AssetDesign

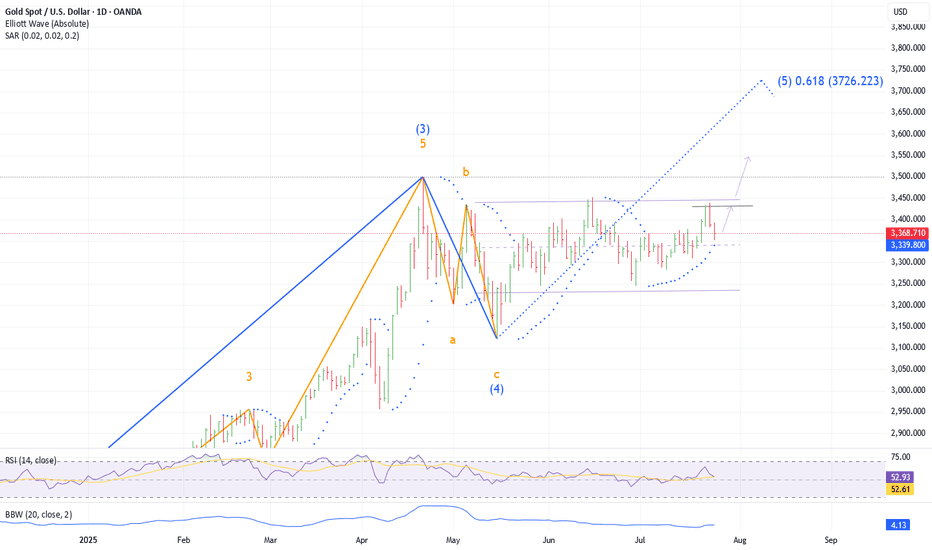

PremiumExpect gold to snap back to 3431 and likely much higher in the next day or two. Any recent gold downdraft was quick, prices shooting back up to the highs. Long term trends are too powerful. While Gold could drop down to the 3100 range completing an A-B-C for Wave 4, I think we are already in wave 5. A quick move to 4,000 would stun many but for those who see...

A three day test of the high is as obscure as it can get, especially when I hear on tv that there is near certainty that every dip is a buying opportunity. We have enough for the move to count as a wave 5. The next move down should be a doozy. I'd be happy with a few down days with the intense resiliancy of stocks. Too much money in the system. Can prices go...

Classic look. Strong despite weakening gold price. As S&P continues into new high territory, time for the laggards to pick up the pace.

The end of the month has typically been a rough time for gold as options expirations and deliveries affect price. But after the end of the month selling completed with a climax, gold has kept rising and I expect it to continue on to recent highs and on through to new highs. There has been a lot of talk on YouTube about $4,000 gold. The dollar continues to get...

Unlimited money sloshing around means no end to upside in the markets. When the Fed finally lowers interest rates, all markets will go crazy. Calling for 7,500. Go big!!

When a price goes to oversold/overbought levels as indicated by the Bollinger Band, one must them look at the Band Width. When this indicator is rising, it shows that price is stronger than the average. My rule of thumb is to stay positioned in the direction of the trend until this number reverses.

Bonds got a big boost out of the recent inflation number. A nice run but I'm taking profits here and taking a short position.

Corn may continue the trend higher, reaching at least 450 but a more likely projection 460.

Rates pattern forming a reverse head and shoulders formation. Look for the 20 year at 5.25%

wave structure preparing me to expect more corrective action. Adding to shorts on any rally

I've been selling option premium as momentum has fallen. Money is leaving gold and moving into silver. As price reaches lower band, I'll be adding delta in anticipation of moves to much higher levels. Gold appears to be at the bottom on a long-term, rising channel and is providing positive long term opportunities.

May showed price heading back up to the high. This is four months now from the previous top. Generally for a major top to exhibit itself, it might take only three months to test. Four months is also not uncommon so it is possible that today's close will be last positive monthly close in a while. I expect that the price will continue to rise, probably above...

Still focused on a C wave pushing below the neck line of a head and shoulders-appearing top.

Gold has had a tremendous run over the past two years and as it burst to 3,400 before backing off, I'm feeling that the consensus for a sure trip to 5,000 is beginning to get too prevalent. Can't lose sight of the fact that we have completed a five wave impulse and needed to correct. The only question is have we already corrected and now are on the path to...

Price is nearing the top of Bollinger Band resistance. The Band Width is decreasing, suggesting that price might regress to the moving average. I good time to sell call options.

A brief pause in the gold run may be a good time to pick up some of these cheap miners I'm coming across. For those less risk tolerant (is that possible in the mining sector?), AEM , GDX, WPM and others are breaking to new highs. I see WPM at 75 within the next year or two and big moves from NEM from current levels. If you have nothing in gold/silver/miners...

I've been sticking with Pfizer for far too long to abandon it. The dividends have continued to roll in and with a 7%+ payout rate, this one is bound to get some bids, sooner or later. I'm adding at this level.

Downward possibilities for SP can be breathtaking. 1000 point drop possible. Cheap puts can score big. Perhaps Friday's job report will be the trigger??