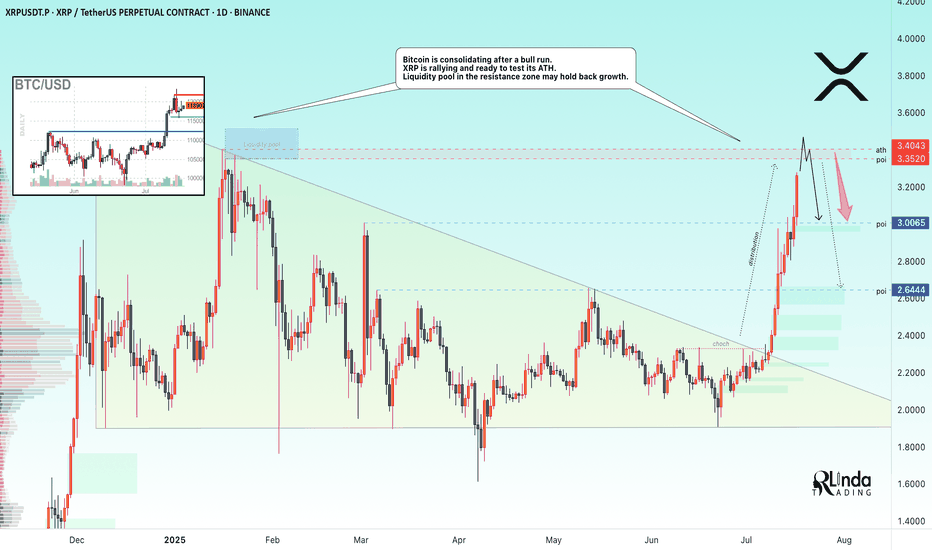

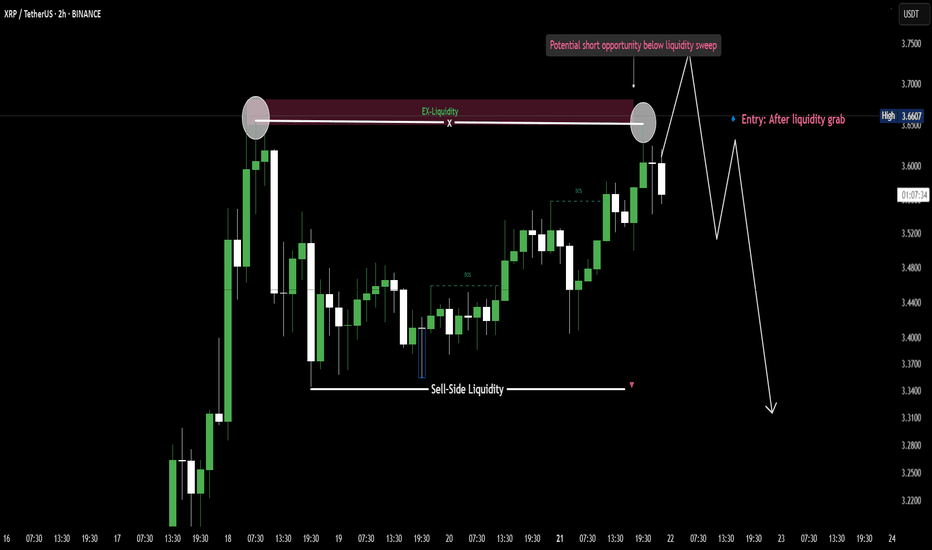

XRP → ATH retest. Reversal or continued growth?BINANCE:XRPUSDT.P is rallying and ready to test the resistance zone - ATH. Against this backdrop, Bitcoin is consolidating after a bull run. The liquidity pool may hold back growth.

Fundamentally, there is excitement across the entire cryptocurrency market. Altcoins are rallying after Bitcoin hit a new high and entered consolidation. The BTC.D index is declining, which generally provides a good opportunity for altcoins to grow. However, the index is approaching technical support, which may affect market sentiment overall...

As for XRP, there is a fairly strong liquidity pool ahead — the ATH resistance zone. The price is in a distribution phase after a change in character and a breakout of the downtrend resistance in the 2.33 zone. The momentum may exhaust its potential to break through the 3.35-3.34 zone, and growth may be halted for correction or reversal (in correlation with Bitcoin's dominance in the market).

Resistance levels: 3.35-3.40

Support levels: 3.0, 2.64

A breakout of resistance without the possibility of further growth, a return of the price below the level (i.e., inside the global flat) will confirm the fact of a false breakout of resistance, which may trigger a correction or even a reversal.

Best regards, R. Linda!

XRPUST trade ideas

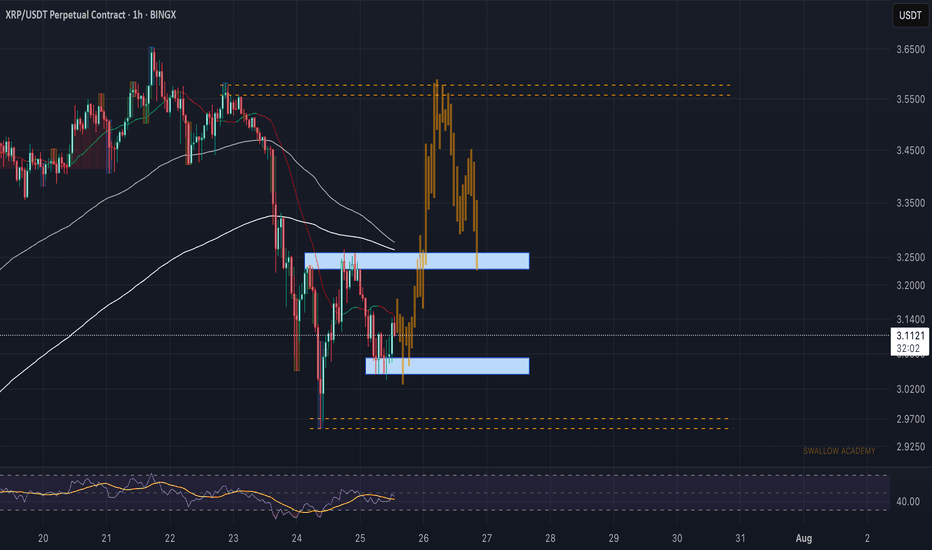

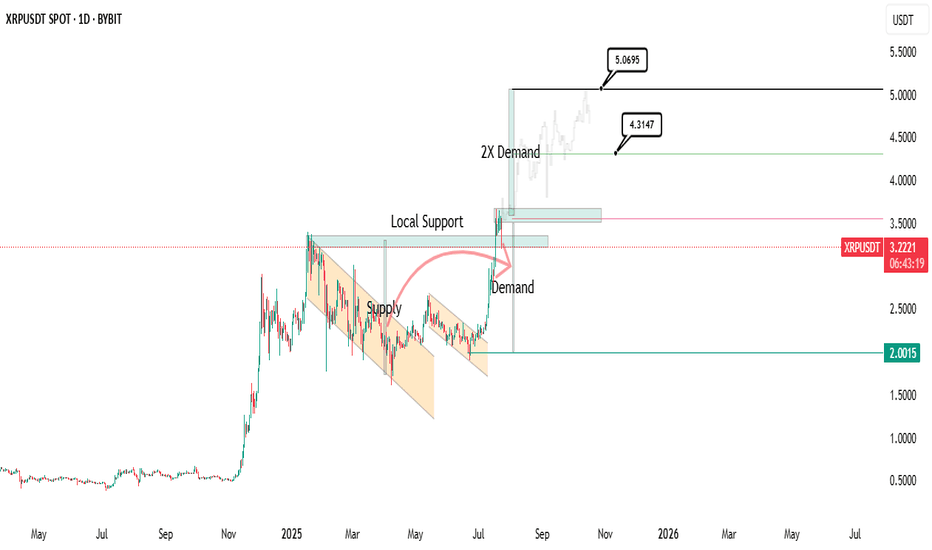

Ripple (XRP): Looking For Breakout and Smaller 10% PumpRipple coin has established some kind of local support zone, where we had a potential MSB to form but failed to break the area near $3.25.

Now price has cooled down and most likely will head again for another attempt to form the market structure break, so we are looking for a 10% gain right here.

Swallow Academy

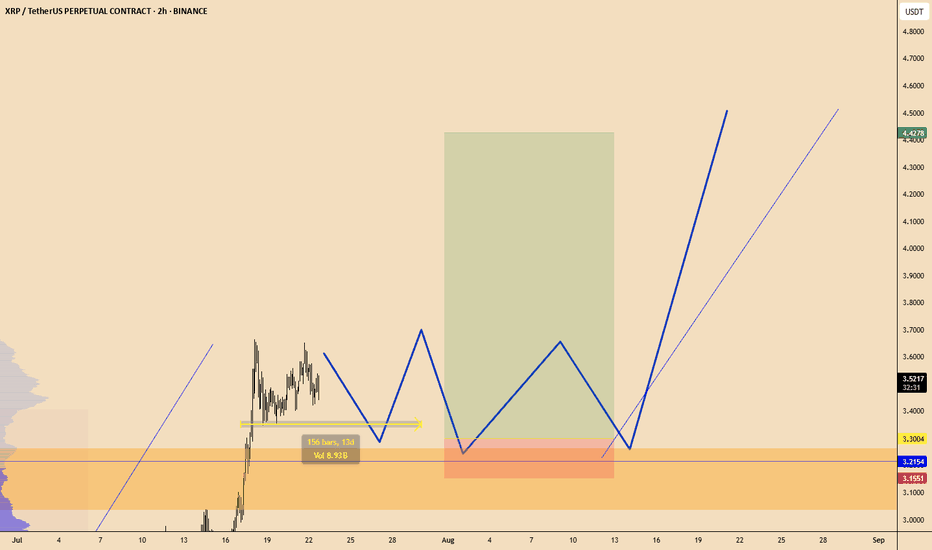

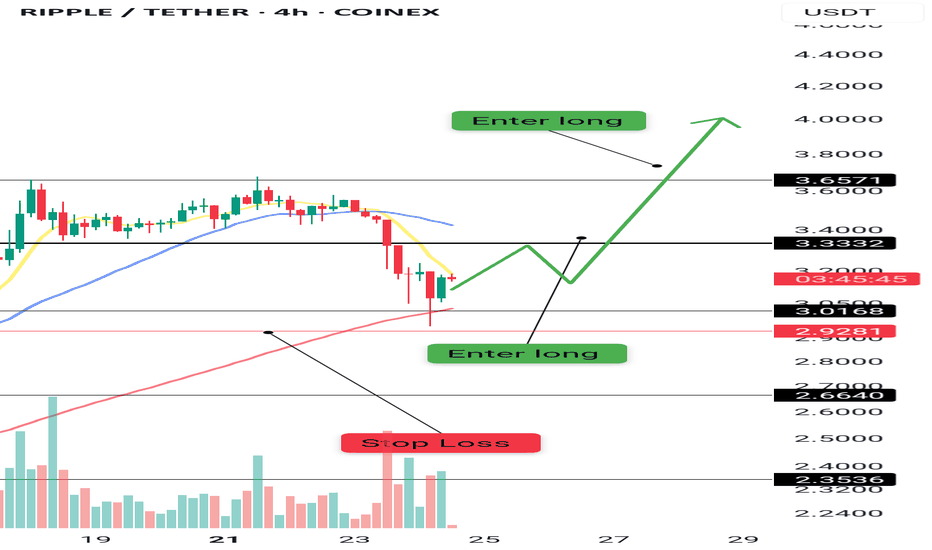

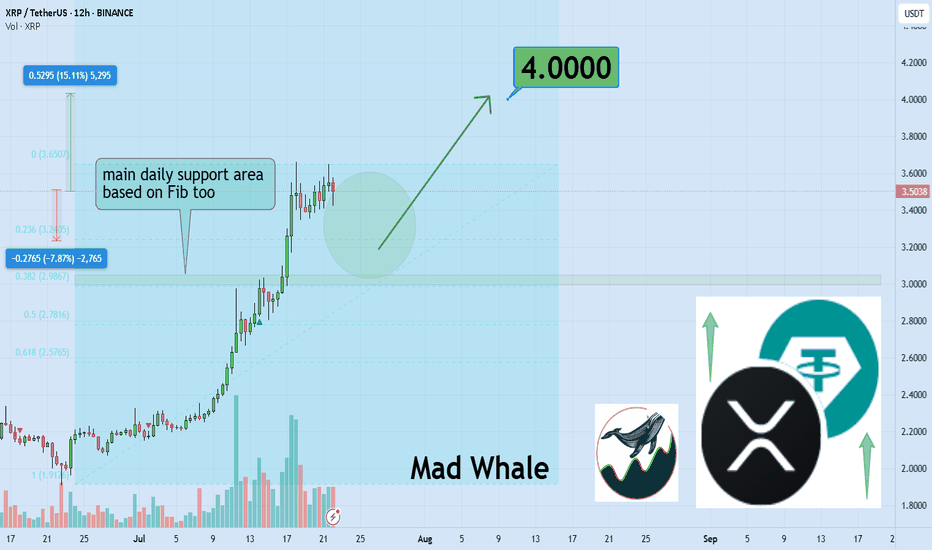

Can Ripple hit $3.40 with 15% upside soon?Hello✌

let’s dive into a full analysis of the upcoming price potential for Ripple📈.

BINANCE:XRPUSDT is poised to challenge the $3.40 level soon, supported by a notable increase in market volume 📊. This price zone also coincides with a key support area aligned with sharp Fibonacci levels, offering a strong base for potential upward movement 🔥.

✨ Need a little love!

We pour love into every post your support keeps us inspired! 💛 Don’t be shy, we’d love to hear from you on comments. Big thanks , Mad Whale 🐋

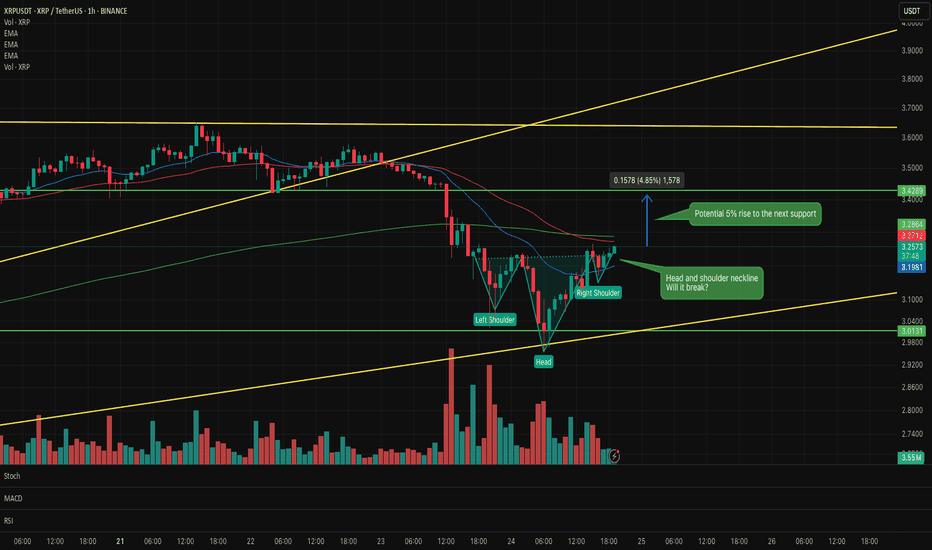

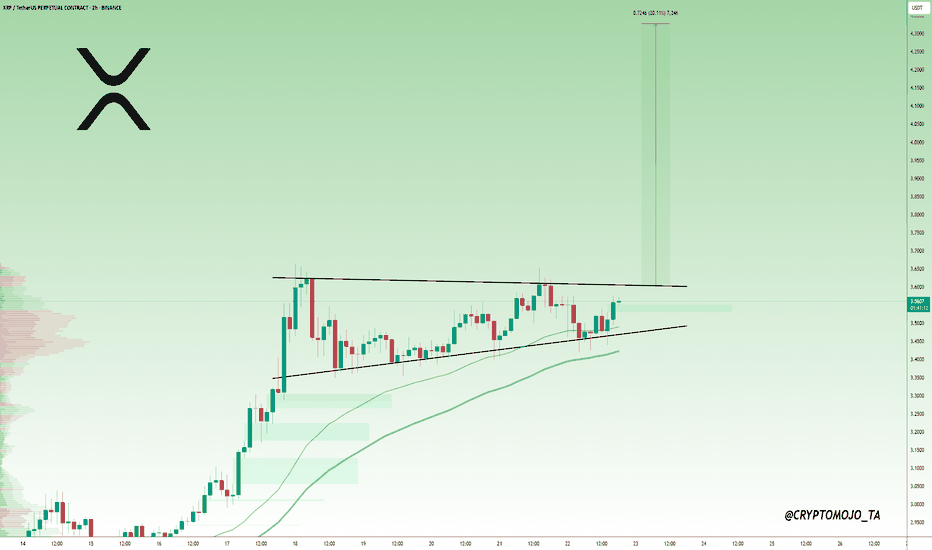

$XRP Breakout Loading, Watch That Triangle! XRP is forming a bullish ascending triangle

The price is holding higher lows while facing resistance around $3.60. This is a typical sign of buyers stepping in. If XRP breaks above this resistance with strong volume, a sharp move toward $4.30–$4.40 could follow. Until then, it’s building pressure inside the triangle. Breakout confirmation is key for the next leg up.

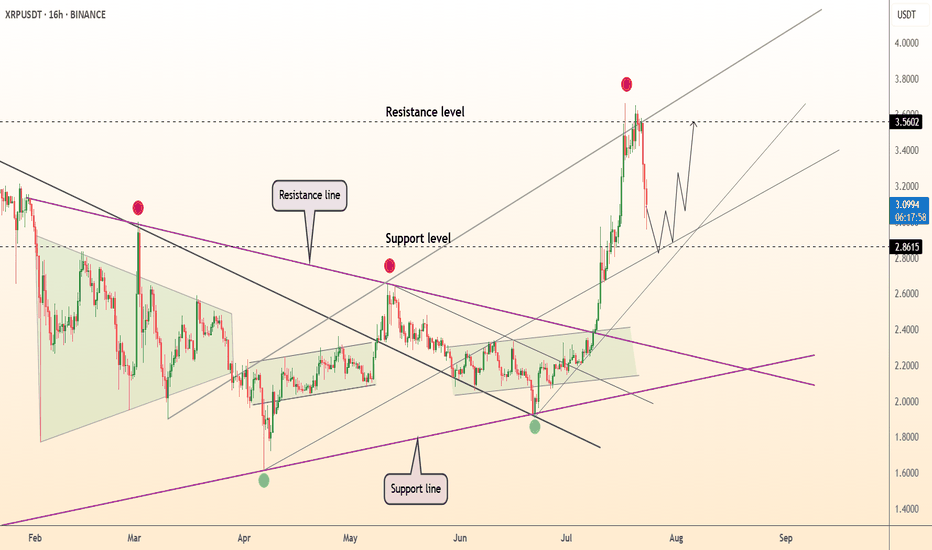

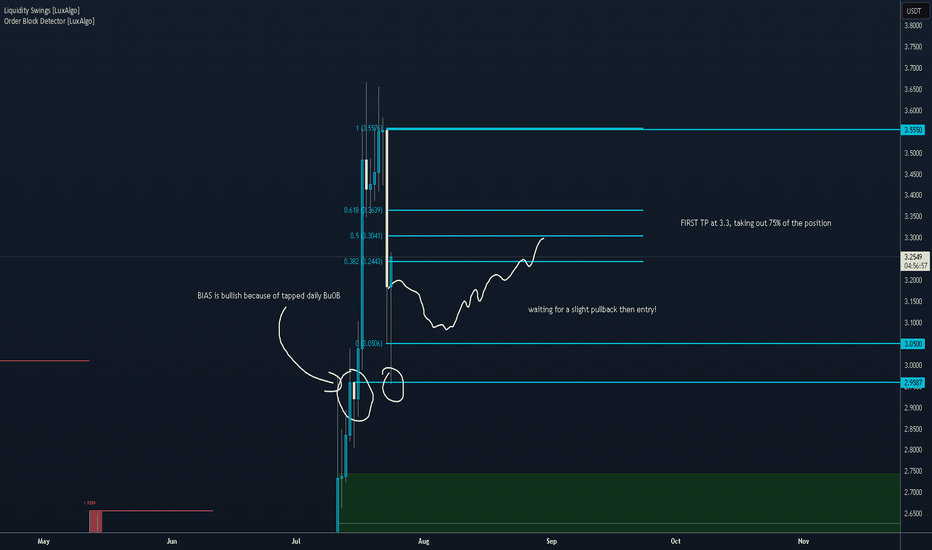

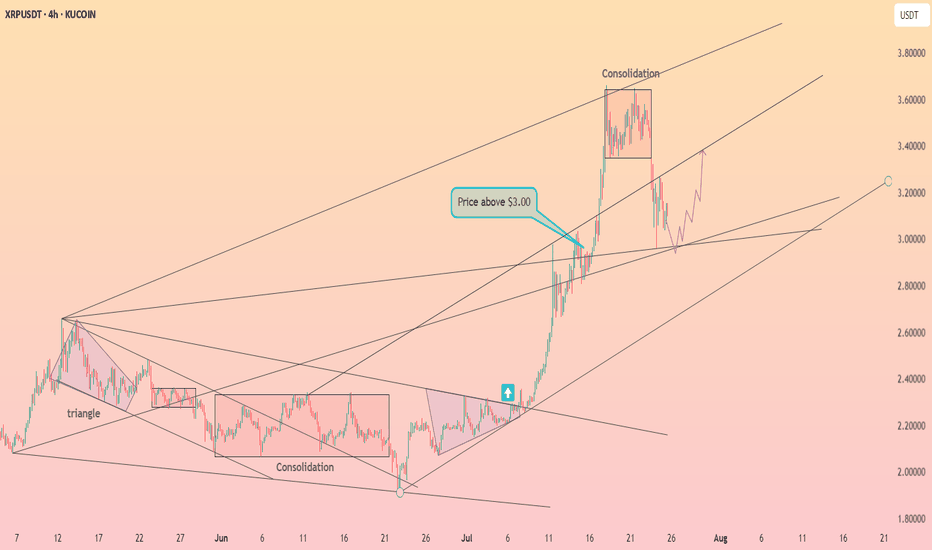

DeGRAM | XRPUSD rolls back to support📊 Technical Analysis

● After spiking to 3.56 (red dot) price slipped into a shallow bull-flag that is holding on the grey inner trend-line and the broken purple 2-year cap, converting 2.86-3.00 into firm support.

● Volatility compression inside the flag sits midway of the rising channel; a 16 h close back above 3.22 activates a 1:1 continuation toward the median-line cluster at 3.80, with the outer rail still pointing to 4.00.

💡 Fundamental Analysis

● CME’s launch of micro-XRP futures and fresh US exchange relistings lifted open-interest 18 % w/w, while Coinglass shows $12 M shorts liquidated since Monday—evidence of renewed upside pressure.

✨ Summary

Buy 3.05-3.22; breakout over 3.22 aims 3.80 → 4.00. Invalidate on a 16 h close below 2.86.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

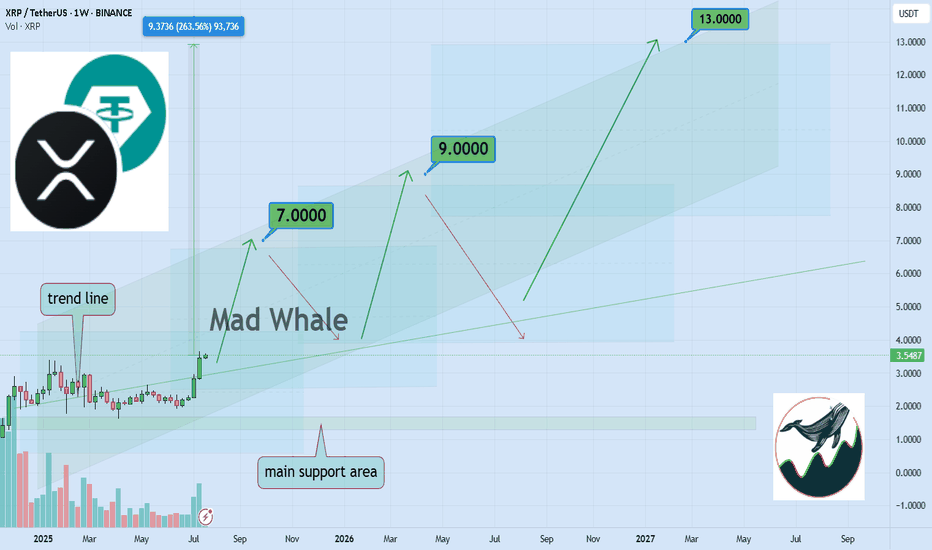

Bullish XRP Setup: $7, $9, and $13 Main Price TargetsHello✌

Let’s analyze Ripple’s upcoming price potential 📈.

BINANCE:XRPUSDT , I expect a long-term upward bullish trend.

There are three main targets in this analysis: $7, $9, and a final target of $13, which could be reached within 2 to 6 years.

The price may form parallel channels at times, which are shown on the chart. I also expect the current bullish channel to remain valid and continue upward. Additionally, there is a strong trendline guiding the movement.

✨We put love into every post!

Your support inspires us 💛 Drop a comment we’d love to hear from you! Thanks , Mad Whale🐋

🐋Many of the points and levels shown on the chart are based on personal experience, feeling, and over 7 years of research and daily study of crypto charts.

Some of the lines, channels, and price zones are drawn to make the chart easier to understand and to help imagine possible future price movements.

I’ve also included one very big drop in price even bigger than the others because in the crypto market, it’s common for prices to suddenly fall hard and push out small investors and traders with positions.

The targets on the chart are not guaranteed; they might be reached, or they might not.📚

📜Please make sure to do your own research before investing, and review the disclaimer provided at the end of each post.

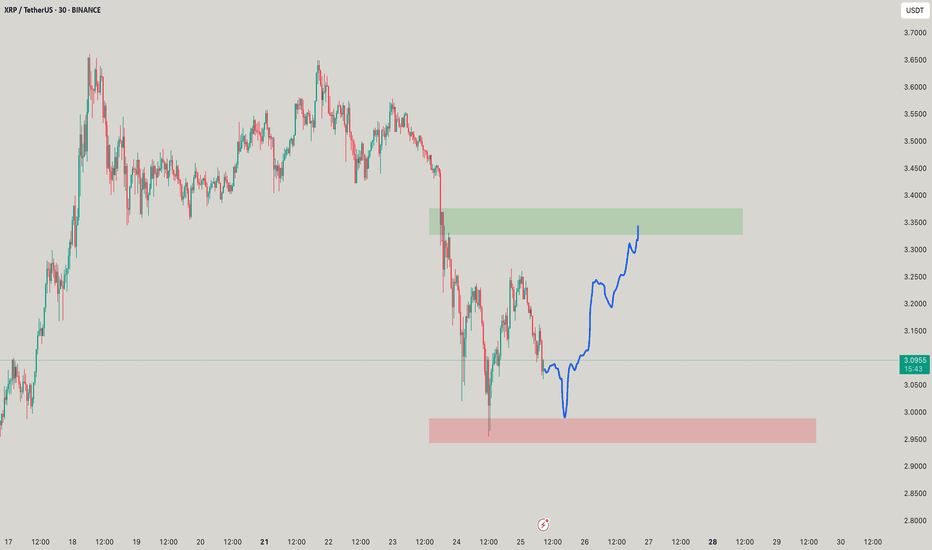

#XRP Update #3 – July 18, 2025#XRP Update #3 – July 18, 2025

XRP has surged roughly 28% in its latest impulsive move. Naturally, we now expect a correction phase. Potential retracement levels are:

Level 1: $3.30

Level 2: $3.20

Level 3: $3.10

Pullbacks to any of these levels should not be alarming — they are typical and healthy corrections.

I plan to go Long if XRP bounces from the first correction zone. However, at the moment, I’m just observing, as the current signals are not strong enough to justify entry.

It’s also important to note that there are heavy whale sell orders between XRP’s current price and the $4.00 zone. Breaking through this resistance will likely require strong buy-side volume from large players. Caution is advised.

Ripple (XRP/USDT) Analysis – 4H🚀 Ripple (XRP/USDT) Analysis – 4H

Hello everyone,

Today I want to analyze Ripple (XRP). I hope you find this analysis useful and share your thoughts in the comments.

The following analysis is based on MWC (4H).

📢 Quick Overview of Key Ripple News:

• $759M transfer by XRP whales, indicating heavy behind-the-scenes activity that could signal a major price move.

• This large transfer could be a sign of Accumulation or preparation for high volatility.

Our main focus to maintain the bullish scenario should be on btc.d and usdt.d charts.

♦️ Btc.d ♦️

After the heavy drop in the past week, Bitcoin dominance started correcting yesterday.

The levels I expect reactions from are:

61.31 (already broken),

Next levels 61.74 and 62.17 (currently testing).

A breakout and stabilization above these levels will put altcoins under strong selling pressure.

However, a rejection at these levels will bring attention to altcoins close to breaking their zones.

♦️ Usdt.d ♦️

This chart also shows signs of forming a bullish structure.

We need to watch for a reaction to the next important zone 4.44 – 4.36.

But for altcoins to continue their uptrend, 4.14 must break downward.

♦️ Others.d / Total / Total2 / Total3 ♦️

These charts are naturally bearish.

Before their support levels matter, we should focus on the potential reversal of btc.d and usdt.d.

These give earlier signals of correction continuation or completion.

We can use Total, Total2, Total3, and Others.d for confirmation.

Important levels:

Total: 3.91

Total2: 1.55

Total3: 1.08

Others.d: 8.05 (for now), but if the correction ends and a bullish move starts, we may see a lower high forming.

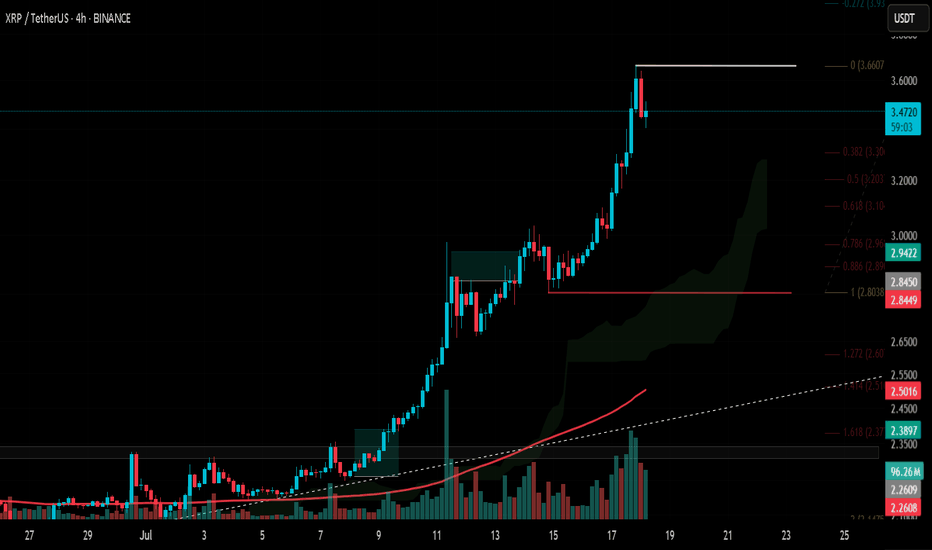

♦️ XRP ♦️

Currently, a breakout above 3.65 is the entry trigger.

The more likely bullish scenario: create a new high → minor correction → breakout = entry signal.

This will happen if Bitcoin dominance drops.

According to our strategy, both the market and XRP are in a bullish structure.

I will not consider short positions, even if XRP falls to 2.66.

Considering the strong seller activity at 3.65, I expect the breakout to be sharp and whale-driven.

Thus, there are two ways to enter:

1. After forming a new high and low, enter upon candle close and confirmation around 3.33.

2. If we miss the move, enter with a STOP BUY at 3.6.

In both cases, if the scenario is activated, Stop-Loss = 2.92.

🔥 If you found this analysis useful, hit the 🚀 and follow me for more updates!

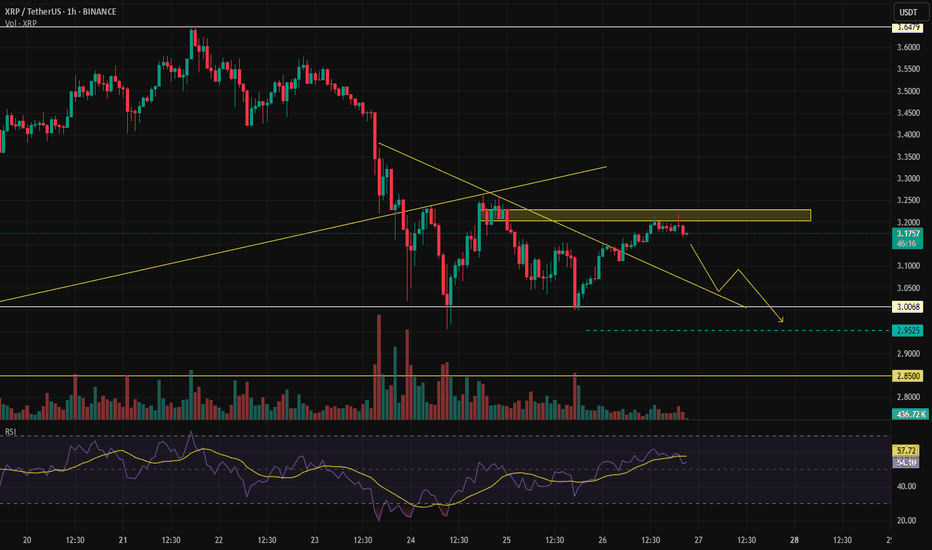

XRPEarly Pullback Potential:

Given the overbought RSI (76.45-89.52) and recent 3% price swings, a slight pullback early in the day is plausible, especially during lower-volume pre-market hours before the New York open (8:00 AM EDT). Key support levels to watch are $3.05 (immediate support) and $2.95 (20-day EMA). A drop to $2.90-$2.95 is possible if profit-taking intensifies, as suggested by declining volume and bearish MACD signals.

Pump on New York Open : The New York market open often brings increased liquidity and institutional activity, which could trigger a price pump. XRP’s recent correlation with bullish market sentiment (Fear & Greed Index at 74, Greed) and high futures open interest ($9.25B) supports potential upside. A breakout above $3.25 could target $3.30-$3.50

The More You Believe You Know The More You LoseThe moment you see your first green position something changes Suddenly your brain convinces you you’ve got this But the market doesn’t punish bad traders it punishes the ones who think they’re too good to lose

You don’t lose because you’re unskilled

You lose because you believe you’ve mastered the game

Hello✌️

Spend 3 minutes ⏰ reading this educational material.

🎯 Analytical Insight on Ripple:

BINANCE:XRPUSDT remains undervalued at current levels, showing strong volume near a key daily support zone that aligns closely with a major Fibonacci retracement. This confluence suggests a potential shift in momentum. If buyers hold this level, a move toward the $4 area is on the table, representing an estimated 15% upside. 📈 Watch for confirmation through sustained volume and price reaction at support. ⚡

Now , let's dive into the educational section,

🎯 The Confidence Trap

One of the most dangerous mental states for a trader is early victory That moment after a couple of green trades when you start feeling like you’ve figured the market out That’s when the market does to you what you used to do to clueless beginners

From that point forward your decisions aren’t based on analysis they’re based on this thought

I already know how this works.

🧠 How Your Mind Tricks You

You win once Your brain says “Told you you’re good”

You win again It says “Go heavier now”

You lose It says “Fix it now You’ve done it before”

This cycle leads to overtrading and emotional revenge You’re no longer trading the market you’re defending the version of yourself you believe you’ve become

🔄 The Market Doesn’t Send Signals It Sends Lessons

When the market moves against you it’s doing the right thing It’s breaking down your ego so you can finally start seeing the chart for what it is not what your confidence wants it to be

🧱 Experience Can Kill Learning

Many failed traders are not beginners they’re the ones with years of bias built up At some point they stop learning Every chart starts looking the same That’s when their final trade shows up

🕳 The Ego Pitfall

If your mind tells you “I know this” it’s time to be extra cautious That means you’re trading with a rigid mindset And in crypto markets the rigid get destroyed

📉 High Leverage = High Confidence = High Risk

Nobody gets reckless on 2x leverage But once you start feeling pro you go 20x 50x or more And when the market flips the same ego that won you your first big gain is the one that wipes out your entire account.

📊 How TradingView Tools Can Save You

In this mental trap three tools from TradingView can seriously help

Replay Bar Tool

Go back in time and relive previous market conditions This tool shows you exactly where your bias failed and where your overconfidence blinded you It helps kill that false feeling of mastery

OBV (On Balance Volume)

A simple yet powerful volume indicator If price rises but OBV is falling the uptrend is fake If price drops but OBV is climbing sellers are weak and a reversal might be near This gives volume context beyond candles

Volume Spike

Watch out for sudden surges in volume If volume explodes but price barely moves someone big is moving in silence It’s often the prelude to fakeouts traps or major directional shifts These spikes scream pay attention

Risk-to-Reward Tool

Don’t let your “confidence” make you forget basic math This tool gives you the true ratio of what you’re risking versus what you’re chasing It doesn’t care how good you feel it shows you if the trade makes sense

🧊 Humility Is the Only Edge That Lasts

Humility means accepting you might always be wrong It means checking yourself with objective tools It means saying “maybe” instead of “definitely”

It means lasting longer than the rest

🔚 Final Words

If you’re sure you’ve mastered the market pause The best traders second-guess themselves often not because they’re weak but because they know confidence fades but risk never does

✨ Need a little love!

We pour love into every post your support keeps us inspired! 💛 Don’t be shy, we’d love to hear from you on comments. Big thanks , Mad Whale 🐋

📜Please make sure to do your own research before investing, and review the disclaimer provided at the end of each post.

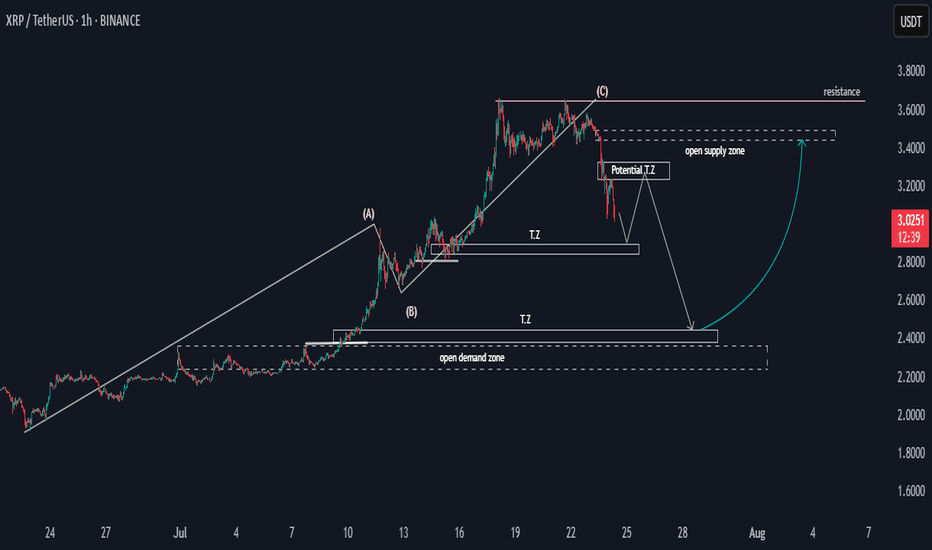

XRP Potential SND Flow MapHello,

This is a general overview of the XRPUSDT flow map, outlining potential price movements.

The price may experience a decline, followed by a pulse upwards before a final drop. Target zones have been identified, and following this, there is a possibility for the price to rally toward the 3.4 supply zone. This would establish the 2.4 to 2.2 range as a key potential bullish zone.

Happy Trading,

Khiwe.

Not trading advice

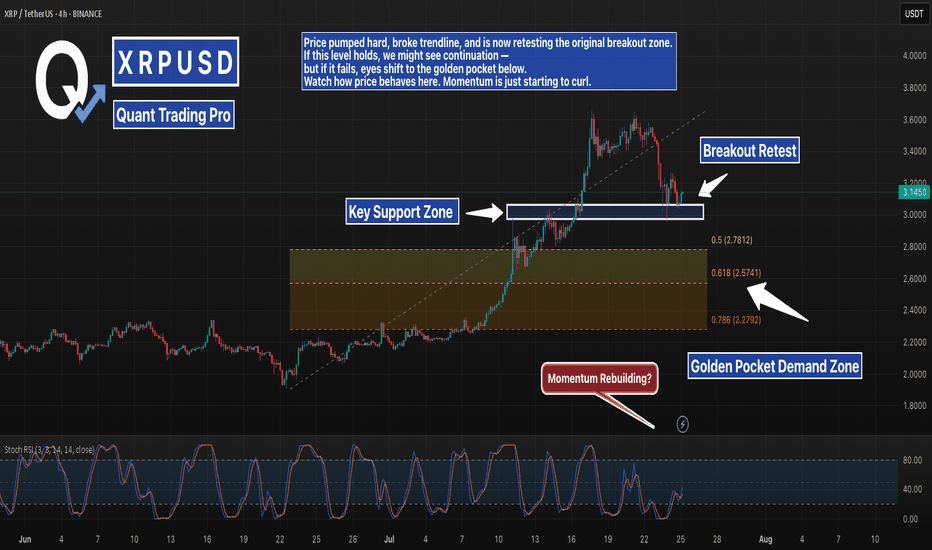

XRP 4H – Critical Retest Zone + Golden Pocket BelowXRP is sitting right on its prior breakout zone after a clean rally and trendline break. This zone is acting as critical support — the same area that triggered the last explosive move. Bulls want to see a bounce here with momentum building again (Stoch RSI is curling from oversold).

If this level fails, price could retrace deeper into the Fibonacci golden pocket (2.57–2.78), where stronger demand is likely waiting. That confluence of fib levels and past consolidation makes it a high-interest area for potential long setups.

For now, this is a pivotal moment. Either we bounce here — or things get a lot more interesting below.

#XRP #CryptoAnalysis #FibonacciRetracement #GoldenPocket #BreakoutRetest #Altcoins #TechnicalAnalysis #QuantTradingPro

XRP - ContinueRipple's price movement in the main channel and its decline or decrease to the lowest price level has been completed, and we can expect an increase in the price of this currency in the crypto market. Ripple's analysis has recorded a 200% increase so far, which you can see the results of in past analyses.

Sasha Charkhchian

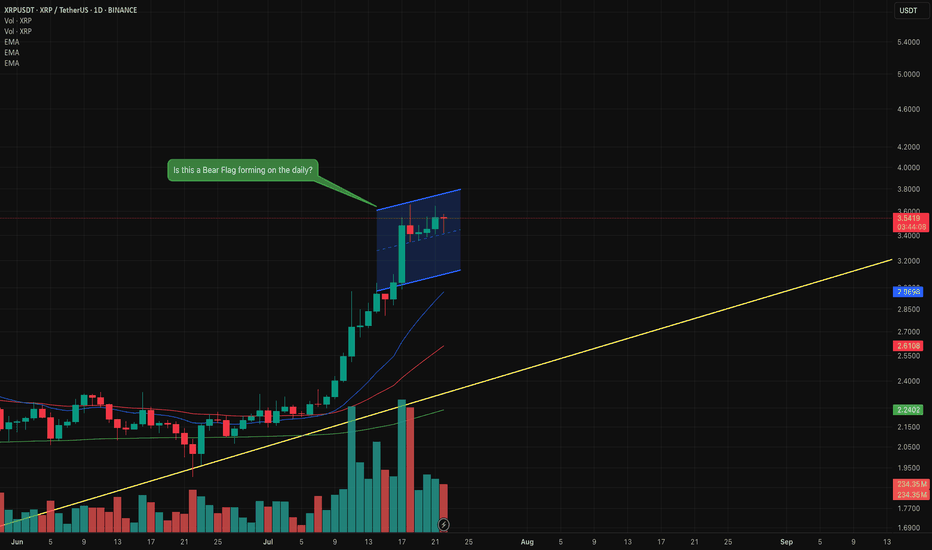

Is this a Bull Flag forming on the XRP daily timeframe?Although sentiment for XRP is strong and recent trend has been sharply upwards. I'm wondering if this is a bear flag forming on the daily?

Given the sharp rise it could be and may not be a negative signal as it could give the opportunity for a healthy pull back before rising again to new all time highs.

Let's watch how it progresses over the next few days. I will not be jumping into a trade until it confirms.

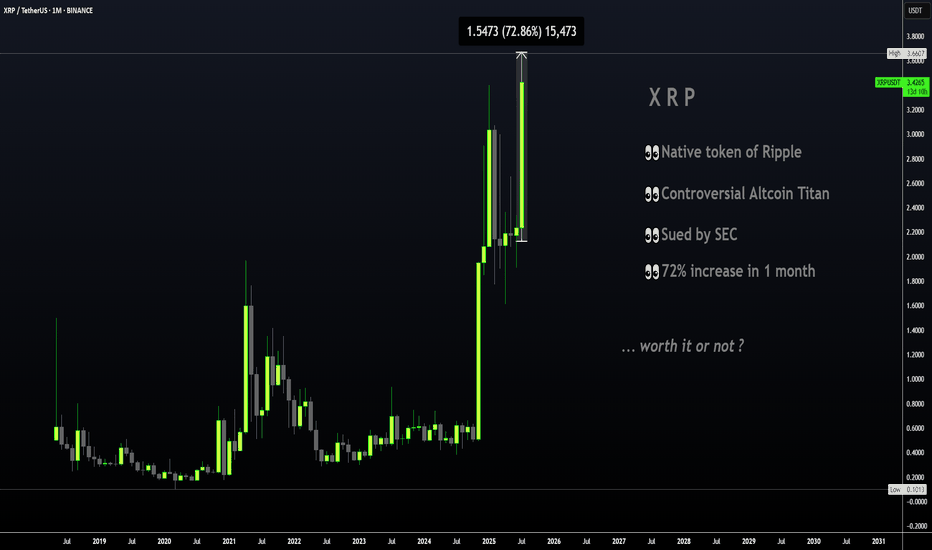

XRP | Great TP Zone is HERE for HODLERSXRP has seen a 62% increase since breaking out above the moving averages in the daily timeframe.

The previous time XRP broke out above the moving averages in the daily, the price increased around 440%:

However, with XRP being the ultimate pumper and dumper, I'll take my chances at 62%! Because this bull run has been anything but ordinary and it's best to avoid being too greedy. The price of XRP falls extremely quick, just as quick as it rises.. ( Maybe not overnight but you know, it has happened before ).

If you're one of few who bought around $1, or heck even later at $2, this is a solid increase and it should not be taken for granted. XRP has gone LONG periods without increases and often stayed behind making new ATH's when other cycles have come and gone (twice), as other alts make new ATH's. Over the years, I've made extensive posts on XRP; documented its use case, followed the SEC case closely and yet, XRP still remains one of the strangest and most unpredictable alts I have ever tried to analyze. Long term followers will remember that a I was bullish in 2018/2019 and then slowly became uninterested up until the point of negative towards XRP for probably the past 3-4 years.

This is not only because of the lagging price compared to other older alts that soared like ETH and even Litecoin. Sure we did not see the growth and the taco stand ( who remembers ) just kept dumping on the market... But the entire "scandal" of the actors marketing/pimping, the dumping behind the scenes by executives to fund Ripple in early days, the lawsuit etc. was just such a colossal mess that I even wonder how XRP is still alive and kicking today.

All I'm saying is that this is truly a spectacular moment - it's hard to even imagine cripple crossed $3 after years and years of waiting on XRP when other alts x1000% and beyond. Point being - Don't miss it! Trading only works when you take profits.

________________________

BINANCE:XRPUSDT