China_MsWang

PremiumGood evening, everyone! Due to health reasons, I had to take a short break from updates — thank you all for your understanding and support. This week, gold rallied to the 3440 level, forming a double-top pattern, and has since entered a phase of consolidation with a downward bias, currently retracing back to the key 3337-332 support area. While a short-term...

Good morning, everyone! Last Friday, gold tested the support around 3332 but did not break below it. The price then rebounded to the 3358 zone, where it encountered selling pressure and pulled back. At today's open, the price retraced to the 3343 level, where support held well, prompting another rally back toward 3358. It’s important to note that since the 3358...

Good morning, everyone! I’ve unfortunately injured my lower back and will need to rest in bed for a while, so I’ll keep today’s market commentary brief. Yesterday, gold rallied to test the 3400 level, a key psychological and technical resistance area that naturally triggered notable selling pressure. Given this, chasing long positions at current levels is not...

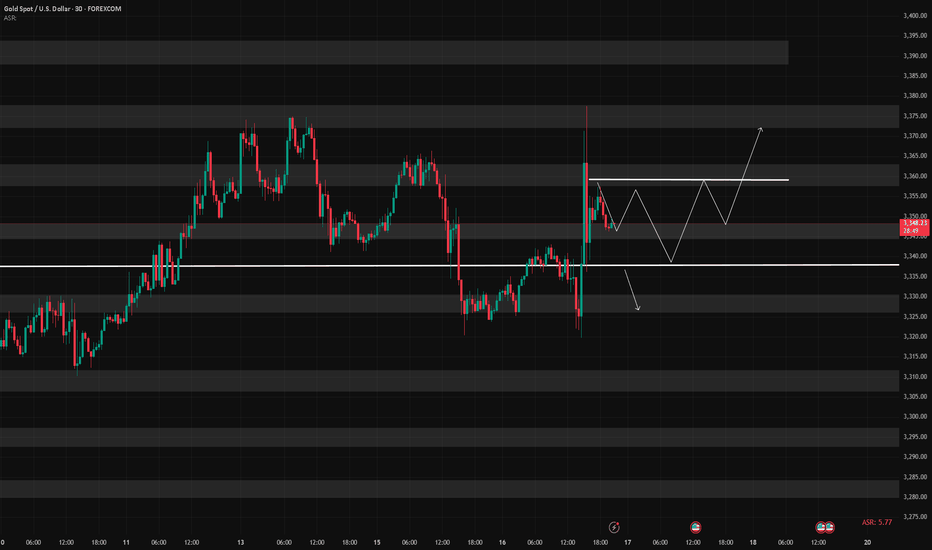

Good morning, everyone! Yesterday, gold broke below the 3337 support after consolidating there, driven lower by bearish data, and eventually reached the 3323–3312 support zone. A rebound followed, and price has now returned above 3323, which also aligns with the daily MA60. 📌 Key Levels to Watch Today: Resistance: 3343 / 3352–3358 → A sustained break above 3343...

During the Asian session today, gold rose as expected into the 3337–3343 resistance zone. After failing to break through, the price retraced during the European and U.S. sessions, reaching the 3323–3313 support area. A sharp rally followed due to unexpected news, pushing the price into the 3372–3378 resistance zone. Overall, the intraday bullish strategy performed...

During today’s session, gold briefly broke through the 3352–3358 resistance zone, but due to news-driven pressure during the pullback, bullish momentum weakened, and the price retreated to the MA60 support level on the daily chart. Given the significant retracement, there is a possibility that a short-term bottom may form during the upcoming Asian session,...

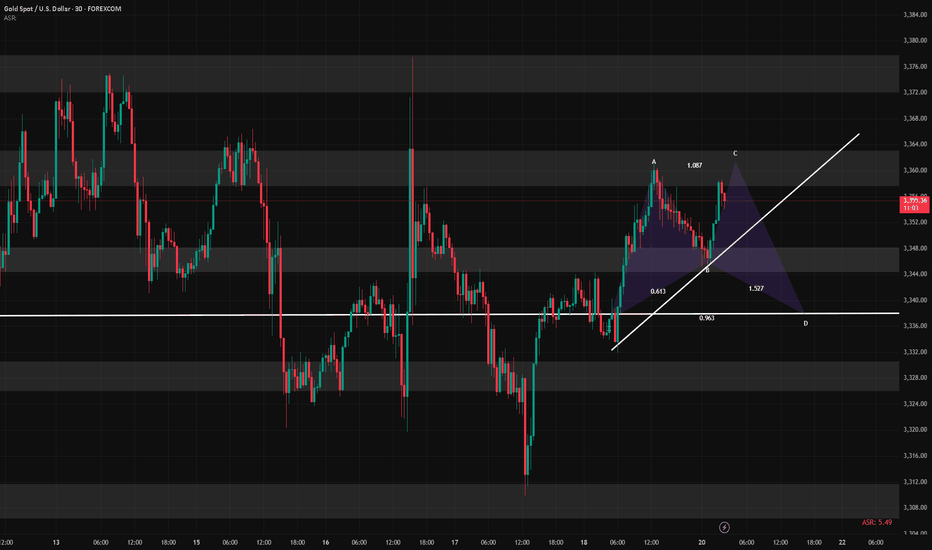

Good morning, everyone! Yesterday, gold rose into the resistance zone before pulling back, testing support around 3343. After today’s open, the price continues to consolidate near this support level. On the 30-minute chart, there is a visible need for a technical rebound, while the 2-hour chart suggests that the broader downward movement may not be fully...

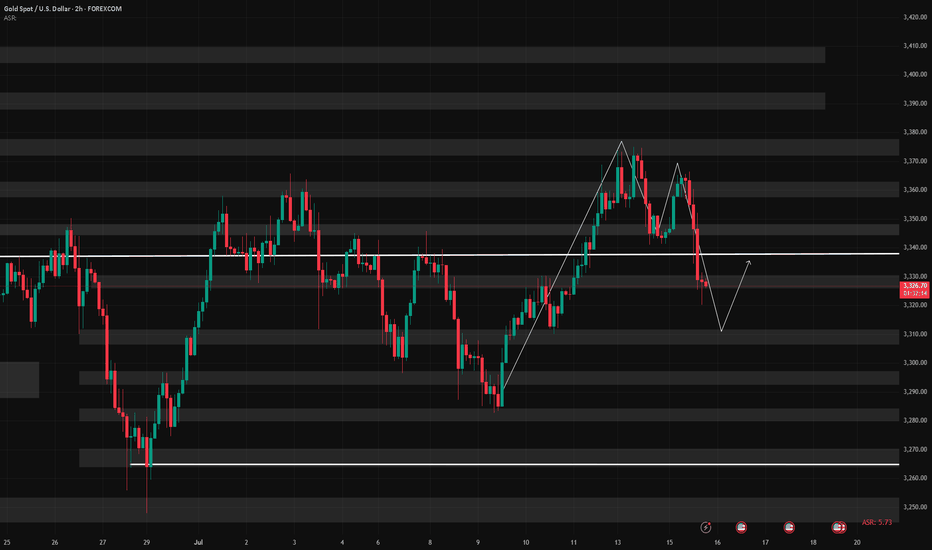

Good morning, everyone! At the end of last week, renewed trade tariff concerns reignited risk-off sentiment, prompting a strong rally in gold after multiple tests of the 3321 support level. The breakout was largely driven by fundamental news momentum. On the daily (1D) chart, the price has fully reclaimed the MA60 and broken above the MA20, signaling an emerging...

Good evening, everyone! Apologies for the late update today—I had some matters to attend to. I hope your trades are going smoothly. Yesterday, gold found support around 3284 and continued to rebound during today’s session, reaching as high as 3330. The key resistance at 3321 has now been broken and is currently acting as a short-term support level. However,...

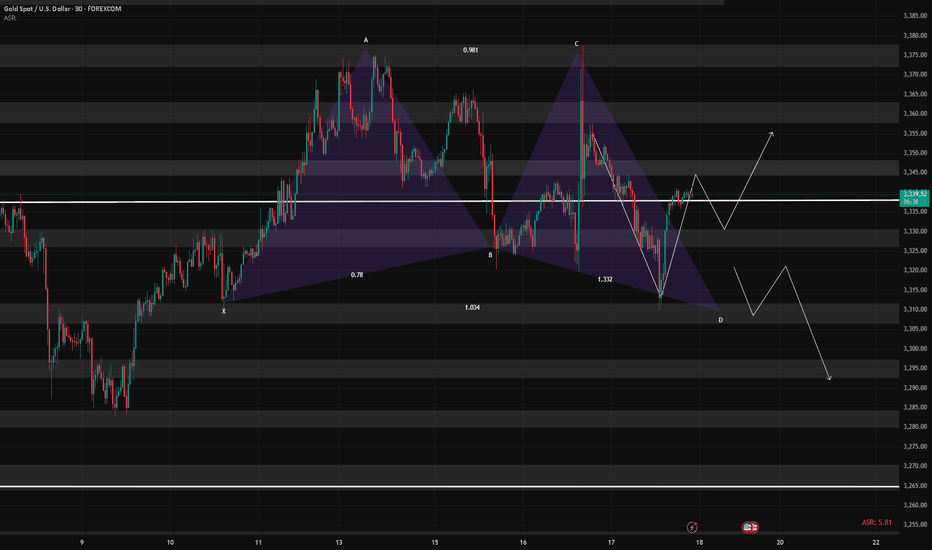

Good morning, everyone! Yesterday, gold tested support and attempted a rebound but failed to break through resistance, followed by a second leg down that broke the support zone, invalidating the potential inverse head-and-shoulders pattern and resulting in a drop below the 3300 level. On the daily (1D) chart, price has now broken below the MA60, signaling a...

Good morning, everyone! Yesterday, gold broke below the 3321 support during the session, dropped to around 3296, then staged a strong rebound back toward the opening price—forming a classic deep V-shaped reversal and regaining support above the MA60 on the daily chart. The market remains in a consolidation phase between the MA20 and MA60 on the 1D chart, with no...

Good morning, everyone! Due to the U.S. market closure on Friday, price movement remained relatively subdued, and the week concluded with modest gains. As of this morning, gold opened higher but has since pulled back, and the price remains in a consolidation phase. Key technical levels for today: Resistance: around 3350 Support: near 3321 Short-term traders...

Good morning, everyone! Yesterday’s intraday trades delivered solid profits. Since the U.S. market will be closed today, news-driven volatility is expected to be limited. Therefore, today’s trading focus will primarily revolve around technical setups. Current structure: Key support: 3321–3316 Immediate resistance: 3337–3342, followed by 3360 If support holds...

Good morning, everyone! Yesterday, gold tested support near 3328 but failed to break below it effectively. The price then rebounded toward the 3350 level. At today’s open, gold briefly extended to around 3365 before pulling back. Technically: On the daily (1D) chart, the price remains capped by the MA20, with no confirmed breakout yet. Support levels below are...

Good morning, everyone! Yesterday’s early-entry gold short position encountered some temporary drawdown, but thanks to flexible adjustments, the trade has now moved into profit overall. Currently, the price is hovering near a key support area. Based on the 1H and 2H charts, there is still room for further downside. At this point, there are two strategic...

Good afternoon, everyone! Gold has now entered a resistance zone, and on the 30-minute chart, a technical correction appears likely. This correction typically takes one of two forms: A direct pullback from current levels; A minor upward push before the pullback, intensifying the need for correction. In most cases, the second scenario doesn’t result in a large...

Good morning, everyone! At today’s open, gold once again dipped into the 3258–3248 buy zone, then rebounded toward 3270. From a structural perspective, gold has clearly entered a downward trend, but this decline is unlikely to be one-directional—short-term rebounds and consolidations are expected along the way. Based on my experience, below 3250 remains a...

Good morning, everyone! Yesterday, gold encountered resistance in the 3348–3352 zone and fell back to around 3310 before rebounding toward the 3336 resistance area. Today’s session opened with renewed weakness, and so far, the overall price action has closely followed our expectations. Whether it was selling near resistance, buying after the dip, or shorting the...