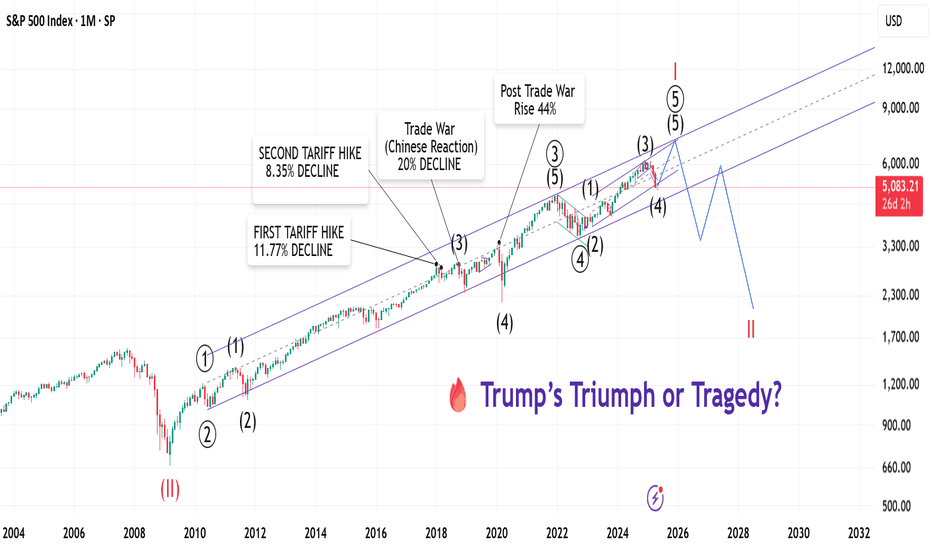

Introduction The S&P 500 recently faced a sharp decline, with many rushing to blame renewed trade war tensions under President Trump's second term. But is this downturn truly a political reaction — or was it already baked into the market’s DNA? A deeper dive using Elliott Wave Theory suggests something far more structural: the recent fall is part of a broader...

The S&P 500 recently faced a sharp decline, with many rushing to blame renewed trade war tensions under President Trump's second term. But is this downturn truly a political reaction — or was it already baked into the market’s DNA? A deeper dive using Elliott Wave Theory suggests something far more structural: the recent fall is part of a broader wave pattern,...

S&P 500: US indices may continue their upward trend until the first quarter of 2025. The ultimate target appears to be above 6300, where they may peak and begin a significant correction. A global stock sell-off could potentially trigger a stock market crash similar to that of 2008. India's Nifty 50: India's Nifty 50 may find support around the...

Bitcoin is nearing the culmination of a remarkable price surge, targeting $127K as it moves through the final fifth wave of its Elliott Wave structure. This rally, which began at $15.48K in November 2022, has captured global attention as the world’s largest cryptocurrency continues to demonstrate resilience and increasing adoption. After a brief dip from $99.8K to...

Nifty has made a significant recovery after hitting a low of 19223 on August 31, 2023. According to Elliott Wave Theory, the Nifty made its low as Wave iv of Minute Degree Wave {iii} within Wave (i). Until November 2023, Wave (i) of Minute Degree Wave {iii} might drive the index toward 20400-20600. As Wave (ii) of Minute Degree Wave "{iii}," a pullback toward...

A rise from the November 2015 level of $1050 per ounce in Gold Spot may have ended at $ $2080 per ounce in May 2023. Over the next year and a half, a correction to $1500 per ounce is possible. Gold may rocket higher in wave 3 after bottoming near $1500 per ounce by the end of 2024.

Brent Crude: A quick rise of about 10% till September 2023 end & then fall about 40% from high towards year end. Brent may ultimately explode towards $200 towards the end of year 2024.

USDINR has been trading in the 83-80 area since October 2022. The USDINR has been consolidating for nine months and is on the verge of breaking over the 83 barrier. If it breaks over 83 per USD, the pair might go to 86 within 6 months. When the rupee reaches 86 per USD, the Indian central bank may interfere. The ultimate target for Primary Degree Wave 3 may be 90...

The Rectangular Pattern in Wave IV suggests that the USDINR may rocket higher towards 86 before the end of the year. Because of the barrier rectangle pattern, the pattern is quite bullish.

The current upward trend, which began on October 20, 2022, at a low of 3491, may last through the end of the year, reaching levels of 4900–5000. From there, we might observe a correction of 15%–18%.

Since the low of $15500 in November 2022, the BTC/USD uptrend has maintained a series of higher highs and higher lows. It is currently on Wave 1-2, Wave - , and Wave (i)-(ii). This series may continue until it breaks below $24825. Immediate support is expected to be found near $28335 and $27506, which correspond to the 50% and 61.8% Fib. retracement levels of...

Current Wave (iv) is expected to fall around 19300-19250 in double combination zigzag.

The Long-Term Trend which started since 2009 may finish near the end of 2024. Next Big Financial Crisis may be unfolding in the year 2025.

A 5-wave rally from 18650 is seems to be over right now. Target of 19250 is quite possible.

A 5-wave rally from 43350 is seems to be over right now. Immediate target below 45000 is possible now.

Sensex is in the final stage of its cycle wave rally. In the very short run, it may drop towards sub 62k and then rise towards 80k+ towards end of the year 2024. Ultimately, we may see 90k+ till mid 2024 to finish its cycle degree wave III or V.

The largest merger agreement in India to date, between HDFC and HDFC bank, has piqued the interest of Indian investors. Whenever there is news about a merger, prices peak in the near term and then recover. So, for the time being, it is extremely possible to halt current progress and retrace to 1600 before rising to 2600-2800 during the next year.

The largest merger agreement in India to date, between HDFC and HDFC bank, has piqued the interest of Indian investors. Whenever there is news about a merger, prices peak in the near term and then recover. So, for the time being, it is extremely possible to halt current progress and retrace to 1600 before rising to 2600-2800 during the next year.