AlgoBotTrading

PremiumFollowing the previous analysis on BTC, we saw Bitcoin as it crossed below the blue trendline and dumped towards lower levels. BTC has spent the past couple of days retesting the broken level of 106,700 and now it seems the retest is complete and BTC is ready to continue its move towards lower levels. Once again it is advised to look for Short setups across the market.

We followed BTC from the 74,000 low and stated that BTC would have a good upward move and will probably hit the previous ATH. In reality, BTC followed the analysis very nicely and after some 50% gain, it did hit the previous ATH. But looking at the chart right now and considering the bearish confluences on the chart, it seems BTC is likely to drop to lower...

he recent drop in BTC dominance accompanied by the drop in USDT.D resulted in stronger pumps in altcoins. After a temporary upward correction, it looks BTC dominance is ready to continue the downward move. Crossing below the blue trendline can be a good trigger for the drop towards the 62.10%, 60.70% and 59.90% levels.

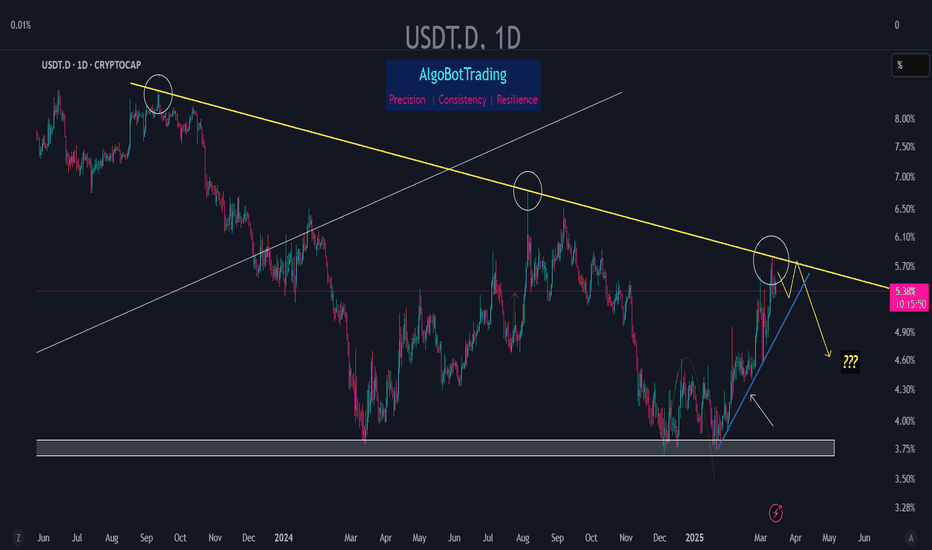

Following the previous analysis on USDT dominance, the index has spent the past week having a slight upward correction and as a result BTC and altcoins has dropped somewhat in the past few days. Looking at the chart right now, it appears that the index is ready to continue its downward move which means there are going to be good pumps across the market again. A...

Using a series of analysis on USDT dominance so far, we've been able to accurately predict and follow the market step by step so far. Following the previous analysis, as it was expected, the index started showing some reaction upon reaching the designated zone of 4.58% - 4.73% and thus some slight corrections have taken place across the market. The said zone is...

USDT dominance has beautifully followed the analysis so far. After crossing down the indicated blue trendline, USDT.D has begun a downward movement and we can see many coins have had nice rises since April 9th as it was predicted. This downward move will probably expand towards the 3.7% support zone where we expect BTC and altcoins to form major daily and...

BTC has so far followed March 14th analysis in which it was stated that BTC needs to drop towards the the prz of 73,000 - 74,000 zone where if a good upward reaction occurs (which happened!), we can be optimistic about seeing BTC rising towards the previous ATH and even crossing above it. So far, bullish confluences can be seen on the chart and when BTC crosses...

TOTAL3 index which represents altcoins has seen some 40% drop since December and as we all saw many altcoins got crushed under heavy sell pressures. Now since bullish confluences can be seen on the chart, it is likely to see TOTAL3 moving towards higher levels in the coming weeks. This means a good upward move in many altcoins. The trigger for the said scenario...

USDT dominance has beautifully followed last month's analysis so far. Looking at the chart right now it seems the index is going to continue following the predicted path in which it crosses below the indicated blue trendline. The said crossing shall result in heavy upward moves in BTC and many other altcoins. A daily close below the 5.0% level shall further...

Following the previous analysis USDT dominance dropped and has now reached the indicated ascending trendline. Whether it will be supported here (followed by another upward move) or it will cross below the trendline is still unclear and we will have to wait a bit more to see the market's decision and open positions accordingly. As said previously we don't expect...

Bitcoin moved to touch the indicated trendline and has had a positive upward reaction so far. This upward reaction can wick into 89,000 zone as well but considering USDT.D chart, it's still unclear whether BTC keeps rising above the said zone or it goes for another temporary drop towards 73,000 - 77,000 zone. it is recommended to keep observing the market during...

#BTC update (1D) We followed BTC's drop from 95,000 zone and so far BTC has wicked 76,000 zone. 77,700 - 80,600 zone is a prz (potential reversal zone) so it is natural to see some support here but if Bitcoin is to continue rising to higher levels, it needs more time and probably another drop towards the next key prz of 73,000 zone. In fact it is highly crucial...

Back in Feb when USDT dominance was at 4.7% level, it was stated that the index was about to rise and in reality the same took place and the rise in USDT dominance caused heavy dumps across the entire market. USDT.D is now in the vicinity of the long term descending trendline and some initial bearish signs are visible. Since it is the 3rd touch of the said...

As previously analyzed, BTC has been dumping rather heavily following the breaking of the blue trendline. Trump's tariff war is taking its toll on US stock market and also the crypto market. Investors are afraid of a possible recession in 2025 so they are selling heavily in both markets. we can define two possible scenarios for BTC for the upcoming weeks. One...

It was also stated that 81,900 - 84,400 zone is considered a valid support area where BTC can make an upward reaction. In fact during Feb 26th and 27th, BTC had some +6% rise. BTC has returned back to the said support zone and based on the chart's conditions, BTC is in decision-making phase (in which both reversal and continuation scenarios are present) If we see...

As analyzed and predicted yesterday, BTC had a heavy dump and touched levels below 89,000 zone. It is possible that the downward move isn't over yet. In case BTC makes a daily close below 89,200 level in 3 hours, it is likely that BTC will keep dropping to lower levels. The next important zone as support can be the 81,900 - 84,400 zone.

We were previously expecting a drop (price correction) in USDT dominance. But the drop did not fully unfold and instead USDT.D spent days forming a trading range instead (time correction). The thing that can be seen by checking USDT.D chart is that a continuation pattern has been completed and an upward move is underway (crossing above 4.7% zone). this means more...

After reaching the blue trendline and having an upward reaction, BTC faced the dynamic resistance of the dotted trendline and dumped. It seems BTC is going to cross below the blue trendline and is going to touch 89,000 zone and this time, it will probably cross below that level as well.