ZARUSD trade ideas

USD/ZAR Bullish Structure Holds, Waiting for PullbackUSD/ZAR is currently trading at 18.80, having recently rejected the key resistance level near 19.00, which has acted as a historical ceiling multiple times. Despite the rejection, the pair maintains a clear bullish structure and continues to trade above the Ichimoku cloud (Span A at 18.86 and Span B at 18.48), confirming the dominant upward trend.

The Trend Strength Index (TSI) shows:

TSI(10): 0.64 (approaching overbought)

TSI(20): 0.37

This suggests strong upward momentum in the medium term, though a temporary pullback is expected as short-term momentum cools.

The optimal scenario is a retracement toward the support zone between 17.59 and 16.68, where we could see a new TSI oversold signal, similar to previous bullish continuation setups. This would offer a high-probability entry aligned with the trend, targeting a move back toward the 19.91 swing high, or even further to 21.80, as suggested by the projected extension.

If price breaks below 16.68, the bullish structure would be invalidated, and the setup would no longer be valid.

Trade Setup Summary:

Buy Zone: 17.59 – 16.68 (support area)

Target: 19.91 (resistance)

Stop Loss: Below 16.68

Bias: Bullish while above 16.68

TSI Confirmation: Look for oversold reading at support for ideal entry

The US dollar remains firm on the back of relatively strong macroeconomic data and persistent inflation concerns, keeping rate cut expectations limited. In contrast, the South African rand is under pressure due to political uncertainty, slow growth, and structural fiscal issues. These macro conditions support continued USD strength over ZAR, aligning with the current technical uptrend. Any global risk-off move could further weaken the rand and accelerate bullish continuation on USD/ZAR.

Disclaimer: This content is for educational and informational purposes only. It does not represent financial advice or a recommendation to buy or sell any financial instrument. Trading involves risk, and you should only trade with money you can afford to lose.

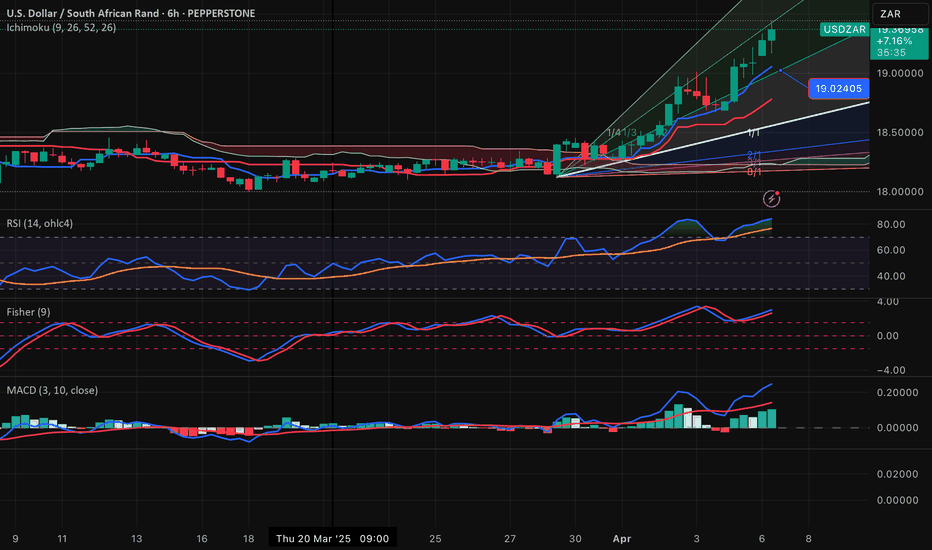

USDZAR-BUY strategy 6 horuly chart GANN The pair has been undergoing some downward pressures, but my overall indicators seems still showing upside potential. I would be careful below 18.7500 though, as this may fill the gap 18.6000 and low again.

Strategy is for now BUY @ 18.8250 - 18.8650 and take profit near 19.0450. I am not committed, except the run upwards before.

USDZAR-SELL strategy 12-hourly The pair does show longer-term the possibility of moving towards 17.75 based on the s/h/s pattern we have. The key is the neckline, and as long we remain above this level, we still can have another go higher before lower again.

Strategy SELL between 18.8200 - 19.0000 and take profit near 17.9350 for now.

USDZAR-BUY strategy 6 hourly chart Regression channelThe pair is in an complex frame, whereby part is move lower longer term, but shorter time frame it is buoyant in character. We should see higher levels near 19.4500 again I feel.

Strategy BUY @ 18.9575 - 19.0200 range and take profit near resistance 19.3300.

USDZAR-BUY strategy 3 hourly chart - regression channelI am not super convinced, and same as yesterday, am not committed to a trade in the pair at this moment in time. However, the pair looks a bit better BUY now, and I feel there is some potential for recovery from the current levels. Overall still pressure judging 12 hourly chart.

Strategy BUY @ 18.8000-18.8350 and take profit near 18.9850 for now.

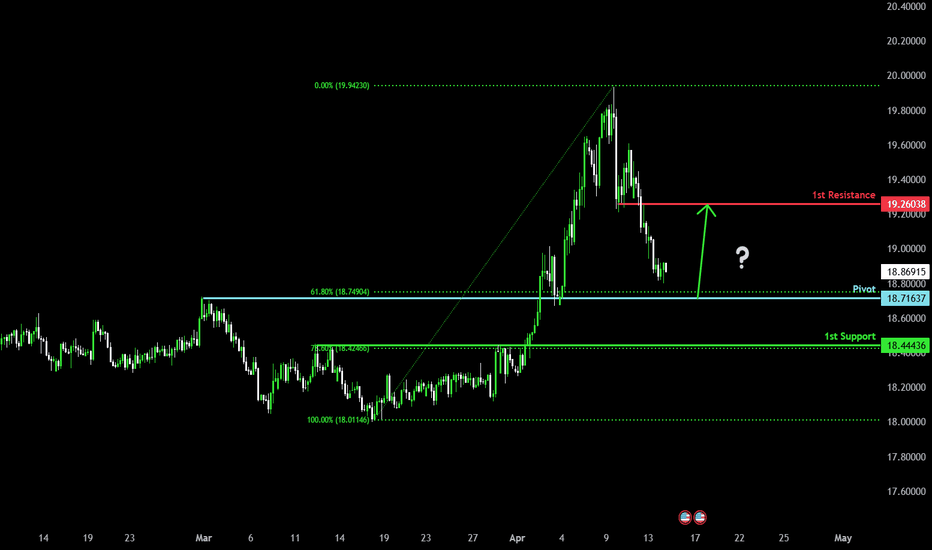

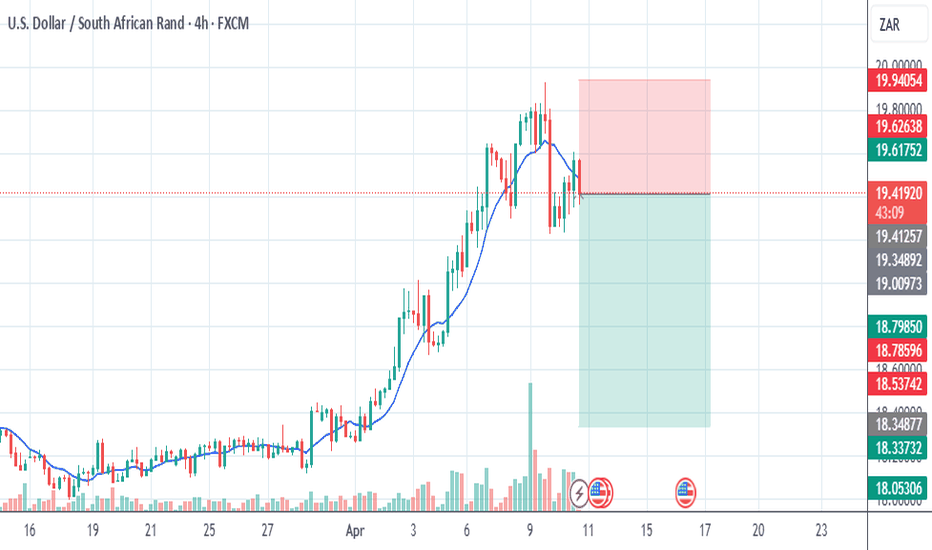

Bullish bounce?USD/ZAR is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 18.71637

1st Support: 18.44436

1st Resistance: 19.26038

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

UPDATE I was wrong with USD/ZAR - Now it's undecidedWith trading it's not about certainties but probabilities.

And in this case I was soo optimistic about the rand breaking its Inverse Cup and Handle and heading to R16.50.

But instead the USD/ZAR rallied to R19.74.

Apart from the negativity kicking in with the US, there is one thing I didn't really consider. And that is the US Dollar is going to hurt - no doubt.

But the rand and emerging economies will more likely hurt even worse. Because despite it all we still follow the big boys (DOw, SP500, UK100)

Hence when the US sneezes, the world catches a cold.

But then we have other reasons for the rand weakening

1. 🗳️ Political Uncertainty in SA

Coalition tensions and governance concerns are making investors nervous, pushing money out of SA.

2. 📉 Lower SARB Interest Rates

South Africa cut rates again, making the rand less attractive to yield-seeking investors.

3. 🌍 Global Risk-Off Mode

Traders are fleeing emerging markets amid global tensions—hurting the rand, boosting the dollar.

4. 💼 Weak SA Economic Outlook

Low growth, high unemployment, and power issues reduce confidence in South Africa’s economy.

5. 🇺🇸 Stronger Dollar Demand

U.S. dollar gaining strength globally due to safe-haven demand and higher relative rates

So, yes - We are seeing some rand strength now and we are back to R18.88.

We will need to wait for the next formation before we make any deductions on where it is likely to go.

It could break up with the Falling Flag and run up to R20.00.

Or it could stabilise and form an Inverse Cup and Handle again and drop to R17.50.

We need to wait and see. I can't always post my winners - or else I wouldn't be an actual trader.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDZAR-NEUTRAL BUY 3 hourly chart regression channelThe move lower was expected and I have exited 19.0000 when it tested. it went further south, and this is normal behavior, but I feel comfortable to exit and remain on side lines cuerrently with the pair. If one wishes to trade:

1. strategy BUY near 18.8850 - 18.9100 and take oprofit near 19.0450

2. strategy SELL @ 19.0500-19.1150 and take profit near 18.8750 for now.

USDZAR-SELL strategy Monthy chart GANN SQSome weeks back I had posted a monthly chart with a viewpoint of a likely S-H-S top formation, and that at that time the right shoulder still suggested we would see 19.3500 or more. Now we have formed this right shoulder pattern, and likely some more consolidation adding to the shoulder.

The overall view is long-term a larger decline to unfold and a break of the neck line (shown) may translate to 15.3000 objective roughly. so for those trading long-term, and have deep pockets, this may be an interesting pattern to look at.

USDZAR-SELL strategy 3D chart KCThe pair's range has been large, and judging the regression channel, we should see reasonable move lower over time. For now, there is still upward pressure existing, but if we are able to remain or sell between the 19.45-19.65 range, eventually a return to mid-channel level 18.9500 seems feasible.

Strategy SELL @ 19.4500-19.6500 and take profit near 18.9750.

USD/ZAR Poised for a Strong Breakout as Market Forces Align1️⃣ Key Technical Insights from the Chart

A. Wyckoff Accumulation & Support Zone

The chart suggests Wyckoff accumulation with a Spring phase (H) and Test (H) in October 2024 at the 17.80 - 18.00 zone.

This Spring phase often signals a liquidity grab, where smart money accumulates before a trend reversal.

The current price level (18.06 - 18.12) is near the support line for SC Accumulation (D), reinforcing the idea of a bullish move from here.

💡 Macro Connection:

If US inflation surprises higher (March 11 CPI), interest rate expectations shift hawkish, and USD strengthens, reinforcing the Wyckoff accumulation phase leading to an upward breakout.

If global risk sentiment worsens, USD could also see inflows as a safe-haven, confirming the upward trajectory.

B. Harmonic Pattern & Fibonacci Levels

The Bearish Gartley/XABCD pattern has completed its correction phase at Point A (~18.06) and now shows signs of reversal.

The B point rejection near 1.238 Fibonacci extension indicates exhaustion of the bearish move.

The chart suggests a bullish continuation, targeting 19.26 by March 20, 2025, based on projected Fibonacci extensions.

💡 Macro Connection:

If US Nonfarm Payrolls (April 5) and Fed Meeting (March 19) reinforce strong USD fundamentals, the technical bullish move aligns with macroeconomic data.

A rise in bond yields above 4.5% on the 10-year Treasury could confirm the expected upside.

C. Elliott Wave Structure

The chart labels a completed 5-wave impulse up followed by an ABC corrective pattern, aligning with Elliott Wave theory.

The current structure suggests the start of a new Wave 3 rally, which is typically the strongest and most extended move.

Potential upside target: 19.26 (aligning with Wave 3 extension).

💡 Macro Connection:

If March and April macro data support continued USD strength, this Elliott Wave 3 scenario could materialize.

A higher inflation surprise could extend this move to 19.50+ in the next few months.

2️⃣ Key Fundamental Factors Supporting the Bullish Scenario

🔹 U.S. Inflation & Interest Rates (March 11, March 19)

Higher CPI would delay rate cuts, strengthening USD.

Fed’s March 19 statement will confirm if rates remain “higher for longer.”

🔹 U.S. Economic Growth (March 27, April 5)

If GDP data (March 27) comes in strong, it could fuel USD gains.

Nonfarm Payrolls (April 5) will determine the labor market’s strength.

🔹 South African Economic Risks (March-April)

Load shedding worsening → Weakens ZAR.

Political uncertainty ahead of elections → Triggers risk-off flows into USD.

3️⃣ Key Trading Levels & Strategy Based on the Chart

Key Level Technical Importance Bullish/Bearish

17.80 – 18.00 Strong support & Wyckoff Spring Bullish Bounce Zone

18.50 Minor resistance Bullish above this

18.66 – 18.88 Resistance cluster (AR accumulation) Key breakout level

19.26 Harmonic projection & Fib extension Final bullish target

Trade Idea

Buy near 18.06 - 18.12 if macro factors confirm USD strength.

Confirmation: Break above 18.50 → Bullish continuation.

Final target: 19.26 by March 20, 2025.

📌 Summary: Strong Confluence Between Technical & Macro Factors

✔ Wyckoff Accumulation & Harmonic Pattern suggest reversal from 18.06-18.12

✔ Elliott Wave 3 & Fibonacci targets align with 19.26 projection

✔ Upcoming U.S. macro data supports a strong USD outlook

✔ South African risks (Eskom, political uncertainty) favor ZAR weakness

USDZAR-SELL strategy 6-hourly chart - GANN No change in view, even though markets are severe, and a lot of extreme moves. The overbought status still is valid, and I feel we will see low 19.00s again.\

Strategy SELL @ 19.4750-19.5500 (or if lucky this morning above 19.6000 which I did sell).

Take back @ 19.0750 for now (or first stop 19.1750).

USDZAR medium term buyThe rand's appreciation has had a positive impact. However, the dollar index is showing some support structure and a potential direction change. SA's ties with the US comes with more uncertainty and this could have more negative impact on SA's economy. In the long run, the rand loses value and you would not want to buy the rand but hold more dollar unit denominations. Take TP at R19.0000/$1