CandelaCharts

Premium1. What is a Swing Failure Pattern (SFP)? A Swing Failure Pattern (SFP) occurs when the price temporarily breaks a key swing high or low but fails to continue in that direction, leading to a sharp reversal. This pattern is often driven by liquidity grabs, where price manipulates traders into taking positions before reversing against them. An SFP typically...

What is VWAP? VWAP is a price benchmark that gives more importance to prices where higher trading volume occurs. Unlike simple moving averages, which treat each price point equally, VWAP provides a volume-weighted perspective, making it more representative of market activity. Traders use VWAP to gauge market trends, confirm trade entries and exits, and...

The Williams %R is a fast, sensitive momentum oscillator ideal for short-term trading strategies. It provides early signals of overbought and oversold conditions by comparing the current close to the high-low range over a defined lookback period (typically 14 bars). By understanding where Williams %R fits among other oscillators, traders can better utilize it...

How Institutions May Be Using Moving Averages to Align Technicals with Fundamentals Are moving averages just for retail traders and chart watchers? Not if you're JPMorgan Chase. While many associate moving averages (MAs) with simple trading strategies, institutional giants like JPMorgan Chase likely use them very differently. Instead of relying on MAs to chase...

Today, we dive into a comprehensive guide on Moving Averages (MAs) — one of the most fundamental yet powerful tools in technical analysis. Whether you're a seasoned trader or just starting out, understanding how MAs work can help you better interpret market trends, identify potential entry and exit points, and smooth out price data for clearer decision-making....

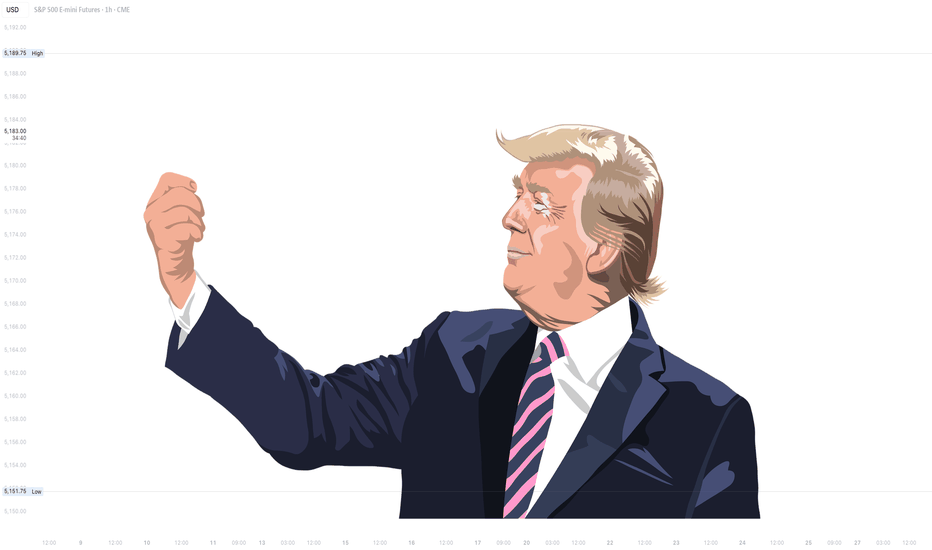

When Donald Trump took office in 2017, the U.S. stock market experienced dramatic fluctuations—marked by steep declines followed by eventual rebounds. This pattern, which we'll call the "Trump Pattern," repeated itself during his presidency and is now emerging again as a point of interest for investors. While the specific causes of these market shifts...

The Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that measures the relationship between two moving averages of an asset’s price. Developed by Gerald Appel in the late 1970s, MACD is designed to provide insights into both trend strength and momentum. Unlike simple moving averages, which merely smooth price data over a...

While we can’t say for certain that Merrill Lynch specifically uses VWAP (Volume Weighted Average Price) in their strategies, one thing is clear: they certainly rely on sophisticated statistical tools and data-driven insights to inform their investment decisions. Merrill Lynch, known for its expertise and successful track record, employs a range of techniques to...

Volume is one of the most crucial yet often overlooked aspects of trading. It represents the total number of shares, contracts, or lots traded in a given period and provides insight into the strength of price movements. By analyzing volume effectively, traders can identify trends, confirm breakouts, and detect potential reversals before they happen. Unlike price...

You might be wondering, do the traders at Goldman Sachs use the Relative Strength Index (RSI)? The answer is, perhaps they do, and perhaps they don’t. However, based on my experience, I can confidently say that even the most seasoned and professional traders rely on RSI from time to time. While it may not be their sole tool for decision-making, it’s often...

Buying the dip is a trading strategy where you take advantage of temporary price drops in an overall uptrend. The goal is simple: enter the market at a lower price before it resumes its upward move. It sounds easy, but knowing when and how to do it makes all the difference. In this guide, we’ll explore key setups, ideal market conditions, and smart risk management...

Unlock the secrets of Fibonacci and its powerful applications in trading. Learn how to use Fibonacci tools to identify optimal entry and exit points, manage risk, and refine your trading strategies. While many traders are familiar with basic Fibonacci retracements, this guide will also explore advanced techniques and lesser-known concepts. 📚 The Foundation of...

This article takes a deep dive into the Relative Strength Index (RSI), a powerful tool for traders at any level. We’ll break down how RSI works, how to interpret it, and how to use it effectively in your trading strategies. Plus, we’ll touch on the math behind it. Whether you’re a seasoned pro or just getting started, this guide will give you the insights you need...

❔ What Are ICT Weekly Profiles? ICT Weekly Profiles are conceptual frameworks designed to illustrate common patterns of price behavior observed during a trading week. These profiles help traders analyze and anticipate potential market movements based on historical tendencies and recurring patterns. Each ICT Weekly Profile has distinct characteristics,...