Double_RR

Through the dynamic monitoring of market sentiment and capital flows found that the recent global risk appetite significantly increased, the structure of funds tilted to risky assets, the currency benefited from this trend to show upward momentum. Public opinion analysis shows that the market is generally concerned about the positive impact of economic recovery...

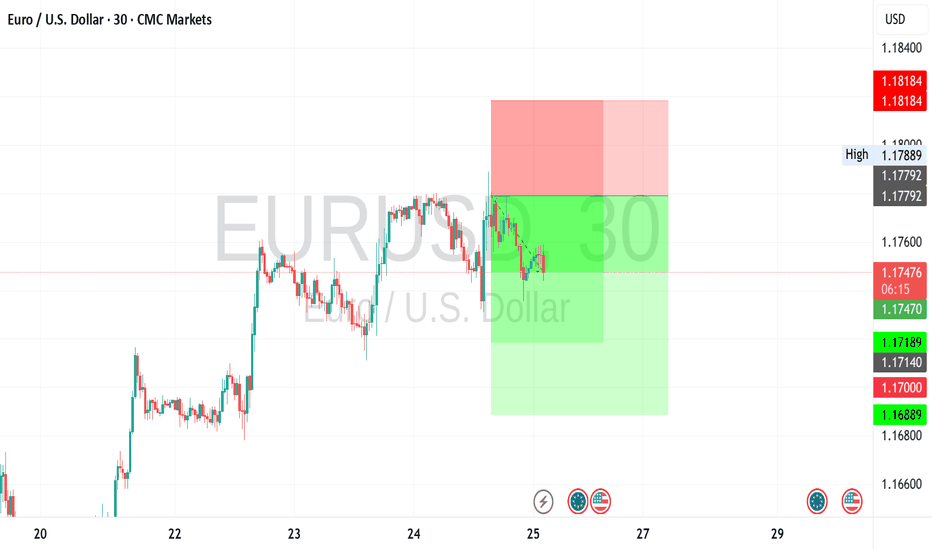

Confirmed that the currency pair has been dominated by the short side in the short term through high-frequency aggregated reasoning on the time-sharing K-line pattern, capital turnover bias, and short-cycle public opinion winds, especially suggests that under the current market conditions, investors need to be wary of what appears to be a mild rebound but is...

Combined with the global market news sentiment, social platform dynamics and real-time capital flow situation, comprehensive judgment of the current foreign exchange market long and short pattern of positive changes. Especially after some key economies announced higher-than-market-expected GDP and inflation control results, the market's judgment on the future...

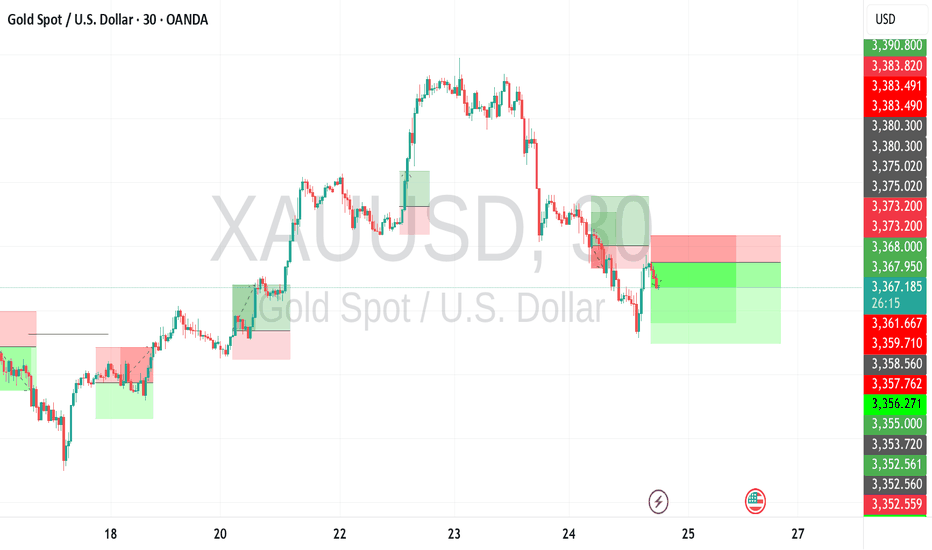

Capital dynamics and sentiment modeling, found that the gold market has recently experienced a typical "suppression and release" type of reaction. After a period of sustained pressure on the emotional background, the dominant force of the short side began to weaken, and both long and short sentiment tends to be balanced, and the logic of gold as a safe-haven asset...

Market confidence is gradually repairing, from a number of markets reflected in the panic indicators decline, liquidity can be known, risk aversion demand then weakened. Gold, as a defensive asset, is gradually losing its short-term support. The signal is not only reflected in the transaction data, but also reflected in the social public opinion of the decline in...

Identified a more pronounced risk aversion bias in the current market after integrating news opinion, social media keyword distribution and institutional trading behavior. Recent economic data has deviated from expectations, raising concerns about global economic growth. Relevant currency pairs gradually lost the initiative in the market, and the price trend...

Long-short strength comparison model, the long side of the current foreign exchange market continues to weaken, and the short-dominated rhythm has been confirmed by most short- and medium-term accounts. Signals tracked by the model show that the share of short trading volume has increased for several consecutive trading days and started to affect the short-term...

A comprehensive judgment, the current market overall defense mechanism is lifting. With the liquidity risk gradually easing, gold's safe-haven attribute has lost its key pivot point. the market preference indicators tracked show that gold as a defensive asset is being marginalized, with trading activity and capital attention both declining. The structure of...

A comprehensive reasoning found that the macro-economies behind the currency pair demonstrated a relatively robust growth capacity, especially in manufacturing, emerging exports, or trade surplus has a clear advantage. The system captures that such economies are in a position to benefit structurally from the global economic divergence process, and the capital...

After Synthesized public opinion analysis, capital dynamics and sentiment modeling, it found that the gold market has recently experienced a typical "suppression and release" type of reaction. After a period of sustained pressure on the emotional background, the dominant force of the short side began to weaken, and both long and short sentiment tends to be...

Triangle has broken through the resistance line at 5/28 06:30. Possible bullish price movement forecast for the next 7 hours towards 3,320.19.

Approaching Resistance level of 3,318.23 identified at 5/28 06:30. This pattern is still in the process of forming. Possible bullish price movement towards the resistance 3,318.23 within the next 1 day.

Hello,Traders! GOLD is making a nice bearish Correction and will soon hit A rising support line at which point Gold will be trading at a 10% discount Giving us a great entry point To ride the coming bullish wave Buy! Comment and subscribe to help us grow! Check out other forecasts below too!

Hello,Traders! GBP-JPY is trading along The rising support line And the pair will soon hit A trend-line from where we Will be expecting a local Bullish rebound and a Further bullish move up Buy! Comment and subscribe to help us grow! Check out other forecasts below too!

MASSIVE VOLUMES Mark Liquidation Lows as Bitcoin and Altcoin Market Send Shockwaves, XRP Back Test

ON THE MOVE, Altcoins Take Lead with Bitcoin Price Chart Stall, XRP and Dominance Shift

GOLD went above the Key horizontal level Of 2325$ then made a Retest and is going up now Again so I will be expecting A further move up Buy! Like, comment and subscribe to help us grow! Check out other forecasts below too!