Bicoinmoney

Premium1. Price Chart & Falling Wedge Pattern PEPE is currently trading within a falling wedge, a pattern that typically signals a bullish reversal upon breakout. Price just bounced from a key support zone around 0.000000525 - 0.000000690, forming a potential double bottom. Still hugging the lower wedge boundary, meaning a breakout or a strong bounce is possible. 2....

🧠 Technical Overview: ✅ 1. Price Action: The price is forming a descending triangle pattern, which typically signals bearish continuation if broken to the downside. It’s currently testing a key horizontal support zone around $0.164 – $0.18 USDT (marked in pink), a historical accumulation area. Lower highs suggest sellers are still in control. ☁️ 2. Ichimoku...

🔍 1. Price Trend SHIB is currently trading inside a descending channel, capped by a major downward trendline (black line). Price is approaching a strong support zone around 0.00001150 – 0.00001200, aligning with the 0.786 Fibonacci level (0.00001503) — a common area for bullish reversals. 📊 2. Technical Indicators ✅ RSI (Relative Strength Index) RSI is at 34.17,...

✅ 1. Current Price Zone Current price: 0.00001390 USDT Price is near the 0.786 Fibonacci retracement level (0.00001503) – a strong historical support zone. 📉 2. RSI (Relative Strength Index) RSI (14): 39.18 – slightly oversold but not yet deeply oversold. RSI is starting to curve upward, suggesting a potential short-term rebound if it crosses above the moving...

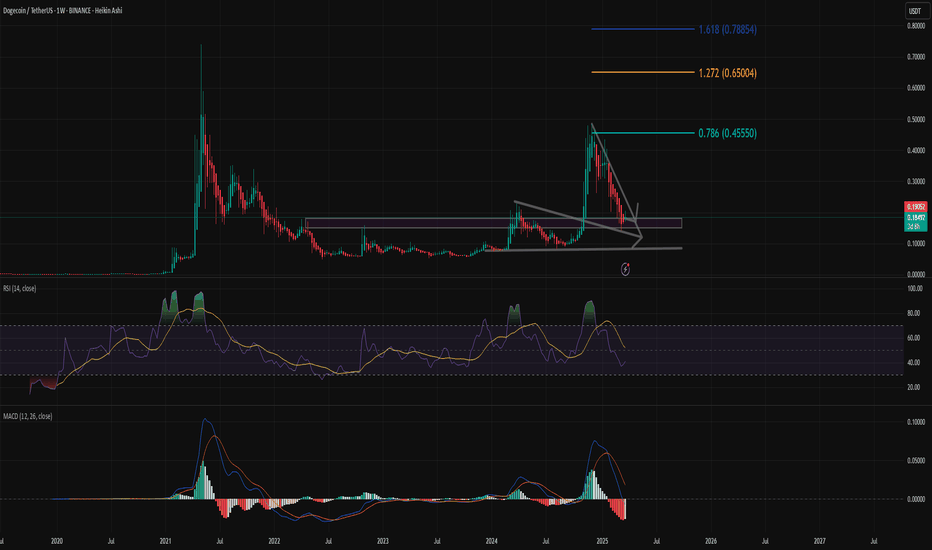

1. Chart Structure: Current price: ~0.18497 USDT. The chart uses Heikin Ashi candles for smoother trend visualization. A falling wedge pattern is forming — typically a bullish reversal pattern. A strong accumulation zone (purple box) is visible between ~0.07 – 0.19 USDT. 2. Price Behavior: After a strong rally in early 2025, DOGE is currently retracing. The...

📊 Technical Analysis Overview: ✅ Price Action & Candles: The latest Heikin Ashi candle is a strong green, signaling early bullish momentum. Current price is around $0.214, showing a clear bounce from the recent low at $0.175. Potential double bottom pattern forming, which is typically bullish if confirmed. 📉 EMA (20/50/100/200): Price is still below all major...

. 📊 Triple Bottom Pattern on the APT Chart: 🔵 The Three Bottoms: Bottom 1: around Dec 2022 Bottom 2: around Oct 2023 Bottom 3: Mar 2025 (current low) → All three formed within the major support zone around $4.8–$6.2. 🟣 The Resistance (Neckline): The key resistance is around $8.0–$8.3 (also the Ichimoku cloud edge). If the price breaks above this level, it...

🟢 1. Overall Trend: ONDO is still holding above a long-term ascending trendline (blue upward line), indicating the bullish structure remains intact. The current price is testing this trendline, which acts as a strong support level. 🧠 2. Elliott Wave Structure: The chart suggests a W-X-Y corrective wave pattern may have just completed or is close to...

1. Price & Moving Averages: Current price: Around 0.493 USDT Price is below all EMA lines (20/50/100/200) → still in a long-term downtrend. Ichimoku Cloud: Price is below the Kumo cloud, and both Tenkan & Kijun are flat → indicating no clear bullish confirmation yet, but potential consolidation phase. 2. RSI (Relative Strength Index): RSI = 54.71, slightly...

1. Overall Trend CHZ remains in a long-term downtrend, as shown by the descending trendline from its 2021 highs. However, price is now consolidating near a long-term support zone around $0.045–$0.05, signaling a potential reversal zone. Price is approaching a key confluence area: the downtrend line + bottom of the Ichimoku Cloud. 2. Ichimoku Cloud Price is...

🔍 1. Elliott Wave Structure The chart illustrates a classic 5-wave Elliott Wave cycle: Wave (1): Initial impulsive move up. Wave (2): Corrective pullback. Wave (3): Strongest bullish wave – already completed. Wave (4): Currently in progress – a corrective phase. Wave (5): Forecasted to peak around June 30, 2025 with a major upward move. 📈 2. Fibonacci...

Since ENA/USDT is consolidating at a strong daily support zone ($0.36 - $0.38) and showing bullish divergence on both RSI and MACD, you can look for a buying opportunity near this range. The falling wedge breakout on D1 suggests that the market may be preparing for a short-term rebound. However, because the price is still under the Ichimoku cloud on D1 (meaning...

1. Key Technical Signals: Ichimoku Cloud: Price has just broken above the Ichimoku Cloud after a long consolidation phase, giving an initial bullish signal. However, the future Kumo cloud has yet to expand strongly. RSI (14): The RSI is currently around 66.98, approaching the overbought zone (70), suggesting strong bullish momentum but also warning of a possible...

1. General Technical Signals: This is the AI/USDT daily chart, showing a potential Elliott Wave scenario (5-wave bullish pattern). The price has been in a long-term downtrend but appears to be forming a base around the $0.15 - $0.19 area, suggesting accumulation. 2. Ichimoku Cloud: The price is currently trading below the Ichimoku cloud, indicating the...

1. Elliott Wave Structure: The chart is projecting a bullish Elliott Wave pattern with potential targets: Wave (1): around $5.00 Wave (3): around $6.90 (close to the 0.618 Fibonacci level) Wave (5): final target around $12.35 (near the 1.272 Fibonacci extension) 2. Fibonacci Retracement: The price has retraced down to the $3.34 level (the 0 level) and has...

This weekly chart provides a broader perspective and helps identify longer-term targets and trends. 1. Price Structure (Elliott Wave Projection): The chart suggests a potential 5-wave Elliott structure, implying a medium-to-long-term bullish reversal pattern. Wave (1) starts from the current support (~1.2 USDT) aiming towards ~6.1 USDT. Wave (2) is projected to...

1. Major Support Levels 0.3300 - 0.3400: This is a very strong long-term support zone, marking the bottom of the previous bearish cycle (wave (Y)) and aligning with the 0% Fibonacci retracement. 0.3700 - 0.3800: This is the short-term support level where the price is currently consolidating near a thin Ichimoku cloud base. 2. Resistance Levels & Take-Profit...

1. Indicators Present: Ichimoku Cloud: Currently, the price is below the cloud, which generally indicates bearish conditions, but the cloud ahead seems thin, suggesting a potential breakout. RSI (Relative Strength Index): The RSI is around 45.81, signaling neutral momentum but with a bullish divergence forming (higher lows in RSI while price was making lower...