Quickly we dive into analyzing our favorite pairs for the day we check and confirmed our directional biased which at the end of the day 1:2 is being targeted. BTC is is in a tricky spot but we will always follow the direction of the market to be more o the safer side.

We continue following our trade setup from Monday and looked into valid entries for the day

we did a quick look on last week analysis and how price eventually went, so we try to look the direction of price as the general trend currently isa side ways move.

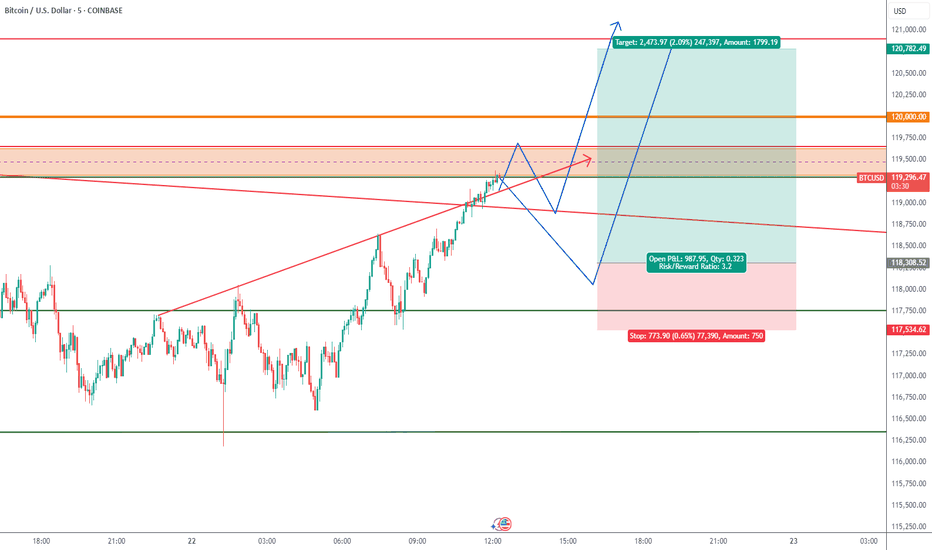

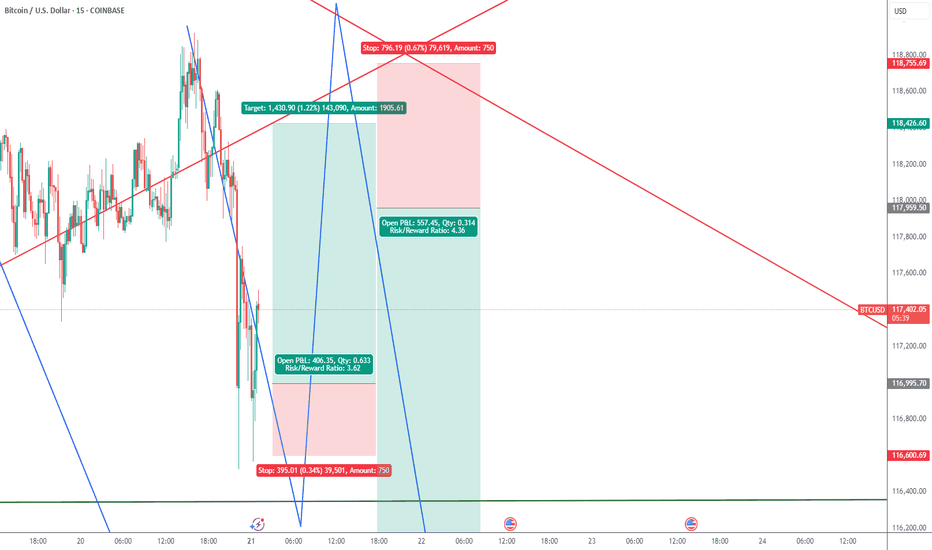

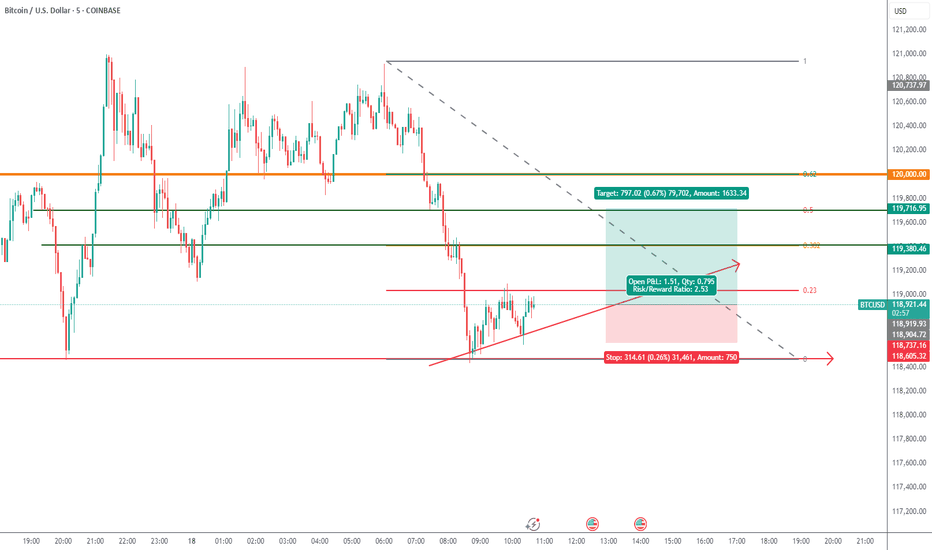

BTC is currently on a sell retracement and after this retracement we are expecting a bullish run but before then we will be currently bearish till we see sell exhaustions.

BTC is currently on a sell retracement and after this retracement we are expecting a bullish run but before then we will be currently bearish till we see sell exhaustions.

from yesterday analysis we see how price played out in our favor, today we are still leveraging on price movement for BTC and we are looking into shorting Gold and Longing it depending on the opportunity market presents to us.

IN this we analyze gold and btc for the day and understood the price movement for the day and what we are expecting and anticipating.

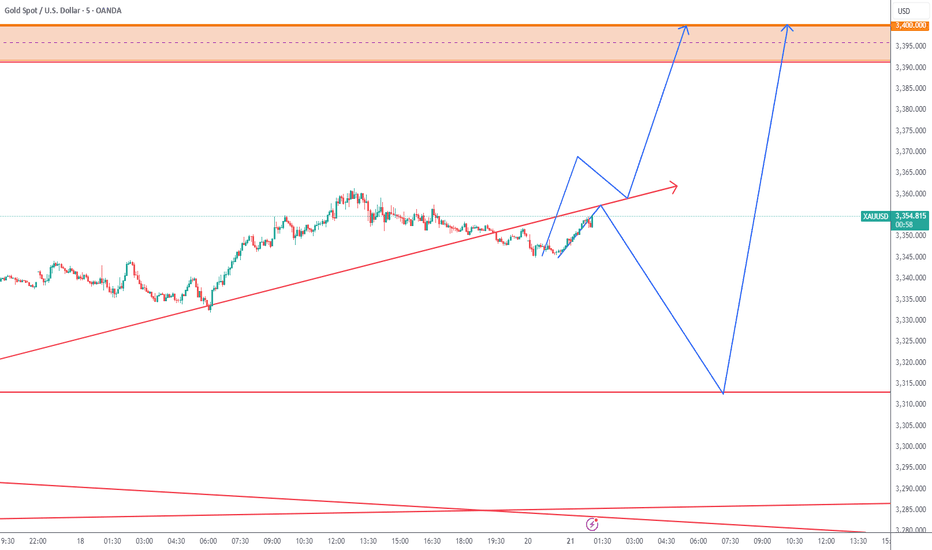

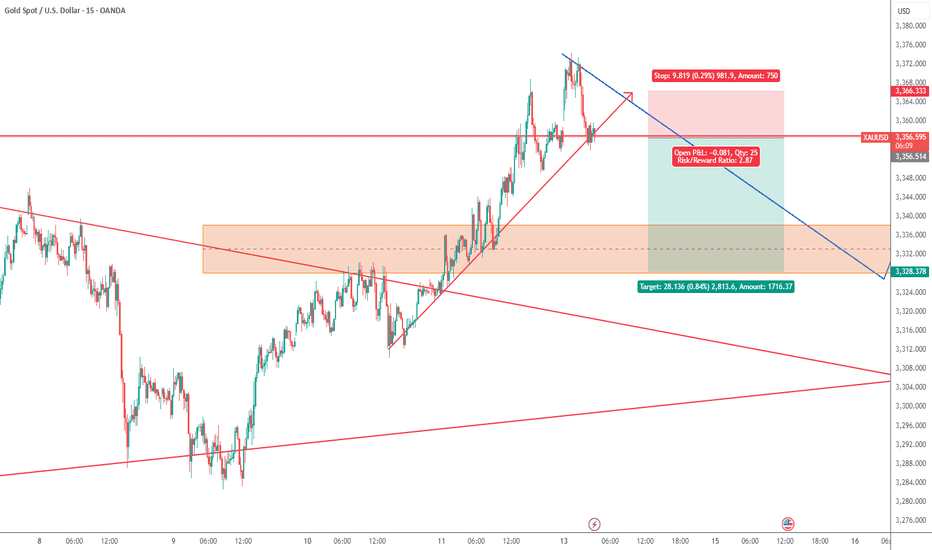

WE analyze gold for the day we will see move of side ways movement before we see a momentum to the upside. for now we will targeting 1:2 to the upside

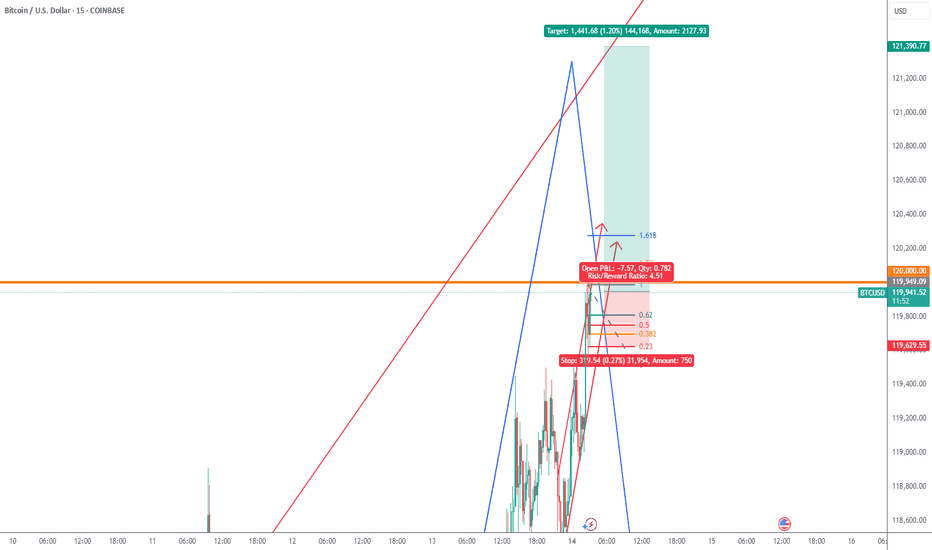

Price has broken out from the external trendline which has signify for a momentum to move up at this point the overall trend is bullish while we will be expecting sell as retracement for us to reenter to the upside. in this trend we will be targeting a R:R OF 1;3

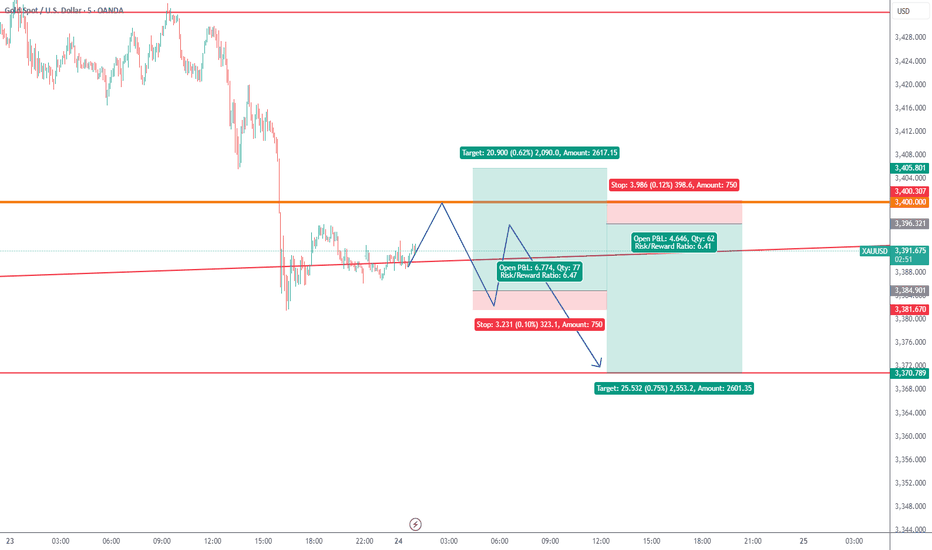

Gold have come to our overall first target area as analyzed in previous videos, so we will see more of retracement to the downside to recover for 50% movement before we movemore to the upside. for this trade call we will favour more of the downside rather than the upside we will be targetting 1:3 for this price move

The market general trends sideways we haven't seen a major breakout to the upside or downside, so for this morning we will be favoring the upside b targeting 1:3, then we wait to see how price playout

We are favoring more of the sell sides to give us a better risk to reward while the buy side we will be risking a little on it.

MULTIPLE BIASED on gold we are waiting to react based on market direction but we are favoring the buy side for the week. any news can make us to see a surge in price but we will be on the lookout either ways

A Mini buy for btcusd targeting a R:R OF 1:2, although the overall trend is a sideways market favoring the downside over the upside. this buy opportunity is worth taking based on shift in market structure and we have a double bottom and order block retest. we will need a major retracement before we have our continuation sell.

A SELL opportunity on AUDUSD, a little bit of retracement before we have our sell to continue. the overall trend is sideways but within the band, we are favoring the downside more than the upside.

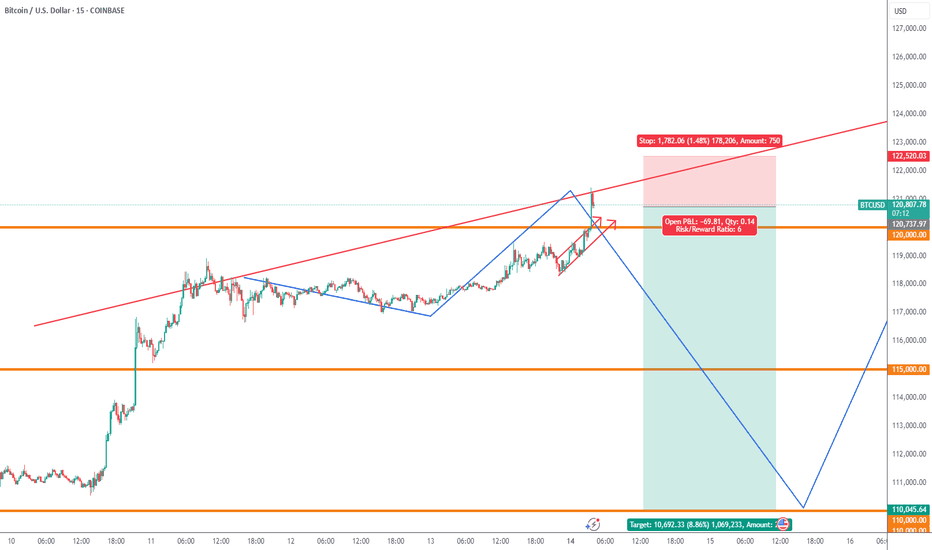

Weekend price pump will fade expecting price to fall back to $110k region before we see a major price move to $130k

A short sell but our overal biased is a buy. once we see a sign of weakness to the downside we will definitely close our open trade and focus on entry to the upside.

A short term Long biased although we favor the down side rather than the upside but we are trying to make some entry before we see major price retracement