BMW3 trade ideas

BMW, General Motors, Honda, Ford and Renault are working with tA group of major automakers are about to hit the road with the first field testing of a blockchain-based vehicle identification network next month in the U.S.

As reported by Nikkei Asian Review, BMW, General Motors, Honda, Ford and Renault are working with the Mobility Open Blockchain Initiative (MOBI) on integrating the system to automatically make payments on typical commuting runs without the need for cash or credit and debit cards.

By assigning vehicles unique identities that store data such as ownership and histories on a blockchain, the industry initiative aims to remove the need for a human when settling tolls and parking fees.

Founded in May 2018 by multiple major car manufacturers, MOBI has been working to enable the sharing of road data between manufacturers, a step towards developing self-driving cars.

As Nikkei writes, participating vehicles would eventually be able to automatically pay expenses once plugged into other networks such as charging or refueling stations.

MOBI is also looking into incorporating cryptocurrencies. One such system involved compensating users in crypto for putting energy back into the power grid following an outage.

A number of automakers are looking at blockchain for facilitating processes such as payments and data sharing, especially for the not-so-distant future where automated vehicles have become the norm.

This summer, CoinDesk reported how Daimler – parent company of Mercedes-Benz – partnered with blockchain firm Riddle & Code to produce a hardware wallet for automobiles. Looking long term at solutions for self-driving vehicles and car-sharing platforms, the firms’ wallet would also create a cryptographic identity for vehicles.

Jaguar Land Rover too is looking at rewarding drivers in cryptocurrency in return for their data

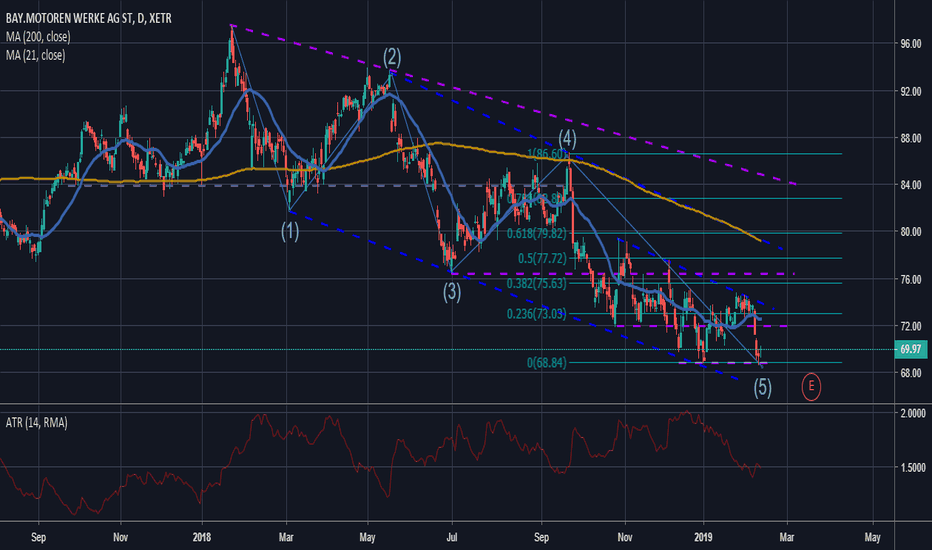

Time to buy BMW? Day before ex-dividend dateBMW entered a bullish trend back in 13 May 2016, when it paid the dividend of 2016. Yesterday was at minimums of 2013 if we do not take into account Brexit effect on 2016. Today is the day before the ex-dividend date of 2019 and it offers a dividend yield of 5.12%. Nonetheless, it's worth reminding that BMW's 2018 Earnings where -16.9% YoY so in case you happen to buy shares today, do not hold them for long. A positive point for the auto sector is that Trump will delay tariffs on autos 6 months from now. Therefore, we might expierence some volatility with BMW stock and it could have a trend reversal right from today up to levels of 74-75€. So the final conclusion would be: Buy today, seize the dividend this month and sell in 5-6 months time depending on market news.

BMW, end of cycle fadeIn Europe and Japan car makers are leading the advance on the stock market today. A new concern for automakers is Car Sharing which has taken off in cities like Moscow. BMW and Daimler are joining forces to combat ride hailing software and car sharing. DMW’s DriveNow unit which is their version of Car Sharing together with Daimler operate a total of 20,000 vehicles in 20 large international cities. Each company owns 50% in the new venture, but they remain rivals in their core business.

The reason we are presenting this trade is that global macro indicators are on the rise. A change in sentiment is approaching and BMW is a cyclical stock. Meaning it fluctuates in very wide price moves and we have currently come up against a very strong level of support. Last time these levels were in play was 2016, and the reversal from these levels was quick and strong.

BMW is at the bottom of a weeklong descent due to difficulties around Brexit and the slowing economy in Germany. We are looking for something called the “fade”. Markets move in wave formations and we expect a correction up to 72.00. For this quick long trade we put a stop loss order around 68.50 and enter the market at 69.80-70.00. The average true range of the stock is currently around 1.5€. The Fibonacci level of 38.2% is too far away, currently if we reach 72.00 this week, we can expect a retest of the 23.6% Fibonacci level at 73.00. This is not a buy and hold strategy, move your stop loss up after price breaks 71.00.