XRP Cools Near $3.00 Amid Overbought SignalsFenzoFx—XRP remains bullish after piercing $3.00 earlier this week but cooled near resistance. Trading around $2.90, Stochastic (~84) and RSI 14 (80) indicate overbought conditions, suggesting consolidation.

We anticipate a pullback toward $2.66 support before resuming the uptrend. Alternatively, a decisive break above $3.00 would target $3.21 next.

XRPUSD.P trade ideas

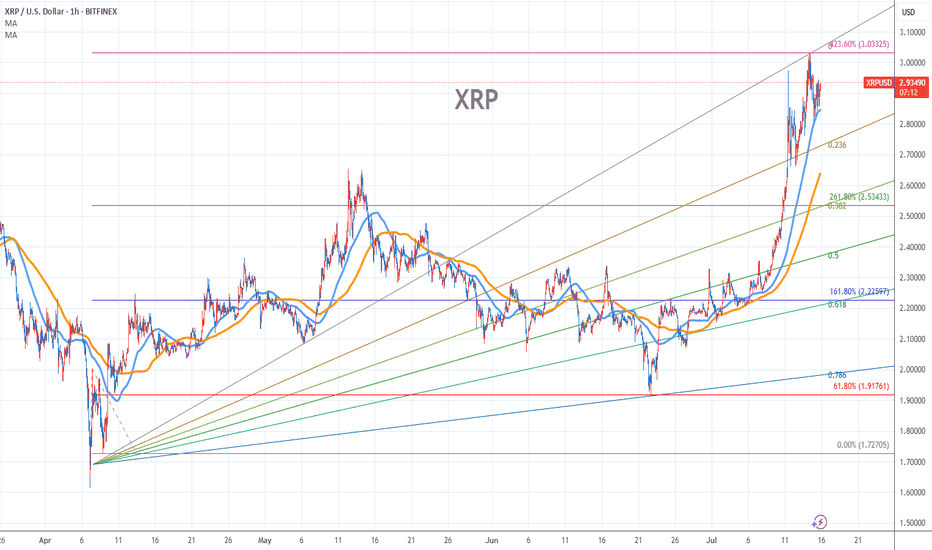

XRP Stock Chart Fibonacci Analysis 071525Trading idea - Hit the top - 3.03/423.60%

Chart time frame:B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:E

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

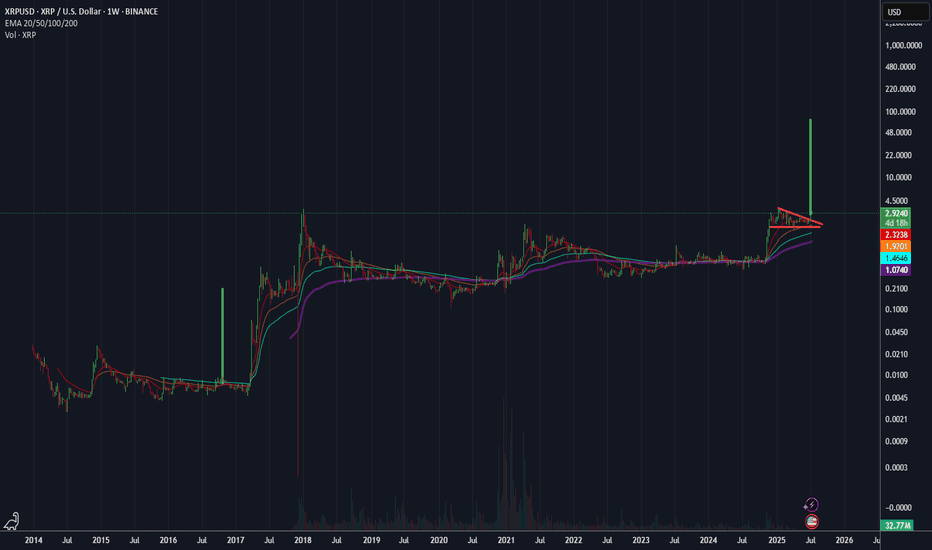

Why XRP Holders Are About to Get Super Rich!I believe XRP is heading into a mass adoption cycle—something even bigger than what Bitcoin saw in 2021. We’re looking at a truly sustainable growth pattern fueled by a longer accumulation phase and crypto being adopted and invested in by major institutions.

This means we could see XRP skyrocket to $22 as my lowest target— and potentially even well over $100 per coin . This coin is truly ready for massive things. Be prepared!

Let me know what you think: Will XRP crash? Or is it heading for mass adoption? Share your thoughts in the comments below.

As always, stay profitable,

– Dalin Anderson

XRPUSD – Broke Out, Not BrokenXRP surged to just above $3, forming a local top. The breakout we tracked above $2.80 played out nicely. Since then, it’s stair-stepped down, but each dip got bought — structure still bullish. Currently stabilizing above $2.88. Clear new upside trigger is $2.97–$3.00 retest zone.

$XRP All Tie High After Shallow Pullback?CRYPTOCAP:XRP had a fantastic week smashing all resistances. I am looking for a shallow pull back to test the High Volume Node support at $2.7 at the .236 Fibonacci retracement before continuing to challenge the all time high.

Wave (3) of a motif wave appears complete adding confluence to a shallow retracement for wave (4).

Daily RSI is extremely overbought.

Safe trading

XRP Price Corrects After Strong Rally: Support Levels in Focus

In the lead-up to the ETF announcement, XRP experienced a powerful rally, surging to fresh highs and demonstrating significant bullish momentum. The token climbed to the $2.85 zone, marking a substantial gain and outperforming many of its peers in the top tier of cryptocurrencies. This impressive run was fueled by a combination of factors, including the broader market upswing led by Bitcoin, growing optimism around Ripple's legal clarity, and the increasing institutional interest that the ETF launch now epitomizes.

However, following this strong upward move, a period of price correction was both expected and healthy. Profit-taking from short-term traders and the natural ebb and flow of the market have led to a slight pullback, bringing key support levels into the spotlight. Currently, XRP is trading above the crucial $2.80 mark and the 100-hourly Simple Moving Average, indicating that the underlying bullish sentiment remains intact.

A key technical feature that has emerged on the hourly chart of the XRP/USD pair is a bullish trend line with strong support forming at the $2.820 level. This trend line is acting as a critical floor for the price, and as long as XRP continues to trade above it, the potential for another upward leg remains high. The ability of the price to hold above this level suggests that buyers are actively stepping in to defend it, absorbing selling pressure and laying the groundwork for the next move higher.

Should the price dip below this immediate support, the next significant level to watch is the $2.750 zone. A successful defense of this area would further solidify the bullish case, demonstrating the resilience of the current uptrend. A break below this level, however, could signal a deeper correction and a potential shift in short-term market sentiment. For now, the price action suggests that the path of least resistance is to the upside, provided these key support levels hold firm.

The recent price correction, therefore, should not be viewed as a sign of weakness, but rather as a necessary consolidation phase before the next major rally. It has allowed the market to shake out over-leveraged positions and build a more solid foundation for future growth. The focus for traders in the immediate term will be on the interplay between the established support levels and the renewed buying pressure that is expected to accompany the ProShares XRP ETF launch.

A ‘Highly Rare’ Setup Eyes a 60% Gain Past $3

Adding to the bullish narrative surrounding XRP is a compelling technical analysis from a veteran trader who has identified a "highly rare continuation compound fulcrum" setup on the weekly price chart. This complex and infrequently observed pattern suggests that XRP is in the process of forming a major price breakout. The resolution of this setup, according to the analyst, could see the token's value surge by approximately 60%, pushing it past the psychological $3 barrier and towards a target of $4.47 in the coming months.

The "compound fulcrum" is a sophisticated chart pattern characterized by a complex base formation. It often consists of multiple smaller patterns, such as failed breakdowns, minor ranges, and wedges, that develop over an extended period. This intricate dance of price action serves to confuse the market, shaking out weaker hands while allowing more determined, long-term investors to accumulate their positions. Once this accumulation phase is complete and the balance of power shifts decisively in favor of the bulls, the price is expected to break out with significant force in the direction of the prevailing uptrend.

This bullish outlook is further substantiated by XRP's recent market performance. The token has posted its strongest weekly gain since last November, a clear indication of the growing momentum behind it. This rally has been accompanied by a significant increase in the number of "whale" wallets – those holding at least 1 million XRP. The accumulation of XRP by these large holders has reached a record high, signaling a profound and growing confidence among institutional and high-net-worth investors. This is a powerful leading indicator, as these market participants often have a longer-term perspective and their actions can foreshadow major price movements.

A break below the support line near $1.80 would invalidate this particular bullish setup. However, given the current market dynamics and the positive catalysts on the horizon, the probability of such a breakdown appears to be diminishing. The confluence of a rare and powerful technical pattern with strong fundamental developments creates a potent recipe for a significant price appreciation.

On-Chain Sentiment Transitions to "Belief-Denial"

Beyond the technical charts and institutional news, on-chain data provides another layer of insight into the current state of the XRP market, and the picture it paints is overwhelmingly positive. On-chain sentiment analysis shows that XRP is transitioning from the "optimism-anxiety" phase into the "belief-denial" phase. This shift is a crucial indicator of market psychology and often precedes a period of sustained price growth.

The "belief-denial" phase is characterized by a growing conviction among investors that the asset's value will continue to rise, despite any short-term corrections or pullbacks. It is a phase where the market begins to price in the long-term potential of the asset, moving beyond the initial excitement and into a more steadfast and resilient bullishness. This transition suggests that the current rally is not a fleeting speculative bubble, but rather a more sustainable and healthy uptrend.

Further supporting this view is the Net Unrealized Profit-Loss (NUPL) metric, which gauges the overall profitability of the market. In previous bull cycles, XRP's price corrections have often coincided with the NUPL entering the "euphoria-greed" zone, a sign of excessive speculation and an overheated market. However, the current data shows that the NUPL is indicating rising investor conviction without any signs of panic selling. This suggests that the current rally is built on a more solid foundation and has room to run before reaching a state of market euphoria.

The combination of increasing whale accumulation and the shift in on-chain sentiment points to a market that is maturing and gaining strength. The growing institutional confidence, as evidenced by the record number of whale wallets, is a testament to the long-term value proposition of XRP. As more large investors enter the market, they bring with them not only capital but also a sense of stability and a long-term investment horizon, which can help to dampen volatility and support a more sustainable price trajectory.

In conclusion, the upcoming launch of the ProShares XRP ETF on July 18 is set to be a watershed moment for Ripple and its native token. This event is not just a symbolic victory; it is a tangible catalyst that is expected to unlock significant institutional investment and propel XRP into a new era of mainstream adoption. The recent price correction, while causing some short-term uncertainty, has served to strengthen the underlying bullish structure, with key support levels at $2.820 and $2.750 holding firm.

The technical outlook is exceptionally bright, with a rare and powerful chart pattern suggesting a potential 60% rally to $4.47. This bullish forecast is strongly supported by the record accumulation of XRP by whale wallets and a clear shift in on-chain sentiment towards a more resilient "belief-denial" phase. As the worlds of traditional finance and digital assets continue to converge, XRP is positioning itself at the forefront of this revolution. The confluence of these powerful factors suggests that the stage is set for a significant and sustained upward movement in the price of XRP, making the coming weeks and months a period of intense interest and opportunity for the entire cryptocurrency market.

You Are Getting Ripped Off On XRP.Look at the massive volume the last year. Look at the news and how this has gone mainstream.

SEC, Potential ETF, Trump elected, Government acceptance etc...

And yet it still cant break 2018 highs.

One would thing with all the bagholders since 2018 highs $3.84. All that new money coming in tokens would be scarce and mixed with the constant positive news, a new all time high should have been met a long time ago..

8 Year XRP / US OIL Range Break out?Not to get ahead of myself, but... The 8 year range XRP has been in is about to give, too.

The fibonaccis on that point to (at current oil prices):

- $110 (also in range of a number I'd called for)

- $165 (also in range of a number I'd called for)

- $1035 (w/ full global adoption and swift - not out of the question, but I hadn't been able to substantiate this high with my current model. But I am over solving in the model and have a lot of conservative assumptions, basic math could support it - but alot of unknowns getting there.)

$XRP / $USOIL is breaking out of the 7.5 month range. It's time.CRYPTOCAP:XRP / TVC:USOIL is breaking out of the 7.5 month range. It's time.

Fibonacci says it's a 4x from here, $12 at current oil prices, within the $8-12 range I'd been calling for.

Other potential pivots (at current oil prices).

- $4.2

- $7.2

If Oil goes up and the chart structure holds - that effectively would be compounding in USD terms.

Ripple and XRP 2025-2026 Outlook: Institutional Adoption, ETF M While most investors rely on chart patterns and historical indicators to guide their decisions, the real edge lies in forward-looking analysis. While trading patterns provide valuable insight for short-term volatility-based investing, understanding roadmaps and projected outcomes paints a far clearer picture of an asset's long-term potential—and helps investors anticipate when price changes are likely to occur. In the world of crypto—where social sentiment can be engineered and narratives drive short-term price swings—it's critical to focus on roadmaps, regulatory movements, and institutional integration.

Utility-based crypto like XRP gains value not just from speculation, but from the outcomes it delivers: seamless cross-border payments, compliance infrastructure, and financial interoperability. This article explores what's already unfolding and what's expected to reshape the XRP landscape through the end of 2025 and into early 2026.

This is not financial advise, just my viewpoint... While some of these events may not happen, they are speculated as ongoing with completion dates stated.

Conservative Price Range Estimate: $6.00 by January 2026 ( My personal view, could be more, could be less.. do your own research)

July 2025: Regulatory Foundation and Institutional Signaling

ProShares XRP Futures ETF Launch (July 18): While a futures ETF doesn’t create real XRP demand, it establishes institutional access and boosts trading legitimacy. XRP saw a 5% short-term lift on the news.

Ripple Applies for a National Bank Charter (July 2): Ripple seeks a U.S. national trust bank license and Federal Reserve master account, aiming to custody RLUSD reserves directly and offer banking services. This move would make Ripple the first crypto-native bank regulated at the federal level.

BNY Mellon Partners on RLUSD Custody: The stablecoin RLUSD will be backed by assets held with BNY Mellon, significantly enhancing institutional trust.

Congressional Crypto Week (July 14-18): Multiple pro-crypto bills including the GENIUS Act and CLARITY Act are set for vote. If passed, they will clarify stablecoin frameworks and digital asset classifications.

July set the tone for XRP’s transition into institutional finance. With the launch of a ProShares XRP futures ETF, investor interest saw a legitimate on-ramp into regulated markets. Ripple’s application for a national bank charter and its RLUSD custody deal with BNY Mellon signal a serious bid for integration with the U.S. financial system. Meanwhile, Congressional attention to crypto regulation during “Crypto Week” builds the political and legal scaffolding Ripple needs to operate as a licensed banking entity.

August 2025: Finalizing Frameworks

OCC Public Comments Close (Aug 1): Comment period on Ripple’s bank charter ends, allowing regulatory evaluation to begin.

SEC ETF Template Finalization Expected: New rules and disclosures for spot crypto ETFs could be released, paving the way for streamlined XRP spot ETF approvals.

Progress on Crypto Legislation: The GENIUS and CLARITY Acts may pass both chambers, offering Ripple and XRP a compliant and recognized framework under U.S. law.

In August, the public commentary on Ripple’s bank application closes, beginning a phase of federal evaluation. The SEC is expected to clarify spot ETF guidelines this month, which would streamline XRP ETF approvals. Combined with likely legislative wins in Congress, August is expected to deliver the regulatory clarity Ripple needs to unlock deeper capital flows and onboarding from cautious institutions.

September 2025: Institutional Inroads

Franklin Templeton XRP Spot ETF Approval: With public comments completed in July, the SEC is expected to rule on Franklin’s ETF by late September. Approval would create true XRP demand from asset managers.

Ripple Bank Charter Decision Expected: Based on standard OCC timelines, a decision could land in September, granting Ripple official trust bank status.

Bank Adoption of RippleNet: New U.S.-based banks are expected to onboard RippleNet and RLUSD, pending charter clarity.

September may mark one of XRP’s most pivotal months. The expected approval of the Franklin Templeton spot XRP ETF introduces real XRP demand from traditional financial platforms. Ripple’s bank charter decision is anticipated, which, if approved, formalizes Ripple as a regulated trust bank. Institutions watching from the sidelines could begin onboarding RippleNet and adopting RLUSD as a digital settlement instrument.

October 2025: Full Financial Integration

Federal Reserve Master Account Approval: If the bank charter is approved, Ripple may gain direct Fed access, reducing friction in cross-border liquidity operations.

Hidden Road Acquisition Finalized: Ripple’s $1.25B purchase of the prime-brokerage platform expands XRP Ledger's reach into institutional DeFi.

Crypto Regulatory Acts Signed Into Law: Expected signing of the GENIUS and CLARITY Acts into federal law establishes Ripple and RLUSD as compliant players.

October represents a leap from planning to execution. If Ripple secures a Federal Reserve master account, it gains direct access to U.S. payment rails—dramatically reducing cross-border friction. The finalization of Ripple’s acquisition of Hidden Road builds new institutional bridges to DeFi. With the GENIUS and CLARITY Acts likely signed into law, Ripple’s operations become formally protected under U.S. legislation.

November 2025: Global Payment Infrastructure Alignment

SWIFT ISO 20022 Final Cutover (Nov 22): RippleNet becomes a competitive ISO-native alternative as legacy systems complete their migration.

Banking Partnerships Expand: With charter and Fed access, expect Ripple to announce new integrations across both U.S. and global banks.

November marks the global synchronization point. SWIFT’s ISO 20022 cutover transitions legacy finance into the same language RippleNet already speaks. This timing could prompt a new wave of partnerships from U.S. and international banks looking for compliant, faster alternatives. The technical alignment removes a final excuse for not adopting Ripple’s infrastructure.

December 2025: Stablecoin Acceleration

RLUSD Volumes Surge: With the infrastructure in place, stablecoin transactions over XRPL and Ethereum are expected to see significant enterprise use.

New Spot ETF Filings: Firms like Bitwise, 21Shares, and WisdomTree may file or receive approvals, expanding XRP's ETF market share.

Year-End Analyst Price Targets Raised: Institutional research desks may revise XRP targets upward, citing infrastructure, compliance, and volume data.

With legal clarity and infrastructure live, RLUSD adoption is expected to surge in December. Stablecoin flows through Ethereum and XRPL should grow significantly, showcasing XRP’s value in facilitating enterprise-grade financial transactions. Analysts are expected to raise XRP price targets based on these integrations and actual volume, setting up a strong year-end momentum.

January 2026: DeFi and XRP Ledger Scaling

Hidden Road Tooling Goes Live: DeFi integrations through institutional APIs create new XRP use cases.

RippleNet Usage Reporting: Post-charter metrics likely show increasing XRP volumes in institutional corridors.

New U.S. Legislative Proposals: Follow-on legislation could further streamline crypto regulation, with bipartisan support likely to continue.

January begins with tangible growth. Ripple’s DeFi strategy via Hidden Road goes live, giving institutions plug-and-play access to XRP-based liquidity protocols. Early usage metrics post-charter will offer proof of adoption. With bipartisan momentum behind crypto legislation still building, 2026 could see an even deeper alignment of XRP within regulated finance.

Strategic Outlook

The convergence of banking infrastructure, spot ETF exposure, and regulatory clarity may push XRP into a sustained growth arc. If Ripple secures its charter and Fed access while ETFs go live, XRP could see institutional capital inflows, utility-driven velocity, and price discovery not seen since its early 2018 surge.

Estimated Price Range (Base Model): $5.00 to $6.50 by January 2026

Key Watchpoints:

OCC and Federal Reserve decisions

Spot ETF trading volumes

RLUSD transaction data

Adoption by banks and brokers

XRP's next chapter is not just about price—it's about becoming a foundational asset for regulated global finance.

XRP SHOOTS UP TO $3! 🌠 Wow, we'll, we've done it. We've hit $3 once again. Before I start this idea just want to give my thanks for tuning in, appreciate it.

🌠 This month has been pretty incredible for Ripple to say in the least from the BNY-Mellon Custodian Deal to Trump's Media company filing for a crypto Blue Chip ETF of which included the likes of XRP. With all the news and positive sentiment around XRP and Bitcoin which itself has hit a new All-Time-High hitting $123,000! Below I'll add a Bitcoin chart for reference:

🌠 To say in the least it's been a golden month for Crypto and Digital Assets. And one important thing to note is that as of today the Fedwire Funds Service is set to go live with the ISO 20022 standard starting July 14, 2025. The implementation will replace Fedwire's dated (FAIM) format with the ISO 20022 message format with the change happening over a single day.

🌠 For those that don't know ISO 20022 is a global messaging standard for financial transactions meant to reduce cost and fraud alongside automate transactions and reduce transactional costs. What this means for XRP is that it could become a much bigger player in cross-border payments now through RippleNet as XRP is one of the selected assets for the ISO 20022 standard.

🌠 ISO 20022 and global institutions will start utilizing XRP and it's ability to process transactions seemingly instantly and efficiently while significantly cutting down on cross border and transaction costs making it a considerably solution for banks and financial institutions. After all, if your objective is to make money, and you can make more money while cutting down on costs and making transactions, record keeping much simpler, then why not? Especially in an age where everyday things are continuously advancing and improving nobody want's to be left behind. Especially the big financial players.

🌠 Curious to see if prices can hold and keep pushing but just going off technical, we already know $3 is a tough point. At $3 just over 95% of XRP holders are in profit which makes a good reason for many to sell and take profit but with all the news and ISO now really kicking in we may not see as much selling, especially as holders are more confident and less likely to be swayed in letting go of their XRP. So it'll definitely be interesting to see how things play out.

🌠 Main thing will be Bitcoin, even if XRP holders hold I can't guarantee the same for Bitcoin, especially should it start to reverse, we know how financial institutions play taking advantage of the news. Just be cautious and set some price level alerts whether your trading XRP or Bitcoin.

🌠 In the long run things look very good regardless of what happens in the next week or two so keep that in mind. I'll be watching XRP to see if we can continue and break $3 but in my experience, with these impulse waves we usually see a big move up followed by some retracement as traders look to test support and liquidity so the waters may turn choppy but again like I said, we're here focused on the long term, whatever happens happens. We'll still be here for that but nonetheless the main objective is the longterm. $3 may seem like a lot but it's nothing compared to what XRP has in store.

🌠 This week is also 'Crypto Week' for lawmakers in DC as U.S lawmakers get ready to potentially pass changes in the regulatory setting when could push even more institutional demand further adding to the hype and optimism the crypto space has been running with as of lately.

🌠 Have to run but thanks as always for tuning in, really appreciate it and hope everyone is doing well! thanks as always and all the best till next. Feel free to keep posted and follow for more as always.

Best regards,

~ Rock '

Everybody and their mother is waiting for another bigger XRP DIPEveryone and their mother is waiting for an XRP dip. The biggest liquidation wave of all time happened last week. But nothing is enough for them and they assume that the market will be so kind as to offer another place to buy and win.

The train has already left and the journey is just beginning. I can't give exact dates but my graph follows the historical price development of XRP in 2017-2018 when it rose explosively. A similar graph adjusted to today's prices could roughly raise XRP 0.5$->3$->10$->100$ which could be the peak prices of this bull run in about a year.

nfa dyor ...

Where Will XRP go?Short‑Term (some weeks)

-There’s strong excitement around the ProShares XRP ETF, launching July 18, 2025, which has boosted institutional inflows and whale wallet activity.

-Technical indicators currently signal overbought conditions, increasing the chance of a correction before further upward movement .

Mid‑Term (6–12 Months)

-Analysts are factoring in XRP potentially becoming a $750 billion asset ($12–$13 per XRP) through institutional acceptance and tokenization use cases .

-However, hitting that target will require transformative adoption, regulatory clarity, and heavy usage on the XRP Ledger.

Long‑Term (1–5 Years)

-If XRP captures large markets like CBDCs, remittances, real‑world asset tokenization, and stablecoin usage, prices could surge significantly.

-Still, such outcomes hinge on regulatory alignment and broad ecosystem deployment.

Recent Crypto Mining News

AI + Mining Megadeals

-CoreWeave (an AI infra firm) is acquiring Bitcoin miner Core Scientific for $9 billion, signaling a pivot from mining to AI compute.

Ethereum‑Backed Treasury Shifts

-BitMine Immersion saw its stock surge ~3,000%, moving its treasury to Ethereum.

-BIT Mining Ltd. doubled its stock after investing heavily in Solana, diversifying beyond Bitcoin.

Broader Mining & Regulation Trends

-U.S. “Crypto Week” is underway with bills like the CLARITY Act and GENIUS Act aiming to define stablecoin rules and improve clarity.

-Tech energy demands, especially from AI, now rival those of crypto mining—raising questions of sustainability.

-Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice, investment recommendation, or an offer to buy or sell any securities. Stock prices, valuations, and performance metrics are subject to change and may be outdated. Always conduct your own due diligence and consult with a licensed financial advisor before making investment decisions. The information presented may contain inaccuracies and should not be solely relied upon for financial decisions. I am not personally liable for your own losses, this is not financial advise.

XRPUSD – Higher Staircase, Not Done YetXRP surged into $2.96 after our last breakout call and now grinds higher in a steady up-channel. No parabolic thrust yet — just strong bullish structure. Key continuation zone: $2.95–$3.00. Pullbacks into $2.88 are being bought. Still trend-up unless $2.84 breaks.

XRPUSD SELL 3.197On the daily chart, XRPUSD stabilized and rebounded, with short-term bulls in the lead. At present, attention can be paid to the resistance near 3.197 above, which is a potential short position for a bearish bat pattern. At the same time, this position is in the previous supply area, and the downward target is around 2.340.

XRP: Breaking Out of Accumulation! Stablecoin Supercycle Part 5!🚨 XRP: Breaking Out of Accumulation! 🚨

XRP is missing Waves 3, 4, and 5 in green to complete the bull market. There are two ways to measure the target of Wave 5 which should be the bull market top. The 1st is taking the 1.618 fibbonaci retracement of Wave 4 which would give us a $5.39 XRP. The 2nd method is taking a 0.618 to 0.786 trend based fib extension which would give us a $6.21 to $8.97 XRP. In other words, this bull market should at least at the bare minimum give us a $5.39 XRP to $8.97 XRP.

"XRP/USD: Bullish Raid Alert! Ride or Escape Fast!"🚨 XRP/USD HEIST ALERT: Bullish Loot Grab Before the Escape! (Thief Trading Style) 🚨

🌟 Greetings, Market Pirates & Profit Raiders! 🌟

(Hola! Oi! Bonjour! Hallo! Marhaba!)

🔥 Thief Trading Strategy Activated! 🔥

Based on ruthless technical + fundamental analysis, here’s how we SWIPE THE LOOT from XRP/USD (Ripple vs. Dollar). Follow the chart’s Long Entry blueprint—our target is the high-risk YELLOW ATR ZONE (overbought, consolidation, potential reversal). Beware of traps! Bears and cops lurk here, but we strike smart.

🏴☠️ ENTRY:

"Vault’s cracked—bullish loot is FREE GAME!"

Buy Limit Orders preferred (15-30 min timeframe near swing lows/highs).

Aggressive? Swipe instantly—just mind the cops (liquidity traps).

🛑 STOP LOSS (Save Your Loot!):

Swing Thieves: 4H recent wick low ($2.1500).

Risk Tactics: Adjust SL based on your trade size, orders, and guts.

🎯 TARGETS:

Main Take: $2.5400 (or escape earlier if momentum fades).

Scalpers: Longs ONLY! Trail your SL—no greedy holds!

💣 KEY DRIVERS (Why This Heist Works):

Bullish momentum brewing (check fundamentals, COT, on-chain data 👉go ahead to klick 🔗).

NEWS ALERT: Avoid fresh trades during high-impact news—protect open positions with trailing stops!

💥 BOOST THIS HEIST!

Hit 👍 LIKE, 🔔 FOLLOW, and 💬 COMMENT to fuel our next robbery plan. Together, we steal the market’s cash—EVERY. SINGLE. DAY.

📢 Final Warning: Markets shift FAST. Stay sharp, adapt, and CASH OUT BEFORE THE COPS ARRIVE.

🤑 Stay tuned—more heists incoming! 🐱👤🚀

XRP/USD: "Bandit’s Breakout" – MA Confirms the Profit Raid!🔥 XRP/USD HEIST ALERT: The Bullish Bank Robbery Plan (MA Breakout Strategy) 🔥

🌟 Attention, Market Pirates & Profit Bandits! 🌟

"The best traders are just thieves with a calculator."

🚨 Mission Brief (XRP/USD):

Based on Thief Trading tactics, we’re plotting a bullish heist on Ripple. High-risk, high-reward—police traps, fakeouts, and overbought zones be damned!

📌 ENTRY ZONE (Breakout or Pullback Heist)

"The heist begins at MA breakout!"

Buy Stop: Above 2.2200 (confirmed candle close).

Buy Limit: Near swing lows (15m/30m pullback).

🚨 Set an ALERT! Don’t miss the breakout.

🛑 STOP LOSS (Escape Route)

"No stop loss till breakout—then hide it like stolen cash!"

Thief SL: Nearest swing low (3H candle wick) ~2.1000.

Rebels adjust at own risk—your funeral, not mine. 😎

🎯 TARGETS (Profit Hideouts)

First Escape: 2.2400 (scalp & run).

Swing Bandits: Ride longer (trail SL advised).

⚡ SCALPERS’ NOTE:

Longs ONLY. Rich? Go all-in. Broke? Join swing heists.

Trailing SL = Your getaway car.

📡 MARKET CONTEXT (Why This Heist?)

Bullish momentum + consolidation breakout play.

Fundamentals? Check COT, on-chain, macro trends (check everything here 👉🔗🔗).

🚨 NEWS WARNING (Avoid Police Raids)

Avoid new trades during high-impact news.

Trailing stops = Your invisible cloak.

💥 BOOST THE HEIST!

"Like & Boost this idea—strengthen our robbery squad! More alerts = more stolen profits. 🚀💰

Next heist coming soon… Stay greedy, thieves. 😈

XRP at Range High – Breakout or Rejection?XRP is pressing against a macro resistance zone after a clean run-up. Price is stalling just under $2.90, and Stoch RSI is in the oversold zone — a bounce from here could trigger a breakout. But failure to hold current levels could send price back to the $2.10–$2.20 support range.

Watch this area closely — it’s the line between continuation and correction.