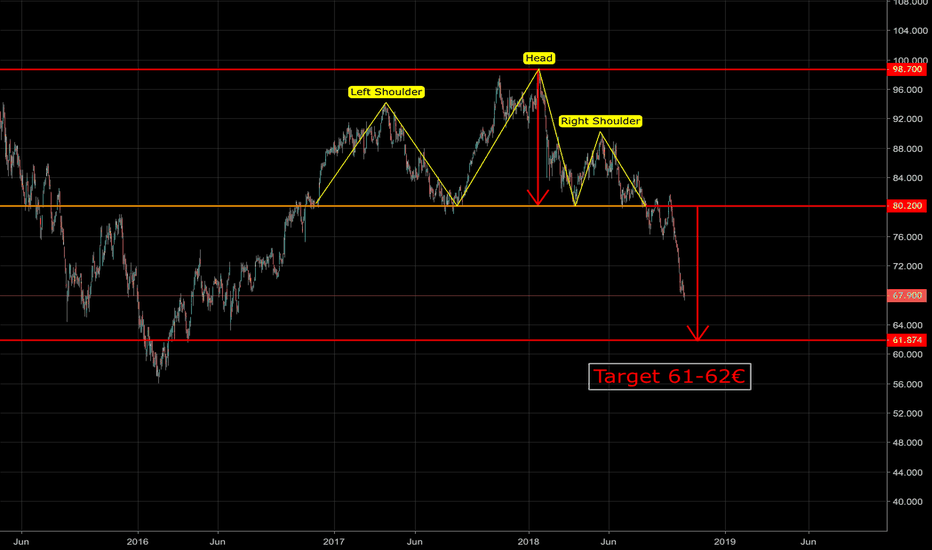

BASF - MY ASSUMPTION:WOLFE WAVE, SUPPORT, SHORT->LONG,DIVERGENCEHI BIG PLAYERS,

on this BASF chart I want present you my assumption for a developing Wolfe Wave pattern.

Currently BASF is fighting against court decisions. This is why I think, the next 3 months it will be a shortsetup. After this, BASF will touch the support line. It is close to develop a bullish Wolfe Wave pattern and start a huge rising up movement.

Furthermore, I guess that the reason for the ascent will be the the development of a remedy against the Corona Virus. In the last published WHO meeting it was talked that a remedy will be developed in 3-5 months. This would make my prediction possible, because the touching of the support line and the Wolfe Wave pattern would be final in 3-5 months.

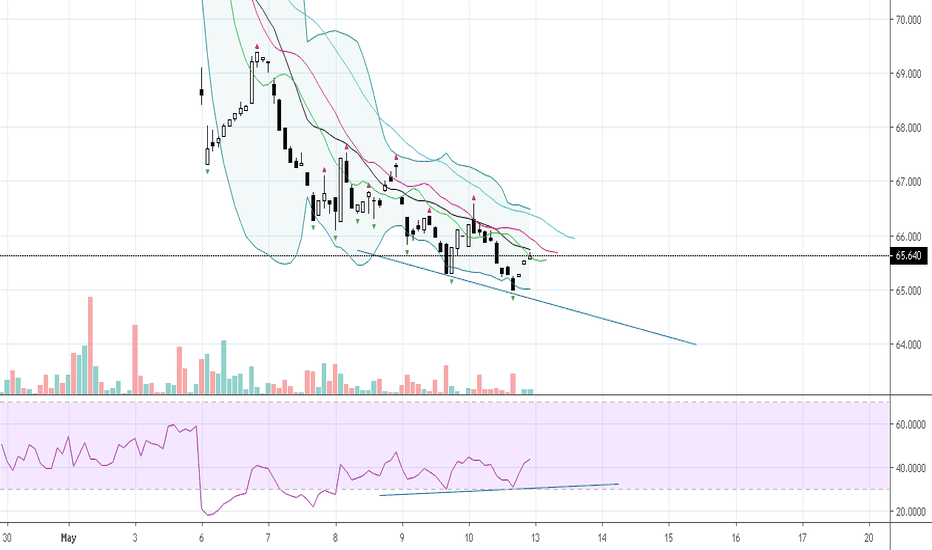

In addition, the RSI is building a divergence to the price.

Kind regards

NXT2017

BAS trade ideas

Long BASFY and short SAPThis is purely based on machine learning - but the mental model also triangulates nicely. The dip of the spread is at a 16 year low, BASF has strong fundamentals with a 5% dividend, exposure to agriculture and chemicals and there are strong components of value investing in this leg of the trade. SAP is loosing share in the cloud battle, has a much higher cost structure than competition and is pricey by all metrics. Also - FANG stocks going a bit out of fashion and cyclicals gaining ground ...

German giant BASF getting bullish.BASF SE engages in the provision of chemical products. It operates through the following segments: Chemicals, Materials, Industrial Solutions, Surface Technologies, Nutrition and Care, Agricultural Solutions, and Other. The Chemicals segment supplies petrochemicals and intermediates. The Materials segment includes isocyanates and polyamides as well as inorganic basic products and specialties for the plastics and plastics processing industries. The Industrial Solutions segment develops and markets ingredients and additives for industrial applications such as polymer dispersions, pigments, resins, electronic materials, antioxidants, and admixtures. The Surface Technologies segment offers coatings, rust protection products, catalysts and battery materials for the automotive and chemical industries. The Nutrition and Care segment consists of nutrition and care ingredients for consumer products in the area of nutrition, home, and personal care. The Agricultural Solutions segment comprises fungicides, herbicides, insecticides, and biological crop protection products, as well as seeds and seed treatment products. The Other segment is the exploration and production activities. The company was founded on April 6, 1865 and is headquartered in Ludwigshafen am Rhein, Germany.

Chemical Industry Collapse - BASF Is The BellweatherMacro

German industry in freefall - ESI Lower & PMIs lower.

Consumer confidence lower, the chemical industry relies heavily on consumer products.

China PMIs lower again.

Micro

60% of sales are based in China/Europe new orders slowing

"In China, the world’s largest automotive market, the decrease was more than twice as high, at around 13%."

Profit warning 30% revision.

The strategy has been to move into Asian markets but they are all contracting.

If the share price is higher than December 2018 and Germany is going into recession, how is the current price justified?

"Basf predicts a slower year For 2019, we expect the global economy to continue to grow at a

slightly slower pace than in the previous year. "

What a perfect 2016 for BASF....to be continued?BASF is the 4th largest DAX titel with a market capatilization of 83 Mrd. €.

It was a fantastic 2016 for BASF!

From 56,01 in February 2016 all the way up to where we are now, not far away from the ATH of the titel @ 97,22 which is not far away at all.

Therefore I would recommend to buy the breakout to a new ATH which is one of the strongest singnals a stock could generate. If BASF breaks out that would push DAX closer to its ATH at 12.400 and above.

There a several support levels above the up trend where I will try the buy in.

I a very bullish scenario the titel would not fall below 86,90.

Successful trades

BASF - update (last Oct. 22nd)okay guys. this an update from october the 22nd (). now we have finish the impulse for the first and we can look for an update. in this chart we have a bar construction like a trendchange. it's important to know how it works. let us look the chart.

we have two lines. one is red and one is blue.

is the redline the first triggerpoint, so we look at the price at 89,2 €. normally should there the trendchange starting. the stopp loss is at 97 and we going out from this trade at 91€!!! IMPORTANT!!!

let us watch the blue line. is the blue line the first triggerpoint at a price at 85,6 so we take a call with a stopploss by 80€ and going out from this trade at 84€. also IMPORTANT!!!

in the chart we have a green and red full color rectangle. the green rectangle is the finish point for the guys whose token a call at 69€ or lower. the red rectangle is the stopploss or the NO RETURN POINT! is the price below this this rectangle is the price going down to neverland ;)i hope u understand and what i mean.

for the last. if the price at 97 € i'll give an update!

good trades!