XRPUSD.P trade ideas

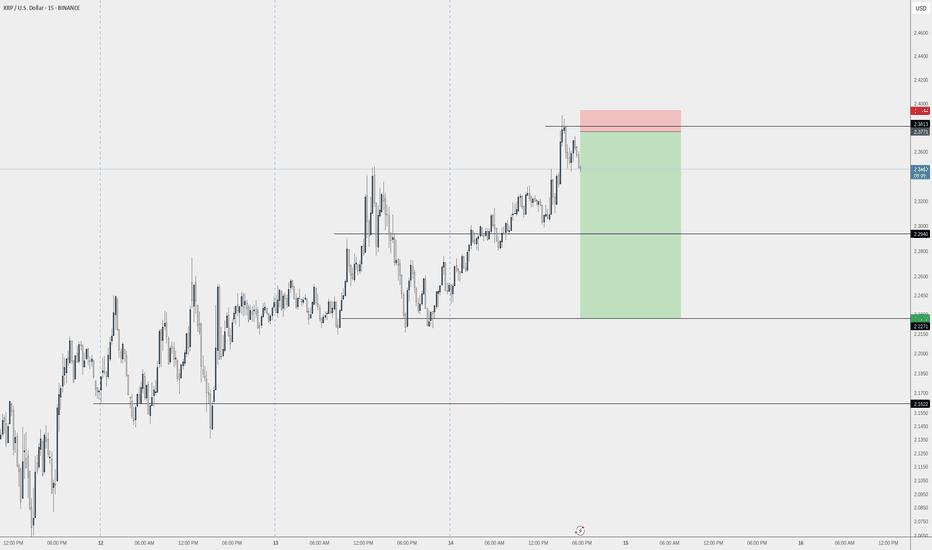

So with the new day and the new blue volume candleSo with the new day and the new blue volume candle.

You note that the four yellow line still exist and are accommodated by the new blue candle we may see this do a double top at the $2.38 Mark but then I anticipate it's going to pull back to the $2.26 area the first 50% byline area overall it will be an up move but it has to come down to cool off and allow investors to take some profit off the table

Adjusted Fibonacci Sequence due to the higher priceAdjusted Fibonacci Sequence due to the higher price

All else is as is I'm buying lower did not chase this candle sold it $2.32 I believe that that was the top of $2.38 it caused the Divergence and now the price reverses once it hits the 50% line I'm going to sell my xrp 3s short and by long $7,777 which is 50% of my Holdings and by lower if necessary

XRP Approaches Critical Support at $2.00Key Technical Level:

XRP is testing the strong $2.00 support level, which has consistently acted as a key price floor since December.

Descending Triangle Formation:

The price action is forming a descending triangle, where decreasing volatility suggests an imminent breakout. This pattern emerges as XRP approaches the intersection of descending resistance and horizontal support.

Bullish or Bearish?

A confirmed breakout above resistance could trigger a strong rally.

A sustained drop below $2.00 would invalidate the bullish outlook, potentially leading to a retracement toward $1.60-$1.80.

Market Perspective:

XRP’s rally from $0.60 to over $3.40 since November suggests that the current correction is likely a phase of profit-taking rather than a full trend reversal. However, traders should remain cautious and watch for confirmation of direction.

Stay alert—XRP is at a decisive moment! 🚀📉

#XRP #Crypto #MarketAnalysis #Trading #TechnicalAnalysis #Cryptocurrency #Bullish #SupportLevel

Updated Fibonacci sequence to the bar on xrpUpdated Fibonacci sequence to the bar on xrp.

Prior post States at all however my bylines were incorrect I took the Fibonacci sequence on the blue bar to get the lines to put my buy-ins on they were incorrect on the prior chart I want to update that for you now

For those that follow xrp on my behalfFor those that follow xrp on my behalf

I had already posted that at around $2.32 I would sell all I have actually been buying and selling throughout the candle going up I would make a cell line by lower sell it higher by lower sell it higher I have been doing that all the way to the top now you're going to see 50% lines of my total going in on those bylines 50% on each of those lines and then all of it at the bottom line if it goes that far when a price reaches those by lines I will be putting in that amount in three times Leverage

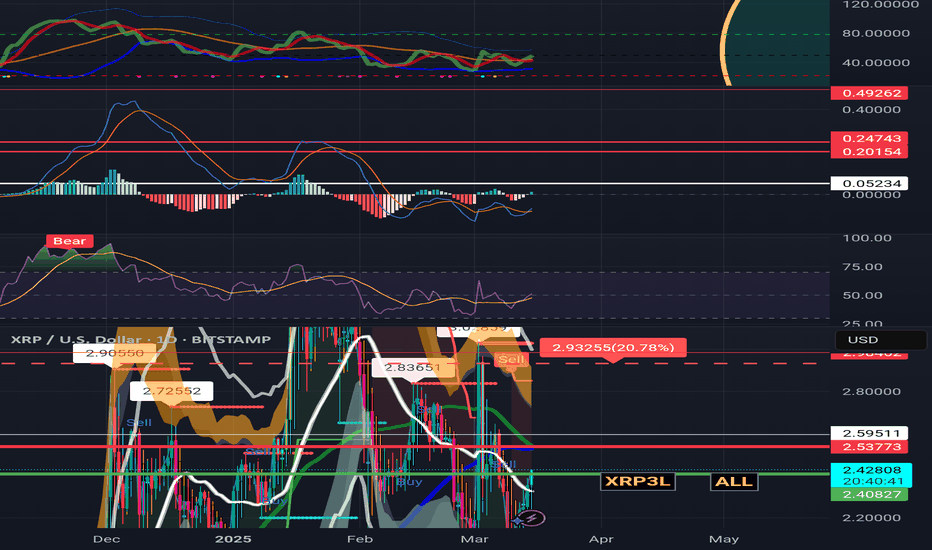

XRP next potential move to $4.00 !Between now to 17 March - Potential scenario's for XRP

Bearish scenario's

3D RSI need to break 55 . If reject at around 55 or lower, it will go downtrend to 28 or below. Look for signs if crossing the SMA yellow line for bullish move.

MACD on 3D showing hope for uptrend but lets see if it breaks above by 17th Mar.

Full Moon indicator printed today, usually marks the downtrend scenario to begin today till 29

March before a new moon begin

* A potential rejection can happen at $2.48 or $2.60 . If breaks above and stays there, then good.

* Ascending broadening pattern is generally bearish and it's a sign that it's nearing a significant resistance level it indicates an upward momentum is weakening and a potential breakdown can happen

Bullish scenarios

Daily candle looks good now but may be short-lived beyond the 17th Mar. So watch the movement towards this date

3D candle have been bearish since 22 Jan. 2nd half of March need to show upward strength

Candle bounced at 50 MA and showed signs of upward trend .

This ascending broadening wedge is quite unique in my opinion. It also shows the market is quite undecided about which direction to go and waiting for a violent move. But if you notice the trajectory, the likelihood is more is towards uptrend .

It needs to break the $2.48 and $2.60 with a volume for the pump to arrive at a new ATH of $4.00

Beyond $4.00 is the new price discovery zone and it's anyone's guess where it will go next. Perhaps back to $1.00 😅 for a cooling down retracement?

Next Likelihood Potential Move

↗️Bullish: 60%🟢

↘️Bearish: 40%🔴

XRP'S PATH IS OVER AT $2.335 and I have a safe sell.7This is crazy Chad, when this ends and I'm positive we're going to go to the second round and you see I've already got those lines prepared I didn't measure them with the vertical line that I created from the first run and overlaid it to the second run and it matches and I thought okay this is one two three four and I've got to have one more so you'll see where my cell lines in that third echelon and that red line is my safe cell okay I want to get out on that line even though it could go a little bit higher but that's as far as it's going to go and then this whole thing is going to fall down we're not going to $2.48 we're not going to $2.52 and we're not going to any other number above $2.32 on the safe side and know that overall on this Market this is a down Market so we're profiting up in the down market and we still got two more times to do it and double down each time remember I'm doing 3XL which is three times the bonus profit that I get for the amount of participation that I'm giving I'm buying billion

XRP will explode in valuePrice Movement and Trends

Initial Consolidation (August 2024 - November 2024):

XRP starts the chart trading sideways around $0.50 to $0.60. This period shows low volatility with small candlesticks, indicating a lack of strong directional momentum. It suggests a consolidation phase where buyers and sellers were in balance.

Breakout and Uptrend (Late November 2024 - January 2025):

Around late November 2024, XRP breaks out of its consolidation with a sharp upward move. The price surges from $0.60 to a peak of around $4.00 by early January 2025, a massive increase of over 500% in a short period.

This rally is characterized by large green candlesticks, indicating strong buying pressure. The consistent higher highs and higher lows confirm a strong bullish trend.

Volume likely increased during this period (though volume bars aren’t visible), as such a significant price move typically requires high participation.

Peak and Correction (January 2025 - February 2025):

XRP reaches a high of approximately $4.00 in early January 2025, followed by a sharp correction. The price drops to around $2.50 by mid-February 2025, a decline of about 37.5% from the peak.

This correction is marked by large red candlesticks, showing strong selling pressure. The drop suggests profit-taking by traders who entered during the earlier rally, possibly triggered by overbought conditions (though no RSI or similar indicators are visible to confirm this).

Stabilization and Recovery Attempt (February 2025 - March 2025):

After the correction, XRP stabilizes between $2.50 and $3.00. The price shows smaller candlesticks and some consolidation, indicating a pause in the downtrend.

Toward early March 2025, XRP attempts a recovery, climbing back to $2.837 by March 13, 2025. The smaller green candlesticks in this phase suggest cautious buying, but the momentum isn’t as strong as the earlier rally.

Key Levels and Support/Resistance

Support: The $2.50 level acted as a support during the correction in February 2025. This level held multiple times, indicating buyers stepping in to defend it.

Resistance: The $4.00 level was a significant resistance, as it marked the peak of the rally before the correction. If XRP attempts another upward move, this level may act as a barrier.

Current Price: At $2.837, XRP is trading above the recent support but far below its January peak, suggesting it’s in a consolidation phase with potential for either direction.

Technical Observations

Volatility: The chart shows periods of both high and low volatility. The rally in November-December 2024 was highly volatile, while the consolidation phases (August-November 2024 and February-March 2025) show lower volatility.

Trend: The overall trend from November 2024 to March 2025 is bullish, despite the correction. The price is still significantly higher than its starting point in August 2024.

Candlestick Patterns: The large green candles during the rally and large red candles during the correction indicate strong momentum in both directions. The smaller candles in March 2025 suggest indecision in the market.

Potential Scenarios

Bullish Case:

If XRP breaks above $3.00 with strong volume, it could signal the start of another uptrend, potentially retesting the $4.00 resistance.

A move above $4.00 could open the door for new all-time highs, especially if market sentiment for cryptocurrencies remains positive.

XRPUSDAs shown in the image,

We are witnessing a bullish pattern

If the important support number 2 is lost, we can expect the bullish pattern to complete and take the price to the indicated levels.

If there is demand from the current price range and we have liquidity flowing into the market, we can expect to see new highs for Ripple.

Update on xrp...Currently we are in an uptrend even though ultimately we will be in in overall downtrend...

The entire blue box may get filled with red as freshly pulled back making an even better opportunity to buy more as this is going out.

This is why it's always good to have extra powder handy when you need to buy more