AlfarisR

EssentialUS indices were bullish so far despite the NEW HUGE tariffs. As the tariffs become in play by Aug 1st, we shall see its effect in Q3 results, Q2 earnings beats, but will Q3 do ? Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

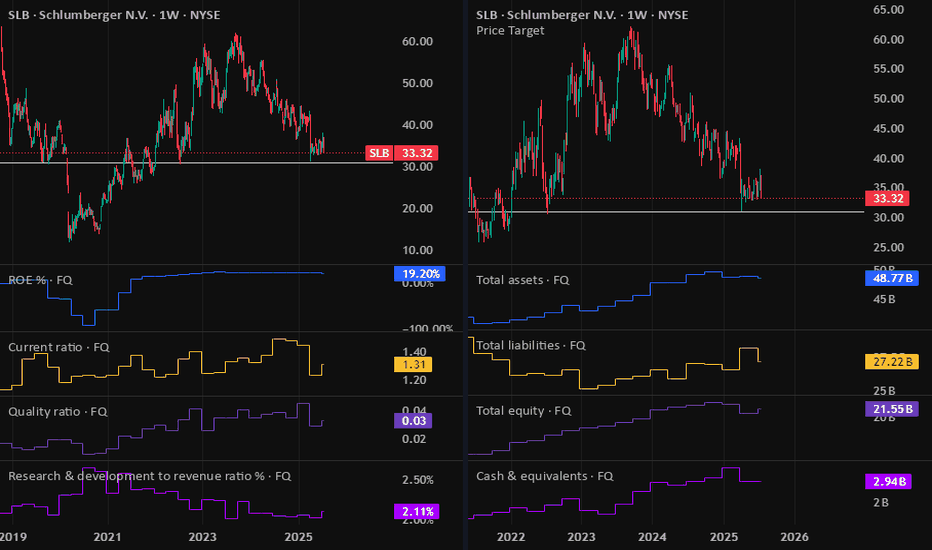

President Trump policies to support oil companies aiming to increase oil supply in the market and hence to reduce oil prices not to increase it, which mean lower margins for oil companies. Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

Next week we will have some quantum computing stocks that announce earnings results, so will see if it the time to secure this position. Noting that this is a very long-term position, the company still not profitable yet. Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

FOMC announced no change to interest rate, but the new tariffs is the major player for the upcoming quarter, we shall see its effect on the economy and corporates earnings soon, then the fed can make better judgment whether to lower interest rate or not. Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

Yesterday we get Boeing earnings report which came better than expected, but the stock down more than 4% as the company is not expected to make positive profit or free cashflow before 2026. No dividends currently paid, so there is nothing attractive to me now. Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

As we have Intel earnings report released on Thursday, it miss on on EPS, but beat on revenue. as Intel lag the industry, we still waiting some confirmations of positive turnaround, once we get it, we may get it long from this competitive level since P/B below $1. Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

High dividends no longer ! I was waiting the stock to reach the support level to benefit from the 10% high dividends yield... but the company cuts its dividends yield from 10% to 5%, so it is no longer valid to me. Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

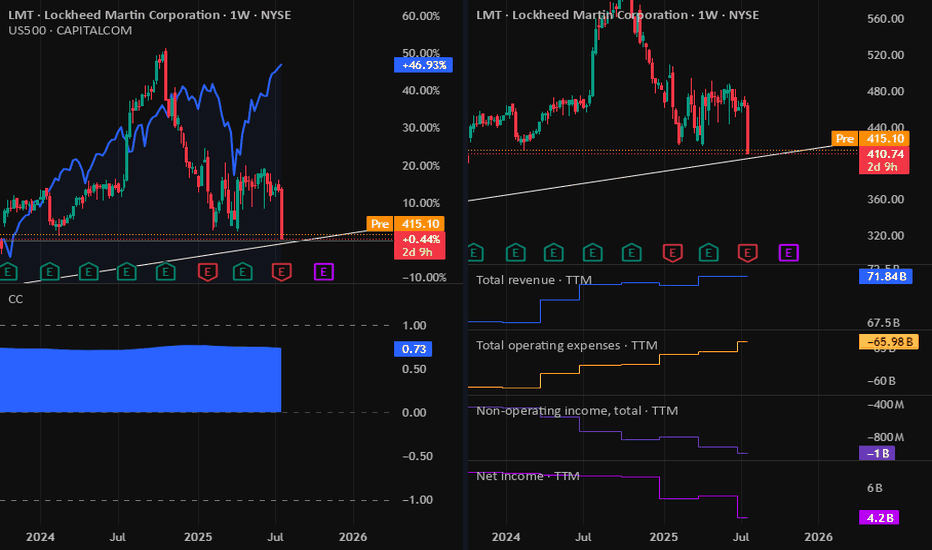

The dividends now is around 3% which is good for a strong company like Lookheed Martin. But as we are seeing a drop in company profits & Equity, and the stock price is near to a support level, we have to monitor the stock for the next few days or weeks. If all is ok, I will consider buying it. Disclaimer: This content is NOT a financial advise, it is for...

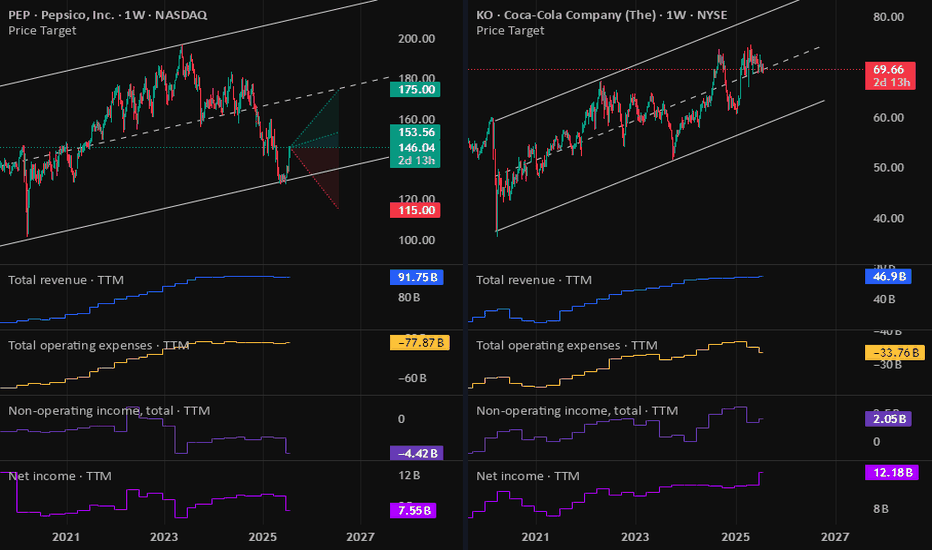

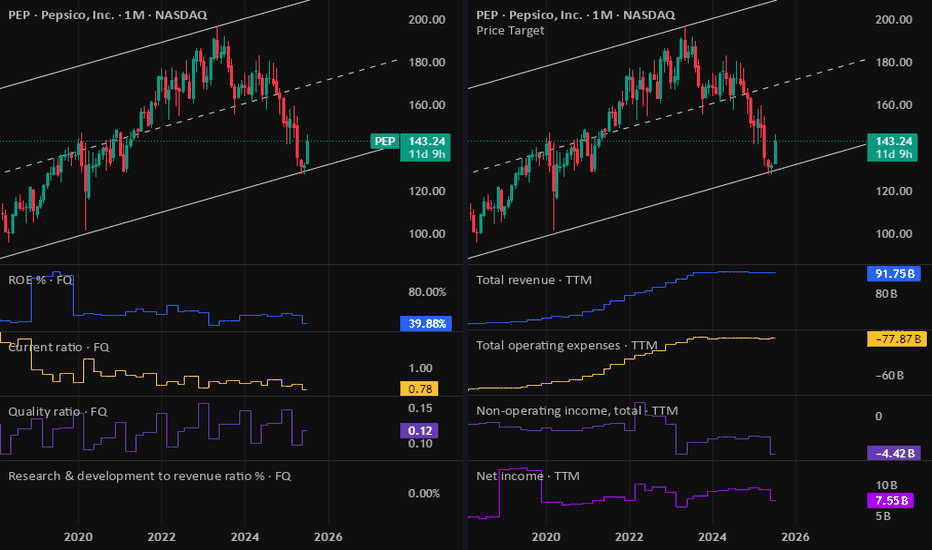

Yesterday we have the Coca-Cola earnings report came out and beat on both earning and revenue. But due to the technical position I do not see it a good entry on the stock CFD, still see PepsiCo stock CFD is a better option. Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

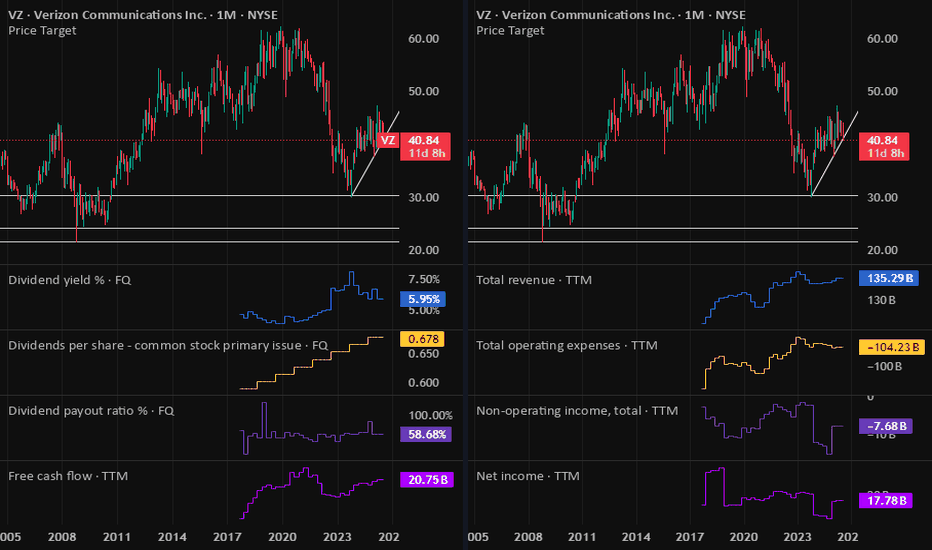

Verizon jumped on positive results, which aligned with my bullish view on it. Tomorrow will have its competitors T-Mobile & AT&T earnings result, this will update us on the industry as well. Most probably that I will go long on it in the next 24Hr. Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

with 6% dividend yield and stock price at support level on the lower channel band, this draw attention to the earnings report tomorrow pre-market hours. Focused on future outlook as well. If all good, I will buy VZ. Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

Its looks like PEP is a buy now. Just want to double check on future sales growth as it is stable for a while. Lower stock price made the dividend very attractive since PEP is a defensive stock. Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

It seems SLB is at good valuation now, but a risk in dropping international revenue still need to be figured out. if this can be solved, then SLB is good to go. Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

S&P500 gains a lot in the past week, is this the end or the downtrend? is it the bottom? We should monitor the main levels here at $4200, it will tell us!

After the strong employment data last week, with stronger inflation! where stocks is heading to? Earning season will be key, not due to quarter earnings themselves, but due to the earnings and sales forecasts in the near future. SP:SPX NASDAQ:NDAQ DJ:DJI

![Stocks Markets Breakout or Reversal ? [Arabic Language] US500: Stocks Markets Breakout or Reversal ? [Arabic Language]](https://s3.tradingview.com/x/xYPe7Zra_mid.png)