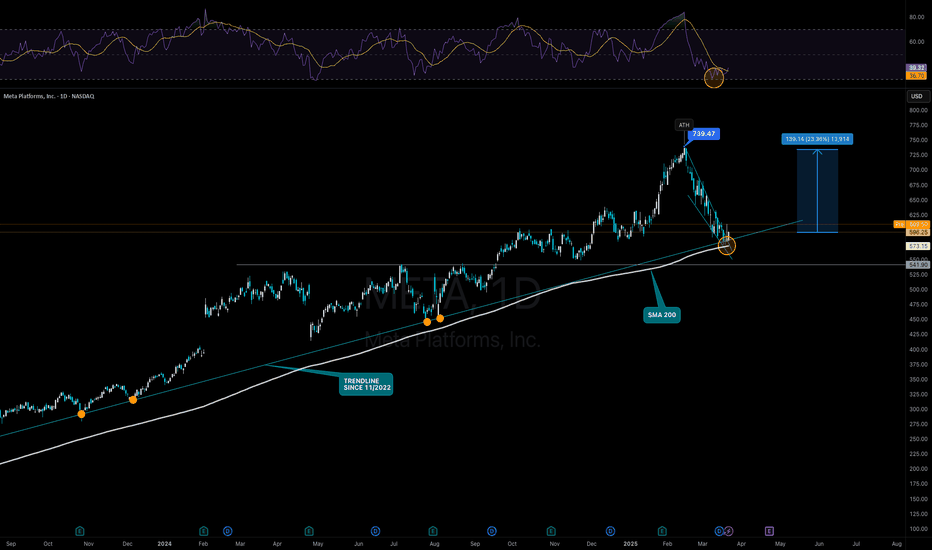

META to $740 - Chance for Strong BounceNASDAQ:META Meta has hit the trend line from November 2022 after a price loss of 20% and has shown with a first small bounce that it is still relevant. At the same time, the SMA200 is also at the same point. Last but not least, the 0.238 Fib is also located in this area (from the entire upward movement from November 2022). Technically, we can therefore definitely expect a bounce that could take us to the previous ATH at $739.

Fundamentally, Meta is also not overvalued due to its strong growth. As with many of the Mag7s, there are still problems with the AI strategy, which does not appear to be well thought out in either monetary or structural terms. However, Meta is a good candidate for actual efficiency gains due to its affiliation with the advertising market. However, the general growth is already reason enough to buy.

Support Zones

$580.00

$541.00

Target Zones

$740.00

FB2A trade ideas

$META The Last of UsThis is most certainly set to be a short analysis.

While everyone is talking about NASDAQ:TSLA no one is talking about NASDAQ:META at the close of the first quarter.

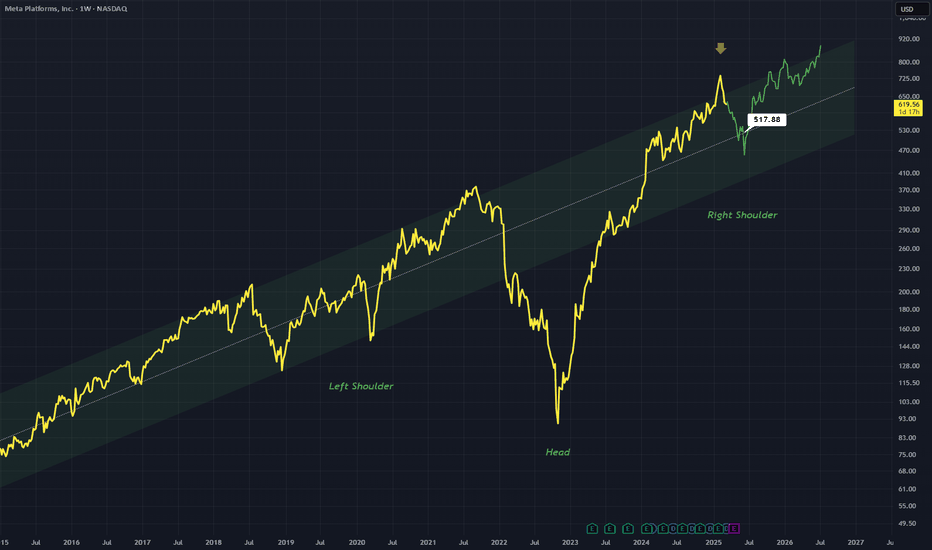

We are at the end of a massive rising wedge ending in a double Doji soon to be Missive blow off top. Previously when we called the 70%+ drop on NASDAQ:META in 2021 is was only the first move. The beginning.

This time when NASDAQ:META and all other stocks sell off 70% or more they will not be coming back with a thunderous vengeance. We will be back to the old market that hardly moves and all those poor retailers who are used to taking large moves will be in for a huge surprise. The buy and Hold market is coming back.

The liquidity is drying up and the Fed nor anyone else will step in to help.

They will take rich, poor, old young to the poor house. Liquidity wont be back for another 60-70 years.

Cash out that retirement now. Before it's too late.

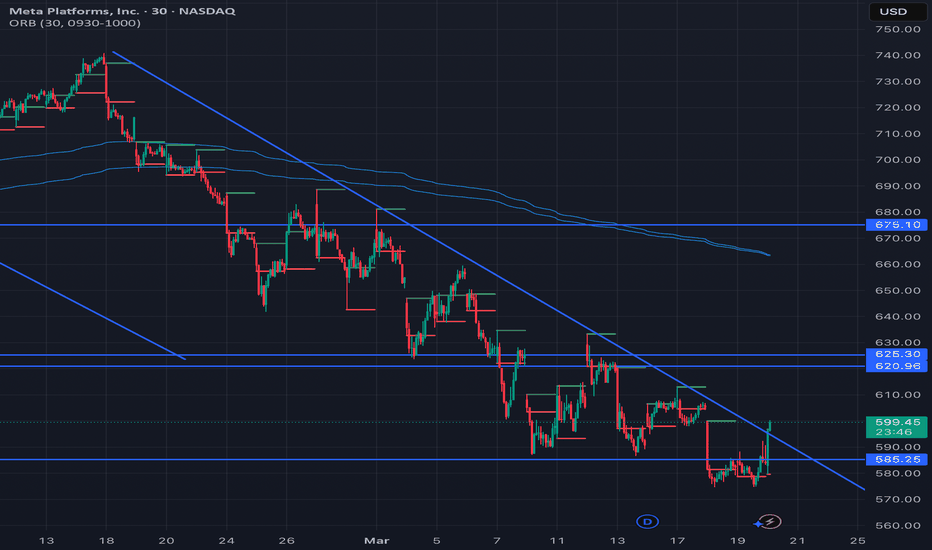

Meta bottom in?Meta has moved back above the key $600 level after holding the 200-day average test. Today the stock has broken its short-term bearish trend line, too. A close above the trend line should be a positive technical development for the stock, making it one to watch in the days ahead.

By Fawad Razaqzada, market analyst with FOREX.com

META is coming back to life!NASDAQ:META

As we discussed before a breakdown out of this Bullish Trend since 2022 would be very bearish and take META to the $400's.

Well, they said, hold my beer, and bounced hard exactly at the bottom of the channel and Anchored VWAP.

It's not over yet, as we need to follow through next week with a nice engulfing candle to make people into believers!

Not financial advice.

META) Testing Key Support – Is a Reversal on the Horizon?Technical Analysis & Options Outlook

📌 Current Price: $587.60

📌 Trend: Bullish Attempt After Key Support Hold

📌 Timeframe: 1-Hour

Price Action & Market Structure

1. Bullish Rebound from Support – META bounced off the $585–$580 demand zone, signaling buyers stepping in.

2. Breakout Setup Developing – Price is approaching trendline resistance at $595, a critical level to watch.

3. Potential Pullback Before Breakout – If META gets rejected at $595, expect a retest of $585 before another push higher.

4. MACD & Stoch RSI – Both indicate bullish momentum, but META is nearing overbought conditions, suggesting possible consolidation before continuation.

Key Levels to Watch

📍 Immediate Resistance:

🔹 $595 – Trendline Breakout Level

🔹 $605 – 2nd CALL Wall Resistance (42.52%)

🔹 $620 – 3rd CALL Wall (37.57%)

📍 Immediate Support:

🔻 $585 – Demand Zone & Breakout Retest Level

🔻 $580 – Highest Negative NETGEX / PUT Support

🔻 $574.66 – Critical Support Level for Bulls

Options Flow & GEX Sentiment

* IVR: 28.6 (Lower Volatility)

* IVx: 40.9 (-2.14%) (Declining Volatility, Favoring Breakouts)

* GEX (Gamma Exposure): Bearish Bias, But Improving

* CALL Walls: $605 & $620 (Upside targets)

* PUT Walls: $580 & $574.66 (Key demand zones)

📌 Options Insight:

* Above $595, META could see a momentum-driven rally toward $605–$620 as dealers hedge long positions.

* Below $585, risk increases for a test of $580–$574.66, where heavy liquidity is concentrated.

My Thoughts & Trade Recommendation

🚀 Bullish Case: If META holds above $585, expect a push toward $605–$620.

⚠️ Bearish Case: If META fails at $595, expect a pullback to $580 before another reversal attempt.

Trade Idea (For Educational Purposes)

📌 Bullish Play:

🔹 Entry: Break and hold above $595

🔹 Target: $605–$620

🔹 Stop Loss: Below $585

📌 Bearish Play (Hedge Idea):

🔻 Entry: Rejection at $595

🔻 Target: $580–$574.66

🔻 Stop Loss: Above $600

Disclaimer

This analysis is for educational purposes only and does not constitute financial advice. Always perform your own research and manage risk accordingly.

Final Thoughts

META is attempting a breakout from support, but $595 is a critical level. A successful breakout could lead to $605–$620, while failure at resistance could bring a retest of $580 before the next move. Wait for confirmation before taking a trade.

META: Still My #1 Stock for 2025META is at a great spot to look for an entry.

It was my favorite stock in 2024, and as we move into 2025, it remains my top pick.

Last year, I started using META as an advertising platform, and it completely blew me away. The speed at which money goes out is unlike anything I’ve seen. Compared to Google? There’s no comparison. In the last 30 years, I haven’t dealt with any service or company that can burn through ad dollars this fast—and that’s exactly why I’m bullish and I started buying on Friday, March 7, with a sample size—now watching for the next opportunity to add.

META to the $400s?! I hope so!!!NASDAQ:META

Is the show over or will the show go on?

At the bottom of the Bullish Channel that started in October 2022.

A breakdown of this channel could lead NASDAQ:META back to a stock price in the 400's...

A Breakdown retest of the lower Anchored VWAP band could be a false breakdown and bounce area as well. If we break through that though then this name is going to the $400's area.

Not financial advice

META’s Best Correction in a Long Time – A Prime Buying Opportuni🔹 Current Price: $583.39

✅ TP1: $620 – Short-Term Rebound to Mid-Channel Resistance

✅ TP2: $720 – Retesting Previous Highs

✅ TP3: $765+ – Analyst Average Target, Aligning with Recovery Patterns

🔥 Why Are We Bullish?

1️⃣ Analyst Ratings & Price Targets

Strong Buy Consensus: Major institutions maintain bullish ratings on META.

Average Price Target: $765 → +29% upside from current levels.

Price Target Range: $580 (low) to $935 (high).

JPMorgan Calls META a Top Pick: Meta and Spotify named as two of the best investment opportunities currently.

2️⃣ Market Correction Presents a Strong Entry Point

Biggest pullback since September 2023 – The last time META corrected 23% in two months, it fully recovered within two months and resumed its uptrend.

META is now at major trendline support , historically a strong accumulation zone.

RSI indicates potential reversal , aligning with previous rebounds.

3️⃣ AI Expansion & Business Growth

Meta’s Llama AI Model Hits 1 Billion Downloads , reinforcing the company’s dominance in AI innovation.

Heavy investments in AI & machine learning strengthen long-term growth prospects.

4️⃣ Strategic Growth & Revenue Expansion

Strong Ad Revenue Growth: Despite market volatility, Meta’s ad business remains a cash machine.

Metaverse & Reality Labs: Long-term investments positioning Meta as a leader in next-gen digital experiences.

New Revenue Streams from AI & Cloud-Based Services: Expected to drive earnings in 2025 and beyond.

📌 Conclusion

META’s 23% correction is presenting a rare discounted entry opportunity in an otherwise strong bullish trend. With AI growth, ad revenue expansion, and a rebound pattern that historically favors a recovery, META remains one of the best opportunities in the tech sector right now.

Meta’s Wild Ride: Skyrocketing to $866 or Crashing to $374 Get ready, traders—Meta’s at a crossroads! If we smash past $64.70, buckle up for a thrilling climb to $866 as AI hype and Metaverse dreams fuel the fire. But if the bears take over, we could tumble hard to $442—or even skid down to $374. This isn’t just numbers; it’s a rollercoaster of hope, greed, and nail-biting suspense. Which way will it break?

Kris/Mindbloome Exchange

Trade Smarter Live Better

Reversal To The Long on Meta Platforms. METAThe previous ides on short was very profitable and I believe that we are facing a local reversal here based on price action and volatility , stochastic indicators below. This is a within one candlestick set up, so relatively risky. And yet most pivot setups are.

Meta Stock Chart Fibonacci Analysis 031125Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 600/61.80%

Chart time frame: D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: B

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

META: Key support! Watch out for a possible opportunity!For a few weeks now we have been experiencing PANIC in the markets due to Trump's AGGRESSION with tariffs. The question we all have to ask ourselves is whether the USA will enter a RECESSION and ALL COMPANIES will continue to fall sharply, or on the contrary, if Trump will negotiate and therefore the markets will RECOVER.

From my point of view, TRUMP has become too aggressive and IS ALREADY STARTING TO WORRY ABOUT SOME COMMENTS OF THE LAST FEW DAYS, and HE WILL NEGOTIATE!! Regardless of this, there are companies that despite the great fall suffered, REMAIN BULLISH AND POSITIVE in the year, as is the case of META, which has risen by +2% in 2025.

The graph above SHOWS YEAR BY YEAR the trend and WHEN a CHANGE IN TREND occurs, in this way we will see more clearly the current situation of the company this year. In the graph below with H4 time frame we see a ZOOM of the current situation to know more precisely when a floor is formed and the retreat phase in which it is immersed ends.

If we look at this year 2025, its TREND is still BULLISH in a RECOIL PHASE and at this moment it is in A VERY IMPORTANT SUPPORT that it should respect (zone 580) in order NOT TO START A CHANGE IN TREND.

If the zone respects it and a BOTTOM is formed, the price will quickly rise towards its first resistance at 641, which if it is surpassed WE WILL SEE NEW MAXIMUMS in the value.

---> What do we do?

1) If our PROFILE is AGGRESSIVE, we enter LONG IN THE CURRENT ZONE.

2) If our PROFILE is CONSERVATIVE, WE WAIT for a floor to form or for the price to surpass the 641 zone.

-------------------------------------

Strategy to follow IF OUR PROFILE IS AGGRESSIVE:

ENTRY: We will open 2 long positions in the current zone of 610

POSITION 1 (TP1): We close the first position in the 640 zone (+5.5%)

--> Stop Loss at 568 (-6%).

POSITION 2 (TP2): We open a Trailing Stop type position.

--> Initial dynamic Stop Loss at (-6%) (coinciding with the 568 of position 1).

---We modify the dynamic Stop Loss to (-1%) when the price reaches TP1 (640).

-------------------------------------------

SET UP EXPLANATIONS

*** How do we know which 2 long positions to open? Let's take an example: If we want to invest 2,000 euros in the stock, what we do is divide that amount by 2, and instead of opening 1 position of 2,000, we will open 2 positions of 1,000 each.

*** What is a Trailing Stop? A Trailing Stop allows a trade to continue gaining value when the market price moves in a favorable direction, but automatically closes the trade if the market price suddenly moves in an unfavorable direction by a certain distance. That certain distance is the dynamic Stop Loss.

-->Example: If the dynamic Stop Loss is at -1%, it means that if the price drops by -1%, the position will be closed. If the price rises, the Stop Loss also rises to maintain that -1% during increases, therefore, the risk is increasingly lower until the position becomes profitable. In this way, very solid and stable price trends can be taken advantage of.

Incoming 40% correction for FacebookOn the above 10 day chart price action has rallied 500% since October 2022. It is somewhat unfortunate to see so many long ideas at the moment.

Motley Fool August 8th:

“Here's how Meta could achieve a $2 trillion valuation within three years, and if it does, investors who buy the stock today could earn a 67% return.”

Very misleading.

Why bearish?

Failed support. It is very clear to see, price action has broken through support and confirmed it as resistance. You can see this more clearly on the Log chart below.

Regular bearish divergence. Multiple oscillators now print negative divergence with price action across a 50 day period.

On the monthly chart below a hanging man candle print can be seen. Although the candle does not confirm until the end of the month there is a clear indication of buyer exhaustion. This is an important trend reversal indication.

Is it possible price action continues to rise? Sure.

Is it probable? No.

Ww

Log chart

Monthly hanging man candlestick