XLMUSD trade ideas

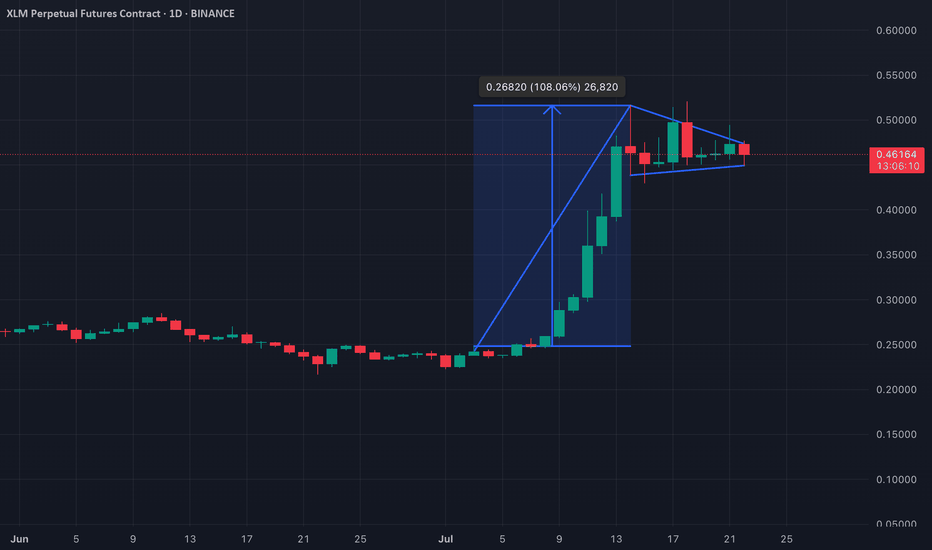

Juicy 12hr Setup on $XLMUSDT

Decided to take this as a short-term play, level by level.

Already holding an initial position (see my previous CRYPTOCAP:XLM post), but this current setup was too clean to pass up.

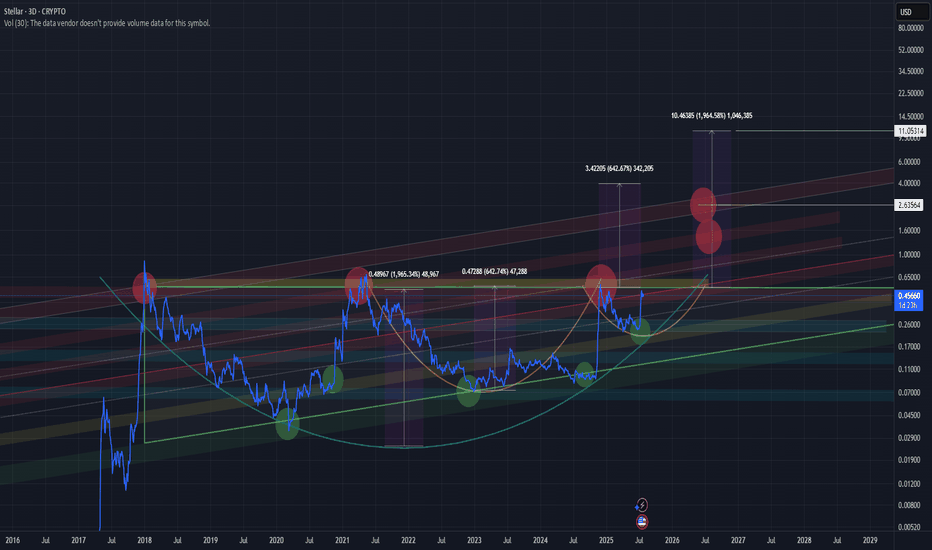

Still believe CRYPTOCAP:XLM is one of those coins primed to finally break out of its multiyear consolidation—and I’m expecting that breakout to happen this year.

First TP at 62c, and letting the rest ride if momentum kicks in. BINANCE:XLMUSDT

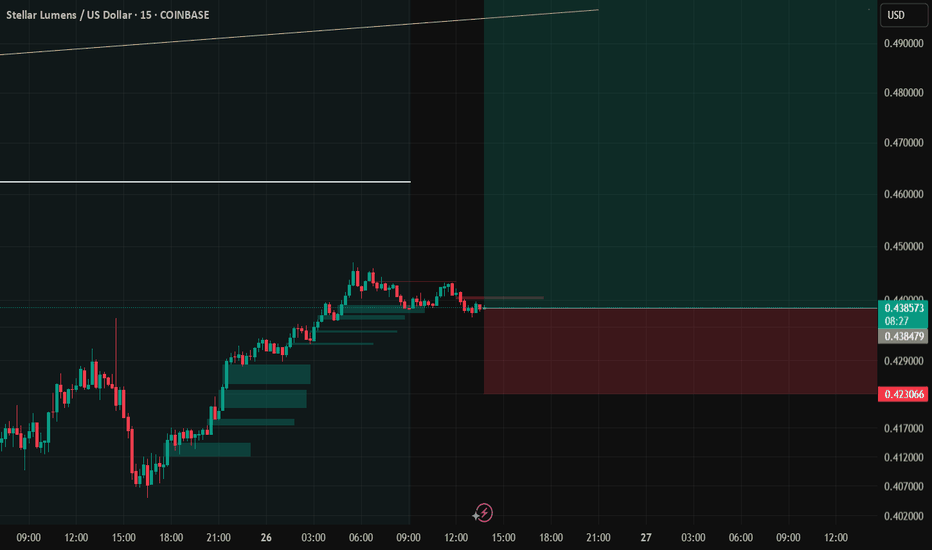

Xlm bounce off my T2 confirmed. Is Xlm now going lower to my T3I was hoping for a larger rally after this anticipated bounce off my T2. But if Xlm doesn't hold support above $0.42, I believe Sui is going lower towards my T3.

I will post my T3 target if/when Xlm holds resistance below my recently hit T2.

May the trends be with you.

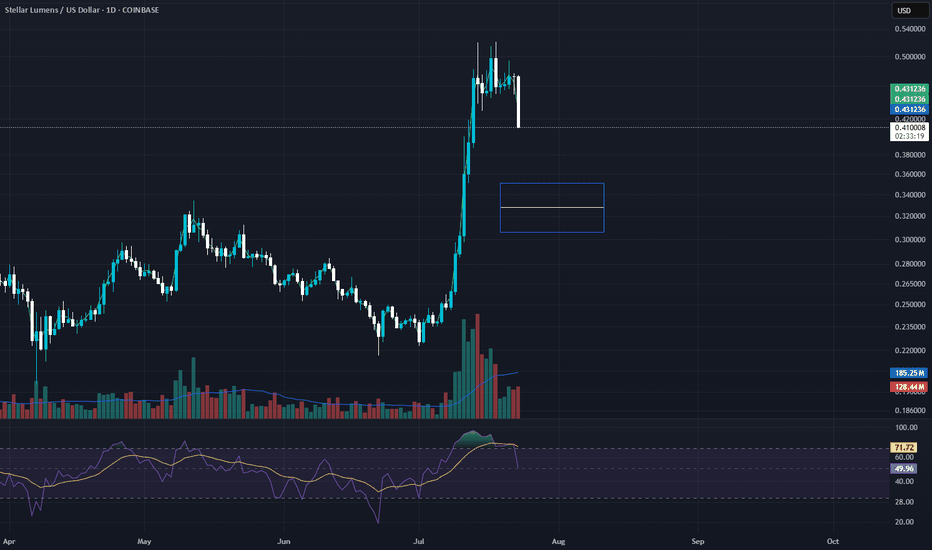

XLM - Getting Ready to go BerserkAfter a huge weekly candle, XLM still holds its ground at around 0.45 - 0.47, it's quite evident that it's getting ready to prime to its next target, Stoch RSI on daily is cooling down, and market is grinding slowly, when this blows past 0.53, it essentially breaks past it's all time high, a 7 year consolidation pattern would be breaking out and heading towards the moon, Targeting $4-$6

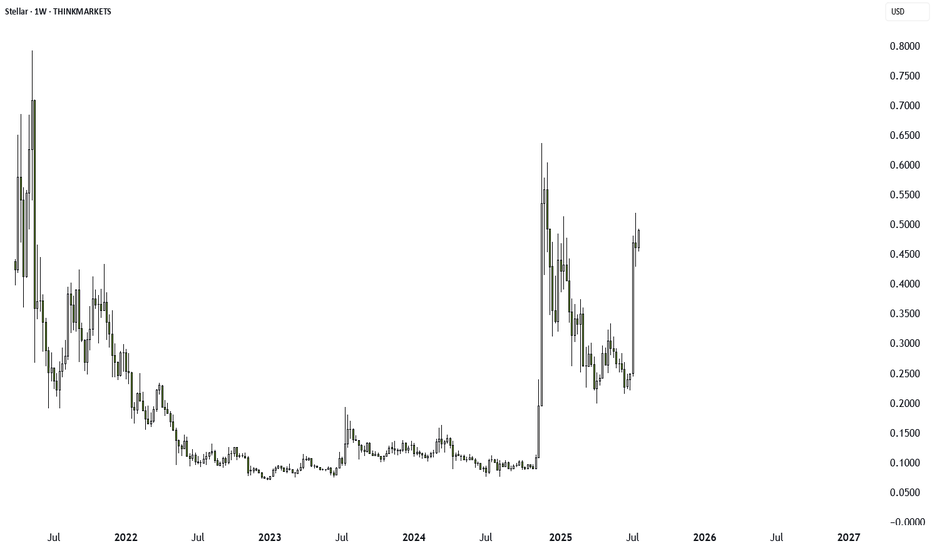

XLM/USD – Glow Faded FastStellar had a beautiful rally—until it didn’t. Price lost the $0.4080 key level and sits well below the 200 SMA, confirming a bear-biased market. Current bounce toward $0.3950–$0.4000 is technical and weak, lacking follow-through or strong RSI signals (still under 52). This remains a fade-the-rip setup unless buyers force a structural reclaim above previous supply.

🔴 SHORT bias continues below $0.4080.

🟢 Long only valid if bullish flip + volume returns above 200 SMA.

📊 Keywords: #XLMUSD #FadingMomentum #SMARejection #CryptoBearish #ChartPatterns #BreakdownAlert

Bears Take Control: XLM/USD Struggles Below $0.40

Price has closed below the middle Bollinger Band (blue line), indicating bearish pressure.

Recent candles show rejection wicks on top and strong red-bodied candles, signaling active selling.

Support zone around $0.40 has been breached and price is struggling to reclaim it.

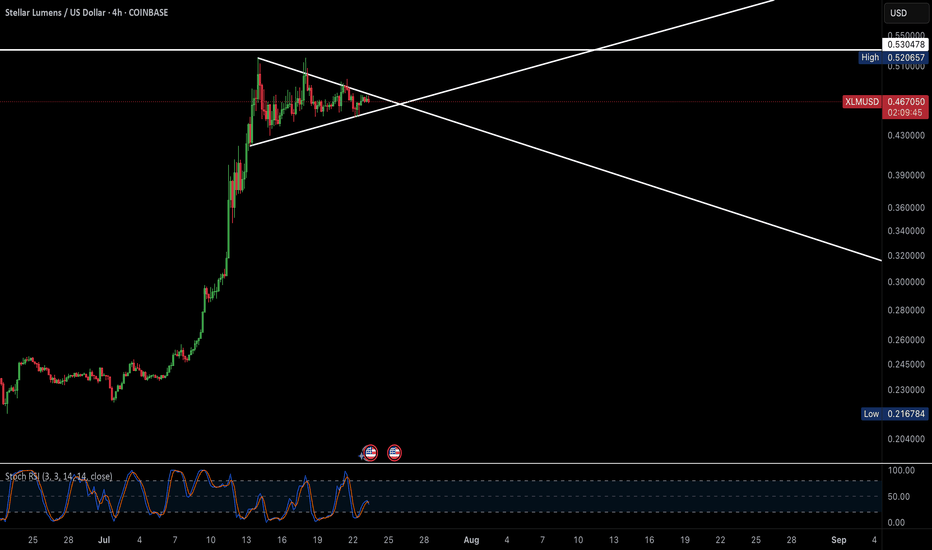

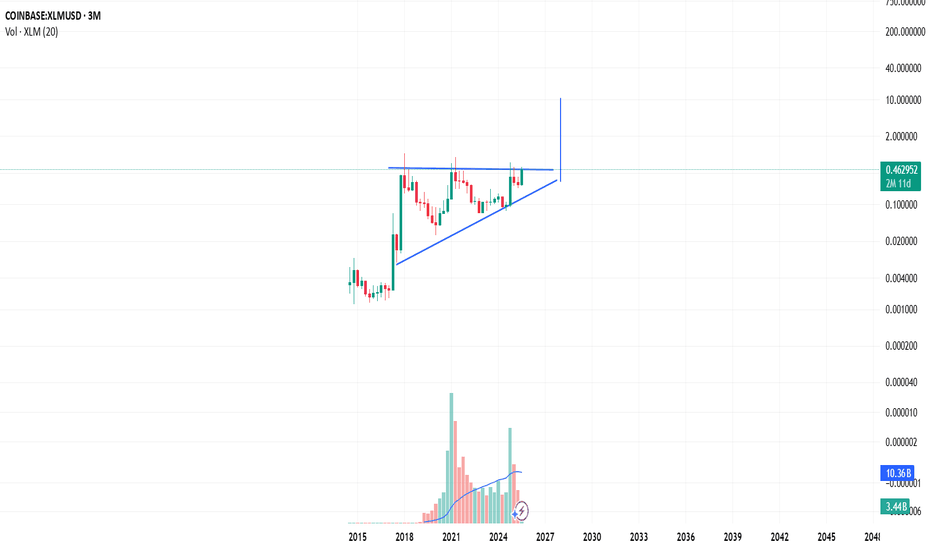

XLM: Bullish Pennant Signals Possible Breakout Rally IncomingXLM has formed a bullish pennant on the daily chart—a classic continuation pattern that typically follows a strong upward price surge. This formation, marked by a consolidation phase in the shape of a symmetrical triangle, suggests that buyers are briefly pausing before potentially resuming the uptrend.

A breakout above the pennant’s upper trendline would likely confirm bullish momentum, giving traders a clear signal to enter long positions. If this breakout occurs with strong volume, XLM could see an explosive move higher, potentially mirroring the size of the initial flagpole that led into the consolidation. Keep an eye on resistance levels as a break could spark the next leg up.

XLMUSD – Trying to Stand UpXLM fell aggressively from $0.4850 and broke below its SMA 200 for the third time in two sessions. RSI rebounded from oversold (~30), currently hovering near 42. The price is stabilizing near $0.4550 support — possible relief bounce brewing, but no higher highs yet. Caution advised.

Solana Hits Target with 9x ROI, More Upside Ahead?Solana just smashed our target, delivering up to 9x returns for those who held on. In this video, we break down the current setup, where the next 40% move could come from, and what to watch in funding rates and BTC dominance. Altcoins are waking up. Are you ready?

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

XLM/USD XLM is showing one of the strongest bullish setups right now.

A macro “Cup”, with a smaller “Cup with Handle” forming inside it — a powerful setup often leading to parabolic breakouts.

Before a true breakout, price may fake out to the downside, trapping longs.

This is classic market maker behavior — shakeouts followed by strong reversal and breakout. Stay focused on the reaction around yellow zone.

Currently in the final stages of the “handle” formation.

A breakout may confirm a move toward $4