Bluecaller

Amazon runs up 250+ prior to every ER the last 5 quarters, especially from the 200ma. Load up

that is a textbook cup and handle.... 3700 by end of year prediction

AMZN likes cup and handles. This next leg should send it to 4000

load up your calls/shares here for the next leg up

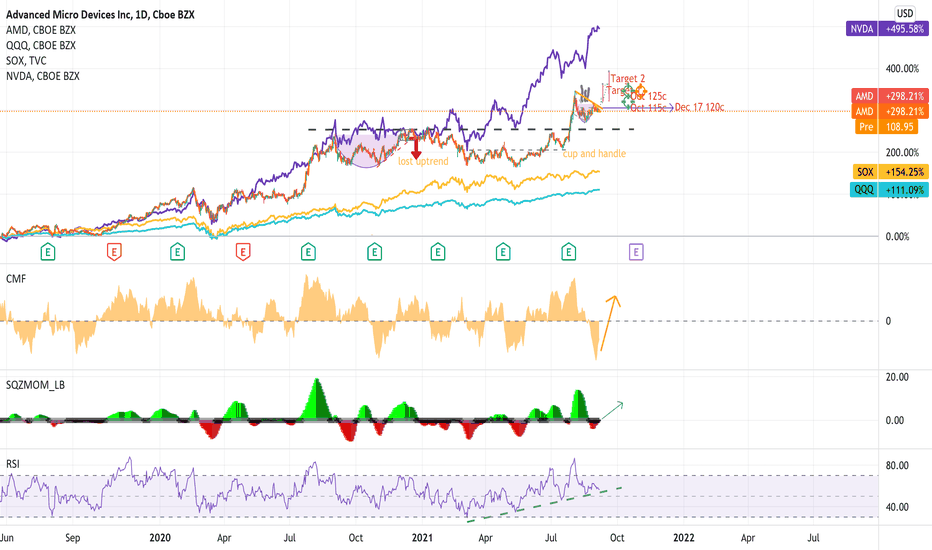

money flow is at rock bottom. The only time QQQ continued down when CMF was this low was during the COVID crash. Take it.

AMD doing what it always does in September. Almost never sees 4 weeks red in a row. 5 out of the last 6 were red. Volume is trending back up this week. Could be range bound like last time, but I believe a retest of 120+ is in store by next ER. The 50d is also the 50% fib retracement. Squeeze momentum is as huge as it has ever been, yet shorts have been attacking...

The likelihood of another long sideways range is minimal and downside is minimal with consistent ER success and blowout numbers. It is going to trend up to 200 by next year. Looking for a retest of upper channel.

AMD lagged the market for about a year and is now beginning its rally. Money flowed out far more this last month than the entire last couple of years and yet has held 107-108. No sellers below that--too much consolidation in 90-100 range for too long and this is a parabolic growth stock. 95 is the new 65...the price everyone would love to buy at but will never get...

Broader look of a cup and handle formation if the handle forms in this box, we can expect a a run to ATHs

This is respecting the trend lines, and squeezing in this wedge after breaking out of the downtrend... soon to break up to new ATHs by October.

The last "breakout" was invalidated and a new upper trendline created. Expecting a a small bounce up then back to 650s before testing 700 and breaking out of the new long term pennant.

The rule of three conditions is certainly met by the positive ER, the break of the long down trend, the tight price range, and now the bull flag. This is primed to breakout. Rotation back into the EV sector. There was a "rotation out" of the EV sector just like there was a "rotation out" of the tech sector. In other words, there was no rotation out. Just a stall...

Volatility has died down significantly since the 'ol pandemy crash of '20. Rolling over, dropping, retesting resistances, then advancing further is normal boring repetitious behavior. Wait and Buy the Dip.

Taking into account the performance, guidance, demand, and 1 year of consolidation, this company was forgotten and neglected but now everyone is paying attention. AMD used to be the cheap processor option for the poor 20 years ago. Now it is cutting edge hot. Who knew?

Long term bullish, but TSLA is not ready to move up yet. This flag is still forming. It needs to consolidate a little more, and break that upper resistance. I can see it revisting 600 again and that will be the right timing IMO. Often stocks with mega runs need a year of sideways action. TSLA is hot enough that it will probably return to ATHs in the fall.

Run up to ER next week will complete the handle... Second time is a charm, right?

AMD is in a new bullish trend . Breaking the previous yellow line downward trend was a big feat and allowed for a fat run. This break was significant. It has now just corrected from strong resistance and touched the trendline where it currently sits. Monday should see it pop up, LONG as long as the trendline stays intact. If it drops below 85 without buyers...

Multiple signals for a long position: 1) inverse H&S on the daily. 2) Sell off over 3) Momentum going positive again 4) RSI trending up 5) Gap fill at 545. NFLX always fills those gaps