AndeWave

PremiumGOLD has reversed its upward trend and a local downward channel is forming. There is pressure from sellers on the market while the dollar is rising... NFP data will be released today. The market may form a short squeeze before declining within the local downward trend. There is a possibility that NFP data will be strong (needed by the presidential administration)...

The breakout of the downward channel resistance forms a strong distribution. However, the most important thing here is that after strong growth, the coin entered a consolidation phase. Strong resistance has been confirmed and the market is forming an ascending triangle. The coin's behavior is strong, as the entire cryptocurrency market has been red for the past...

Breakdown of channel support, price consolidation below the level. There was an attempt to return to the range, but the fundamental background changed sharply. The dollar is rising, forex is falling. GBPUSD may continue its local decline to 1.3158.

Gold is testing local resistance at 3325 with a touch. It is also touching the lower boundary of the channel. Thus, the price is stuck in the range between 3325 and 3320. A return of the price to the upward channel may attract buying activity. In this case, we can expect growth to 3375 or to the channel resistance. The trend is upward. If gold does not fall but...

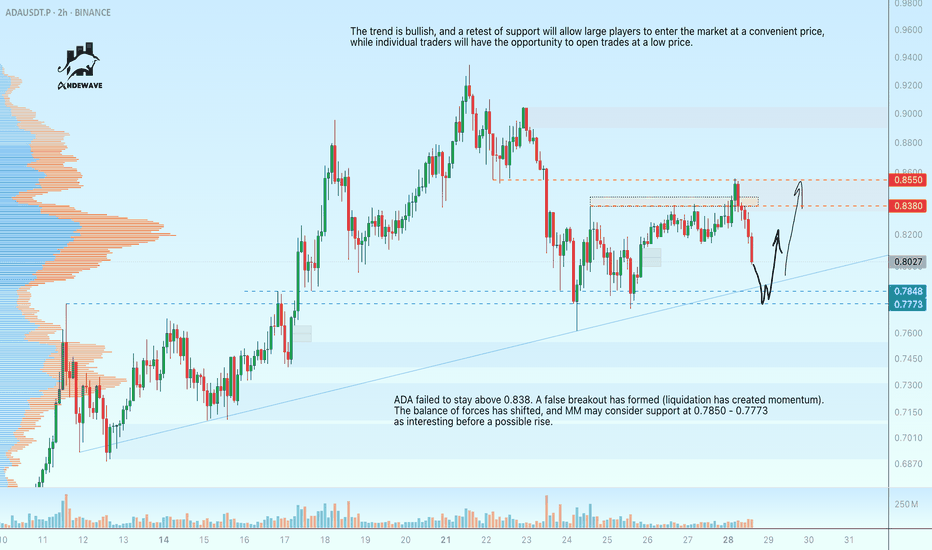

ADA failed to stay above 0.838. A false breakout has formed (liquidation has created momentum). The balance of forces has shifted, and MM may consider support at 0.7850 - 0.7773 as interesting before a possible rise. The trend is bullish, and a retest of support will allow large players to enter the market at a convenient price, while individual traders will have...

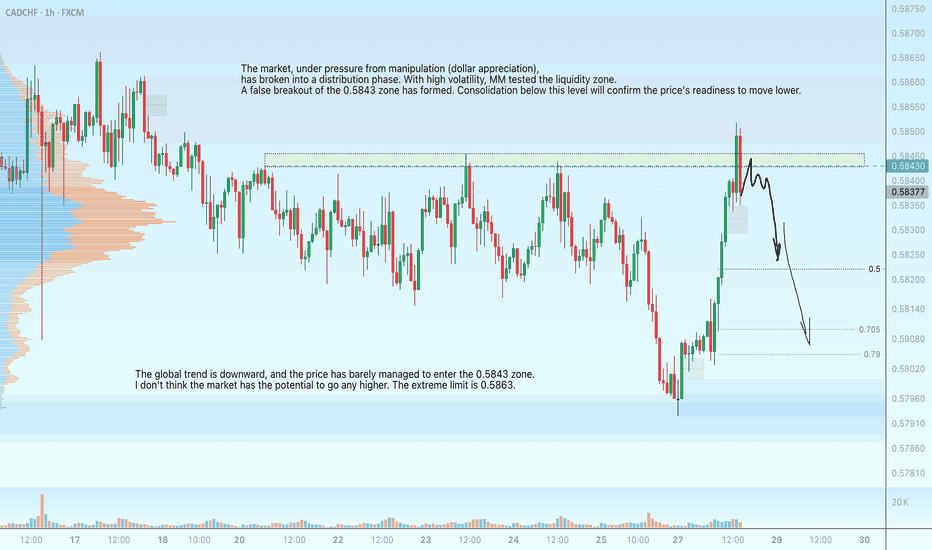

The market, under pressure from manipulation (dollar appreciation), has entered a distribution phase. Amid high volatility, MM tested the liquidity zone. A false breakout of the 0.5843 zone has formed. Consolidation below this level will confirm the price's readiness to move lower. The global trend is downward, and the price has barely managed to enter the 0.5843...

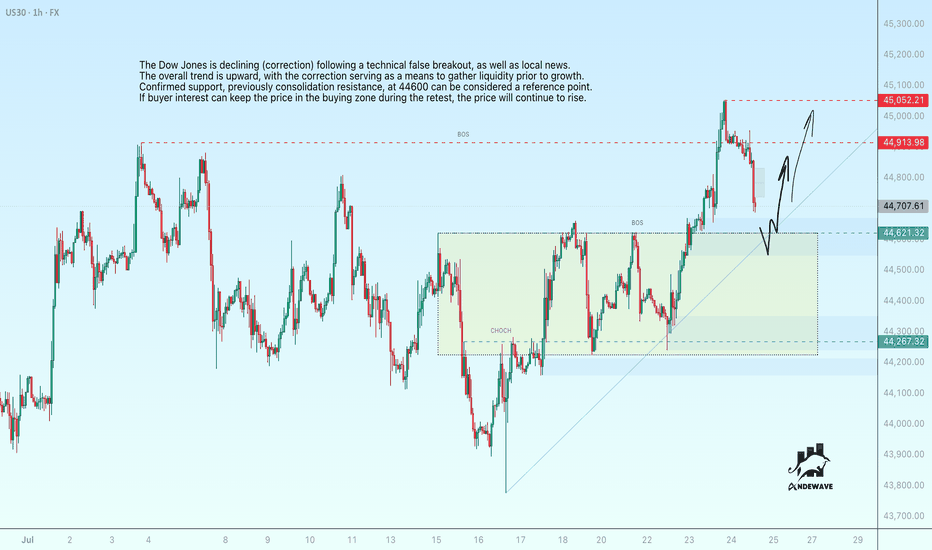

The Dow Jones is declining (correction) following a technical false breakout, as well as local news. The overall trend is upward, with the correction serving as a means to gather liquidity prior to growth. Confirmed support, previously consolidation resistance, at 44600 can be considered a reference point. If buyer interest can keep the price in the buying zone...

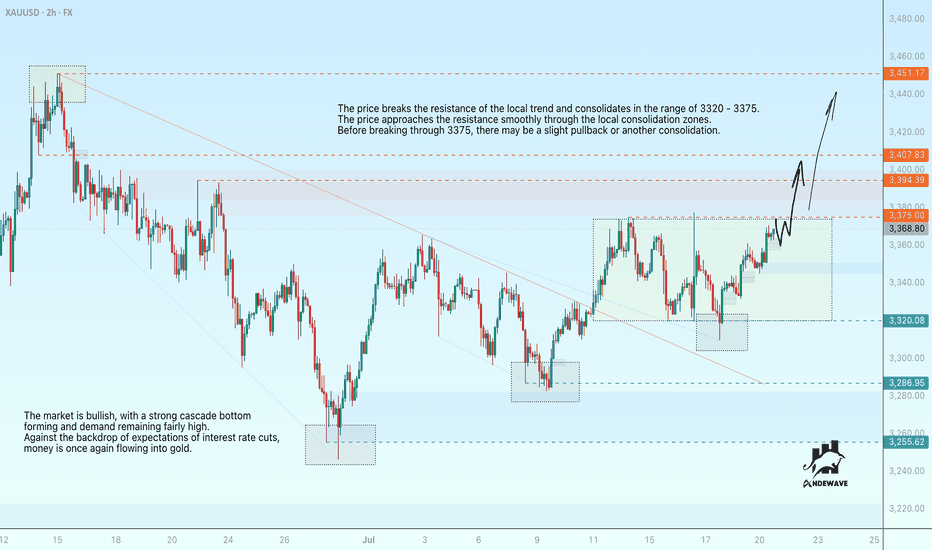

The price breaks through the resistance of the local trend and consolidates in the range of 3320-3375. The price approaches the resistance smoothly through local consolidation zones. Before breaking through 3375, there may be a slight pullback or another consolidation. The market is bullish, with a strong cascade bottom forming and demand remaining fairly high....

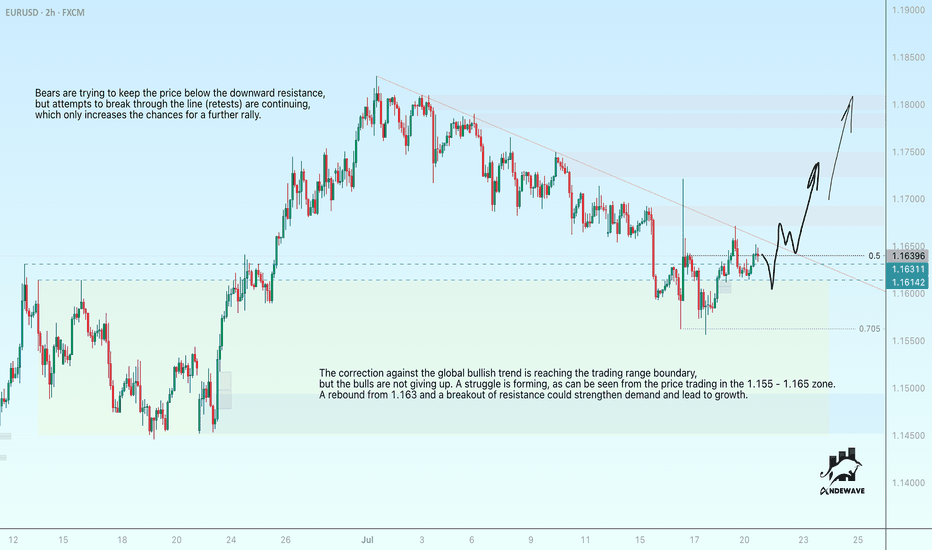

The correction against the global bullish trend is reaching the trading range boundary, but the bulls are not giving up. A struggle is forming, as can be seen from the price trading in the 1.155 - 1.165 zone. A rebound from 1.163 and a breakout of resistance could strengthen demand and lead to growth. Bears are trying to keep the price below the downward...

AUDJPY is forming something remotely resembling a head and shoulders reversal pattern, based on consolidation support at 95.977. The price is consolidating near the level, the reaction to support is weakening, and the chances of a breakdown are growing. Consolidation of the price below 95.977 could increase pressure from sellers. In addition, the fall of the...

ETH is gathering liquidity ahead of a possible decline The gray square is the active buying zone. When the price returned below the 3040 level, a liquidation phase occurred. Against the backdrop of the news, a retest of resistance is forming, but not with the aim of breaking through the level, but with the aim of gathering liquidity for a move to 2960-2913. A...

Gold is in a global bullish trend. Locally, the market is beginning to restore its structure. During the European session, the price broke through the resistance of the local maximum of 3358. At the moment, buyers and sellers are fighting for the 3350-3360 range. Consolidation of the price above 3350-3360 could lead to continued growth, a breakout of 3374, and...

EURUSD is consolidating in a wedge. The trend is bullish, with the correction reaching the 0.7 Fibonacci zone and making a false breakout, which generally changes the market imbalance. All attention is on the wedge resistance (red line) and the 1.17000 level. A breakout of the resistance and consolidation of the price above this level will confirm the end of the...

The global trend is bullish, with gold undergoing a local correction. The price is attempting to avoid the liquidation zones located below. The fourth retest of the trend resistance over the past two weeks is forming. Regarding the current situation, gold is consolidating near the resistance level of 3329, a break of which could trigger growth. Buyers are...

Bitcoin is forming a false ATH breakout. There is a possibility of a correction beginning. Consolidation is forming with a local upward support line (accumulation of potential before correction). A breakdown of 110K could cause the correction to continue to 0.5 - 0.7f.

Bitcoin is within the range. Quite a bit of time has passed since the last retest, and the liquidity pool that has formed below 106345 may not allow the price to fall on the first attempt. Global and local trends are bullish. Enter a buy position after a false breakout of support and the formation of a local reversal pattern on TF m5-m15 Scenario: if, after a...

Weak market structure. Gradually declining lows and no reaction to support at 0.5211. Buyers are trying to keep the price above 0.5211, but under market pressure their strength is weakening. Relative to 0.5211, we see the formation of consolidation, which is of a “pre-breakdown” nature. Accordingly, a break below the 0.5211 support level could trigger the...

XRPUSDT is not yet ready for growth. The important support level is 2.081. The price cannot stray far from it and has been attacking it for several hours amid a locally weak market. Scenario: Consolidation with price compression towards 2.081. (descending triangle) A breakout of support could lead to a decline. Two targets: 2.032, 1.984