XRP ... silence before the storm !Hello Traders 🐺

I hope you're doing well — especially during the current market conditions.

Honestly, these days everything seems to be bearish, and staying positive and motivated through the losses is a bit hard, even for pro traders.

But as they say:

If you can't hold during the crash, you probably won't hold during the boom.

Or like the old man said:

"Those who survive the dump, deserve the pump!"

Let’s talk about XRP 👇

As you can see on the chart, price is clearly inside an ascending channel, which can also be considered a bull flag — because when we see a correction after a strong rally, it’s healthy for the market.

In such cases, price tends to form a pattern, and most of the time it's either a channel or some kind of wedge.

In this case, we have an ascending channel — or as mentioned, a bull flag.

So what can we do now?

There are two important trendlines to watch:

The blue line (monthly resistance)

The yellow line (channel support & resistance)

Right now, price is sitting below the blue trendline, so we’ll need a monthly close above it to confirm breakout — it's too early to judge just yet.

If we break in either direction, we have key Fibonacci levels to keep in mind:

0.618 and 0.718 fib levels are acting as support for now — and if we break to the upside, the upper channel resistance is the next big level to watch.

In my opinion, despite BTC.D's current position, there’s a strong chance we’ll see a reversal in the Altcoin sector and a major drop in BTC.D.

If you haven’t read my recent idea about BTC.D yet (which is going viral and was even chosen as an Editor’s Pick), I strongly suggest checking it out here 👇

It’s super important to combine macro fundamentals with technical analysis — and when it comes to Altcoins, BTC.D is a key index you should always pay attention to.

I hope you find this information valuable — and as always, remember:

🐺 Discipline is rarely enjoyable, but almost always profitable

🐺 KIU_COIN 🐺

XRPUSDT trade ideas

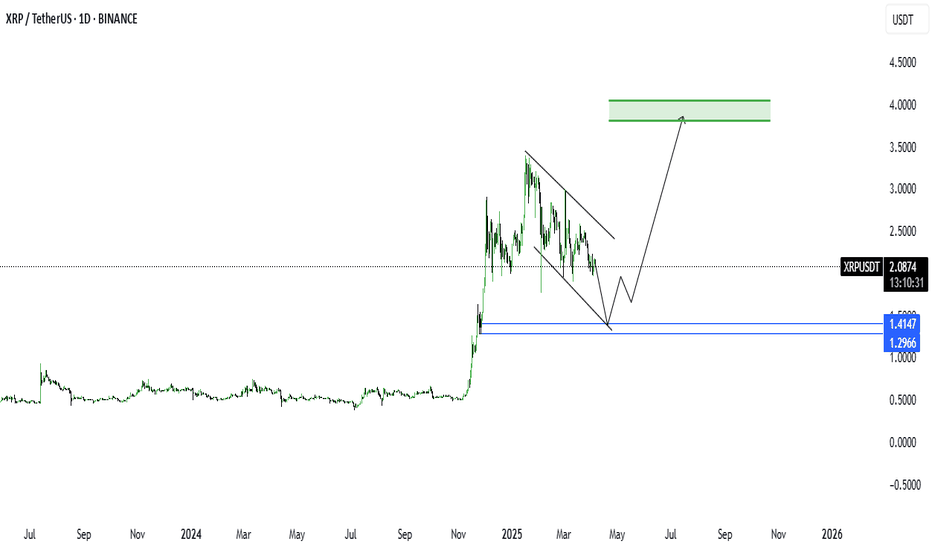

#XRPUSDT: Bullish Reversal Coming With Price Heading Back To 3.5## XRPUSDT Analysis: Long-Term Perspective

In the long term, we anticipate the XRPUSDT price to revert to its all-time high of 3.5. From a fundamental analysis standpoint, we maintain a positive outlook, with the potential for the price to surpass 3.5. We have identified a favourable trading opportunity, as illustrated in the chart.

Our approach is neutral, as the trend remains undecided. Based on the duration of your positions, you can set two targets:

1. **Short-Term Target:** If you intend to hold your positions for a short period, aim for a price level above 3.5.

2. **Long-Term Target:** For long-term investors, a target price of 4.0 or higher is plausible.

We are committed to providing comprehensive analysis and support. Should you have any inquiries or require further clarification, please do not hesitate to contact us.

Additionally, we would appreciate your insights on which cryptocurrency pair you would like to explore next.

Regards,

Team Setupsfx_

Phemex Analysis #71: Pro Tips for Trading Ripple (XRP)Ripple ( PHEMEX:XRPUSDT.P )has seen significant developments with the launch of its US dollar-backed stable coin, RLUSD (launched in December 2024), integrated into its Ripple Payments platform to improve cross-border enterprise transactions. The stable coin, regulated by the NYDFS, has experienced substantial growth, approaching a $250 million market cap and nearly $10 billion in trading volume, exceeding Ripple's projections. RLUSD is increasingly used as collateral in both crypto and traditional finance markets, and NGOs are exploring its use for donations.

Despite the positive developments surrounding RLUSD, XRP's price has failed to hold above the $1.76 support level. XRP recently dropped to a low of $1.61 due to US tariff news that pushed the broader market downwards.

Today, we will explore several possible scenarios for XRP's price action in the coming days to identify potential profit opportunities in this uncertain market.

Possible Scenarios.

1. Bearish Breakdown Below Support:

If XRP breaks decisively below the $1.61 support level with significant volume, it could signal a continuation of the bearish trend.

Pro Tips:

Consider shorting XRP on a confirmed break below $1.61.

Potential support levels to target: $1.43, $1.28, or even $1.05.

Place a stop-loss order above a recent swing high (e.g., $1.65) to manage risk.

2. Rebound from Support:

The $1.61 level represents a recent low, and a price bounce is possible, especially if broader market sentiment improves. Besides, support levels like $1.43, $1.28, and $1.05 are targets to watch for too.

Pro Tips:

Watch for bullish reversal patterns around the support level (e.g., increased buying volume, RSI divergence, bullish candlestick patterns).

Consider entering a long position on confirmation of a rebound.

Potential resistance levels to target: $2.0, $2.17, and $2.45.

Place a stop-loss order below the targeted support level to protect against further downside.

3. Consolidation within a Range:

XRP might consolidate between the $1.61 support and the $2.0 resistance if market uncertainty persists.

Pro Tips:

Consider range-bound trading strategies: buying near $1.61 and selling near $2.0.

Utilize grid trading bots within this range.

Set stop-loss orders outside the range (below $1.60 and above $2.0) to prepare for a potential breakout or breakdown.

Conclusion.

XRP's price action is currently influenced by both the positive developments surrounding RLUSD and the broader market uncertainty. Traders should remain vigilant and adapt their strategies based on the prevailing market conditions. By carefully monitoring key support and resistance levels, analyzing trading volume and technical indicators, and implementing appropriate risk management measures, traders can position themselves to capitalize on potential opportunities in the XRP market. Whether the price breaks down, rebounds, or consolidates, a disciplined and informed approach is crucial for successful trading.

Tips:

🔥 Break free from "buy low, sell high"! Our new Pilot Contract empowers you to profit from ANY market direction on DEX coins with up to 3x leverage. Go long, go short, go further!

Check out Phemex - Pilot Contract today!

Disclaimer: This is NOT financial or investment advice. Please conduct your own research (DYOR). Phemex is not responsible, directly or indirectly, for any damage or loss incurred or claimed to be caused by or in association with the use of or reliance on any content, goods, or services mentioned in this article.

XRP range - price sitting on supportXRP seems to have established a range here with price now close to the bottom of the range.

Also possible ascending channel with price reacting to bottom of channel.

Also seeing these possible flags/descending channels with price consolidating downwards with a good possibility for a reaction around these confluences.

Invalidation is below the lower support for the range with maybe a little room in case of deviation.

Long Position XRP/USDT🚨 XRP/USDT – Intraday Outlook (15-min Chart)

After reacting strongly to the mid-term support at 1.630, XRP has been climbing steadily and is now testing short-term trendline support to break it down to 1.8153.

🔹 Current Price: 1.93

🔹 Support Zone to Watch: 1.8153 – 1.7083 (Possible Long Zone)

🔹 Upside Target: 2.15+

📉 A short-term pullback toward the Possible Long Zone could offer a high-probability long setup. If bulls step in around that level, we might see a trend continuation toward the 2.15 or even higher regions, signaling a potential bullish reversal on the mid-term.

📊 With the overall recovery trend still holding, traders should watch for a break-retest setup or a bullish confirmation in the demand zone.

🧠 Smart Play: Patience is key. Let the price come to your level and watch for confluence.

What do you think? Is XRP ready to reverse for good?

XRPUSDT → The bulls won't hold support. Falling to 1.9BINANCE:XRPUSDT is under pressure despite quite positive news. The coin, being in a downtrend, continues to test the key support. The chance of a breakdown is growing

XRP continues to test a strong support zone on the weekly timeframe, relative to this zone, in the medium term, two scenarios can develop, which depend on the general mood in the market. If the current backdrop persists, the chance of a downside breakdown and further decline is quite high.

At the moment, the focus is on the key support at 2.0637, relative to which the retests continue, and the reaction is getting weaker and weaker, which in general only increases the chances of a further fall to 1.9 - 1.63.

Resistance levels: 2.265, 2.365, 2.509

Support levels: 2.0637, 1.9

The cryptocurrency market is going through bad times (Tariff War, high inflation, stock market decline, disappointment of the crypto community due to expectations) and until the situation starts to change, the technical picture will remain negative. XRP may continue its fall after a small correction.

Regards R. Linda!

XRP at $1.9: Testing Key SupportXRP is currently trading at $1.9, a pivotal level, as the crypto market grapples with a 4.4% drop in the last 24 hours. Macro uncertainty, think US inflation data and Fed rate hike fears, is pressuring risk assets. Yet, XRP holds steady, buoyed by whispers of a Ripple partnership with a major European bank for cross-border payments and ETF speculation (unconfirmed).

Technical Analysis

Short-Term (Daily Chart):

Support: $1.90 (current), $1.80

Resistance: $2.00, $2.10

RSI sits at 48 (neutral), while MACD hints at bearish momentum. XRP’s testing the lower edge of a descending channel, holding $1.90 could trigger a bounce to $2.00, but a break below eyes $1.80.

Long-Term (Weekly Chart):

Support: $1.70, $1.50

Resistance: $2.50, $3.00

The 200-day MA is sloping down, signaling caution, but $1.70 is a solid base for bulls.

Potential Scenarios

Bullish: If $1.90 holds and $2.00 falls with strong volume, expect a push to $2.10 short-term, possibly $2.50 long-term if adoption news hits.

Bearish: A crack below $1.90 could test $1.80, with $1.70 next if selling ramps up.

Trading Tips and Context

XRP’s real-world use in payments and recent partnerships fuel long-term hope, but the SEC lawsuit looms as a risk. Short-term traders: trade the range between $1.90 support and $2.00 resistance, set stops tight (e.g., below $1.90 for longs). Long-term holders: $1.70 is your critical level. Keep an eye on SEC updates or ETF chatter for catalysts.

XRPUSDT Bearish ForecastHi there,

If the price breaks below the support area, there might be a bearish continuation down to two levels that make up the price targets for a bias of 1.2611.

The price is currently bullish above that support area in a strong downward momentum; it might be possible that it will play around that area, consolidate or do some fake-outs.

Happy Trading,

K.

Not a trading advice.

Ripple’s Triple Top Signals $2 Breakdown, Eyes $1.90 SupportHello and greetings to all the crypto enthusiasts, ✌

All previous targets were nailed ✅! Now, let’s dive into a full analysis of the upcoming price potential for Ripple 🔍📈.

Ripple has demonstrated a classic triple top formation, with each successive peak showing weaker momentum. As it nears a formidable resistance zone, a break below the $2 threshold appears imminent. This downward move is expected to extend to at least $1.90, reflecting a minimum decline of 18%. Such a drop aligns with the primary target and a key daily support level.📚🙌

🧨 Our team's main opinion is: 🧨

Ripple’s losing steam after three peaks, eyeing a drop below $2 to around $1.90, with an 18% plunge hitting a key support level. 📚🎇

Give me some energy !!

✨We invest hours crafting valuable ideas, and your support means everything—feel free to ask questions in the comments! 😊💬

Cheers, Mad Whale. 🐋

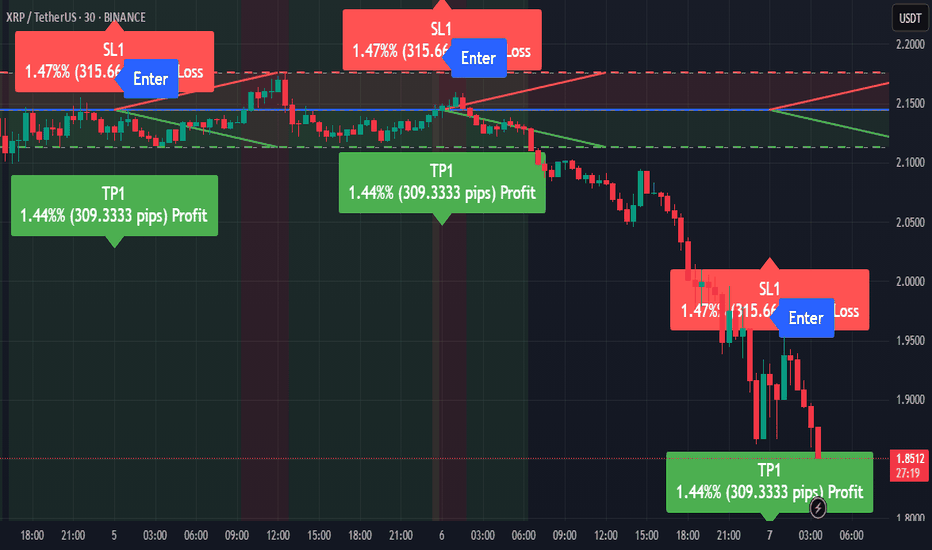

XRPUSDT Short Opportunity Highlighted by EASY Trading AI StrategAnalyzing XRPUSDT today using the EASY Trading AI model, I've identified a solid Sell signal. The AI indicates entering short at 2.1442, targeting a profit at 2.11326667, with a recommended Stop Loss at 2.17576667.This forecast emerges from specific patterns detected by the EASY Trading AI, showing weakened bullish momentum and increased seller activity. Continued bearish pressure aligns with technical resistance at current levels, supporting a downward move.Stay disciplined and adhere strictly to the entry, TP, and SL provided, ensuring robust risk management in your trades.

XRP back to $0.75 ??if the bounce will continue going up i am looking for a short position... all the way down to $0.75 and slightly lower. YES IT IS POSSIBLE!. on the weekly candles there is a huge FVG and also the projected move from the range where XRP now trades in is at $0.75

letst see what it does the coming weeks/months.

// LOW LEVERAGE \\ (max 5x)

short entry 2.275

stoploss 2.65

take profit 0.75

Rounded Top Forming – Will XRP Hold the $2 Support Line?CRYPTOCAP:XRP is currently showing signs of weakness as it continues to drift lower beneath a rounded distribution arc. The price action indicates a potential rounded top pattern, which typically suggests a gradual shift from bullish to bearish sentiment.

The asset has broken below the mid S/R zone and is now trading near a crucial strong support area, just above the 200 EMA — which is acting as dynamic support at around $1.95. This level is a key battleground for bulls and bears.

DYR, NFA

XRP XRP failed to break through the $2.1597 resistance and is now heading back toward the $2.0216–$1.9000 support zone.

If this support fails to hold, lower lows may be on the horizon.

A bullish reversal requires a breakout above resistance and confirmation above the 200 MA.

🎯 Next targets: $2.4729 and $2.59

📉 Weak volume and rejection from key levels increase bearish pressure.

xrp update Here's a polished version of your message that you could use for a post or update:

---

**XRP Update:**

Currently trading around **$2.085**, we're anticipating a **pullback toward the $1.40** levels. That zone could offer a **great opportunity** for long-term investors and spot traders to enter.

🎯 **Targets:**

- First target: **$3**

- Second target: **$5**

**⚠️ Patience is key — wait for the opportunity. Don’t jump in too early.**

Good luck, everyone! 💰🚀

---

Want it styled as a tweet, YouTube caption, or short video script?

XRPUSDT Short Opportunity -6.58% TargetWe just bounced (convincingly) off the mean average price established over the last 10 days and we are currently accelerating further down as I write this. I am short this area, it has already moved into profit so I will trail this to it's conclusion.

I think there is a high degree of likelihood we retest the swing low of $1.95 based in the continuing trend on the 1D chart.

The more a support is tested, the weaker it becomes.This is my expectation for Ripple in the coming period.

* The purpose of my graphic drawings is purely educational.

* What i write here is not an investment advice. Please do your own research before investing in any asset.

* Never take my personal opinions as investment advice, you may lose your money.