BITRAF_CRYPTO

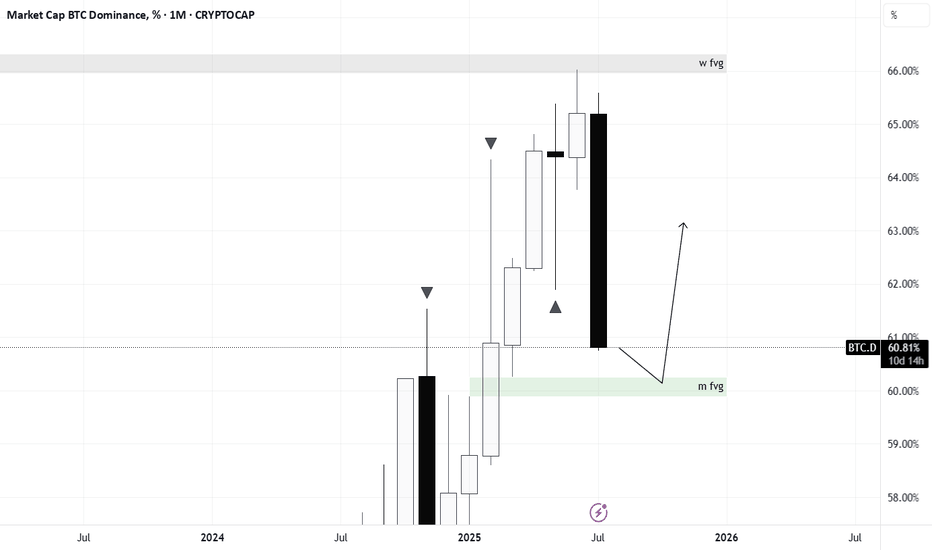

PremiumThe next potential reaction area is the monthly FVG. Once price reaches this zone, I’ll be closely monitoring price behavior for signs of a shift. Patience until the level is tapped — no assumptions without confirmation.

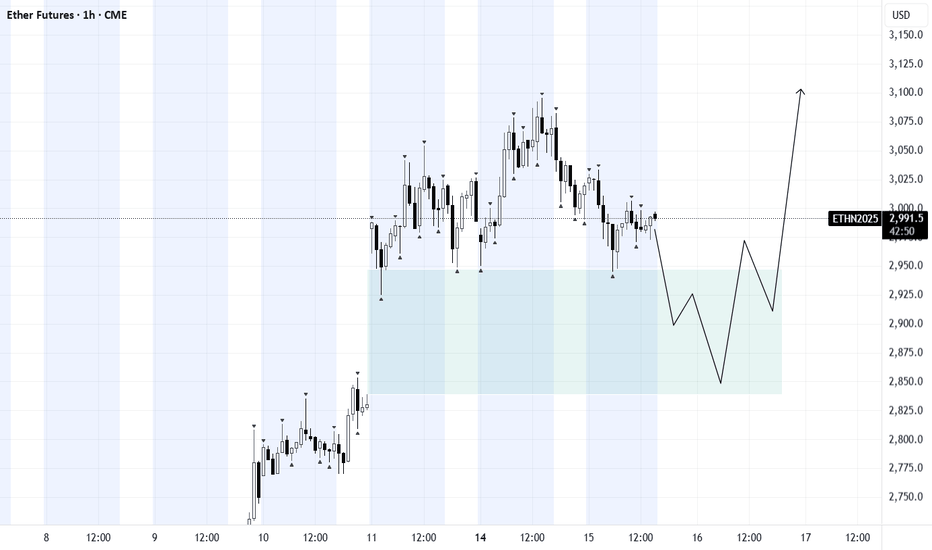

ETH is showing a similar structure to BTC, with a visible gap in play. A partial or full fill of the gap, followed by a bullish structure break on lower timeframes, would be a strong signal of buyer strength. Waiting for confirmation before acting.

A gap is currently in play. For further upside, it would be healthy to see a full or partial fill in the near term, followed by a strong reaction. Such a move would signal strength and validate bullish momentum.

Price is following an AMD structure with a liquidity sweep to the downside. For full confirmation of the setup, a daily FVG inversion is required. Watching closely — confirmation will unlock further directional bias.

Daily FVG has been fully filled. Now watching lower timeframes for long entry conditions. If confirmed, upside targets sit in the 105–136 range. Let the setup come to you — no entry without clear signals.

Potential AMD setup forming. Ideally, a distribution phase unfolds before July 9th — which could trigger a rotation into altcoins. As always, confirmation is key for any entry. No confirmation — no trade.

BTC is currently trading within an 8H short FVG. For continued upside, a clean inversion of this zone is required. Failure to flip this level may trigger a corrective move toward the $93K–$98K range. Monitor price action closely — confirmation is key.

Price has entered a daily long FVG zone. For long setups to be valid, we’d like to see a short FVG inversion play out. If no bullish reaction follows, the bias shifts to shorts — with potential downside targets in the $2000–$1800 range. Wait for confirmation before taking action.

Following the consolidation phase, we’ve seen a clear manipulation move — the structure closely resembles an AMD setup. As long as the pattern holds, upside targets are in the $2700–$3000 range.

BTC is currently in local consolidation. After a liquidity grab on either side, potential entry setups may form via the AMD pattern — but only if key conditions are met. No setup — no trade. Wait for confirmation.

ETH remains in a consolidation phase. Attention is on the nearest liquidity zone — a sweep or reaction here could signal the next move. Failure to reclaim and hold above the $2600 level on the weekly close opens the door for a potential drop into the $2000–$2300 range, aligning with a possible manipulation phase before reversal. Longs or shorts only considered...

AVAX is currently in a consolidation phase. The key area of interest is the liquidity zone around $20.14 combined with a daily FVG. 🎯 After a move into this zone, long setups can be considered — only if proper conditions are met. Target to the upside: $21.49 📌 Waiting for confirmation before execution. No setup — no trade.

ADA is currently in a local consolidation phase. After a liquidity grab/manipulation sweep, we can start watching for long opportunities. 🎯 Upside target: $0.68 – $0.69 📊 Waiting for confirmation post-manipulation to trigger entries. Patience is key — setup is forming.

🔔 New Month Kicks Off — Caution with Futures I wouldn’t rush into aggressive futures trading right now. Key long zones to watch: • Liquidity sweep near 100,700 • Entry into the weekly FVG zone That’s where I’ll be monitoring closely for potential position building. 🧠 The logic is simple: For a solid entry point, the market needs to define the monthly and weekly...

#AVAX Spot Strategy 🚀 AVAX is currently at a solid buy zone for spot entries. The coin is in the top 15 by market cap, which adds fundamental strength. 💡 Recommended DCA approach: Split your planned allocation into 3 entries — market volatility and manipulations remain high, especially lately. • Entry 1 — at current price • Entry 2 — around $15 • Entry 3 — if...

Alt Market on Watch — All Eyes on ETH ⚠️ Despite a strong start to the week, some red flags are starting to show up on the horizon. The spotlight is on ETH — it’s the key to what’s next for the altcoin market. In the last update, I shared altcoin levels to work from, but right now ETH should be your primary reference. 📍 $2400 is a major zone — I’m watching for...

We're seeing liquidity grabs followed by the start of a local bullish move. Looking to enter long from the highlighted zone, but only if proper conditions and confirmations align. 🎯 Upside targets: 1765 – 1918 – 2496 points

The coin is exhibiting a bullish market structure both globally and locally. A potential long setup could be considered on a pullback into the highlighted zone, provided confluence and confirmation signals are in place. Upside targets are set at 4.27, 4.48, and 5.13.