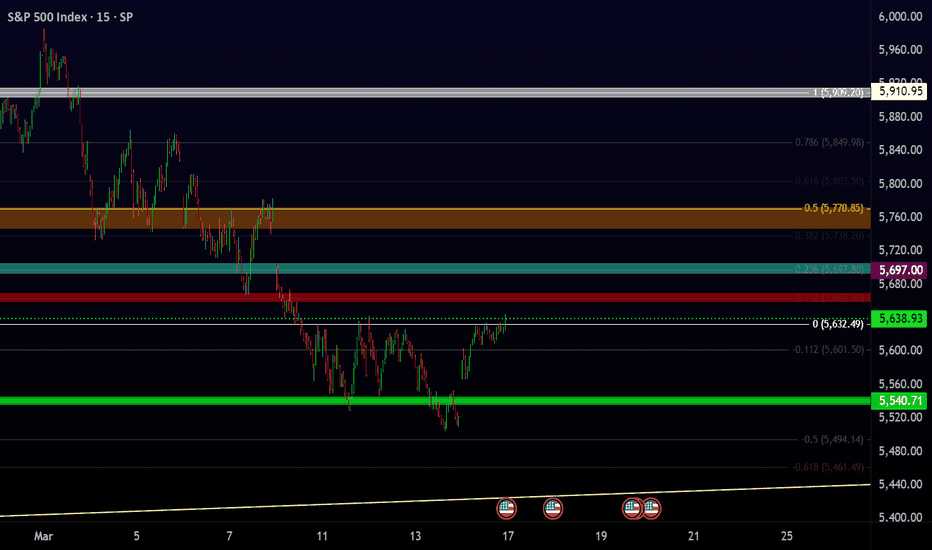

sup.tricky one coming up If price can find itself above 5697 looks like reversal happening. 5663 does have to hold, with threshold 5601 P<5540 continuation📉📉(h i d d e n fibs as a treat 🍦)

Heng seng if price close>22k on weekly time frame 1 or 2 may happen thereafter TVC:HSI GL

if reform does happen alot of change is going to affect investments. I see a break of 46 as bad news bears all the way down

just running trade ideas and to my surprise mirroring from 01 May 2023- 01 Jul 2024 actually has some sense to it. Double top, and then bear trend. also it targets previous important levels as well.

Here are the levels for rivian. A buy at 13.10 with stop at 9.97. Break of 20.23 is a buy regardless.cheers

you know ive been seeing chatter about this ticker more than usual. I know best buy is a consolidation nightmare but i see a trade. Break and entry would be 101. The anchored vwap shows a switch of trend and it can be used to ensure momentum is ensuing and the trade is going well. Also eventually there will have to be a way for consumers to purchase a.i gadgets,...

so after november, which was action packed, we should expect trading to be quite tranquil.Trade the range which is showed by the horizontals lines, or wait for a breakdown and short the retest

Looks like my last prognosisn, which was on MES, is coming to fruition. Now let's take a look at VFC. Last time I saw this stock it was in the 50s, from their it has been bear activities. Now, for my trading style, it's a point where I trade it

This to me seem like a possible outcome. price breaks 4264 and full steam ahead. if p breaks 4264 but gets lame i.e no conituation than 4000-4270 till further notice (after winter, G)

the possible outcome of a market that decides selling is the way

this would be the mega squeeze scenario. it would mean to pick up bull stop-loss liquidity and trap shorts on the way up. panic market selling out of their positions

Setting a nice triangle patter. Given how strong crypto space is, momentum squeeze to continue

Currently performing well compared to other Fx. So I forecasted the move it can make

Very interesting pattern forming. October was a test to see if June's lows would hold, and lows did. What im now thinking is a test and break of the mean will send prices to $9+

A good play to go long is if $69 holds. Ideally, we want to see price retest $75-78, which is a good place to build a position. Furthermore, a break from the channel could is also a buy signal. Key is to hold $69 with some wiggle room

holding up comparing to the equity markets, however, price action does seem to be prepping itself for a significant move.

equities coming on strong, however lets us not forget petrol