AGOSE97

Taking an entry here. Huge potential as we sit at multi-year support.

CODI - Compass Diversified Holdings CODI acts very similar to Berkshire Hathaway in how they pick and manage companies. This has been on my radar since high $17 range in late 2017. I'm really comfortable with this entry although I wished I could've picked them up earlier. I am, however, comfortable with my entry at 15.55 (500 shares) since we are back above...

This is more of a long term yolo as GOLD continues to recover. TAHO - Entry of January 2020 $7 strike call options. Range of $0.01 - $0.05 (Entry at $0.02 average) This has a huge potential to sky rocket as gold continues to recover into the 1300's and higher. TAHO is also right under the daily 200sma which is key resistance for more buyers to come flying in....

BRK.B - Berkshire Hathaway aka Baby Berk I've been a long time fan of Warren Buffett's strategies and mentalities. While this is not a dividend play, the entry under 200.00 is very comfortable for the long term. I picked up my shares at 199.99 (under 200, I wasn't kidding :laughing:)

WHF - WhiteHorse Financial This is one of my long term dividend holdings that I picked up today (400 shares). It pays a 10% annual dividend and is in the process of breaking above a major trendline after a multi-week double bottom. I bought right under resistance in anticipation of a move higher. My entry of 400 shares was at $14.20 today, February 12th, 2019....

NLY - Annaly Capital This is one of my long term dividend holdings that I picked up today (600 shares). It pays a 10% dividend on a mostly flat chart (9.70-10.00). I like the move back above the 200 daily moving average (red line). My entry of 600 shares was at $10.47 today, February 12th, 2019. More info at wingtrades.com

CPLP - Capital Product This is one of my long term dividend holdings that I picked up on Friday (4,000 shares). It pays a 15% annual dividend with a solid and mostly stable chart. Biggest reason for my entry is this fantastic hold above 2 dollars. My true test is a move above $2.40 and that next wedge resistance, but I'm willing to risk the entry early. My...

NYMT - New York Mortgage Trust This is one of my dividend holdings that I picked up today (1,000 shares). Not only does it pay a fantastic dividend, but we are right on the cusp of a long-term breakout and constantly above earnings expectations. Multi-year hold. My entry of 1,000 shares was at $6.33 on Friday, February 8th 2019. More info at wingtrades.com

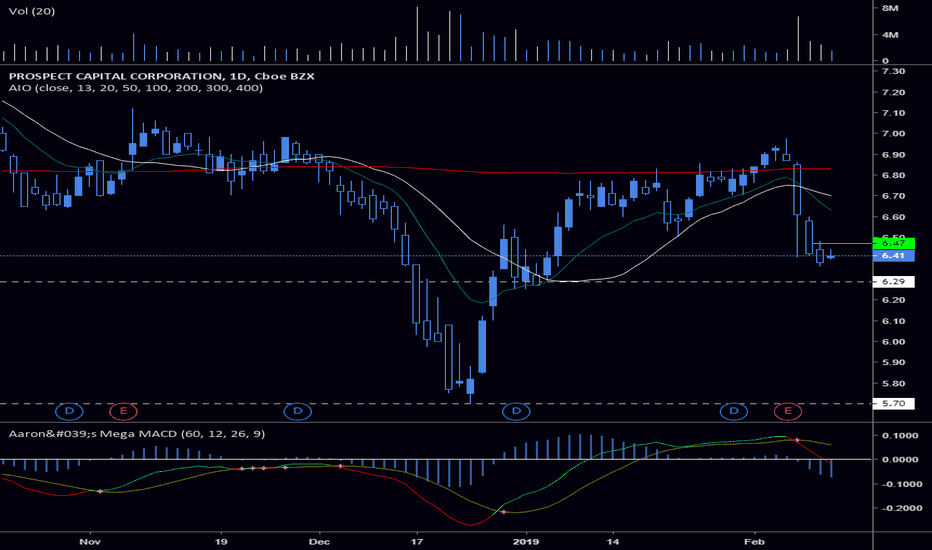

This is one of my dividend holdings that I picked up on Friday (1,000 shares). It pays an 11% annual dividend, but also enjoys movements of quick bearish drops and equally quick recoveries. Full details of this play at https://wingtrades.com! My entry of 1,000 shares was at $6.47 on Friday, February 8, 2019.

LYB - LyondellBasell This is one of my dividend holdings that I picked up today (50 shares). I plan to hold this for at least a few years, adding to the position at supports.

WOOD has found support at $56.69 so we are LONG WOOD at $57 for the long term hold.

USO is finishing weeks of #bearish movement and we're ready for some neutral to bullish price action off the long term trendline support. Accumulating in this area is key.

Super bullish on USO with this inverse head and shoulders in the works.

The last 16 days of SPY have been this ever ending bullish movement. We're almost at the Pivot point, but I'm taking put options early. Expiration - March 15 2019 (56 days) Strike - 260 puts Stoploss - If SPY goes above 270.36 Target - 245 by EoM February

Over the last few years, the monthly chart on the gold spot price has printed higher lows while creating a strong resistance at $1,366/oz. As the stock market continues the recession trend, commodities are used to hedge those losses which will only help increase the price of gold. Technicals: Support - increasing trendline Resistance - $1,366 MACD - Almost...

With a major stock market correction just around the corner, these two points on SPY at 183 and 157 are key supports.

With an extremely weak black friday turnout this year and an already bearish move these last 7 weeks, I expect SPY to take a further move bearish next week.

Back on Oct 15th, BTC as well as many other altcoins pushed bullish in the market giving many traders hope for a raging bull market. However, it pulled back more tan 60% of that move in the same day, giving a clear indicator of market manipulation and further downside. Now two weeks later, BTC continues to bleed and will likely test the 6.1k zone again before...