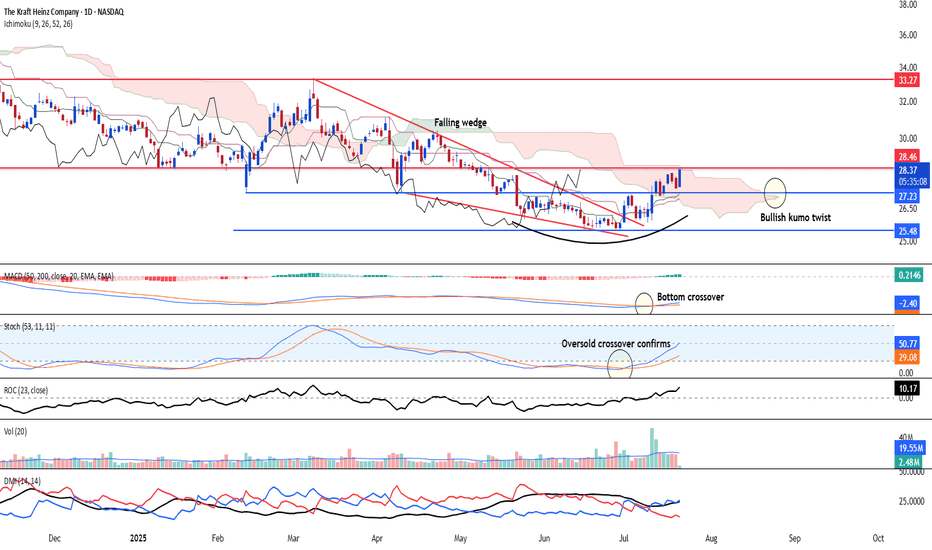

Bottoming out - Likely to see strong reversion up NASDAQ:KHC is looking at a bottoming out after the stock breaks above the falling wedge formation. We could also observe that there is a steady climb up of bullish bars after the breakout. Based on the momentum, the stock is ripe to break 28.46 potentially. Long-term target is at 33.27 and 38.00.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.045 EUR

2.65 B EUR

24.97 B EUR

1.18 B

About The Kraft Heinz Company

Sector

Industry

CEO

Carlos Arturo Abrams-Rivera

Website

Headquarters

Pittsburgh

Founded

1909

FIGI

BBG009J3XB11

The Kraft Heinz Co. engages in the manufacture and market of food and beverage products. It operates through the North America and International geographical segments. The company was founded on July 2, 2015, and is headquartered in Pittsburgh, PA.

Related stocks

KHC – Momentum Reversal with Volume Surge & Tactical Exit Plan📈 Ticker: NASDAQ:KHC (The Kraft Heinz Company – NASDAQ)

📆 Timeframe: 1D (Daily)

💵 Current Price: $27.80

📊 Pattern: Falling Wedge Breakout + Volume & RSI Divergence

📌 Trade Setup:

✅ Our Entry: $26.60

⛔ Stop-Loss: Below $24.80

🔰 Confirmation Signals:

Bullish volume divergence: Selling pressure d

KHC | Reversal Breakout in Motion – Triggered with Target $31📍 Ticker: NASDAQ:KHC (The Kraft Heinz Company)

📆 Timeframe: 1D (Daily)

📉 Price: $26.61

📈 Pattern: Falling wedge breakout + horizontal support reclaim

📊 Breakout Probability: ~68% upward

🔍 Technical Setup:

KHC has just broken above a descending wedge, paired with a clear reclaim of horizontal stru

KHC Monthly Support and Resistance Lines for June 2025KHC Monthly Support and Resistance Lines for June 2025, only valid till end of June.

Overview:

These purple lines act as Support and resistance lines when the price moves into these lines from the bottom or the top direction. Based on the direction of the price movement, one can take long or shor

$KHC (FIXED) I believe in the next 6 months we will see significant price action in favor of the bulls. I could be wrong because technically NASDAQ:KHC did invalidate what I had drawn for the run up using Elliott wave. I still think it is due for a bounce to the upside earnings were better than expected and I

$KHC: Kraft Heinz – Sizzling Growth or Cooling Off?(1/9)

Good Morning, snackers! 🌞 NASDAQ:KHC : Kraft Heinz – Sizzling Growth or Cooling Off?

Kraft Heinz dished out $6.58B in Q4 2024 but missed the mark—price hikes are biting back! Can this food giant spice things up again? Let’s dig in! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Q4 2024: Revenue at $6.58

$KHCKraft Heinz Co. (KHC) is scheduled to report its fourth-quarter and full-year 2024 earnings on February 12, 2025.

Analysts anticipate earnings per share (EPS) of $0.78 for this quarter, consistent with the same quarter last year.

Recent options activity indicates heightened interest, with signif

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US50077LAB2

KRAFT HEINZ F. 16/46Yield to maturity

6.81%

Maturity date

Jun 1, 2046

BRK5107866

Kraft Heinz Foods Co. 4.875% 01-OCT-2049Yield to maturity

6.64%

Maturity date

Oct 1, 2049

US50077LAM8

KRAFT HEINZ F. 2045Yield to maturity

6.57%

Maturity date

Jul 15, 2045

BRK5107863

Kraft Heinz Foods Co. 5.5% 01-JUN-2050Yield to maturity

6.51%

Maturity date

Jun 1, 2050

US50076QAE6

KRAFT HEINZ CO. 2042Yield to maturity

6.42%

Maturity date

Jun 4, 2042

BRK5107867

Kraft Heinz Foods Co. 4.625% 01-OCT-2039Yield to maturity

6.29%

Maturity date

Oct 1, 2039

US50076QAN6

KRAFT HEINZ F. 2040Yield to maturity

6.06%

Maturity date

Feb 9, 2040

KF4B

KRAFT HEINZ F. 2039Yield to maturity

5.90%

Maturity date

Jan 26, 2039

BRK6010577

Kraft Heinz Foods Co. 5.4% 15-MAR-2035Yield to maturity

5.51%

Maturity date

Mar 15, 2035

BRK4396197

Kraft Heinz Foods Co. 5.0% 15-JUL-2035Yield to maturity

5.50%

Maturity date

Jul 15, 2035

BRK4261518

H. J. Heinz Company 5.2% 15-JUL-2045Yield to maturity

5.36%

Maturity date

Jul 15, 2045

See all KHNZ bonds

Curated watchlists where KHNZ is featured.

Frequently Asked Questions

The current price of KHNZ is 24.290 EUR — it has decreased by −1.04% in the past 24 hours. Watch KRAFT HEINZ CO.DL -,01 stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on XETR exchange KRAFT HEINZ CO.DL -,01 stocks are traded under the ticker KHNZ.

KHNZ stock has risen by 0.56% compared to the previous week, the month change is a 8.90% rise, over the last year KRAFT HEINZ CO.DL -,01 has showed a −20.32% decrease.

We've gathered analysts' opinions on KRAFT HEINZ CO.DL -,01 future price: according to them, KHNZ price has a max estimate of 28.36 EUR and a min estimate of 22.35 EUR. Watch KHNZ chart and read a more detailed KRAFT HEINZ CO.DL -,01 stock forecast: see what analysts think of KRAFT HEINZ CO.DL -,01 and suggest that you do with its stocks.

KHNZ reached its all-time high on Feb 22, 2017 with the price of 91.000 EUR, and its all-time low was 18.000 EUR and was reached on Mar 16, 2020. View more price dynamics on KHNZ chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

KHNZ stock is 1.78% volatile and has beta coefficient of 0.07. Track KRAFT HEINZ CO.DL -,01 stock price on the chart and check out the list of the most volatile stocks — is KRAFT HEINZ CO.DL -,01 there?

Today KRAFT HEINZ CO.DL -,01 has the market capitalization of 28.90 B, it has increased by 4.80% over the last week.

Yes, you can track KRAFT HEINZ CO.DL -,01 financials in yearly and quarterly reports right on TradingView.

KRAFT HEINZ CO.DL -,01 is going to release the next earnings report on Jul 30, 2025. Keep track of upcoming events with our Earnings Calendar.

KHNZ earnings for the last quarter are 0.57 EUR per share, whereas the estimation was 0.56 EUR resulting in a 3.09% surprise. The estimated earnings for the next quarter are 0.54 EUR per share. See more details about KRAFT HEINZ CO.DL -,01 earnings.

KRAFT HEINZ CO.DL -,01 revenue for the last quarter amounts to 5.55 B EUR, despite the estimated figure of 5.56 B EUR. In the next quarter, revenue is expected to reach 5.31 B EUR.

KHNZ net income for the last quarter is 658.13 M EUR, while the quarter before that showed 2.06 B EUR of net income which accounts for −68.03% change. Track more KRAFT HEINZ CO.DL -,01 financial stats to get the full picture.

Yes, KHNZ dividends are paid quarterly. The last dividend per share was 0.35 EUR. As of today, Dividend Yield (TTM)% is 5.58%. Tracking KRAFT HEINZ CO.DL -,01 dividends might help you take more informed decisions.

KRAFT HEINZ CO.DL -,01 dividend yield was 5.27% in 2024, and payout ratio reached 70.85%. The year before the numbers were 4.33% and 69.21% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 27, 2025, the company has 36 K employees. See our rating of the largest employees — is KRAFT HEINZ CO.DL -,01 on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. KRAFT HEINZ CO.DL -,01 EBITDA is 5.78 B EUR, and current EBITDA margin is 24.53%. See more stats in KRAFT HEINZ CO.DL -,01 financial statements.

Like other stocks, KHNZ shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade KRAFT HEINZ CO.DL -,01 stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So KRAFT HEINZ CO.DL -,01 technincal analysis shows the buy rating today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating KRAFT HEINZ CO.DL -,01 stock shows the sell signal. See more of KRAFT HEINZ CO.DL -,01 technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.