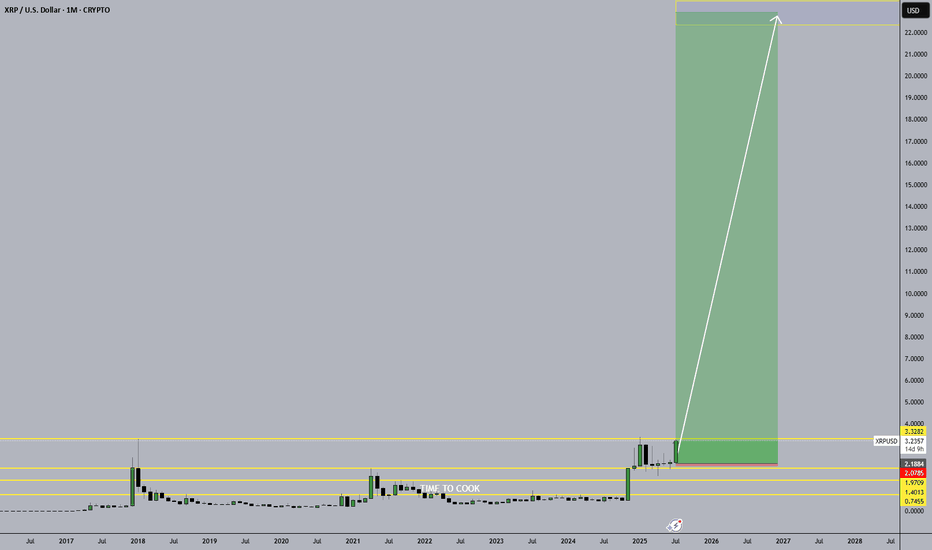

Once Again You Are Getting Ripped Off On XRP.Pro Crypto President.

SEC Case.

Mass Adoption.

Multiple Partnerships

Mainstream

Huge Volume The Last Year

ETF Approval

Crypto Bills Passed By Congress

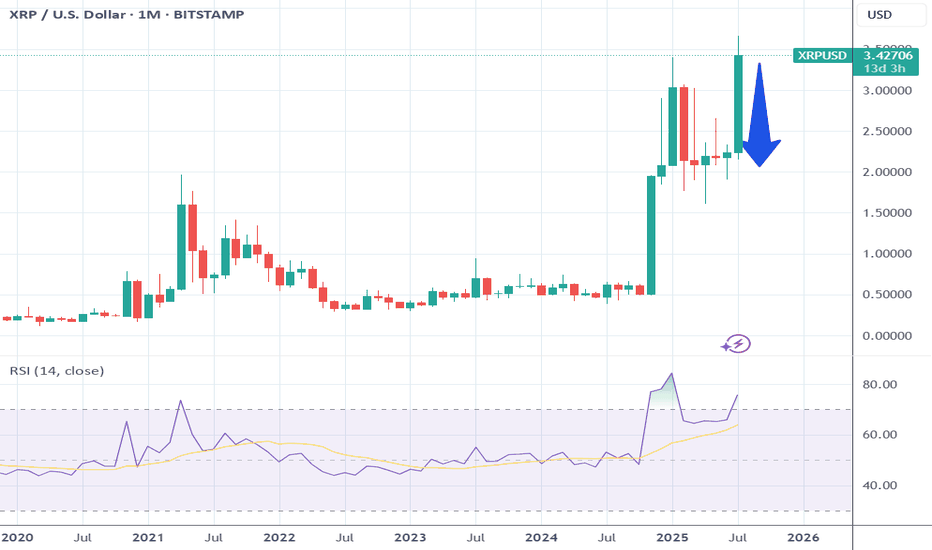

Still cant beat 2017 All Time Highs. They are ripping you off on the price action...!

Whats the catalyst going forward?

The Feds are soon going to cut rates multiple times. Bitcoin tanks everytime when that happens.

This was a crypto pump into whats coming.

This will close with a Monthly double top and August Starts the free fall.

XRPUSD trade ideas

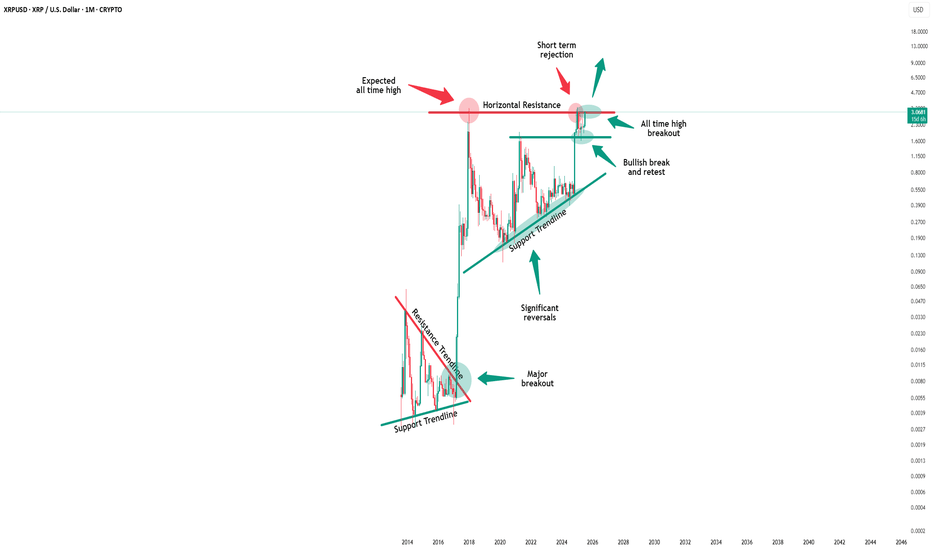

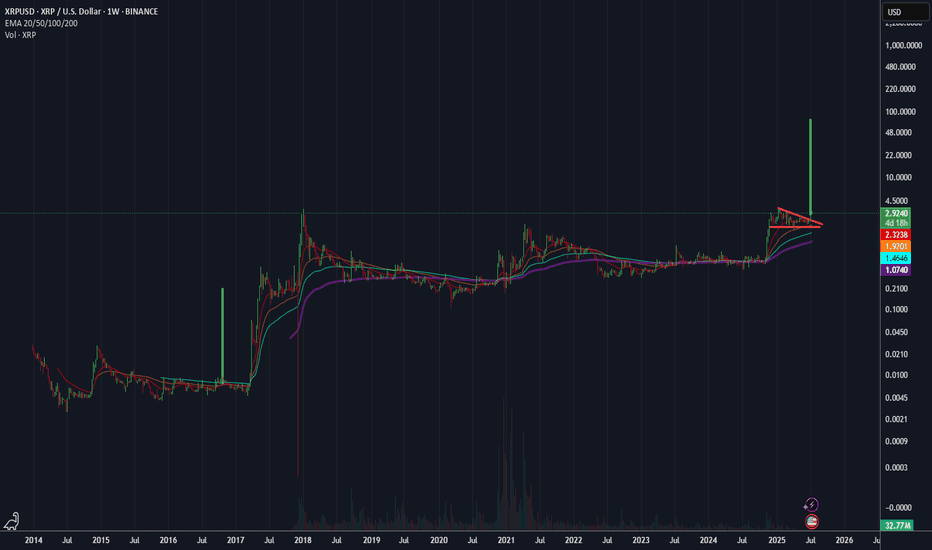

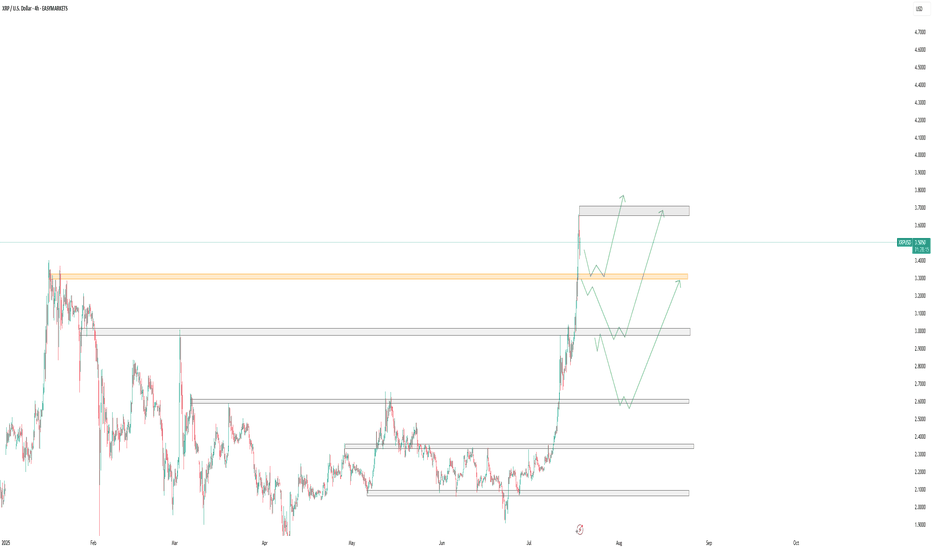

Xrp - The final bullish breakout!💰Xrp ( CRYPTO:XRPUSD ) will create new all time highs:

🔎Analysis summary:

After a consolidation of an incredible seven years, Xrp is finally about to create new all time highs. With this monthly candle of +40%, bulls are totally taking over control, which means that an altcoin season is likely to happen. And the major winner will simply be our lovely coin of Xrp.

📝Levels to watch:

$3.0

🙏🏻#LONGTERMVISION

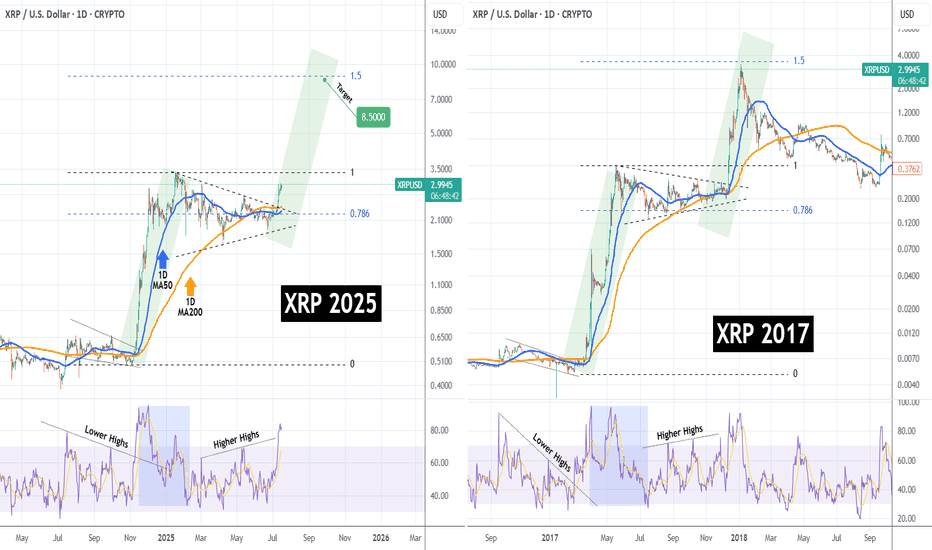

SwingTraderPhil

XRPUSD Has it started the mega rally to $8.500??XRP (XRPUSD) has been trading within a Triangle pattern for the past 6 months (January - July 2025) and only recently, it broke to the upside. Ahead of a pending 1D Golden Cross, this pattern is no different than the one of the previous Cycle from May - December 2017.

That setup resulted into the final Parabolic Rally of the Cycle that peaked just below the 1.5 Fibonacci extension. As you can see, both fractals are identical even from their starts, both initiated after a Falling Wedge that produced the first Parabolic Rally (green), which transitioned into the Triangle we described. Even their 1D RSI sequences are similar.

As a result, it is more than probable to see XRP hit $8.500 (Fib 1.5 ext), by the end of the year.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

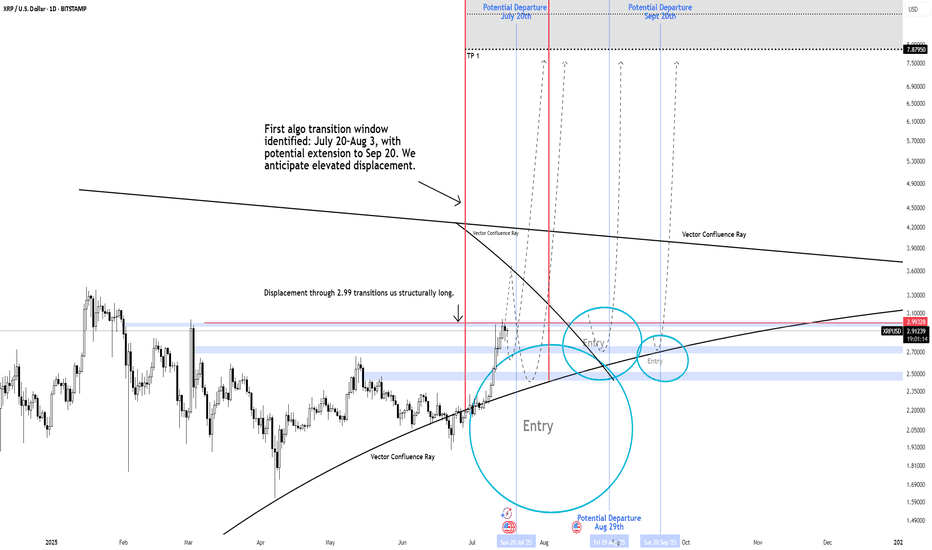

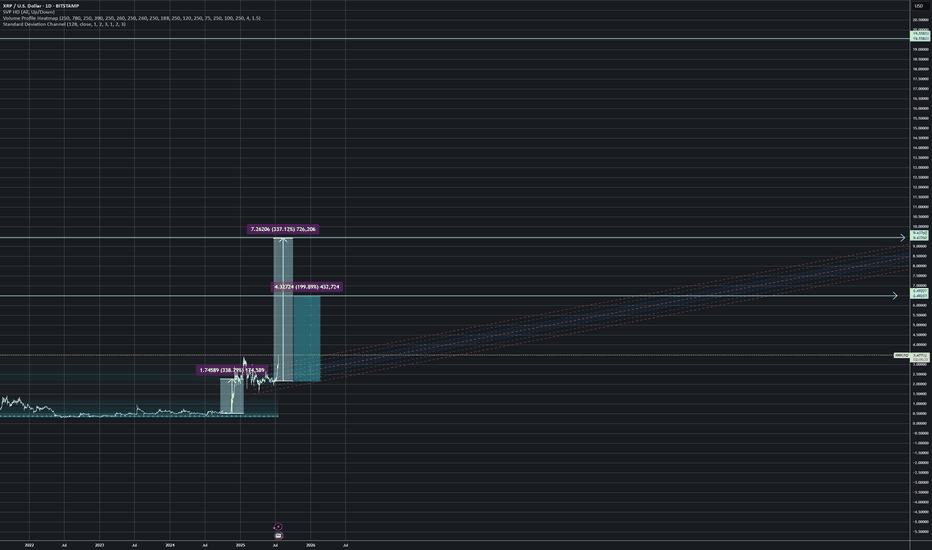

XRP THE $2.99 "NUKE" LEVEL Could Send Price To $30 to $100+ Primary Expansion Window: July 20 – Aug 3, 2025 (potential extension to Sept 20)

XRP is positioned for a structural regime shift. The pivotal $2.99 "nuke" level is on watch a clean break through this price isn't just an ignition, it's the catalyst for explosive directional flow. As algorithms flips long above $2.99, Wave 1 is triggered, opening accelerated risk toward the $30 target during this active expansion window.

Vector Confluence Rays: Dynamic Support/Resistance. order flow and price memory become most active these are potential launch points for expansion or resistance.

Nuke Level ($2.99): The term signals more than a trigger it's the critical inflection where algo's initiate volatility and momentum. When breached, price will accelerate.

What’s Next After Wave 1?

Second Expansion Window: November to December 2025

When momentum and higher timeframe structure persist, a larger breakout framework comes into play with targets of $60, $100, and, in extreme scenarios, $1,500+ if a full structural unlock unfolds.

Key Takeaways

$2.99 is the “nuke” level: The breakout ignition for Wave 1. Algo's are highly likely to accelerate above this line, targeting upwards to $30 within the first expansion window.

Lower probability predictive models do show price can reach $60 Wave 1 in extreme cases.

Expansion windows defined: First window live July–September; second window November–December for further upside potential.

Above $2.99: Upside is highly probable the algo is primed and with years of price suppression means acceleration is very likely once this level breaks.

-Neverwishing

You Are Getting Ripped Off On XRP.Look at the massive volume the last year. Look at the news and how this has gone mainstream.

SEC, Potential ETF, Trump elected, Government acceptance etc...

And yet it still cant break 2018 highs.

One would thing with all the bagholders since 2018 highs $3.84. All that new money coming in tokens would be scarce and mixed with the constant positive news, a new all time high should have been met a long time ago..

8 Year XRP / US OIL Range Break out?Not to get ahead of myself, but... The 8 year range XRP has been in is about to give, too.

The fibonaccis on that point to (at current oil prices):

- $110 (also in range of a number I'd called for)

- $165 (also in range of a number I'd called for)

- $1035 (w/ full global adoption and swift - not out of the question, but I hadn't been able to substantiate this high with my current model. But I am over solving in the model and have a lot of conservative assumptions, basic math could support it - but alot of unknowns getting there.)

XRPUSD – Broke Out, Not BrokenXRP surged to just above $3, forming a local top. The breakout we tracked above $2.80 played out nicely. Since then, it’s stair-stepped down, but each dip got bought — structure still bullish. Currently stabilizing above $2.88. Clear new upside trigger is $2.97–$3.00 retest zone.

XRP Bullish Continuation Eyes Key Resistance at $3.34🚀📈 XRP Bullish Continuation Eyes Key Resistance at $3.34 💥🧠

XRP is showing remarkable strength as it continues to push higher within a well-defined ascending channel. On the 8H chart, we can see price breaking through mid-channel resistance, now retesting the zone around $2.84. This level acted as both a prior resistance and now potentially a launchpad for the next leg up.

The structure suggests:

🔹 A breakout retest scenario, confirming bullish continuation

🔹 Immediate resistance at $3.34, followed by the upper boundary of the channel near $3.77

🔹 Strong support from the dynamic trendline and former breakout zone

The 15-min Heikin Ashi view reinforces momentum: price is respecting the ascending trendline and holding above key breakout levels.

📊 As long as price holds above $2.84, this breakout remains valid, with the potential to target the upper channel resistance.

Technical traders may be watching for:

✅ A bullish engulfing or confirmation candle near current levels

✅ Volume spike on retest bounce

✅ Divergence or RSI confirmation on lower timeframes

Patience pays when structure aligns. Let's see if XRP delivers the full move.

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

XRPUSD - Why I see that Ripple even higherMedianlines, aka "Forks" have a simple but effective ruleset inherent. These rules describe the movement in certain situations. And of course, the most probable path of wher price is trading to.

Here we a rule in play that projects more movement to the upside, even if BTCUSD has had a strong pullback to the south.

Let's see:

If price is closing above a Centerline, then chances are high that it will retest it. If it holds and starts to continue it's path (to the upside), then the next target is the U-MHL, or the Upper Medianline Parallel, was Dr. Allan Andrews named it back many decades ago.

So, there we have it.

Chances are high that Ripple will reach new highs, with a final target at the U-MLH.

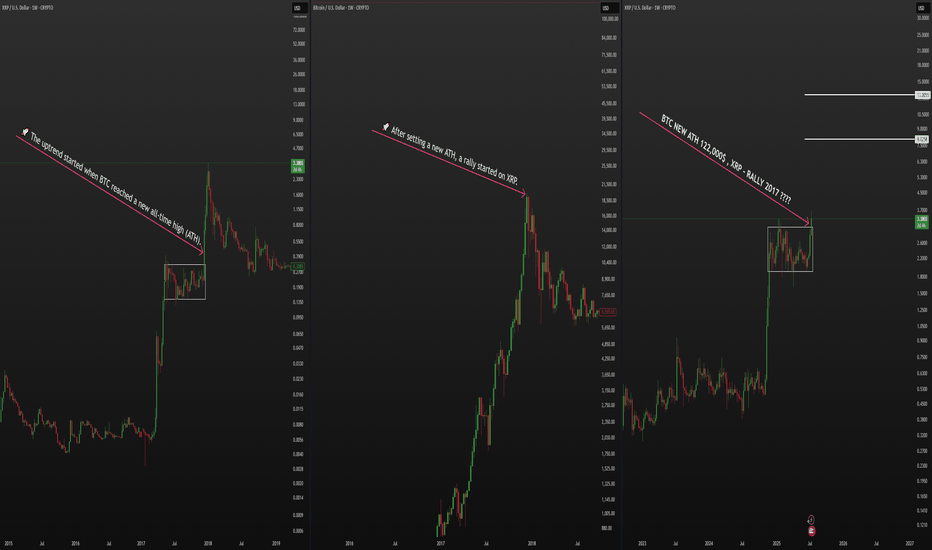

XRP - RALLY!!! 2017 YEAR! LET'S RUN!🔍 Major observation:

Back in 2017, when Bitcoin reached its cycle top, XRP began a massive rally, which marked the beginning of the bear market.

📊 Currently, XRP's structure looks almost identical to 2017 — we've broken out of accumulation.

Is it time for the final rally?

📉 I'm betting that BTC won’t make a new all-time high, while XRP surges to $8+, kicking off the next bear market!

Long - XRP (Weekly Chart)Long Swing Position

Perfectly bounced from .618 and RSI above 50. Expect the bullish momentum

Entry : $2.15

Resistance: $2.3

PT1: $2.7

PT2: $3.39

PT3: Update after crossing PT2

Stop loss: If it shows sign of weak rally to the upside, RSI cross below 50. Stop loss below fib 0.5 at $1.9 & monitor price movement when hitting fib 0.618 -> stop loss below it or re-entry when showing strong rally sign.

$XRP Macro Tiangle Final Thrust ContinuationCRYPTOCAP:XRP completed a macro triangle pattern last year. Triangles proceed a terminal motif wave which already completed a wave 3.

Wave (3) of (5) is underway with a terminal target around $5.7 after price broke out of the pennant / wedge pattern.

Weekly RSI confirmed bullish divergence.

Safe trading

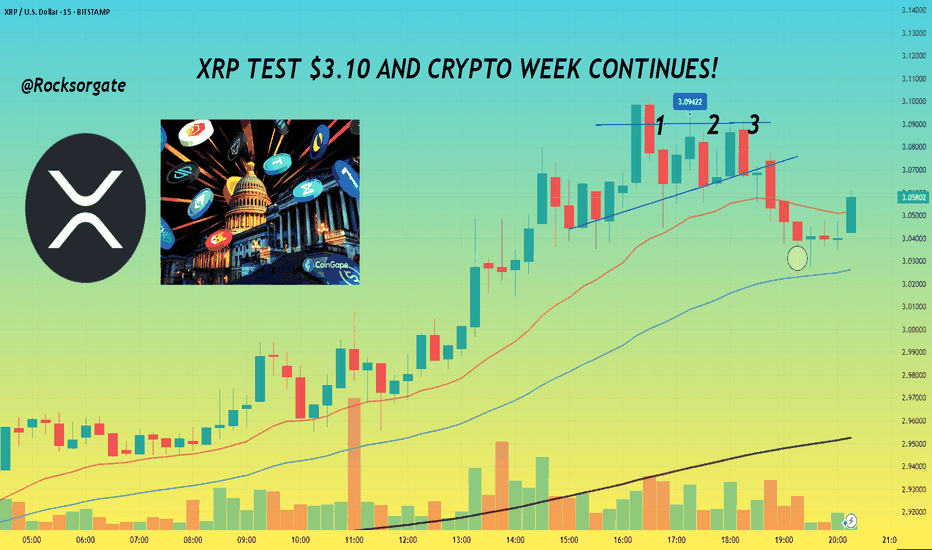

XRP TEST $3.10 AND CRYPTO WEEK CONTINUES!📊 Hey hey, hope all is well, gonna keep this idea pretty short and concise for the day, have a lot to do but thanks for joining as always.

📊 With Crypto week ongoing and the House of Representatives considering the Guiding and Establishing National Innovation for U.S Stable coins or GENIUS for short. Alongside that there's the Digital Asset Market Clarity Act or Clarity for short which is being considered as well. The last bill being considered is one which would be directed towards blocking the Federal Reserve from issuing a central bank digital currency directly to individuals.

📊 For summary CBDC is fiat money, just in digital form and that fiat money is issued and regulated by a central bank of a country.

📊 GENIUS has already made the rounds and passed through senate but is facing a snag, in limbo as House lawmakers as some lawmakers like Marjorie Taylor Greene and Chip Roy who themselves we're looking to get anti-CBDC language in with 12 republicans voting no on Tuesday's vote. Least to say things are still in flux, so we'll have to see if lawmakers can come to an agreement and sort things out simply put.

📊 If passed GENIUS would require stable coins to be fully backed by U.S dollars or similar liquid assets. Along with this you'd have annual audits for issuers with a market cap of more than $50 billion and guidelines would be established for foreign issuance.

📊 the Clarity Act takes a full on approach to crypto and would create a clear regulatory framework for crypto, this would function through the U.S Securities and Exchange Comission and Commodity Futures Trading Commission will regulate the crypto space. Digital asset firms would also have to provide retail financial disclosures and separate corporate from customer funds. More than likely in a nod to the collapse that FTX brought about for money when the company took advantage and started using customer funds.

📊 Overall these bills and acts alongside the CBDC bill would be a significant change for the digital asset space and give much more clarity for Institutions further allowing more money to enter the space basically.

Reference:

www.coindesk.com

www.theblock.co

📊 XRP itself will be impact by these changes just like the rest of the space with some digital assets making significant jumps or declines based on what bills and changes are ultimately decided so it's a crazy week to say in the least. For Technical I've added a chart below for reference:

📊 Can see how we're facing that horizontal level of resistance at $3.10 now, gonna set an alert for that but more than anything, right now what's gonna make or break things will be the news, we've already seen how much that's done us the last few weeks, grateful and blessed for it as always.

📊 Main thing now is to keep an eye on the news and watch that $3.10 level for resistance or a further breakout. We've also converged with our 200 EMA on the 3 minute chart so no doubt we'll see bulls and bears fight to break or keep that point. Should be an interesting next few days.

📊 Have to go study but as always, grateful for the continued support and those that take the time to read through these and continue with me on this journey, it's taken a few years but things are coming together finally, grateful we've perservered.

Best regards,

~ Rock '

XRP Breakout with Target at $4.80XRP just broke out of a typical complex wave 4 Elliott wave formation by completing the last 2D-candle. Consider taking profits in steps as wave 5 is often surprisingly short and disappointing. A $5–6 target is possible if bullish momentum persists, but monitor for early reversal signs.

Weekly/monthly bullflag on xrpusdAn even higher target than the symmetrical triangles two potential targets materializes when we confirm the breakout up from this bull flag. It will likely have a bullish target somewhere around $5.20. Upon reaching this target it will also be breaking above a big cup and handle that will then have an even higher breakout target which I will post in my next idea *not financial advice*

Everybody and their mother is waiting for another bigger XRP DIPEveryone and their mother is waiting for an XRP dip. The biggest liquidation wave of all time happened last week. But nothing is enough for them and they assume that the market will be so kind as to offer another place to buy and win.

The train has already left and the journey is just beginning. I can't give exact dates but my graph follows the historical price development of XRP in 2017-2018 when it rose explosively. A similar graph adjusted to today's prices could roughly raise XRP 0.5$->3$->10$->100$ which could be the peak prices of this bull run in about a year.

nfa dyor ...

XRP Intra-day Analysis 18-Jul-2025Price action on XRP has shown upward momentum after reaching the 3.7 price level.

Possible scenarios include:

* The 3.3 level could come into focus if the market revisits this area. Market participants may monitor it for signs of seller exhaustion or potential reversal patterns.

* Should the price move lower, the 3.0 level may act as the next key area of interest. This round number is often viewed as a psychological level and may attract increased attention from traders.

* If there is a clear intraday move below the 3.0 level, the 2.6 area could emerge as another notable zone that some participants may consider relevant for future market reactions.

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.