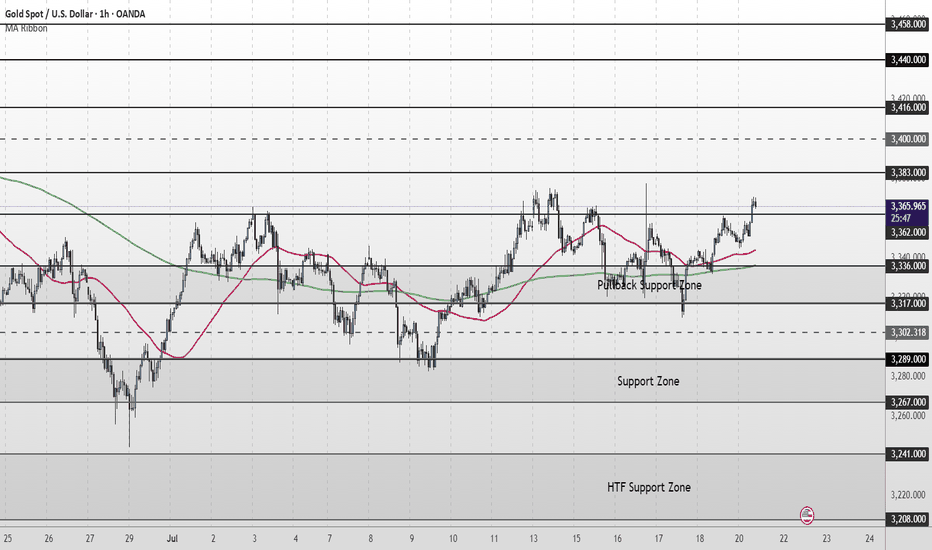

XAU/USD Intraday Plan | Support & Resistance to WatchGold has extended its recovery and is now trading around 3,366, pushing into the next resistance cluster.

Price is holding firmly above both the 50MA and 200MA, which are now flattening and beginning to turn upward, acting as dynamic support.

A confirmed break and hold above 3,362 would open the path toward the next upside targets at 3,383 and 3,400, with 3,416 and 3,440 as higher‑timeframe resistance levels if momentum continues.

If price rejects the 3,362 resistance zone and fades lower, watch the Pullback Support Zone (3,336–3,317) closely. A break back below that area would shift focus to the broader Support Zone (3,289-3,267).

Failure to hold there could expose price to the deeper HTF Support Zone.

📌 Key Levels to Watch

Resistance:

3,362 ‣ 3,383 ‣ 3,400 ‣ 3,416

Support:

3,336 ‣ 3,317 ‣ 3,302 ‣ 3,289 ‣ 3,267

🔎 Fundamental Focus – Week of July 21–25

📌 Tuesday, Jul 22

Fed Chair Powell Speaks

📌 Thursday, Jul 24

Unemployment Claims

Flash Manufacturing PMI & Flash Services PMI

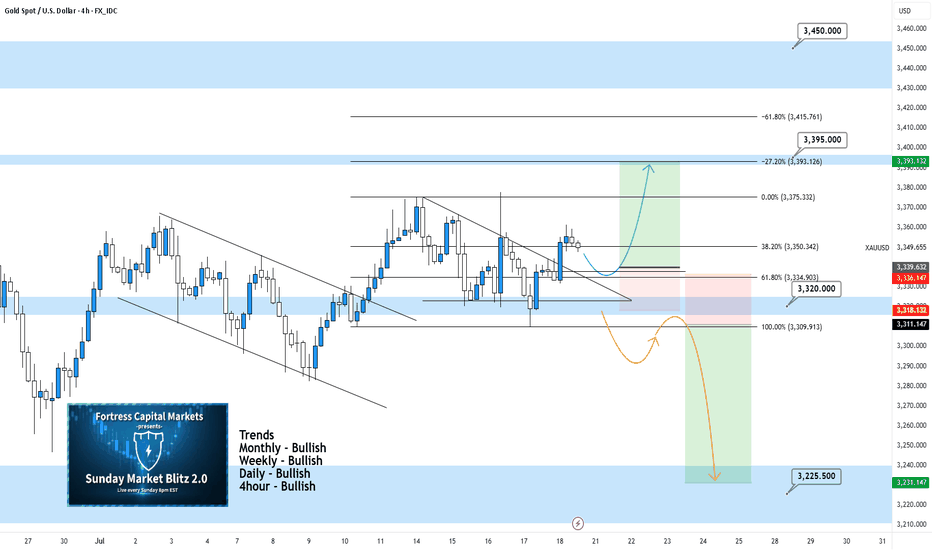

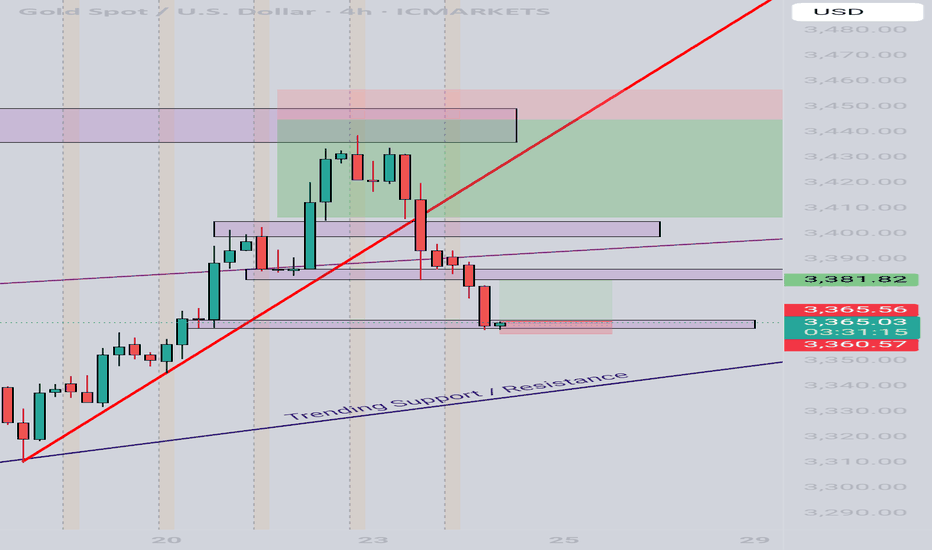

XAUUSD 4Hour TF - July 20th, 2025XAUUSD 7/20/2025

XAUUSD 4 hour Long Idea

Monthly - Bullish

Weekly - Bullish

Daily - Bullish

4hour - Bullish

GOLD,GOLD,GOLD. This thing has been bullish on all timeframes and doesn’t really show any signs of stopping just yet.

We can see two scenarios for the week ahead so let’s dive in:

Bullish continuation - Price action on gold is breaking out of a descending triangle pattern. This is a strong bullish move but for us to consider trades we want the confirmation.

Look for a retest of our 61.8% fib level and mostly recently broken structure. If we can spot bullish conviction coming off this level we can then consider targeting higher resistance levels like 3.395.000. Our -27% fib level lines up with this zone as well.

Bearish Reversal - For us to consider Gold bearish again we would need to see something very convincing. If we did see a break below 3,320.000 with a confirmed lower high I would then consider short scenarios.

Look to target toward major support levels on the way down to 3,225.000, our next monthly support zone.

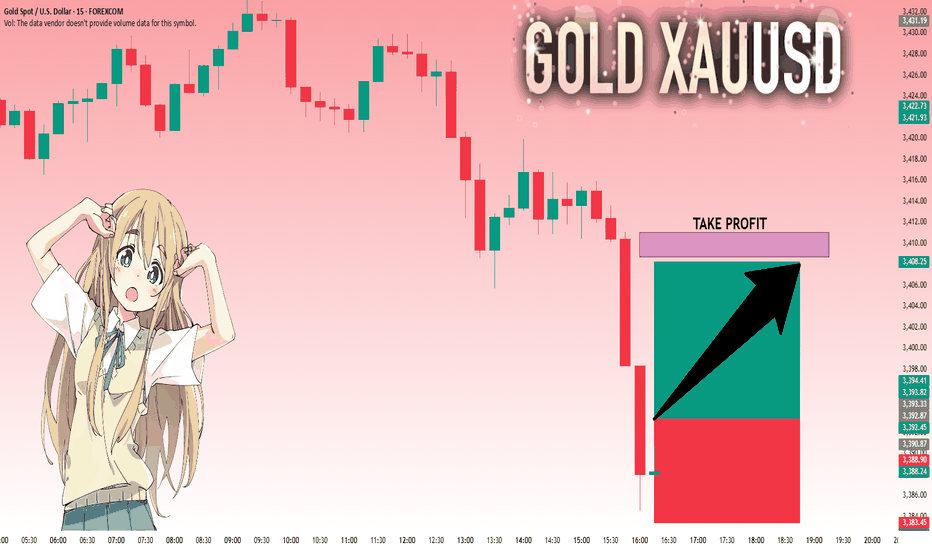

XAU/USD Breakout Playbook – Rob the Market!🚨💰 GOLD HEIST IN MOTION! | XAU/USD Thief Trading Strategy (Breakout Edition) 🏴☠️

🧠 Strategic Mindset | Not Your Average Chart Talk

Yo Market Bandits & Pip Hunters – welcome to the underground playbook!

This isn't your grandma’s chart breakdown – it’s a Thief Trading Takedown on XAU/USD (Gold), where we’re not chasing the market… we’re outsmarting it.

THE MASTER PLAN: Enter Like a Ghost, Exit Like a King 👑

📍 ENTRY POINT – The Break-In Begins!

💥 Breakout Level: Watch for 3370.00 resistance to crack – this is our green light.

🕵️♂️ Entry Style:

• Buy Stop above MA resistance zone (fast & clean)

• OR Buy Limit near swing low zones after confirmation pullback (sniper entry)

🧠 Thief Tip: Wait for the breakout to happen. No orders, no SL before it. Patience is profit.

🔄 Layer the Entry:

• Deploy DCA (Dollar Cost Averaging) or scaling entries with precision

• Build positions like stacking cash bags — smart, silent, and calculated

🛡️ PROTECT THE LOOT – Stop Loss Logic 💣

📍 SL Guide: 3310.00 (4H swing low – update as price structure evolves)

🔥 SL ONLY comes after breakout. Set it too early? That’s how you get caught.

⛔ No pre-breakout orders. No early SL. Stay invisible till it's go time.

🎯 THE ESCAPE – Profit Like a Phantom 🚀

💸 Take Profit: 3450.00

📉 Scalpers: Trail SL as price pushes – never give back stolen pips

🌀 Swing Traders: Monitor resistance layers – don’t let the bulls turn on you

🧭 CONTEXT – Why This Setup?

🔍 Macro Snapshot:

• Trend: Neutral/Bullish Lean

• Influencers: COT reports, geopolitical tension, dollar flows

• Sentiment Shifting – watch the herd, but don’t run with it

🗞️ News Risk: Don’t get wrecked by events! Avoid entries during high-impact news.

🚨 Trailing SL is your best weapon during volatility.

⚡ POWER UP THE CREW – Support the Movement

💬 Drop a comment, hit the 🔥 like button, and share with your trading gang

More Thief Trading blueprints coming soon – bigger breakouts, cleaner setups

⚠️ STAY SHARP, THIEVES!

This ain't financial advice – it’s an outlaw’s edge on the market.

Trade smart. Risk well. Protect the bag.

🏴☠️ XAU/USD GOLD HEIST IN PROGRESS... Join the Movement. Let’s Rob the Market.

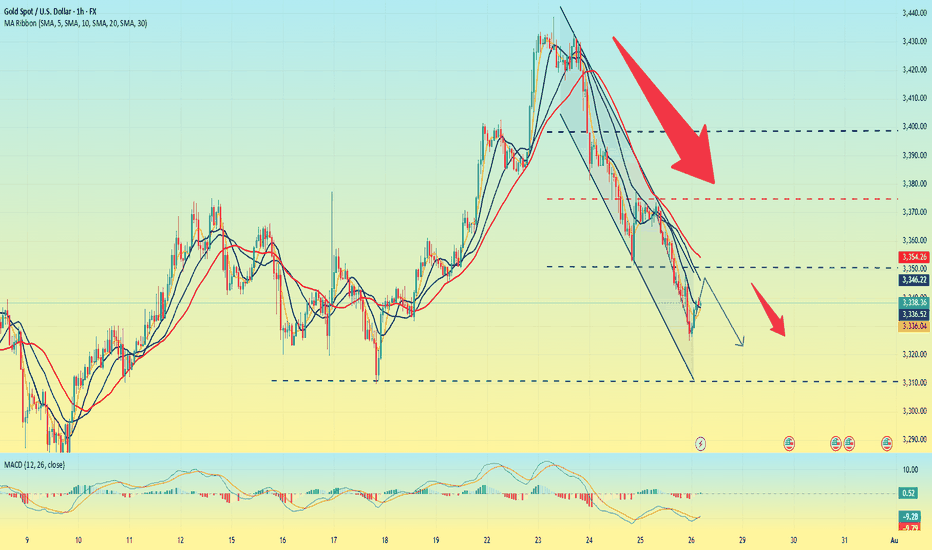

Gold is going down. It may continue next week.On the last trading day of this week, the bears attacked strongly and continued to refresh the recent lows, reaching the lowest point near 3325 before stopping.

From Monday's 3345 to 3440, it closed near 3337. This week, it also walked out of the large range roller coaster pattern, and all the strengths in the previous period did not exist. Under the continuous downward trend, the bulls were also vulnerable, and there was not even a strong rebound, which indirectly explained the strength of the bears in the short term.

As for the current trend, the bears are likely to continue to be strong, and before there is a symbolic upward breakthrough, we still need to maintain the idea of shorts to operate. The current upper pressure is maintained near 3350, which is also the bottom position touched for the first time in the previous period. It is possible that it will be transformed into a top-bottom conversion pattern; and the strong support level below is near 3310.

When the Asian market opens next Monday, we need to pay close attention to whether there is a gap problem on both the bulls and bears. After three consecutive negative daily lines, all the moving average systems have been broken, and it is also likely to form a resonance pressure pattern. On Monday, gold will first touch around 3350 and continue to short. The profit range will be around 3330-3320, and the stop loss will be 3360. If the European session is stronger, you can adjust the point before the US session.

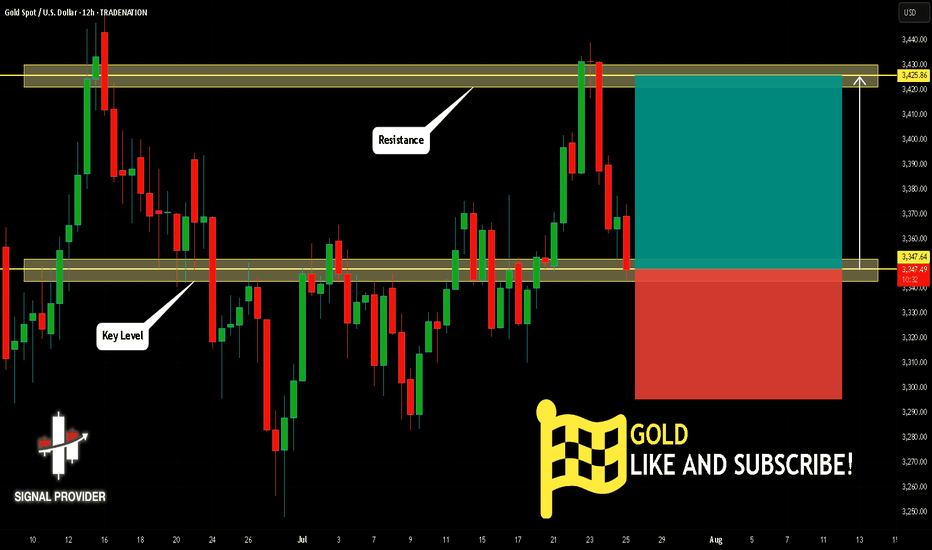

GOLD Will Move Higher! Buy!

Here is our detailed technical review for GOLD.

Time Frame: 12h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 3,347.64.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 3,425.86 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

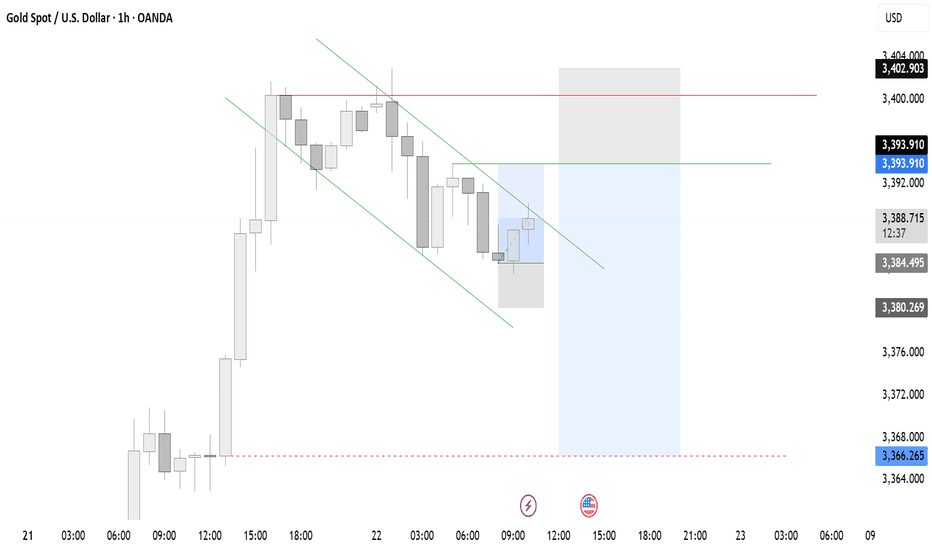

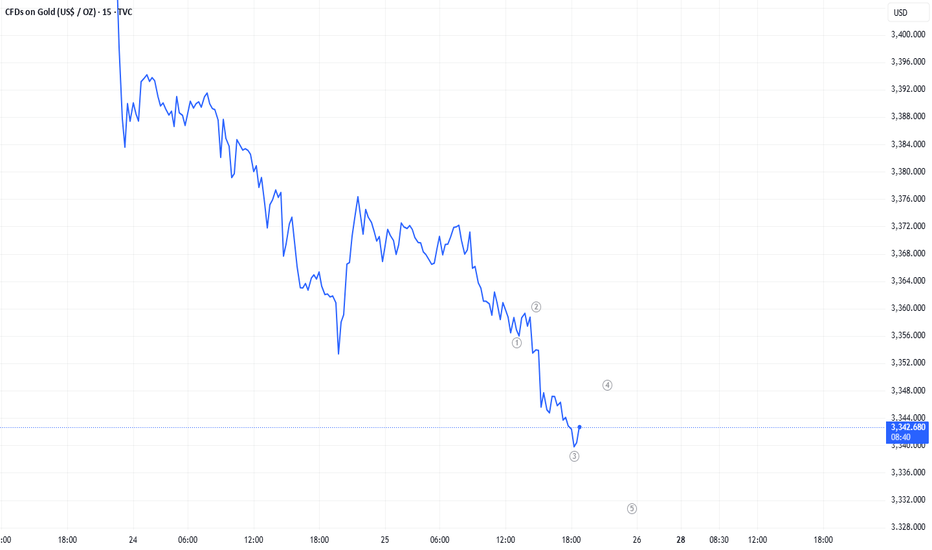

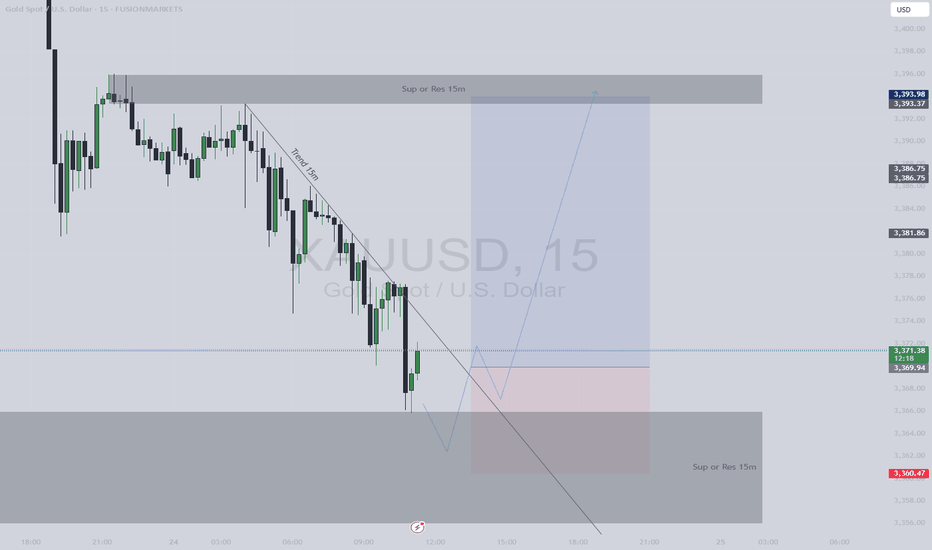

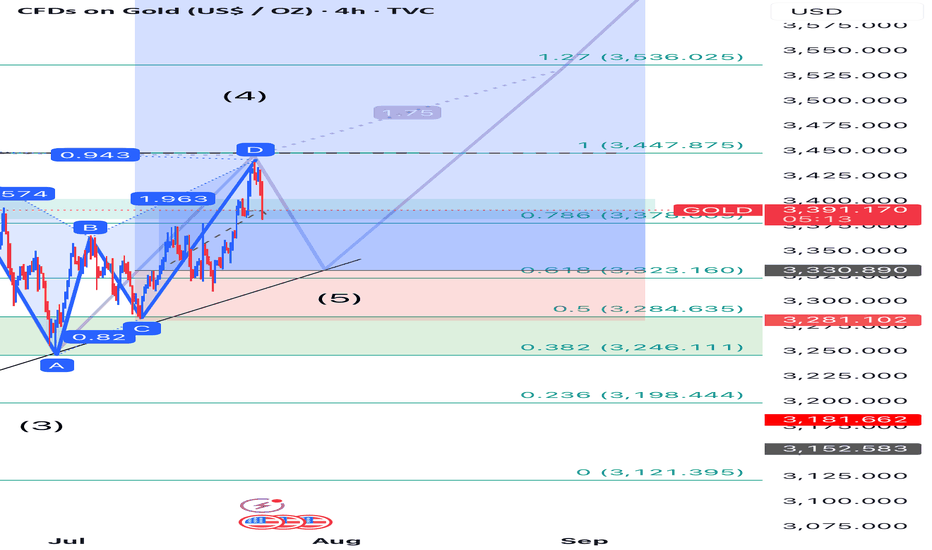

Elliott Wave Analysis – XAUUSD July 25, 2025📊

________________________________________

🔍 Momentum Analysis

• D1 Timeframe: Momentum is declining. Based on the current pace, it’s likely that only 1–2 more daily candles are needed before momentum enters the oversold zone → suggesting one more potential downward leg.

• H4 Timeframe: Momentum is about to turn bearish, indicating we might see a sideways movement or a slight drop in the short term.

• H1 Timeframe: Momentum is currently falling. By the end of the current H1 candle, momentum will likely enter the oversold zone → potential for a bullish reversal soon.

________________________________________

🌀 Elliott Wave Structure

• A clear 5-wave Wave A has already formed with no irregular patterns, so I’m expecting Wave B (black) to unfold as a 3-wave structure.

• Within this black Wave B, price is now developing Wave B (blue), meaning Wave A (blue) has already completed. Looking at the lower timeframe, I can identify a 5-wave structure → suggesting a zigzag correction in the form of 5-3-5 for black Wave B.

• Target for Wave B (blue): The 3360 area – this is a support level and also aligns with Fibonacci confluence, making it a strong candidate for the end of Wave B (blue) and a potential reversal zone.

• If price respects the 3360 level, then projected targets for Wave C (blue) would be around 3386 or 3402.

• However, if price breaks below 3351, the current wave count becomes invalid. In that case, we will shift to an alternate scenario and look for a buy opportunity near the lower edge of the triangle (c)-(e) and other confluence support zones.

________________________________________

🔄 Combining Momentum & Wave Structure

• D1 momentum shows weakening in this downward move, and the lower boundary of the triangle (c)-(e) is a prime area to look for the end of Wave e.

• Ideally, we want to see:

o A short-term bounce upward aligning with H1 momentum reversal to complete Wave C (blue).

o Then a confluence with H4 momentum turning bearish, indicating possible trend continuation or reversal.

________________________________________

📌 Trade Plan

• For experienced traders:

Watch closely around 3385 and 3401 for reversal signals to enter Sell positions.

• For beginners, I recommend the following limit setup:

o SELL ZONE: 3399 – 3402

o SL: 3501

o TP1: 3374

o TP2: 3351

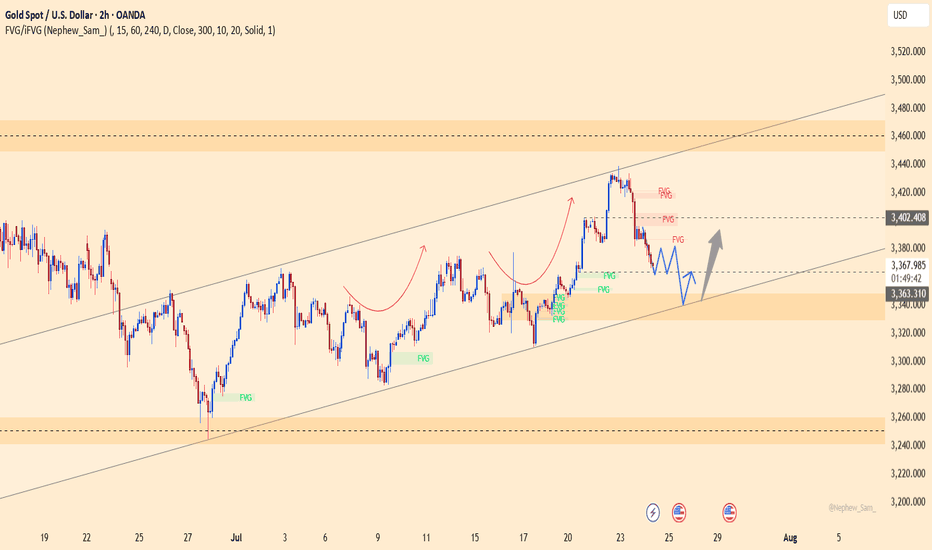

XAUUSD – healthy correction, ready to bounce from 3,338Gold is retracing within an ascending channel after facing rejection at the FVG zone near 3,402.800. This pullback is seen as a healthy correction, with confluence support around 3,338, which previously acted as a springboard for bullish momentum.

As long as price holds above this zone, a rebound toward 3,402 remains likely.

Primary scenario

Buy zone: 3,338

Target: 3,402

Invalidation: Break below 3,320

Note

Weak volume near the FVG zone may cause short-term consolidation, but the broader trend still favors buyers.

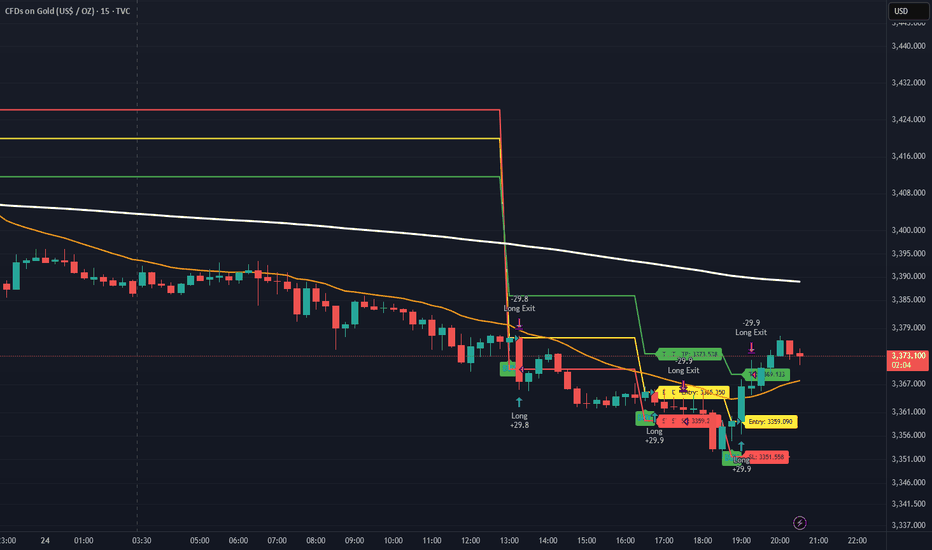

XAUUSD Traders - Turn Chaos into Pips with This StrategyHello Traders,

Struggling to trade XAUUSD due to its high volatility? Taking small profits but suffering big losses?

We’ve got your back.

Introducing Gold Sniper — a high-probability strategy specially crafted for XAUUSD traders. With a 65%+ win rate and a consistent 1:1.33 risk-reward ratio, it’s designed to help you catch sharp moves with confidence.

🚨 Live Performance Highlights:

Today’s Trades:

Signal 1

🟢 Buy @ 3365.350

🔴 SL @ 3359.209

🟢 TP @ 3373.538

❌ Result: SL Hit → 61 Pips Loss

Signal 2

🟢 Buy @ 3359.090

🔴 SL @ 3351.558

🟢 TP @ 3369.133

✅ Result: TP Hit → 75 Pips Profit

📊 Net Profit Today: +13 Pips

📅 Yesterday’s Profit: +150 Pips

✅ Gold Sniper helps you:

• Avoid fake breakouts

• Catch real momentum

• Stick to disciplined entries and exits

🎯 Want to boost your trading accuracy?

📩 DM us now to get access and start using Gold Sniper directly on your TradingView chart.

If you find this valuable, like the idea and show your support. Let’s grow together!

Happy Trading,

InvestPro India

Trading Idea XAUUSD 🎯 Trade Ideas Based on Structure

1. Long Reversal Play (Buy)

📍 Entry: If price retests the support zone around 3,356–3,366 and shows bullish confirmation (e.g. bullish engulfing, pin bar)

🎯 Target: 3,390–3,402 (resistance zone)

🛡️ Stop Loss: Just below 3,355

💡 Why? Buying into support with confirmation aligns with the projected rebound idea

2. Sell into Resistance

📍 Entry: If price rallies to 3,390–3,402 and stalls with weak candles or bearish divergence

🎯 Target: Back to support zone (~3,366 or lower)

🛡️ Stop Loss: Above 3,405

💡 Why? Fading into resistance follows the broader trend while using the shaded zone for timing

3. Breakout Trade (Buy)

📍 Trigger: If price breaks cleanly above 3,402 and closes with strong momentum

🎯 Target: Look toward next resistance (~3,410+)

🛡️ Stop Loss: Below breakout candle (~3,390)

💡 Why? Signals a trend shift or strong bullish move against the recent downtrend

🧠 Smart Trading Tips

Let the candles lead the decision—watch for confirmation before jumping in

Stick to the higher probability zones and avoid overtrading in the middle

Use volume or RSI to filter false breakouts or weak entries

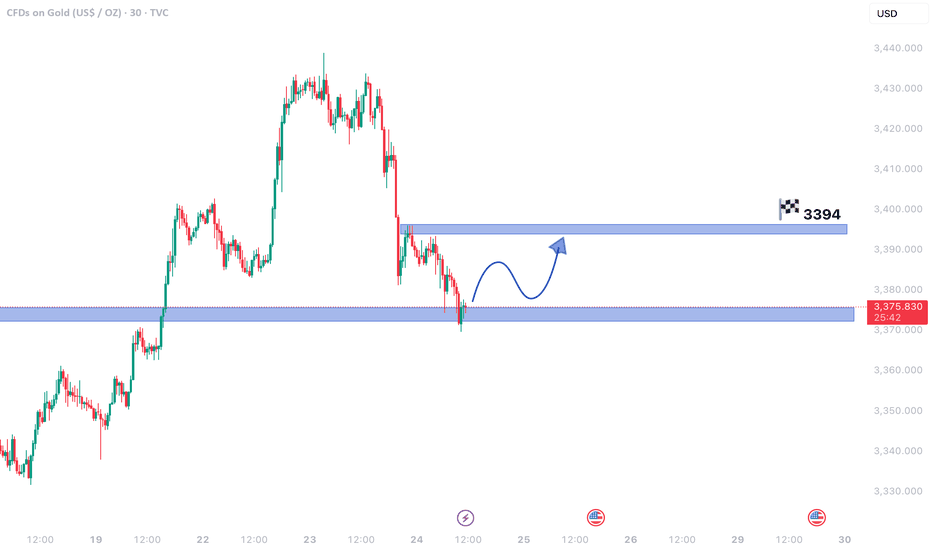

Gold Exhibiting Weak Bearish Momentum – Is a Rebound Imminent?Gold Exhibiting Weak Bearish Momentum – Is a Rebound Imminent?

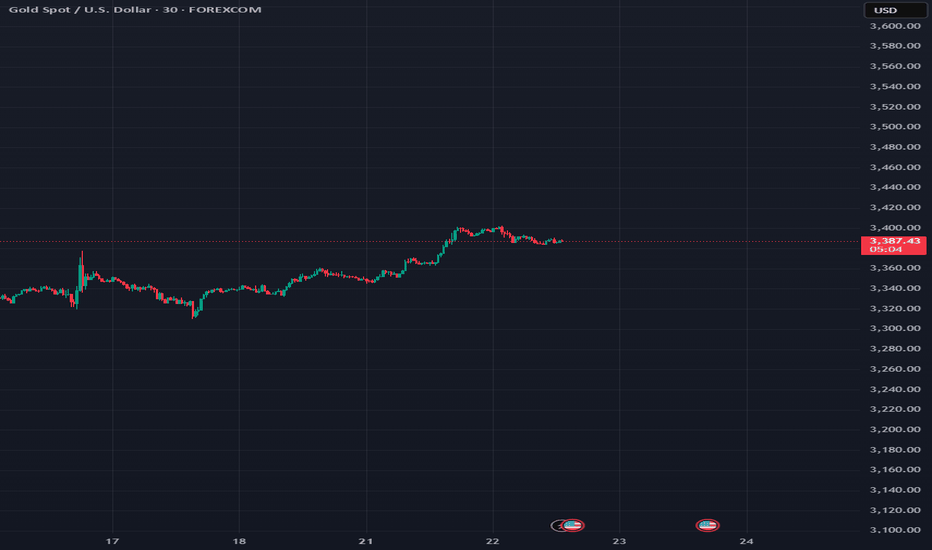

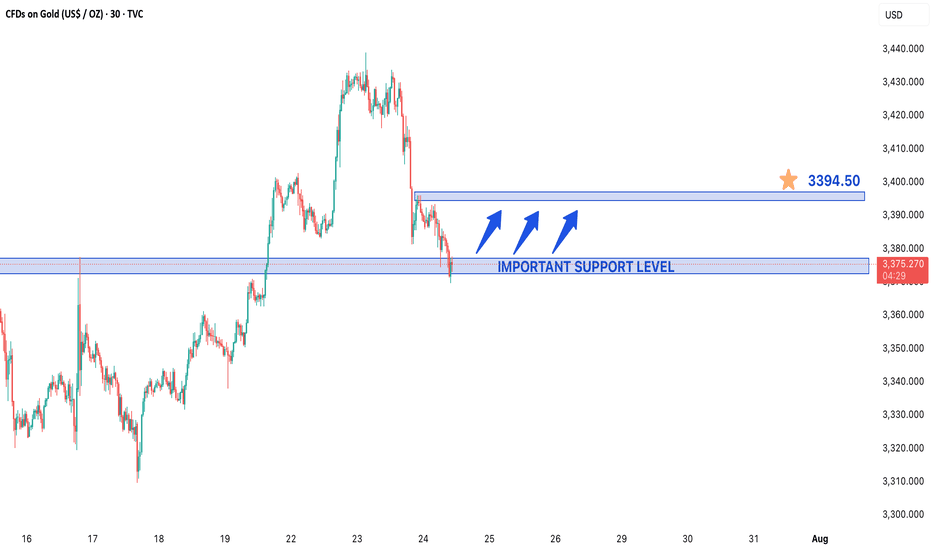

The 30-minute chart reveals gold prices in a mild downtrend, but the sluggish decline hints at weakening bearish pressure. This could set the stage for a temporary price recovery before any further downward movement.

Critical Insights:

- Fading Bearish Strength: The downtrend persists, but its slowing pace suggests seller exhaustion.

- Key Support Zone: With prices hovering near a major support area, a bullish reversal becomes plausible.

- Upside Potential: A resurgence in buying momentum may propel gold toward 3,394.60, a significant resistance level.

Market Dynamics:

1. Possible Short-Term Reversal: Shallow bearish trends near support often precede upward corrections.

2. Bullish Opportunity: A breakout past nearby resistance could fuel a rally toward 3,394.60, creating a swing trade setup.

3. Downside Risk: If support fails, the bearish trend may extend, though weak selling pressure limits immediate declines.

Strategic Approach:

- Entry Consideration: Long positions near current support levels could capitalize on a rebound.

- Risk Management: A drop below support would negate the bullish outlook, warranting a stop loss.

- Confirmation Signals: Bullish candlestick formations or increasing volume would strengthen reversal prospects.

Concluding Thoughts:

Gold’s tepid bearish momentum near a crucial support level raises the likelihood of a short-term bounce. Traders should watch for confirmation—if the recovery gains traction, 3,394.60 may come into play. Conversely, a support breakdown could renew downward pressure.

GOLD IN A WEAK BEARISH MOVE IN 30M TIME FRAME CHARTGold in a Weak Bearish Move – Temporary Rebound Ahead?

Gold prices are currently displaying a weak bearish momentum on the 30-minute chart, suggesting that the downtrend may be losing steam. Despite the downward movement, the sluggish pace indicates that sellers lack strong conviction, which could lead to a short-term price recovery before any further decline.

Key Observations:

- Weak Bearish Trend: The price is falling, but with decreasing momentum, often a sign of exhaustion among sellers.

- Critical Support Level: Gold is trading near a major support zone, where buying interest could emerge, triggering a bounce.

- Potential Rebound Target: If buyers step in, the price could rise toward 3,394.60, a key resistance level.

Market Implications:

1. Short-Term Reversal Likely: Weak bearish moves often precede temporary rallies, especially near strong support levels.

2. Bullish Scenario: A breakout above immediate resistance could push gold toward 3,394.60, offering a swing trading opportunity.

3. Bearish Continuation Risk: If support breaks, the downtrend may resume, but the current lack of strong selling pressure reduces immediate downside risks.

Trading Strategy:

- Buying Opportunity: Traders might consider long positions near support, targeting 3,394.60.

- Stop Loss: A break below the current support level would invalidate the rebound setup.

- Confirmation Needed: Watch for bullish candlestick patterns or rising volume to confirm the reversal.

Final Thoughts:

While gold remains in a short-term bearish phase, the weak downside momentum and proximity to support suggest a possible pullback. Traders should monitor price action closely—if the rebound holds, 3,394.60 could be the next target. However, a failure to hold support may extend the decline.

*Disclaimer: This analysis is for informational purposes only. Trade with proper risk management.*

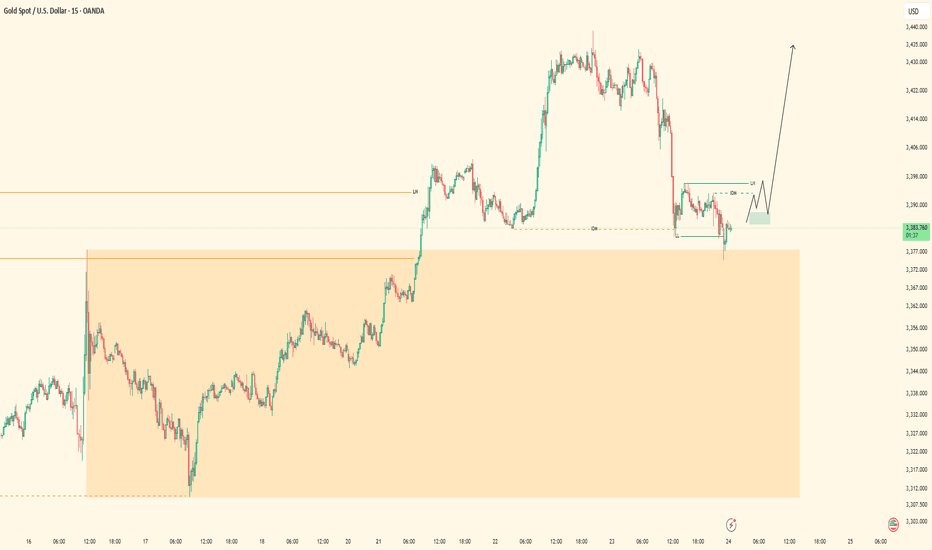

XAUUSD| Smart Money Confirmations LoadingBias: Bullish

HTF Overview: Price has just tapped into the 30-minute order flow zone after clearing out sell-side liquidity. This area aligns cleanly with bullish intent and prior structure.

LTF Focus: Currently waiting for lower timeframe confirmation — ideally a clear CHoCH or internal flip. Once smart money confirms this zone with a shift, I’ll look to enter and ride the momentum.

Target: Initial focus is on the 5-minute highs as a short-term objective. While price could continue toward 30-minute highs, structure suggests the recent 5M high is a more immediate and realistic target, making it a smarter move to secure profit around that level.

Mindset Note: Not in a rush — letting price speak first. The confirmation is what separates a guess from a smart move.

Hybrid Gartley-Elliott Wave Trade Setup on Gold – Bearish Dip In📊 Detailed Analysis & Prediction:**

This trade setup merges two powerful frameworks: a **bearish Gartley pattern** indicating a short-term pullback, and an **Elliott Wave interpretation** suggesting bullish continuation via wave five.

### 🧠 Thought Process:

1. **Gartley Pattern Completion:**

- The chart shows a completed bearish Gartley pattern with point D aligning around the **3,372 level**.

- As per harmonic rules, point D typically signals a reversal zone, suggesting a short-term drop.

2. **Projected Pullback:**

- A drop is expected toward the **3,323 support zone**, which coincides with previous swing lows and Fibonacci retracement confluence.

- This area likely marks the start of **wave five** in the Elliott Wave count — indicating that the bearish move is simply the final corrective wave before continuation.

3. **Wave 5 Bullish Opportunity:**

- Once price reaches the 3,323 zone and shows reversal confirmation, a strong bullish push is expected to begin.

- This aligns with historical wave structures and momentum indicators showing possible trend exhaustion.

Profit Targets:

| Target | Type | Price (USD) |

|--------|-----------------------|---------------|

| TP1 | Fibonacci 1.0 | 3,447.875 |

| TP2 | Fibonacci 1.27 | 3,536.025 |

| TP3 | Fibonacci 1.618 | 3,649.640 |

---

### 🛑 Stop Loss Strategy:

| Level | Type | Price (USD) |

|-----------|---------------------|---------------|

| SL1 | Conservative | 3,246.111 |

| SL2 | Aggressive | 3,198.444 |

GOLD: Move Up Expected! Long!

My dear friends,

Today we will analyse GOLD together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding above a key level of 3,393.33 So a bullish continuation seems plausible, targeting the next high. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️