Sentiment Some negative sentiment is weighing on WTI through Asia and early London. Kpler’s call that China’s gasoil demand could peak in 2026 has been taken as bearish, and headlines like this tend to spark algo-driven repricing. Add in Trump’s tariffs on imported vehicles, and you’ve got a sentiment cocktail pulling crude lower. That said I see this as a...

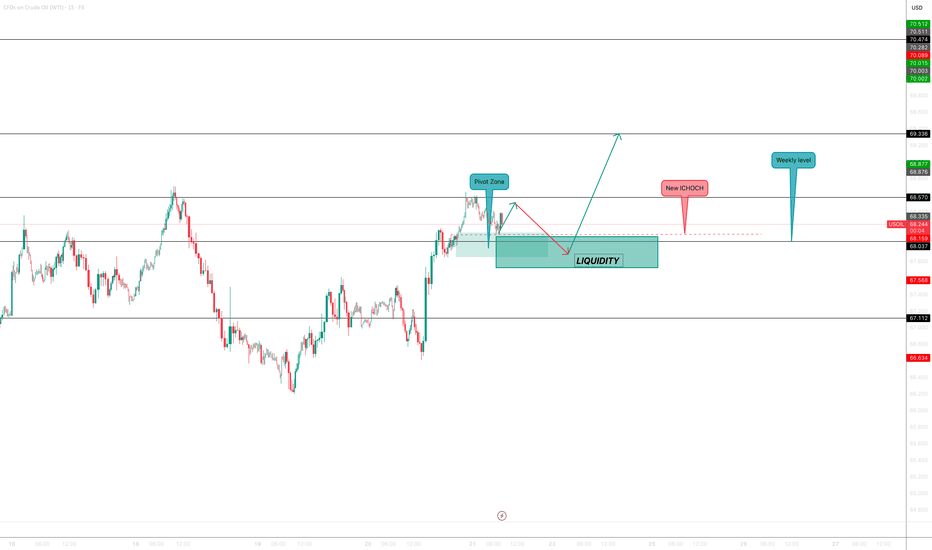

Technical Rationale: I’ve taken a long position following a liquidity grab during last night’s session. Price is still respecting the broader bullish structure, and the move down to $68.77 appeared to be a stop run, faking out breakout shorts. My next target is the weekly level around $70.50, assuming no major market shocks through the rest of the...

Im looking to short Oil from $68.70 - $69.0. Short stops from ($68.65) pivot, and buy stop from breakout traders will be resting here, plus SMC Traders sell limit orders, on this basis I think this will provide nice liquidity to cement our move to the downside, back into the range. The market at the moment is unsure of clear direction with, strong Macro and...

🟢 Bullish Scenario (Main Idea): This setup aligns with Smart Money Concepts (SMC), order flow, and liquidity principles—expecting a manipulation move before the real trend resumes. Waiting on a new ICHOCH to form to valiadte this trade idea. With A Potential move into the demand zone (marked as liquidity area). Wait for confirmation after the liquidity grab,...