This is a live trading session on xauusd , it shows how tough it is to capture the move

In the EUR/GBP currency pair, recent price action has exhibited characteristics reminiscent of a "pump and dump" scenario, marked by consistent breaks in market structure and a prevailing bearish trend.

The latest retail sales data for GBP has exceeded forecasts, signaling strong consumer demand and economic resilience. After four consecutive bullish candles, we observed a pullback that formed a hammer—a key reversal signal—potentially completing a morning star pattern. This price action suggests that buyers are regaining control, and momentum is shifting to the...

Following a strong Canadian GDP report and weaker-than-expected U.S. consumer sentiment data from the University of Michigan, CADJPY has shown significant bullish momentum. Additionally, positive discussions between former U.S. President Trump and PM of Canada Carney have contributed to market optimism. After bouncing off a 1-hour order block, CADJPY has surged...

The Canadian dollar continues to show strength despite the 25% tariff imposed by the United States. Meanwhile, the DXY opened bearish today, and with ongoing tariff uncertainty, this weakness may persist. As investors gain clarity on policy direction, CAD could further appreciate. Given this momentum, CADCHF has the potential to reach at least 0.63000. However,...

We are witnessing a breakout in USD/CNH, with CNH being significantly impacted by tariff developments. Following the release of USD PMI data, the dollar is showing renewed strength, reinforcing bullish momentum. After a liquidity sweep, USD/CNH has gained traction, and today’s price action has formed a strong engulfing bar, signaling continued upside potential....

We can observe that the UK CPI y/y has dropped to 2.8% from 3.0%, signaling potential weakness in GBP. On the technical side, price is reacting from a key Order Block, failing to break further to the downside. While the overall trend remains bearish, this marks the third push downward—a classic signal for a possible reversal. If buyers step in, we could see a...

NZD opens the week with strong bearish momentum, signaling potential downside continuation. Meanwhile, JPY gains strength amid USD weakness, adding to the pressure. With a failed bullish breakout, a possible double top formation could push prices down toward the 85.000 level. Will this key support hold, or is further downside ahead? Share your thoughts in the comments!

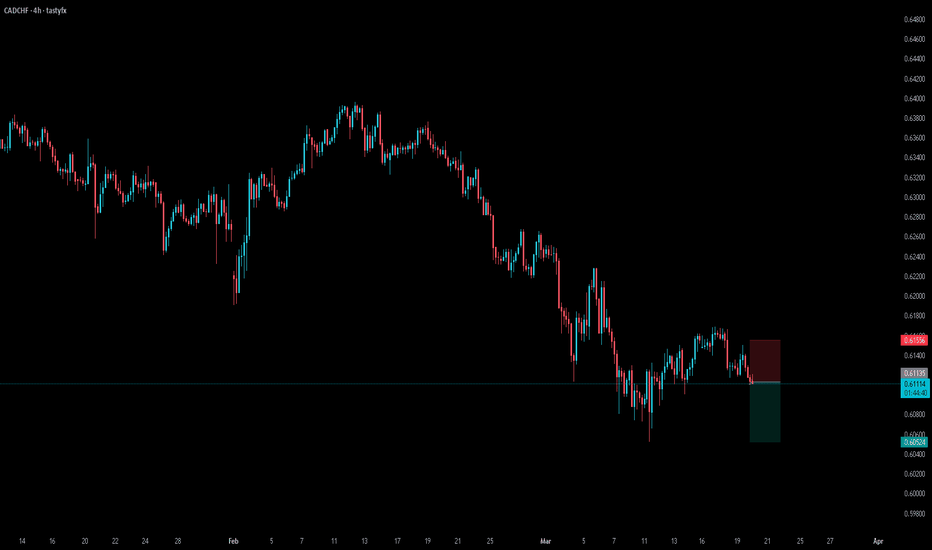

I have taken a short position on CADCHF as the pair continues its bearish trend. Despite the expected 0.25 basis point rate cut from the SNB today, CAD remains weaker overall due to tariff sanctions, adding to the downside momentum. The price action has consistently shown a continuation of bearish break of structures, with clear sell-side pressure. We can observe...

EUR/GBP is showing strong bullish momentum, with the euro gaining strength over the pound. The weakening GBP against EUR suggests the possibility of a range breakout on the upper channel, especially as the London session opens. The daily timeframe signals a classic breakout-pullback-continuation pattern, reinforcing the bullish outlook. If buyers sustain momentum,...

AUD is getting the strength back while CHF is little weaker in a heat map. We can witness that AUDCHF in LONG run were in the down trend, but after liquidly sweep we can see local range break of structure happening signaling the strength of AUD against CHF. Thus Right now we can have trade setup of continuation , if bullish momentum persistent till NY Open.

After reaching the 4H order block, NZD/CHF initiated a bearish momentum, signaling potential downside movement. On the 1H timeframe, we can observe a liquidity grab followed by a break and retest of the support-turned-resistance level, further confirming the bearish structure. This price action suggests continued selling pressure, aligning with the prevailing downtrend.

After the accumulation phase, the Swiss Franc (CHF) has shown significant strength against the Japanese Yen (JPY), maintaining its upper hand in the market. The breakout, followed by a pullback, suggests a potential bullish continuation, indicating that buyers are still in control. If this momentum persists, we could see further upward movement, reinforcing the...

EUR has shown us the potential to be bullish. This setup in EURCAD can be potential opportunity based on the historic bullish bias. CAD has shown significant weakness based on the correlation. do share your views.

At 8:30 AM EST today, the highly anticipated Non-Farm Payroll (NFP) report will be released, offering key insights into the U.S. labor market. This report will cover Average Hourly Earnings, Employment Change, and the Unemployment Rate, helping investors and policymakers assess the economy’s current state. Let’s break down the expectations and potential...

If i compare CAD in correlation to other pairs, I can smell weakness. We can observe EUR is strongest, GBP is strong while AUD is weakest. NZD has started gaining the fresh strength in per London session. give you view in the comment.

Hi, I I have indicated that YEN is taking control as being known as SAFE HEAVEN. Canadian Dollar is weak and this could be an opportunity.

The US Dollar Index has lost momentum. We previously saw optimism and bullishness around the time of the elections. However, after the new President took office, the signing of numerous executive orders and discussions on tariffs led to a decline in trust in the US dollar. We might see a reaction when prices reaches to to historic election pump.