Dear traders, please find updated EW structure for Major Forex Pair. Wave (i) is leading diagonal. Wave (ii) is ABC correction, Where Wave B is triangle. This is my yesterday's premium analysis. As you see everything could be predicted with EW wave before market did its action.

Please find updated AUDJPY Elliott Wave Analysis and future forecast. It has reached 38,2% Fibo resistance level. The next downside resistance to overcome is the 80.64 swing low. If this analysis can be useful for you, leave a comment or LIKE! Thank you for support!

So clear and easy, pleasure to see how it's falling)

Please find Elliott Wave Count and future forecast for EURCHF. If this analysis can be useful for you, leave a comment or even LIKE ! Thank you for support!

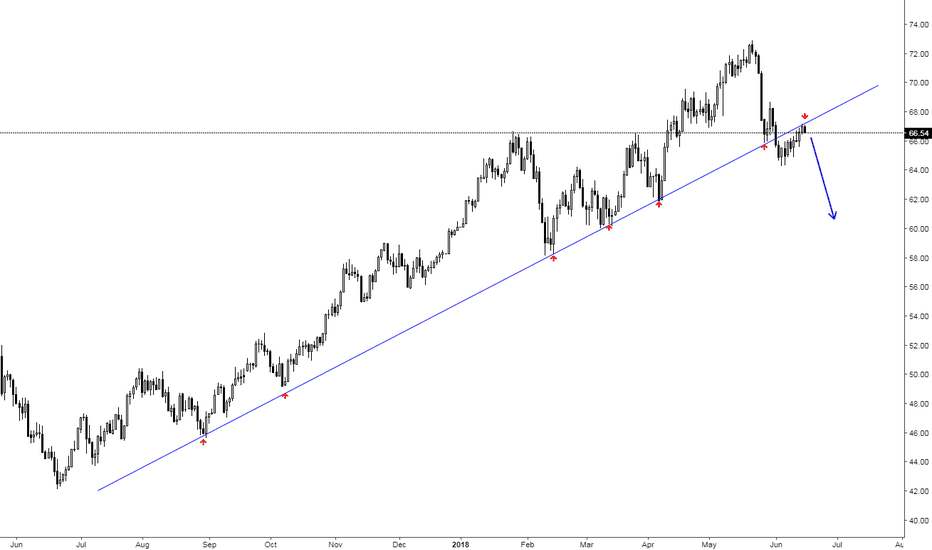

Please see the next update for Oil. All explanations are available on the chart. Also daily analysis with clear broken trend line could help you to see chart. If this analysis can be useful for you, leave a comment or LIKE! Thank you for support!

Hello traders! We have seen strong impulse down, current wave looks like corrective move before the next impulse down. I will be glad to provide any help with Elliott Wave, as I know how difficult to turn from theory to practice. PM

If price goes slightly more down, there is no any support and it falls like knife to $1100 area. But Bulls at the same time have uptrend support, level support and Fibo Support. Who will win? Let's see and join to winners during the next weeks!

This is why it's important to have basic Elliott Wave knowledge to trade and earn money and don't buy too early. Weekly we are still in huge down trend: If you like my analysis, please support me with comments or even LIKE :) If you want to receive everyday Elliott wave coverage, contact me here on TV or my Telegram (@wavecount)

I hope it's so clear and simple chart, no need to more explanations. Yes, sometimes market gives us the gift :) Have a good weekend! Like if you are ready to short Oil :) My previous Oil analysis.

Weekend - is the best time to be prepared to the next Trading week. After an impressive rally over the last month, the AUNZD has now run into a key resistance zone between 1.0850 - 1.0900 area that may cause price to rotate lower. Due to the strength of this long-term resistance, I'm taking a bearish bias whilst price is contained near that area. You can watch...

I would like to post this chart just to click Play in several months to check my forecast. More details at previous post.

Reversal is acting right on time. Please see my previous forecast If you are Crypto Trader and want to support your ETH trading by Elliott Wave analysis, contact me by PM or Telegram (link in profile)

Hello, traders! Current triangle has been defined excatly 2 months ago. If you are Crypto Trader and want to support your LTC trading by Elliott Wave analysis, contact me by PM or Telegram (link in profile)

This is the situation when sell is too late, and buy is too early. But it's nice to have Wave structure before any trade) Contact me to have everyday ETHUSD Elliott Wave Count :)

I have seen a lot of analyses and haven't found these two. The most evident from my POV for experienced Elliott Wave Analyst. So article will be bigger than always. As I know a lot of new and young investors, traders are looking the crypto signals hoping to earn fast easy money. It will be never. Because it's the Market. Market nature, the majority (90%) of...

If you have profitable long positions, I recommend you to fix profit and be ready for short opportunity. This charr pattern looks very bearish, be careful.

Hello traders! It's righttime on Friday to fix your short positions profit, because we see clear ending diagonal, so it's very potential reversal pattern which is plays now in Wave (V). If you like my analysis, please support me with comments or even LIKE :) If you want to receive everyday Elliott wave coverage , contact me here on TV or my Telegram (@wavecount)

My last post for Oil have been created almost 7 weeks ago, on 5th April. I was bullish and expect the next impulse up. Please see this chart. During last week we have clearly finished the next cycle up. Each impulse followed by a correction in the opposite direction, that's why it is important to know the rules of market behaviour in addition to other...