Wowza, what a week we just had! Sunday night the Yen carry trade started to unwind in a magnificent fashion. We came in on Monday morning with the NDX down 1k handles, and the VIX at 60. Most of this has corrected itself as NQ actually closed the week +60 handles - but there is something more sinister at play I fear. This week is going to be a HUGE DEAL for...

What a great fresh week of selling we just had! Last week I was looking for a slight bounce in NQ before running to our 18.5k target area - but they wanted to run is down there faster. We have been writing about this 18.5k area for MONTHS - I'm just glad we finally got the entry we wanted. To be clear - I think the next move higher in markets will cement...

The past 2 weeks of selling in the NDX has been exactly what I wanted to see on the weekly charts. We have been talking about a Tech sell off for a while- into a bottom ~ 18.5k where we can position for the BIG & FINAL Long entry - and we almost got it this week. The Nasdaq sold off this week finally filling the quarterly FVG that we have been looking for. ...

The past 2 weeks were what a lot of perma-bulls were citing as "market rotation" - when I honestly think it was nothing more than a short squeeze in small caps and on the Dow. This weeks post will be a lengthy one as I will cover many different asset classes - as it looks as though the market is setting up for a broad sell of. The Nasdaq came perfectly down...

Last week, we were reminded what selling looks like on indexes. The Nasdaq and Bitcoin tend to lead the technical moves, and I believe we are headed for a 10% correction here soon on NDX. NDX led the market by making its top earlier than the rest - but everything is poised for a nice drop from here. My contention is that this will be the final wash-out on...

A new batch of fresh record highs to start Q3! Last week, we were looking for longs and we got them to TP at ATH for a solid 500 handle move in NQ. From HERE - it gets a lot trickier, but lets start to walk through what we are looking for. Nasdaq To ME - the governing HTF Draw on Liquidity (DOL) is still the fresh FVG that was created on the quarterly chart....

Week of June 24 NQ/10Y/CL/GC I'm back! After a much needed vacation and a break from the charts at ATH - I am BACK on TradingView with a fresh weekly forecast. This week will mark the start of Q3 - which is really important as we need to check back to reference the quarterly charts to see if there is any unfinished business we left behind. I am expecting Q3 to...

New record highs on indexes!! The DJI broker 40k, and CME_MINI:NQ1! itself broke to nATH as well. CBOT_MINI:YM1! never actually made a nATH, but cash DJ:DJI did - so I wan waiting for that to resolve itself. The good news is that CME_MINI:NQ1! has a really clean weekly chart here, so I will be focusing on that this week instead of the Dow. I think we...

Last week we had record low volume on indexes as they drifted higher. There as a drought of news to move the market - and the volume was reminiscent of a holiday week. Indexes The DJI went vertical to fill the last weekly imbalance we had that was MOST in the premium of the swing. From HERE - we are at a major deciding point. The weekly chart still is...

What a WILD week we had! Last week was insanely noisy between the FOMC on Wed, NASDAQ:AAPL earnings on Thursday, and NFP on Friday. This coming week of May 5th offers very little in the way of news catalysts, so it will be great for us TA based traders. So far, all of our weekly objectives have been playing out - and nothing has really changed from my perch...

Last week we got the YM1! backtest that I wanted on the weekly. We rejected the weekly IRL and now I am looking to take out LOY on the Dow. Dropping to the h4 chart, we can clearly see the market is now primed to drop. I am looking for a sweep of highs to begin the weekly sell program. For those watching - we also got the 50% retrace of SPX on the...

Nobody will ring a bell at the top. What a great selloff we had last week! I was expecting a pop higher for the sell but they just wanted to pull the rug on bulls early in the week it seems. Pretty much everything got monkey hammered. Indexes and Oil slid while gold held in (for now). The great news is we now have a directional market to trade again - these are...

What a week we just had! Friday we saw aggressive broad selling all the way into the close. The NDX is once again just flopping around in this multi-week range - while The Dow is meaningfully breaking down. For indexes - I will be focusing on the Dow this week. The DJI has been super clean lately and is the only index really making the sizeable moves as...

The Greatest Depression has Begun. This post will look at the Nasdaq through the lens of ICT concepts. So what happened this week of 10/22/23. NDX broke the equal lows from May/June @ 14220 - and balanced a weekly Fair Value Gap by attacking the midpoint/CE of this weekly FVG. More importantly - by taking out the June lows, we now have a WEEKLY Market...

Everyone and their dog is looking for the Fed Pivot and rate cuts. I think if they do this and return to QE - they will lose the bond market. Then it won't matter for anyone on anything. This is the massive tail that I think nobody is looking for, but check the WEEKLY chart of the 10yr note. Head & Shoulders (or their inverse) are typically formed at the end...

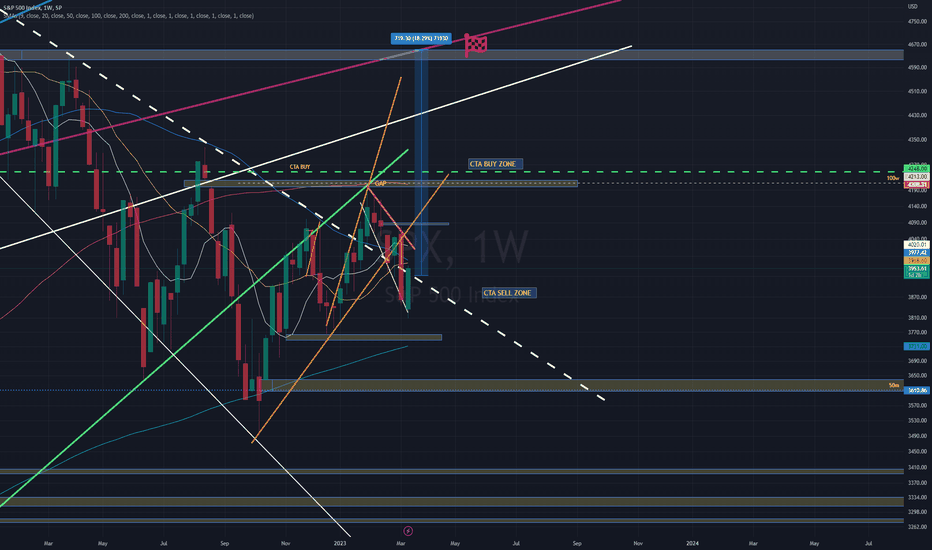

Lots of news/noise this week! Between the mini banking crisis and banks bailing eaother out, the 2yr and oil beat down - where do we go from here? To start, they basically saved the weekly candle on the SPX. We need to close the week above the 200dma and outside of the bear market down -trendline @ 3930. We have open gaps above us but my thesis is basically...

For Starters - Go Watch this guy as he is 100% spot on. twitter.com Lets start with a Chart of the VIX From October 12th (the bottom of the last market rally). Using the 1hr $VIX Chart, you can see we have 5 open gaps. We filled the last gap TODAY: And in fact - we now have a gap overhead! And the VIX bottomed directly into its 100month SMA. If you...

Pretty interesting chart here. The 10year yields have now retraced .618 of the move from the 2018 highs to the Covid 2020 lows. FOMC is in 2 days - if Powell offers no surprises, I wouldn't be shocked to call this the top in the 10 year for now. IF we start to get a reversal in rates - get long bonds such as $TLT or $ZROZ - and tech might even rally. Just...