XRPUSD trade ideas

XRP Critical Levels to Play This MonthHello I am the Cafe Trader.

This weekend we are shifting focus into the crypto market for a quick overview. If you read my last XRP article, we nailed the bottom for longs, and the sellers for a great positional play. This time we are going to analyze the current failed breakout.

Are Bulls Trapped? Does this still have room to leg up?

Point 1

We can start with the trend break. Massive buyers pushed this move higher, giving XRP a relatively quick All time high, But July 23rd shorts were able to shove this back inside of the previous high.

This signifies that there are bulls trapped, but the interesting thing to note is that the volume has reduced significantly since the last two ATH's. So this also would indicate a lack of buying interest at the highs.

Buyers are just not willing to to get involved with the same conviction as before (yet). No buyers, no continuation (even if there is not many sellers/profit takers).

Point 2

Strong buyers proved their interest with a "hot" reaction at $2.95.

With no "real" seller coming into this market yet, there is nothing stopping this continuation from legging up (so far).

Therefore I stand bullish, and am looking for a move up to $4.64 as a Target.

Point 3

Buying into this can feel tricky, your first entry for a classic two bar trend break would've been at the top of demand. I do think we will get another opportunity here, I definitely would not chase this, because it could play this range for a while before another leg up.

Setup

Trend break continuation.

Entry 3.13

Stop 2.65

Exit TP 4.64

Risk to Reward 3.1

If there is a close below these strong buyers, this could com all the way back down to 2.15-2.3 at least.

The reason for the wider stop here is because we don't want to get swept and then ran. A more conservative stop could be $2.85 which would be a 6R trade. Take your pick

Long Term

If you are late to the party on XRP (I know many are) here are some entries according to your sentiment:

Almost FOMO = 3.13

Aggressive = 2.95

Good price = 2.15-2.3

Steal = 1.60 - 1.93

That's all for XRP. We are going to be looking at Ethereum ETH Next.

Thanks for reading and happy trading!

@thecafetrader

XRP WHERE ARE WE HEADED ? LEVELS TO LOOKOUT FORHey trading fam

So XRP is a fun one but based on BTC correcting and what we are seeing there are a couple thesis's that we currently have for it

Thesis 1: We break south from 2.98 lows: Levels to look out for:

2.80

2.70

2.68

Thesis 2: We break the highs of 3.29: Levels to look out for:

3.65

3.79

3.99

Trade Smarter Live Better

Kris

Working to move to the upsideMy views on XRP still hasn't change since my last article. The price action has been quite volatile, but if you look at it in the higher time frames such as monthly/weekly/daily, I think XRP is still working to move to the upside.

Daily:

1) The price has found the temporary support at Fib 0.5 level and EMA55.

2) yesterday's daily candle closed above $3.07 area (previous major resistance area)

3) Both RSI and MACD are still in the bull zone.

4) Stochastic has reached the oversold territory the lines have crossed and now are moving to the upside.

XRPUSD Is Heading Up, The Best Case Above 3.66Possibility for xrpusd as well to go up. As we have complete h4 expanding flat.

The stop could be below the low of the latest low of bullish engilfing candle. The best case we can go all the way up above the high of July 2025, 3.66.

Dont risk more than 1 % for this trade.

XRP retracement levelsWhere is XRP next likely to head next?

$2.65 is the next price level down with 4 points of contact. This level was also a weekly high as well as the 0.5 fibbonachi.

Next level down is $2.34 with 6 points of contact.

There is a downtrend forming so a breakout of this trend could be bullish for XRP 📈

XRP VS AI ?Hi,

This is fun, come on XRP $4.95

Average Speed (Points/Day) 0.053

Retracement Amount (Points) 0.80

Retracement % 51.28%

Probability of Retracement % 5-10%

Projected Next Move Size (Points) 2.09

Next Projected High Price 4.95

Estimated Duration to Next Target 39.4 days

Projected End Date 2025-09-10

All the best

Not a guru

XRP - IH&SLike I said in my last post, xrp was to hit 2.80. Nailed it. Right on the money!

Now, it seems like we're printing an IH&S. No other real patters are matching up l well. We finally have some liquidity in the market to chart some rough patterns.

I'm seeing a little push up off the bottom BB - to 3.12 ish? But rejection back down to the daily pivot for the right shoulder. And acuminate there prior to any news from the SEC. And then were primed and strapped to a rocket!

But honestly, who really knows what these MM have in store. So stay light on your feet in this area.

Roll them bones for it!

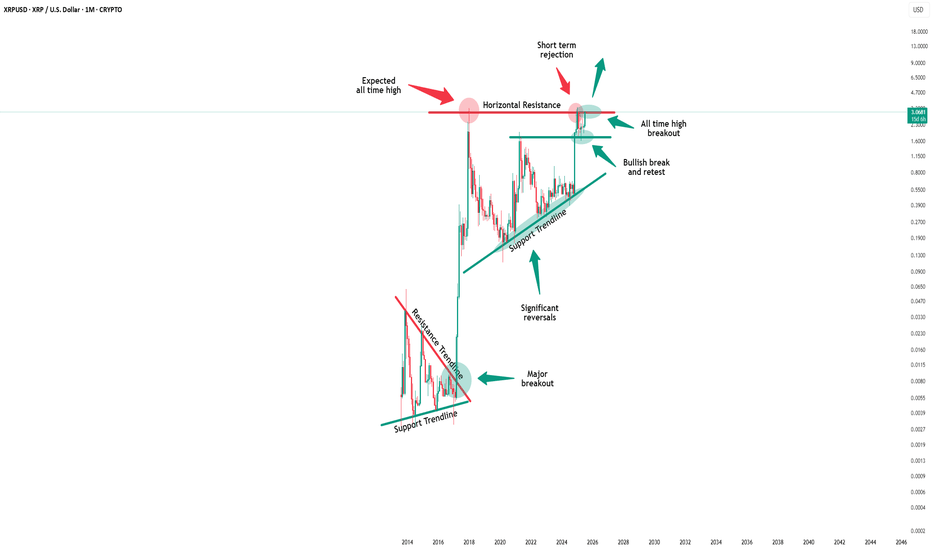

Xrp - The final bullish breakout!💰Xrp ( CRYPTO:XRPUSD ) will create new all time highs:

🔎Analysis summary:

After a consolidation of an incredible seven years, Xrp is finally about to create new all time highs. With this monthly candle of +40%, bulls are totally taking over control, which means that an altcoin season is likely to happen. And the major winner will simply be our lovely coin of Xrp.

📝Levels to watch:

$3.0

🙏🏻#LONGTERMVISION

SwingTraderPhil

Can XRP obtain a 50% increase in the next few weeks XRP has recently been under a lot of manipulation lately! Is it time for the bulls to finally step in and move the price point on this digital asset to a 50 percent increase to another ATH at $4.45………? The world will see with the next few weeks! And why is #Bradgarlinghouse X account always following 589………..? It’s it a signal or is he just trolling

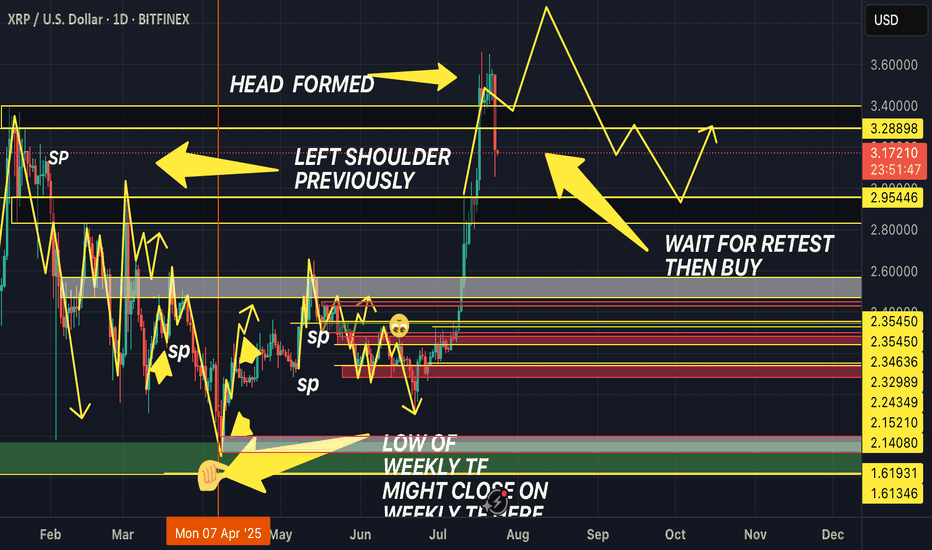

HEAD & SHOULDER DAILY TIME FRAME! (DOUBLE WHAMMY!!!!)The market has previously created a left shoulder. Now, it has broken out of the top of the Resistance and broken back into the support and resistance, about to form the right shoulder.

Wait for retest of the resistance then sell to the support, AND THEN BUY IT BACK TTHE RESISTANCE!! DOUBLE WHAMMMY!!

XRP/USD Breakout Watch: $3.22 Target in SightA key blue trendline on the XRP/USD chart that reflects market sentiment. If price breaks above it with strong volume, we could see a rally toward $3.22.

Support zone: $0.55–$0.60

Bullish case: Improved sentiment, easing tariffs, and regulatory cooling

Strategy: Wait for breakout confirmation before entering

Share your thoughts — are you preparing for a breakout?

XRP at $2.93? They Forgot What’s Coming?XRP isn’t just another coin. With clarity coming from major rulings, its return to previous highs isn’t just possible it’s probable. I like this level. Watching price and fundamentals line up.

I’m not just looking at the chart — I’m looking at the bigger picture.

Super bullish!! (I am not a XRP fan, but still) XRP is one of those cryptocurrencies that attract cult-like followers. I am not one of them.

Fundamentally I have no idea about the long term potential of XRP. HOWEVER, purely based on technicaly analysis, it looks very bullish to me.

Monthly:

1) the price finally broke above the 2018 historical ATH.

2) All momentum indicators in the bull zone.

3) Both RSI and MACD are in the overbought territory but they can remain in the OB territory for weeks and weeks when the macro bull trend begins.

4) Stochastic lines have crossed to the upside in the bull zone.

Weekly:

1) all momentum indicators are in the bull zone.

2) The price broke above the historical ATH. It is going through pull back now, but, there is a strong buying pressure around $3.15.

Daily:

1) all momentum indicators have reached the overbought territory. The lines are now rolled to the downside, however, it is likely to be a corrective move.

2) the price is hovering above EMA21 where the recent price breakout happened on Thurs 17th July. I have been monitoring price action in lower time frames such as 5 and 15 minutes, and it looks like the price does not want to go below the previous historical high at this stage.

I am not very familiar with XRP, but purely based on the current price action, it looks very bullish. For the very first time as a trader/investor, I deployed my capital to buy XRP last Wed (just under $3.00).

I have already took some profit when it hit $3.60. But I am planning to sell 90% of my XRP when it reaches $4.50 and $5.00, and let the rest run just in case it goes to the moon😅.

XRP/USD – Eyeing Resistance Test🟢 LONG above $3.3056 – target $3.34+

XRP has reclaimed its 200 SMA and is pushing toward resistance at $3.3056. RSI climbing to 65 shows renewed bullish momentum. A confirmed move above $3.3056 could lift price toward $3.34–$3.36.

📊 Keywords: #XRPUSD #ResistanceBreak #CryptoLong #AltcoinSetup #PriceAction

XRP To The Moon and Back! Opportunities Presented.Context 1:

Support: $2.50 to $2.75

Resistance: $3.50

Psychological Levels: $3.00 and $2.50 and $2.00

Context 2:

Technical Structure 1: XRP now in a Bullish Flag Pattern. Resistance tested 6 times and Support tested only once.

FVG’s:

FVG Confluence 1: We have an unmitigated 1H FVG located below price. A 4H FVG almost fully mitigated below price as well.

Golden Pocket (Bullish#1): There is a GP located at psych level $3.00. This aligns with the lower anchored VWAP 50% of the way through the Flag Formation.

Golden Pocket (Bullish#2): There is a major GP located at the bottom of the Bullish Flag Pattern. This aligns with Support at between $2.50 and $2.75.

Golden Pocket (Bearish): A mitigated bearish GP located above price may provide the momentum we need to break through multiple FVG’s to the $3.00 psych level leaving a strong confluence for a sweep of liquidity.

Context 3:

Volume Insight: OBVshows a spike in volume at $3.15. Showing strong confluence to clear lower FVG alignment and sweep liquidity at $2.85 to continue upwards.

BullishScenario #1:

We flush liquidity and mitigate all unresolved orders from $2.75 to $2.85. With the help of our lowered anchored VWAP and an EMA 200 confluence we see a sharp rise to the top of our Bullish Flag Pattern for breakout at $3.25. With a retest of the breakout leading to push price upward to sweep the $3.50 to $3.65 area.

Bearish Scenario #1:

After breaking out of the Flag Patter and sweeping the highs around $3.60, we clear a 4H Rejection Block located inside a Daily Rejection Block. We then test the breakout area creating a Head and Shoulders pattern and close out back inside the Flag Pattern

BullishScenario #2:

After we enter back into the Flag Pattern after sweeping highs, we see a move down to test support a third and final time at the $2.50 psych level. Aligning with the initial bullish move and it’s .618 level along with the bottom of our Flag pattern where we may see a sharp move upwards to create a new support level and ATH.