BenGray9

The price trend of BTC has once again become the focus of global investors' attention. Previously, BTC experienced a period of consolidation, during which the bulls and bears engaged in repeated games. Now, the bulls of BTC have risen strongly, unleashing powerful upward momentum. With a swift and fierce move, it has broken through the key resistance level of...

I. Technical Analysis (1) Support and Resistance Levels BTC has a strong support at $80,000. It’s withstood selling pressure multiple times. When the price dropped to $82,000, it rebounded, validating this support. $85,000 and $87,000 act as resistance levels. Failed attempts to break through these thresholds show strong selling above these price points. (2)...

The expiration of the extended US import tariffs on Canada and Mexico next Wednesday may impact USOIL: Supply : Tariffs could disrupt US-Canada crude oil trade, cutting US supply and raising prices. Trade pattern changes may also affect global supply and USOIL prices. Demand : Tariffs may slow economic growth, reducing crude oil demand and exerting downward...

When the GBPUSD pair executes a definitive breach of the 1.30000 resistance ceiling — a level of both psychological and technical significance — it is poised to precipitate a substantial influx of bullish sentiment. This event not only satisfies key technical prerequisites for an upward price trajectory but also catalyzes a profound shift in market...

I. Technical Analysis (1) Support and Resistance Levels BTC has formed a strong support level at $80,000. Judging from past market performances, this price level has successfully withstood selling pressure multiple times, demonstrating the market's recognition of its value at this price. When the price dropped to $82,000, a certain degree of rebound occurred,...

Today, the XAUUSD market is mired in extraordinary volatility. The uptrend in prices has continued unabated, with values rocketing to $3086. This powerful rally has inflicted heavy losses on bearish traders, leading to a mass liquidation of their positions. Currently, the market is in a “double - whammy” situation, where both bulls and bears are feeling the...

Market Sentiment Aspect During sideways consolidation and oscillation with limited price swings, bullish sentiment may quietly build. When the XAUUSD price breaks through the resistance, this sentiment is unleashed, sparking more buying. Moreover, large institutional investors and professional traders may use technical analysis to establish long positions early....

Energy Accumulation during Sideways Consolidation The consecutive days of sideways consolidation represent a temporary equilibrium between the bulls and the bears. During this period, the bulls are constantly accumulating strength, while the bears' strength is gradually being depleted. Just like a compressed spring, the longer the sideways consolidation lasts,...

If GBPUSD can effectively break through the resistance level of 1.30000, it is likely to attract more bulls to enter the market, driving the exchange rate to rise further. The potential resistance levels above might be around 1.31400, 1.32100, etc. On the contrary, if it encounters resistance and drops back near 1.30000, the support levels below are at around...

Supply : The United States has intensified its energy sanctions against Iran. Attacks on Saudi facilities have affected their performance. The OPEC+ will gradually lift the voluntary production cuts starting from April and may increase production for the second time in May. The 30-day ceasefire agreement between Russia and Ukraine has not been effectively...

Economic Fundamentals Australia: Its economic growth, inflation and export prices affect the Aussie. Growth aids appreciation; inflation undermines it. Higher resource prices boost the currency. US: Strong US data strengthens the dollar, weakening AUD/USD; weak data has the opposite effect. Market & Geopolitical Factors High risk appetite benefits the Aussie;...

Presently, Bitcoin is firmly ensconced within a robust upward trajectory. Having transitioned from a sideways trading phase at 84000 last week, it has executed a remarkable rally, surging directly into the resistance corridor in the vicinity of 89000. With the current trading price hovering at 87000, the market exudes a palpable sense of bullishness. Should BTC...

Technical Analysis AUDUSD lies below 50 - period SMA (0.6324, declining) and 100 - day SMA (0.6512, falling), indicating a downward trend yet short - term upside potential. January 2025 RSI bullish divergence shows weakening downward momentum. Break above 0.6340 could push it to 0.6400; otherwise, it may range 0.6131 - 0.6302. Economic Fundamentals Australia:...

From a market - wide perspective, the XAUUSD market is firmly bullish. It has twice tested and held 3,000 level, signaling strong buying sentiment. The key now is the validation of the 3,000 “W” bottom. A break above 3,035 resistance may test 3,045, with 3,057 all - time historical high in sight. If today’s upward momentum fades, prices will likely remain in the...

Currently, Bitcoin is in a strong upward trend. It has soared directly from a sideways movement at 84,000 to the resistance zone near 89,000. Now, with the price at 86,000, the market sentiment remains bullish. If BTC maintains a stable sideways movement between 87,000 and 88,000, the bulls can gradually accumulate upward momentum. Once ready, BTC will...

Crude oil has been fluctuating and rising recently, reaching a three-week high. From a fundamental perspective: Supply: The United States has intensified its energy sanctions against Iran. Attacks on Saudi facilities have affected their performance. The OPEC+ will gradually lift the voluntary production cuts starting from April and may increase production for the...

Analyzing from a holistic market perspective, the gold market is firmly in a bullish upswing. Twice, it has tested and successfully held the 3,000 mark, vividly demonstrating robust buying sentiment. At present, the crucial factor lies in the validation of the “W” bottom pattern at 3,000. A successful breakthrough above the 3,035 resistance level will likely...

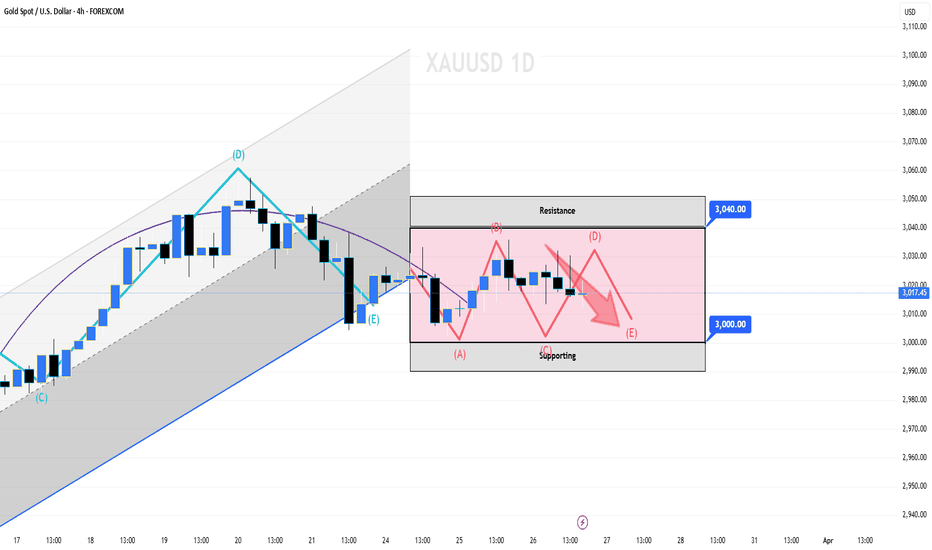

Recently, XAUUSD shows box - range oscillation between 3000 - 3040. 3000 serves as support and 3040 as resistance. Notably, 3000 demonstrated its strong support level yesterday. Keep a close eye on the 3000 support level. If it is broken, then it will likely trigger a downward trend, with prices potentially heading towards the next significant support...