Arora_MA

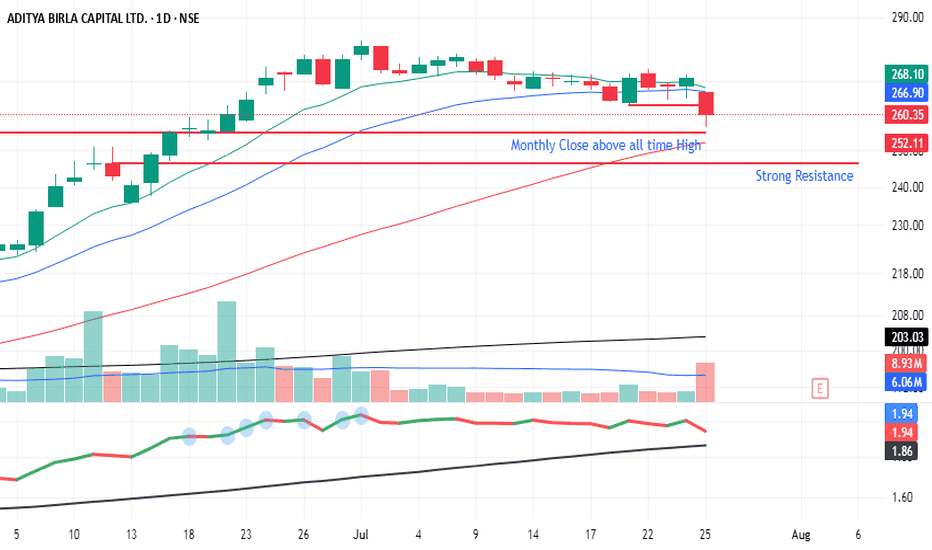

AB Capital After closing above-time high of Rs. 255 in June 2025, the stock has entered a consolidation phase over the past month. Key observations: Support Zone: The 246-255 range is expected to provide strong support. Trading Plan: Look for buying opportunities near the support zone (246-250) with a target of 280 and above. A sustained move above 260 could lead...

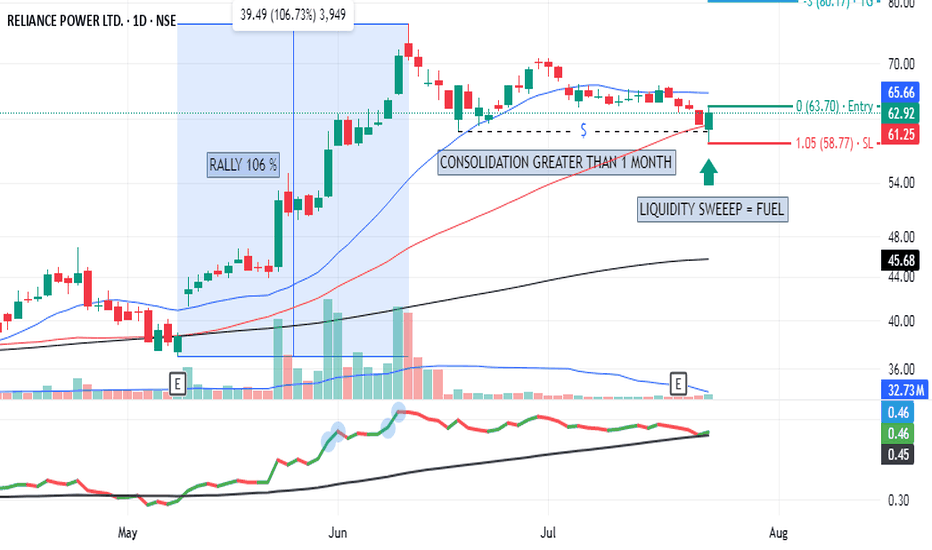

Rally of 106% followed by consolidation of more than a month and fueled by liquidity today. Do I need to say more ? Chart says it all.... follow proper risk management. Investment in stock market is Risky.

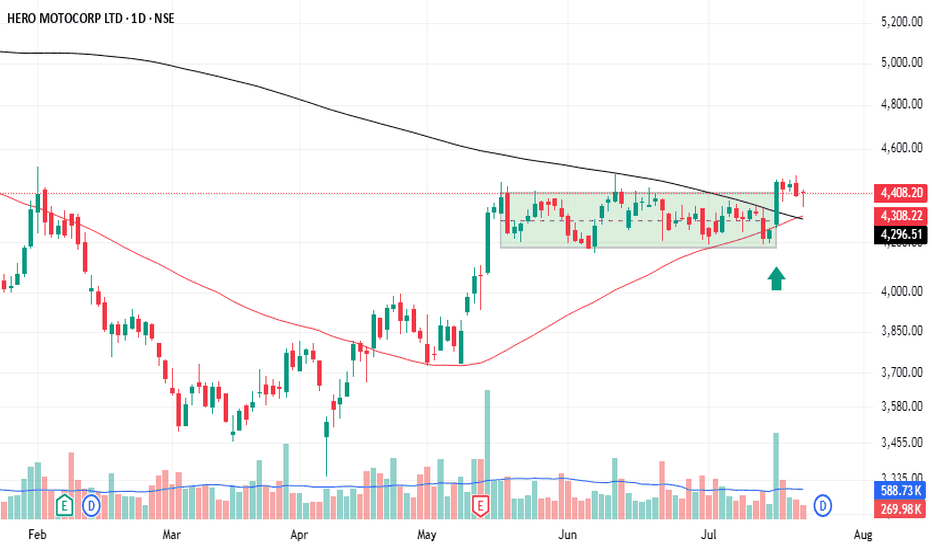

Hero Motocorp's stock has shown period of consolidation, forming potential Darvas Box. A breakout above the box on 15 th july. Price movement was also accompanied by increased volume and then followed by golden cross over - showing a good opportunity to long. Warning - Investing in the stock market involves risks. It's essential to conduct thorough research, set...

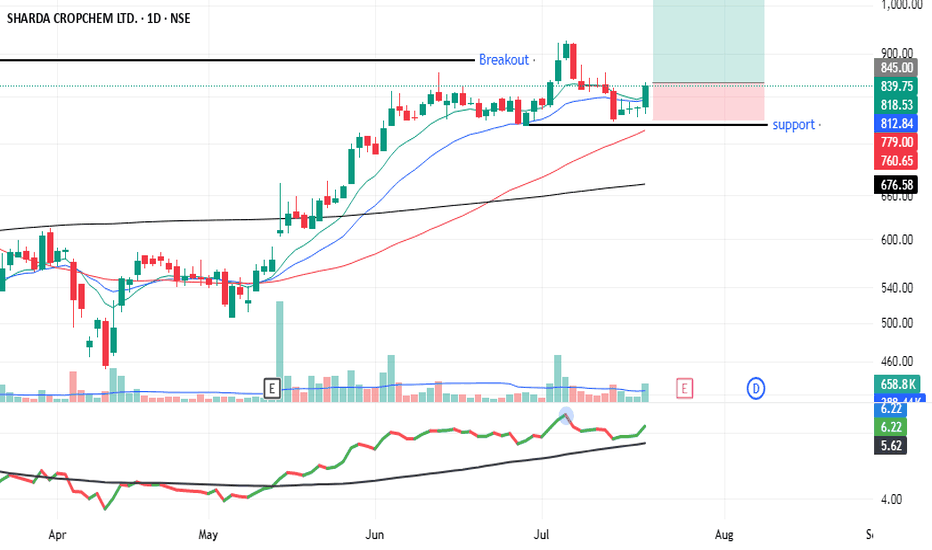

Sharda Cropchem seems to be a BUY candidate. The stock's technicals suggest a strong buy signal, while the fundamental analysis indicates a stable financial performance and a decent valuation. The stock has a strong buy rating based on moving averages and RS line, with both short-term and long-term indicators suggesting a positive trend.

ASTERDM exhibited 3 shrinking pullbacks on its daily with increasingly narrow ranges and diminishing volume followed by a strong upside break. Post-breakout, the ideal setup is a retest: price pulls back to the breakout level (pivot), holding above it. Fundamentally, Aster DM is a solid healthcare growth story: strong expansion, low debt, cash-rich, with robust...

Strong Rally followed by period of consolidation with squeeze in volumes showing lack of selling pressure. Stock is resting at support level. if price drops below 180, could trigger stronger selling. A long-term investor may wait for a better entry near intrinsic value 155–160. Conversely and upside break could tigger a fresh rally. Business fundamentals show...

Robust fundamentals indicate solid upside potential. If you believe in growth in the housing finance space, this could represent a strategic buy with a medium‑term horizon. Stock undercut 50 Day moving average and closed above it. it also undercut last several days low and close above it, showing lack of selling interest. A good close with good volume above PDH...

DCB Bank is fundamentally attractive value‑wise: strongly capitalized, efficient, and profitable, yet deeply undervalued. However, potential risks include credit quality and low free cash flows. Stock has found support from medium-term moving averages.

Technically stock seems to be ready to enter stage 2, looking to buy on dips around 415 (support zone). It shows a cautiously optimistic technical setup. As long as it remains above Rs. 415 pivot/support zone, the bias is bullish with room to push into the Rs. 450–480 range. Keep an eye out for Birlasoft’s upcoming dividend on July 18, 2025 and the next earnings...

The technical setup for ABDL is cautiously bullish overall. Short-term: Slight pullback risk; consider entry on dips near Rs. 419 to 424. Mid to long-term: Supported by bullish EMAs and strong MACD; pivoting around Rs. 424. A well-timed buy on pullback offers a favorable risk-reward, with targets in the Rs.470 - 490 zone.

After a recent upside rally SBI has retraced approx 8.5% from the resistance zone of 825-830, theafter second compression of 5% occurred. Thus I see sucessive Volatility contraction. Recent Golden Cross over clubbed with VCP is indication of good buying opportunity. Short to mid-term momentum is bullish, underpinned by strong moving averages and recent bullish...

Reason for Picking - first support in 50 MA after goldencross alinging with previous resistance turning support. A very simple trade idea. simplicity works best. Bullish Hammer Candle followed byback to back inside bars. A break above Rs. 30 with good volume, is what I am looking for making the entry.

BDL - the defence sector stock, is in strong uptrend. it corrrected slightly to about 14% and has also grabbed liduidity and had taken support with 2 time the delivery volumes. Its now ready for new high with strong momentum

Paytm with first contraction of about 30%, second contraction of about 13% tried to breakout on 2nd June but closing was not very convincing. It failed due to escalation in middle east crises. Now formaing a narrow base with volume also drying up. It is leading to the formation of classic VCP pattern and may lead to Minervini low pivot Cheat entry if closed above...

Stock is making HH & HLs, Taken first support at 50 DMA after golden crossover. Stock has also taken support at previous gap. Over all bullish. Close above 1373 with good volumes will tigger my entry. simple trade idea - no complex analysis.

Max Healthcare is showing VCP pattern Breakout and retest. First Correction was deep upto -22.71 %, followed by second Correction of -11.91% and third correction of 7.12% approx before it finally breakout. Market has tendency to trap breakout traders therefore it again retraced below breakout candle for final sucessfull retest on 20 June. Fundamentally stock is...

This stock is though trading below 200 DMA but it has started making HH and HL. It is currently resting at previous support along with 50 DMA. I may enter the trade with proper risk management with stock closes above 137 with good volume. Sl being 131 and target of 153.

Certainly I am bullish on Canara Bank as stock took its 1st support on 50 DMA after golden cross. Looking Backwards - its also breached previous support / Previous logical SL and closed above it. I may enter after proper confirmation and with proper risk management