ArturoL

EssentialInverse HS forming to break out the 67 resistance area. More than a year trying to break it, and now is forming a super bullish pattern to get over with it. Once it breaks it, will just go up. Hold this for a few months. SL if a weekly candle closes below the support area.

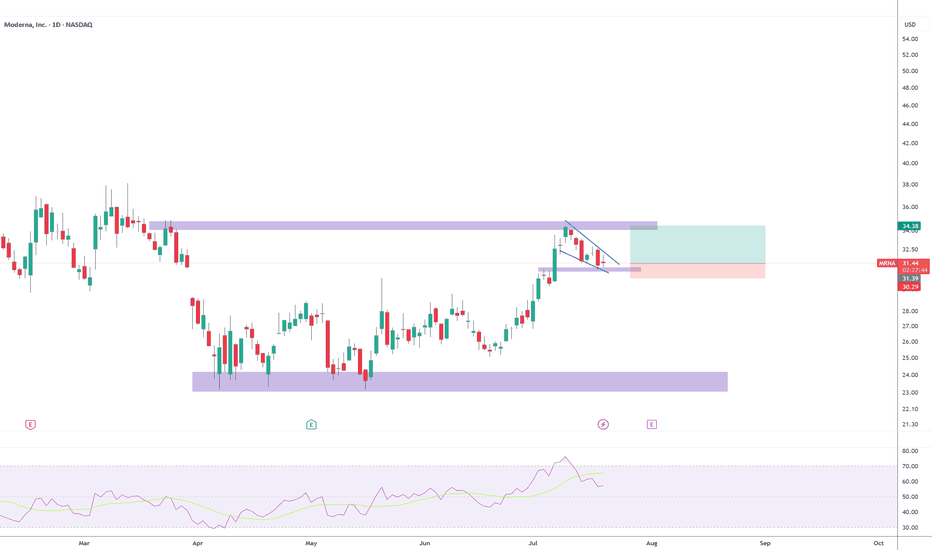

Bullish flag forming to test the ~$35 resistance again. Earnings coming up on 08/01. I expect the flag breakout before earnings. I have calls exp 08/01 strike 31.5. SL triggers if a daily candle breaks down the support area and closes below 30.30.

Price is squeezing into the falling wedge against the 10.2 - 10.5 support zone. I think is going to break out soon. SL Triggers if a daily candles CLOSES below the support zone as shown.

Symmetrical triangle at a monthly support. Breakout is coming soon, could be either way but I think is most likely to go to the upside following the previous two continuation patterns. Price is just over the lower vertex of the triangle, so we have a tight SL, it triggers if a weekly candles breaks down the triangle. I have calls that expire 3 months from now...

Price just tested the support zone and is bouncing off. This is not a dead cat bounce, is going for more. TP 1 at 4.5, TP 2 at 6. SL triggers if a daily candle closes as shown. But it has to close. This stock is highly volatile, be careful.

Two weekly timeframe for a better understanding. Looks like a large bearish flag forming. Price just bounce off the bottom of the flag. But I think is a dead cat bounce. Is hitting a resistance level 35-36. Doesn't look too sting to break it up. SL triggers if a weekly candle breaks up the resistance and closes above it.

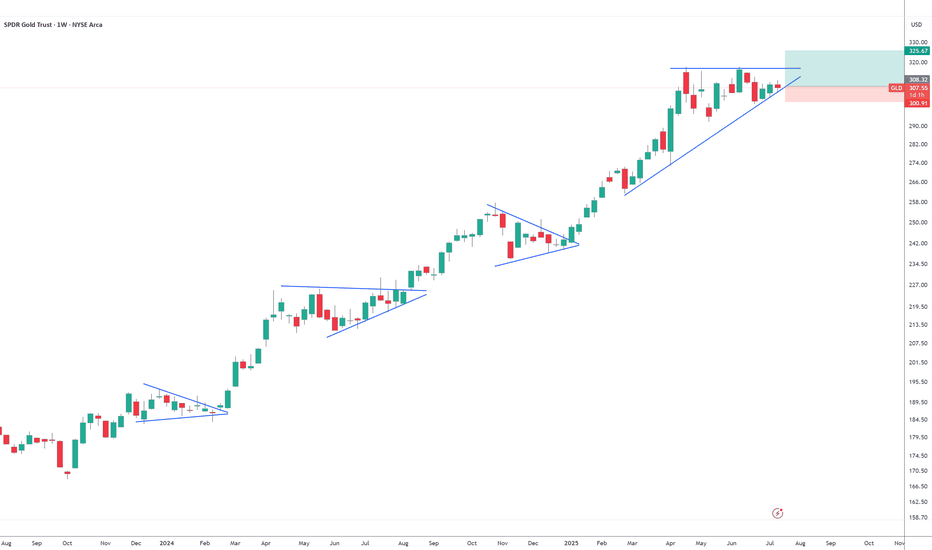

Not confirmed yet but I'm jumping in anyways. I bought some puts of GLD for May 23 strike 304. My SL triggers if the price breaks up the resistance shown and closes above in the daily timeframe. Might be some turbulence, bulls will try to push the price higher. too much noise in the political arena, but Gold is overbought and needs a healthy correction.

I bough some puts form 05/02 strike 242.5. I think is going to respect that resistance in short term. I'll take the loss if it breaks up that resistance. Also SPY is hitting a resistance zone. We might see a pull back soon.

Bought some puts for 04/29 strike 439. Too much resistance above, looks like is going to be a rejection. Tight SL at 550.

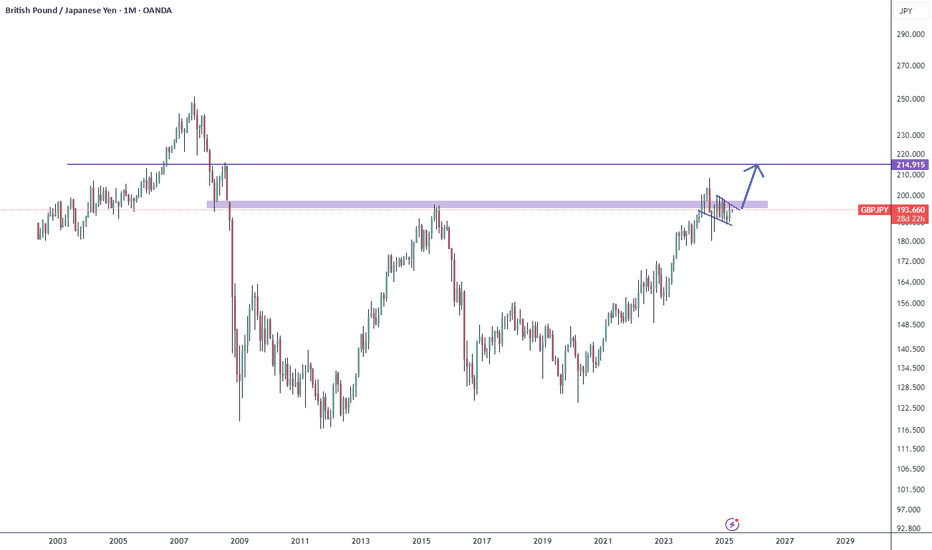

A massive double bottom is forming inside the triangle. The upper vortex is working as a downtrend line from 2008. Imagine the break out. It could come at any time. I don't have a position here yet, but if you want to save cash do it in Euros.

Not enough strength for a break up of the descending channel. I think is going to be rejects again and drop to the bottom of the channel. Be careful of a fake out, SL triggers only if a daily candle closes above the resistance.

The British Pound looks very strong across the board. Check my post of GPBCHF lines below. Is forming a bullish flag at the monthly resistance to break it up violently. If it pulls back I'll add more. SL triggers is a weekly candles closes under the bottom of the flag but I hardly doubt it. I'm almost all in on the British Pound.

Double top confirmed. the pair is bouncing up to test the broken support (dead cat). Not sure if it will make it all the way up the broken support zone, it might start dropping now. SL triggers if a daily candle closes above the broken support now resistance area.

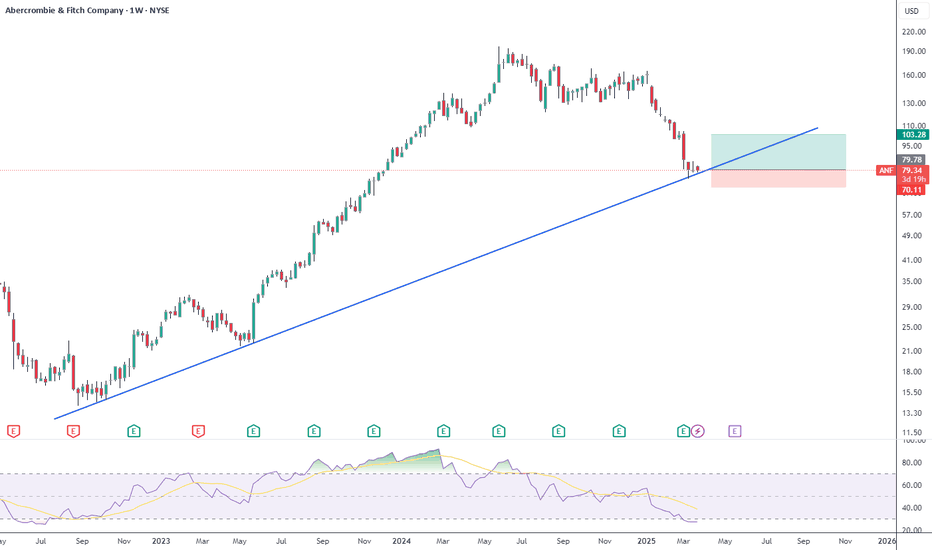

Price is oversold in the weekly and daily timeframes. Also is consolidating on the monthly support trendline. I think is going to test the $105 resistance area that's a 30% upside. SL triggers if a weekly candle closes as shown.

Bearish divergence between the pair and the RSI and also is overbought. The pair is hitting and important resistance level. I expect a pull back to the level shown on the chart and maybe lower. SL triggers only if a daily candles closes above the resistance with great volume.

The pair is testing the upper vortex after breaking it out. I have a small position just for fun. I think is going to bounce up to the next resistance shown on the chart. SL triggers if a daily candle CLOSES under 189.10.

UVXY is landing in a short term trendline. SPY is heading to a resistance zone. I bought the ETF (no calls this time) I'll keep buying if it gets to the support at 18.30. I think the market is consolidating and we will have ups and downs like crazy. I'll take advantage of it. My first TP at 22, then will see.