ZRXUSDT trade ideas

#ZRX/USDT#ZRX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.2175.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading towards stability above the 100 Moving Average.

Entry price: 0.2240

First target: 0.2290

Second target: 0.2357

Third target: 0.2420

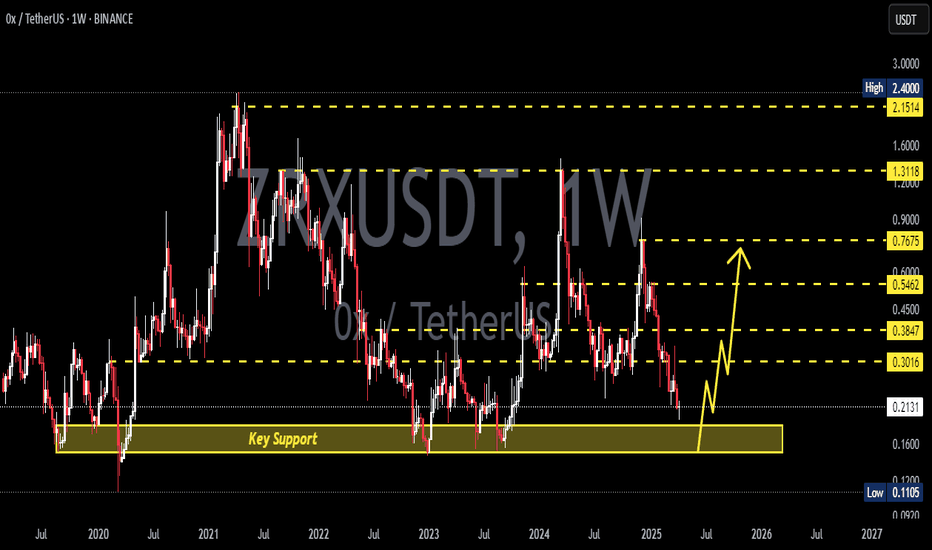

0X New Bullish Impulse, New All-Time High Late 2025I see bullish market conditions with a long-term growing base. Each time there is a correction, or bear market, the end price of the move is higher compared to the previous cycle.

The all-time high remains in 2021. This never breaks. There has been some bullish waves but not enough to break the 2021 ath. This time it will be different.

In 2025 we get a new all-time high. Or in early 2026 we get a new all-time high. No, for this one, in 2025.

So late 2025 ZRXUSDT will produce a new all-time high and this will be the highest price ever and it will be something truly awesome.

Right now the chart is great for buyers. If you are a bear (down-red) the chart is no good. The chart isn't good for a bear because it isn't going any lower. In fact, if you were to place a SHORT here, selling with a loan, then you would end up losing everything as prices move up. You would be certain to a receive a nice liquidation, all money gone.

On the other hand, buy spot hold strong or go LONG, and you are in a great place. While the downside is limited at best, there is no limit to how high prices can go in this upcoming bullish wave.

We are seeing the end of the retrace, the higher low after the initial bullish breakout after the end of a major correction.

Here the correction started in March 2024. The first low happened in August 2024 and the lower high December 2024. At the bottom 7-April 2025 the correction ends. The small bounce is the start of the next bullish wave.

So, March 2024 = 0

August 2024 = A

December 2024 = B

April 2025 = C

That's ABC. A classic correction. After a correction we get a bullish impulse and this simply means new heights for this pair. This new high will come in a set of 3 bullish waves with two bearish waves.

1 = bullish up.

2 = bearish down.

3 = bullish up.

4 = bearish down.

5 = bullish up.

1,2,3,4,5. That's the bullish impulse.

Namaste.

#ZRX/USDT#ZRX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.2586.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.2696

First target: 0.2831

Second target: 0.2948

Third target: 0.3123

0x Idea speaks for itself.

We're currently in 'PROVEN BUY ZONE' with past returns well above 6x.

This is not financial advice nor any indicator or promise of future gains, however...

It's undeniable that within last 5.5 years this infrastructure protocol gave plenty of opportunities and there are no fundamentals (known to me) that should negatively impact potential gains of min. 2x from trigger range within next 12M.

At the moment chart has left the trigger range, but it usually takes time before it develops desired structure for a move up. Personally, I'll be looking to make a decision around range top as LTF show confluence area around $0.228-$0.22 and lower, at $0.209.

For those with 'more sophisticated' pallet for a tighter entries, there's a range low to hope for expanding further 30% to the downside.

Worth to come back to this EOY to reconcile.

ZRXUSDT – Key Support & Resistance Zones Marked!I've outlined the critical price levels—where the market will decide its next move. Green lines = Strong Supports, Red lines = Major Resistances. But remember, we don’t gamble—we execute with precision.

📊 How I’m Trading This:

✅ Wait for LTF Confirmations – We don’t guess, we let the market speak.

✅ Support Bounce? Look for bullish structure + CDV confirmations before entering.

✅ Resistance Rejection? If we get a clean LTF down-breakout, that’s my trigger.

💡 Elite Trading Mentality:

I never insist on a position. If resistance breaks with volume and holds, I adjust and look long instead of forcing a short. Adapting = Winning.

🔥 Follow for sharp, data-driven trades—because strategy wins over emotions, always.

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

ZRXUSDT - bullish divergenceshi traders

There are bullish divergences on ZRXUSDT 1D chart.

We expect a 100% move from the current lows.

Don't get too excited as it may be just a dead cat bounce and after that the price may come back down and make new lows.

Very risky market but the edge for bulls is there so they have to step in now.

Stop loss below 0,21

Good luck

#ZRX/USDT#ZRX

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.2820

We have a downtrend on the RSI indicator that is about to be broken and retested, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.3200

First target 0.3400

Second target 0.3600

Third target 0.3827

0X long time i am monitoring ZRX and for some reason i cant understand how come this project is so low, anyway lets focus on what we want.

as we can see in 1Dtf, it is lots of accumulation and to me this looks like zrx it is trying to push higher, what i want to see it is 0.53-0.55 and then we could climb very fast at 0.64-0.65 where it is the other resistance range.

rn monitoring the volume if something will change

Prepare to BUY Spot ZRXUSDT (M & 3M Cycle Combination)[/b]🚀 Prepare to BUY Spot ZRXUSDT (M & 3M Cycle Combination)

🌟 The combined M & 3M cycles for ZRXUSDT signal a strong accumulation phase – A promising setup for mid-term growth! 🌟

🌍 Market Overview:

ZRXUSDT is currently accumulating for its M cycle within the broader bullish structure of the 3M cycle. The current price level offers an excellent opportunity to start building positions for the next significant uptrend.

📊 Trade Plan:

📌 Entry Point:

$0.45 or lower – An ideal accumulation zone for this cycle setup.

🎯 Target:

1$ - $1.5 – Expected price range as the cycles unfold.

⏳ Hold Time:

6 months – Aligned with the mid-term bullish cycle outlook.

💡 Note:

Focus on accumulating at or below the suggested entry price for maximum returns.

Keep an eye on breakout signals and overall market trends to adjust strategy as needed.

Patience and discipline are key to capturing the full potential of this opportunity.

🔥 ZRXUSDT is poised for mid-term growth – Don’t miss this prime accumulation opportunity! 🔥

Long trade

4Hr TF Structure

5min TF Entry

Pair ZRXUSDT

Buyside trade

26th Dec 24

NY to Tokyo Session PM

10.00 pm

Entry 0.4658

Profit level 0.5143 (10.41%)

Stop level 0.4514 (3.09%)

RR 3.37

Reason: Price reached pivotal support zone (highlighted green) indicative of a buyside trade.

The narrative is based on liquidity along with supply and demand price action.

ZRX ANALYSIS📊 #ZRX Analysis

✅There is a formation of Falling Wedge Pattern on daily chart and currently trading around its major support zone🧐

Pattern signals potential bullish movement incoming after a breakout

👀Current Price: $0.4695

🚀 Target Price: $0.5920

⚡️What to do ?

👀Keep an eye on #ZRX price action and volume. We can trade according to the chart and make some profits⚡️⚡️

#ZRX #Cryptocurrency #TechnicalAnalysis #DYOR