🚨 Markets are shifting fast. CPI and PPI both came in lower than expected, while jobless claims hit an 8-month high. This triple data combo could mark a turning point for the US economy and the Fed’s next move. In this video, I break down: 🔹 What soft inflation and rising unemployment mean for monetary policy 🔹 How DXY is reacting to weakening USD sentiment 🔹 Key...

📊 The markets are on edge—and this week’s economic data could trigger major moves in the US Dollar Index (DXY), Gold (XAU/USD), and Bitcoin (BTC/USD). In this video, we break down: ✅ The latest CPI inflation expectations ✅ Fed interest rate outlook and Trump’s pressure on rate cuts ✅ U.S.–China trade negotiations and what they mean for global risk sentiment ✅...

Get ahead of the markets with this week’s essential macro insights! In this session, we break down the most impactful upcoming events affecting DXY, XAUUSD, and BTCUSD — including the FedWatch Tool outlook, yield curve shifts, and how to interpret changing rate expectations. If you want to understand how the macro backdrop could influence your trades, this video...

🔥 It’s Nonfarm Payrolls Friday – and this month’s report could be a game-changer for the markets. With the U.S. economy showing signs of fatigue, could this be the catalyst that finally breaks the dollar? Or will a surprise upside shock flip the script? In this video, I break down the key drivers behind today’s NFP, how DXY, Gold, and Bitcoin are likely to react,...

🚨 Market Recap – May 2025 Edition This week, markets sent a clear message: rising yields are shaking the foundation. In this video, I break down the key events driving the spike in U.S. Treasury yields — the highest in nearly two decades — and what that means for major assets like: 💵 DXY (U.S. Dollar) 📉 XAU/USD (Gold) 🟠 BTC/USD (Bitcoin) We unpack: Why the...

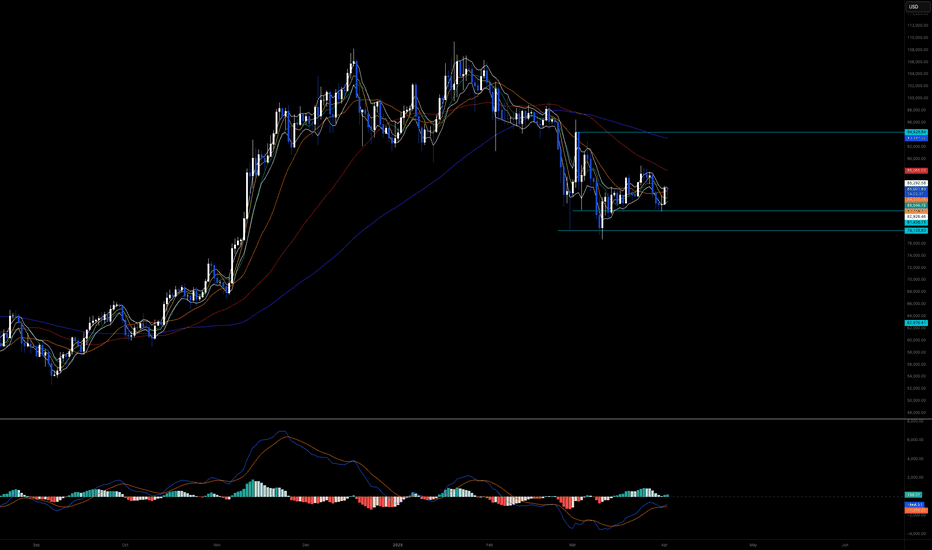

This week’s market landscape is shaped by growing U.S. fiscal concerns, a weakening dollar, and surprising moves in gold and crypto. In this midweek review, I break down the key macroeconomic drivers behind DXY's slide, gold’s bounce from key support, and why Bitcoin is showing unusual weakness despite a softening dollar. Plus, I highlight critical upcoming events...

“You can’t control if you lose — but you can control how much you lose.” In this first episode of Mindset Mondays, we dive into the emotional and practical side of trading losses. I explore how risk management and mindset shape your long-term success, and why learning to accept and limit losses is one of the most powerful skills a trader can develop. Whether...

Inflation is cooling, gold is retreating, and Bitcoin is eyeing another breakout — but what’s really driving the markets right now? In this week’s outlook, I break down: ✅ The key economic data that rocked the markets ✅ What the softer U.S. inflation print means for the Fed and rate cuts ✅ How upcoming data could shift momentum for DXY, Gold, and Bitcoin ✅ The...

This week, markets are on edge as traders react to fresh economic data, shifting Fed expectations, and global uncertainty. In this midweek market review, I break down the key events driving price action across the US Dollar Index (DXY), Gold (XAUUSD). We’ll look at what’s moving the markets, how yields and rate expectations are influencing sentiment, and what to...

If you think you’re going to make a full-time living trading financial markets you’re completely delusional!... and that's a good thing. It was 1997, and two friends—let’s call them Reed and Marc—thought it would be fun to have a movie night and rent Apollo 13 from their local Blockbuster store. For those of you who might need some context, Blockbuster was a...

In this week’s market recap, we break down the key economic and political events shaking up the financial markets: 💥 DXY makes a short-term comeback — but is the dollar still on a long-term decline? 🏆 Gold pulls back from record highs — are dip-buyers already stepping in? 🚀 Bitcoin bounces back — is it acting like a risk asset or a safe haven? We dig into: The...

🔍 Midweek Market Outlook: What’s Driving DXY, Gold & Bitcoin Right Now? We’re in the middle of one of the most eventful trading weeks of the year. The U.S. Dollar is retreating under policy pressure Gold has officially gone parabolic, smashing through $3,000 Bitcoin is pulling back hard, down nearly 30% from its highs These aren’t just price moves — they’re...

“Fear is not real. The only place that fear can exist is in our thoughts of the future. It is a product of our imagination, causing us to fear things that do not at present and may not ever exist. Do not misunderstand me, danger is very real, but fear is a choice.” - Will Smith, After Earth Although I firmly agree with this statement, I also have to acknowledge...

As of April 2, 2025, the financial markets have been significantly influenced by recent economic data releases and geopolitical developments, particularly concerning the U.S. Dollar Index (DXY), gold (XAU/USD), and Bitcoin (BTC/USD). 1. Key Economic Data Reports and Their Impact: U.S. Dollar Index (DXY): The DXY has experienced fluctuations due to recent...

Hey there, So today as I record this video we are just a few hours away from the U.S CPI data release, and the question on everyone's mind is what is going to happen. In today's Midweek Market Review I set out to answer this question by looking at both the fundamental and technical aspects of the market and also take into account the political influence to...

Hey there, So in today's Midweek Market Review, we discuss whats been happening lately in these markets, highlighting the impact of Trumps inauguration, while also explaining the recent run on Gold and the New highs on Bitcoin. Be sure to check out this weeks market review commentary for more insight and ideas on how to best position yourself for these markets...

Hey there, Dollar: The dollar pulled back slightly early this morning from a two-year high as traders await key inflation data scheduled to come out later today. However, the focus remains the plans set by Donald Trump for more trade tariffs, with traders also waiting for an interest rate decision in China and labor market data from Australia for more cues on...

Hey there, So, I though of doing a quick market review just before Christmas, hoping to bring some extra insight into whats happening in the markets this week. Also note that this is but just my opinion and my view of the markets, it should in no way be used or interpreted as advice or signals, but rather as a reference and a soundboard. Furthermore, I wish...