Entellusinvestments

LONG NATURAL GAS GOING INTO US WINTER SEASON WITH STOP LOSS. TAKING PROFITS ON 50% UPSWING. CURRENTLY NEAR LONG TERM PRICE SUPPORT. SHOULD TAKE PROFITS AT ABOUT 3$.51 AS THIS WILL JUST FALL BELOW LONG TERM RESISTANCE

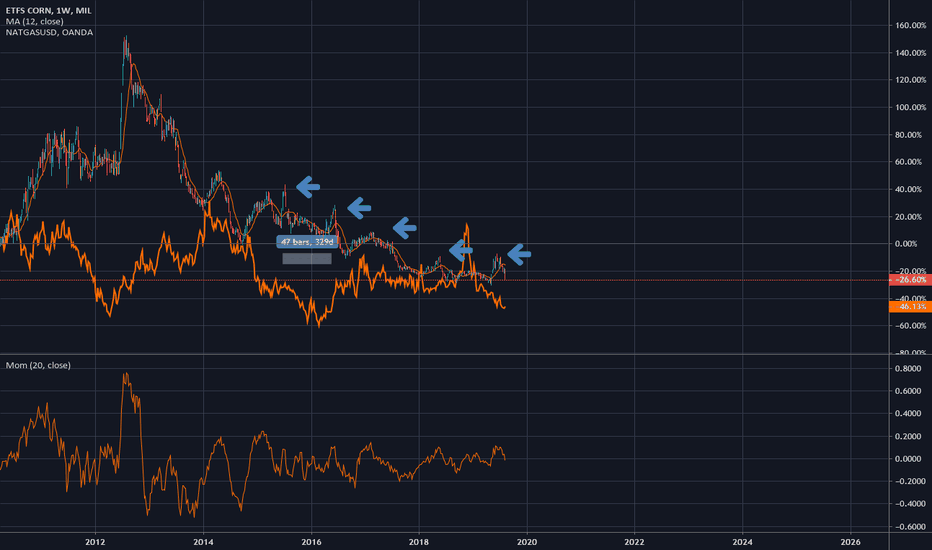

Corn and natural gas show an interesting relationship, Corn has winter Lows with spring Highs with some swings between but roughly correlate to a yearly cycle. Natural Gas is at all time lows, with price levels at pre 1995 prices at points in the recent past. Meanwhile the quantity and quality of dollars has risen. gas also follows a rough cycle of summer lows...

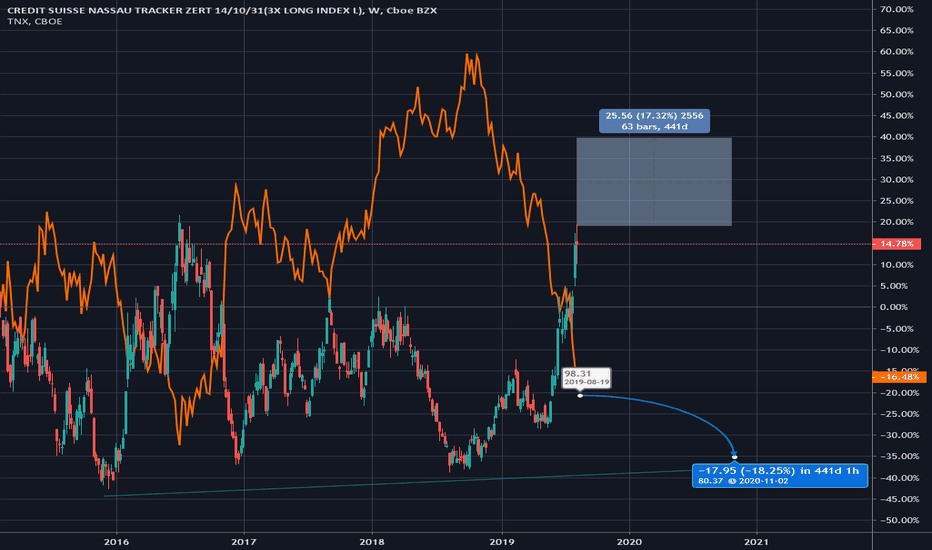

Each Decline in Treasury Yields roughly correlates to an increase in price of Silver, we are positioned Long in both, physical, etf, and 3x velocity shares, taking profits at post 200 levels for velocity shares.

expect further Rate cuts before year end. increased pressure on lowering value of USD. Current Long Gold 3x shares with 2-3 Month Price Target.

Continuing bullish outlook for both silver etfs and physical form

Expect some resistance at 17.75 until about July 2020, if passing 18 expect a rise into 20 - 21 range,

Provided Gold is a hedge against inflation, and its international demand remains stable Its price should rise with inflation. Historically Gold has risen and lowed with inflation and deflation cycles. Silver has remained within a historical range of Gold and also is subject to fluctuations. The historical standard of 20-1 is really not applicable because this...

Nasdaq only thing that beat Gold over a 20 year time frame.