Doc_Deez

The Ichimoku indicator is showing all short signals right now. The Chikou Span (yellow) is below the price line, the Tenkan Sen (red) has crossed the Kijun Sen (blue) downward and has moved below the price line as well. The Senkou Span A (cloud green line) has crossed the Senkou Span B (cloud red line) creating the red Kumo (cloud). Finally, the price line has...

This trend is nothing new to those of you who trade BTC, but for those who don't, BTC is showing a "new" upward parallel channel within the current larger channel. The newer, thinner channel began at the end of Feb with the bounce at 45k and the channel trend held again slightly above 50k. These channels allow for quite a bit of support if it were to trend back...

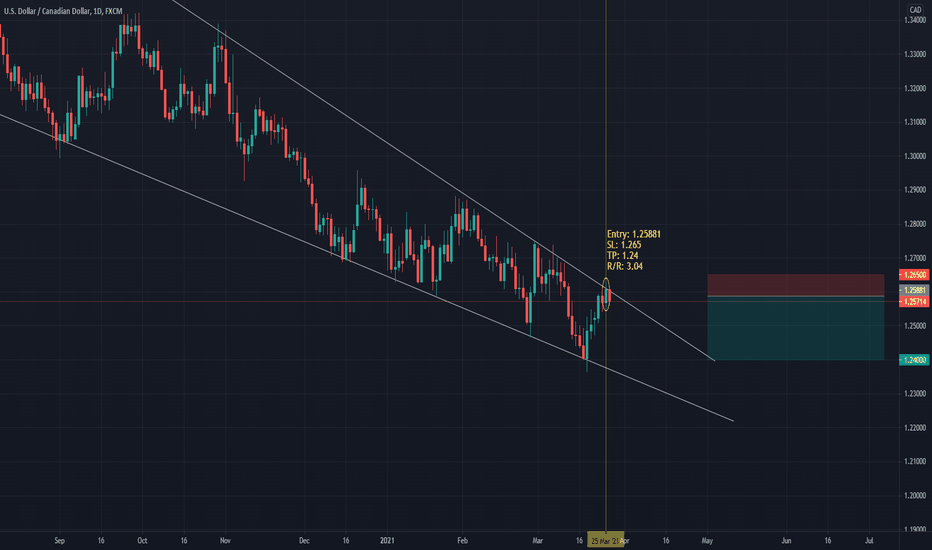

Well, I've been getting back into traditional Forex and not just Crypto, so what better place to start than the USDCAD pair! This is a very nice, and simple pattern that has been in the works for over a year now (hopefully I'm not too late!). It's a typical downward parallel (mostly) channel that is having some pretty predictable ups and downs. As the chart...

We'll start with Ichimoku setup. There are four key indications of potential movement upward indicated by the yellow circles, we'll call them 1-4 from left to right. 1. The Chikou Span lagging indicator has crossed over the priceline, in a technically upward movement. 2. The Tenkan Sen (red line) has crossed upwards over the Kijun Sen (blue line) indicating...

As Bitcoin consolidates we see some potential movement ideas. One is if BTC pulls back past the 56k mark there is a secondary support at 50-52k. If it does not pull back that far then we could potentially see movement off of the 56k support upwards toward 70k+. Multiple scenarios based on the Ichimoku Kihon Suchi are displayed, but all indicate upward movement....

February gave Dash a lot of gains and a lot of pull-back toward the end of the month with March showing slight gains (compared to Feb movement) and consolidation a couple of times so far. As of now it is testing the support area around 223.5 as we approach a 17 and 9 period potential Kihon Suchi reversal area. If the support holds there are a significant amount of...

After the March 1 Mary hard fork ADA saw a pretty sharp downward trend for a few days with a little bit of a pull-back/range, then downward again. It looks like ADA could break either direction with the 1.025 area being the first point of support. If it breaks the 1.025 area it will be followed by a pretty wide potential support block between 0.84-0.95 at a 17 and...

After a steady climb from the end of last year, we recently saw a bounce downward off the 1.32 mark to 1.10 where ADA is seeing some good support. ADA rode the 1.32 mark trying to break until it hit a 9 period reversal area and began drifting down. Now it is at a critical support area at 1.10. If it can hold at this mark we could see a bounce back up prior to the...

ENJIN has made some massive gains the last few days, but I expect a pull back after today as it is running up against the 51, 17, and 9 periods. Pull back seems to be somewhere around 40%, but after a 200%+ gain in the last 9 day period, I think pull back could be sharp, potentially even to the $.45 mark. The E calculation put the high around $.90 which it...

DOT has risen 700%+ since December and had a pretty solid bounce off of the $40 mark back downward since mid-late February. As it winds it way back down toward the Kumo, it will run into some weak support around the Tenkan Sen (Red) and the Kijun Sen (Blue) with more solid support holding up around the $29 mark. I would expect DOT to potentially bounce at $29...

Update: Republished since some of the callouts weren't showing the actual location. There's a lot of patterns on this one. Potential reversal point tomorrow around the $19 mark. That particular area is the reversal point for the 200, 42, 26, and 17 periods. Each particular reversal on this seems to be somewhere around 15-25% each move whether up or down. I would...

There's a lot of patterns on this one. Potential reversal point tomorrow around the $19 mark. That particular area is the reversal point for the 200, 42, 26, and 17 periods. Each particular reversal on this seems to be somewhere around 15-25% each move whether up or down. I would expect the reversal to do the same and head toward the cloud at 18-20% or the $15.6...

This is a hard one to look as the patterns are a little harder to discern. The lower timeframe charts are more bearish and there are some bearish movement indicators in the daily chart like the Chiko Span headed downward for the priceline and the Tenkan/Kijun crossover which already happened as the price gets closer to the Kumo. I see some decent resistance around...

From late December until mid-late February LINK has climbed upwards of $35 with minimal time frame reversals of 3-4 days before continuing the uptrend until around 22 Feb where there is the potential for a full 9-period reversal. If LINK can continue to stay above the area of $24 and the Kumo a rebound is possible. I'm a bit skeptical on this reversal until we can...

Since around the 27th of December DOT has been on the climb without a significant pull-back but it looks like we are at the end of said pull-back. If the ranging continues until around 2 March we should see a reversal upward after a bounce off of the $29 area. Using the N Calculation a potential ceiling could be around $64 near the end of March which would be the...

We're looking at a potential movement in the next couple days. The green represents Kihon Suchi at 51 periods on the daily chart from January 1st to 19 February where there was some ranging on the 1 hour chart (purple box) and the beginning of a potential 9 period reversal indication starting on 20 Feb. The yellow represents 172 Periods on the 4 hour chart to the...

Based on Ichimoku Kinko Hyo analysis, it looks like we are ranging and potentially hitting possibility 1 or moving to possibility 4. - The purple boxes show ranging on the price and the horizontal Senkou Span B. - Kumo still showing slight upward movement - Tenkan Sen above Kijun Sen - Chiko Span upward looking and above price - Senkou Span A upward movement -...

Potential new BTC movement. NOT a reversal, just a slight move.